Economic phenomena in the country inevitably affect the quality of life of each of its residents. At the same time, the sustainability of the economy as a whole is determined by many indicators. One of these calculations is the minimum wage.

As practice shows, not every citizen has information about what this term represents. And many financial articles provide explanations in scientific language that is not always understandable to ordinary people. However, any person needs to know and understand the meaning of the minimum wage, because the level of wages he receives directly depends on it.

This article will discuss what “minimum wage” is, where is it used, and who sets it? And also how the minimum wage and the cost of living are connected, and what changes occurred in 2018.

What will the new minimum wage affect?

The federal minimum wage conditionally affects the minimum wage in each region. The latter is established by the constituent entities of the Russian Federation. However, the minimum level of earnings in the region should not be less than the federal indicator (Article 133.1 of the Labor Code). In some cases, on the contrary, it is much greater than the federal value - for example, in the far north.

The regional minimum is increased depending on the economic situation of the subject and territorial conditions. To do this, the federal minimum wage is multiplied by the coefficients established in the constituent entities. Such decisions are recorded in the regulatory acts of the subjects.

The federal law on increasing the minimum wage from May 1, 2021 in Russia will affect many payments:

- temporary unemployment benefits;

- for pregnancy and childbirth - for the period when the woman is unable to work;

- for child care.

How is the minimum wage calculated?

The minimum wage is the basis for calculating wages for Russian citizens. The country has a single minimum tariff for calculating earnings, but in the regions the local government has the right to change the amount according to allowances and living conditions.

The base rate for calculating remuneration for work is established simultaneously throughout Russia. Taking into account the characteristics of each region, a regional minimum wage has been introduced in the country. Its amount includes:

- premiums for harmfulness, unfavorable working conditions;

- salary;

- regional coefficients;

- some types of bonuses: for high qualifications, length of service, etc.

Bonus payments must be transferred more than once and be more than just an incentive measure, since one-time cash rewards are not included in the minimum wage.

The regional type of the base amount cannot be set below the federal value. The indicator can only be increased. The basic rate also includes personal income tax, after which the employee will receive a lower salary. Since the minimum wage in Russia has been increased to 9,489 rubles since January 1, 2018, when receiving the lowest salary minus personal income tax, the employee will receive no more than 8,255.43 rubles.

Minimum wage and benefits

The regional minimum wage does not affect all benefits or for every employee. For example, to calculate sick pay and allowance for caring for a child up to 1.5 years old, the average daily earnings are taken into account. However, in some cases, the calculation is carried out taking into account the minimum wage:

- the employee does not have a salary in the billing period, or his earnings are below the minimum wage;

- less than six months of experience;

- the employee did not follow the prescribed treatment regimen, and the doctor made a corresponding note on the sick leave;

- The cause of illness or injury is alcohol intoxication.

It is worth taking a closer look at the calculation of hospital compensation and child care payments in accordance with the minimum wage level.

What should ordinary workers do?

People who work and receive a salary do not need to do anything, because the minimum wage and minimum wage do not depend on them. The changes do not affect most payments at all. But one point is worth taking into account. So, when going on sick leave, it is prohibited to violate the regime. If you take risks, even with a large salary, you can lose money due to accrual of sick leave according to the minimum wage. If the patient comes a day later than the doctor said, this is a violation. If there is a good reason, it is important to ask the doctor to make a note accordingly on the certificate.

Calculation of sick leave according to the minimum wage

In the cases mentioned above, sick leave payments are determined by the level of the minimum wage. To calculate sickness compensation in 2021, you can take the following example:

- A new employee got a job at the company. There was a difficult economic situation in his region, so from 2016 to 2021 he did not work. After a month of staying in the organization, he went on sick leave, and a week later he presented sick leave to the HR department for 5 days.

- Since the employee did not receive a salary during the estimated time, accounting relies on minimum wage indicators. First, the average salary is determined as 11,163*24 months/730 days. = 367 rubles.

- If the employee’s work experience is 4 years 2 months, the benefit will be equal to 60% (less than 5 years). Payments are calculated in this way - 367 * 5 * 60% = 1101 rubles.

Similar situations arise for employees who have returned from maternity leave.

The percentages used for calculation depend on the length of service of the employee:

- less than 8 years - daily earnings are multiplied by 100%;

- 5-8 years – guarantee of payment of 80% of daily earnings;

- For working experience of no more than 5 years, the bonus is 60%;

- If you have less than six months of experience, the amount is calculated from the minimum wage.

To apply for sick leave benefits, the employee must submit an application for compensation within a month. Otherwise, the funds due to him will not be paid.

What is a living wage and how is it related to the minimum wage?

The minimum wage is calculated and established based on the subsistence level, which is regulated by Law No. 134-FZ of October 24, 1997 “On the subsistence level in the Russian Federation.”

So, the cost of living is the cost of the minimum set of food and essential goods that are necessary to maintain human life. In other words, this is the amount of money on which a citizen can live for a month. Naturally, this includes the necessary contributions and payments.

It is noteworthy that the cost of living cannot be the same for everyone. It differs depending on which category a person belongs to. For example, a child, a pensioner or an able-bodied citizen. According to statistics, the lowest monthly expenses are observed among pensioners.

The cost of living is calculated both for Russia as a whole and separately for each region. Calculations are carried out every quarter, and changes are observed upward. The obtained data is approved by the Government of the Russian Federation, and in the regions - by local authorities, within the framework of established legislation.

Overall the picture looks like this:

- The rate per child is 10,160 rubles;

- For an able-bodied person – 11,163 rubles;

- For pensioners – 8,506 rubles.

The minimum wage and the cost of living are closely related. After all, a person should not receive a salary with which he cannot buy food, clothing and other necessary things.

For a very long time, the minimum wage lagged significantly behind the “food basket” indicators. The goal to equalize these values was set by the Government for 2021. However, we managed to complete the task ahead of schedule.

Thus, the main change in May 2021 was that the interrelated values of the minimum wage and the subsistence level were equalized to 11,163 rubles.

Child care allowance

In 2021, payments to employees on maternity leave are made both when raising a child under 1.5 years old, and when caring for a child under 3 years old. The employee receives the following guarantees:

- Benefit from the Social Insurance Fund budget until the child reaches 1.5 years of age (Law No. 81-FZ).

- Compensation payments from the company until the child is 3 years old.

If a baby is born in 2021, a new payment will be provided for the birth of the first child in the family.

In 2021, the employee receives 40% of the month's salary as payment for maternity leave. It can be calculated using the following formula:

Benefit = average monthly earnings * 40%.

When an employee’s average earnings are less than the minimum wage, the benefit is calculated based on the minimum wage:

Monthly care allowance = minimum wage (at the start of leave) * 40%.

In this case, the amount of payment must be no less than the minimum established indicator (Law No. 255-FZ).

Once again about salary changes

As noted, the increase in the minimum wage from the beginning of May 2021 will have almost no effect on people’s salaries. This parameter is conditional. For an employer, the minimum wage is the amount below which it is prohibited to pay a person working at 100% full-time. But even in this case, the employer can be cunning and reduce costs. One way is to transfer the person part-time or change the work schedule - from a five-day to a three-day work week. As a result, wages are reduced, and it is difficult to undermine from the legal position.

The main parameter in determining wages is not even the minimum wage, but the minimum wage, which is typical for a certain region of the Russian Federation. But this rule does not always work and does not apply to all employees.

Forecasts

According to the latest news, the Ministry of Labor plans to increase the minimum wage by more than 50% by 2021. At the same time, consumer price growth is projected for the specified period by 12.5%. This forecast for 2019-2020 is based on a new policy of economic strengthening of the state.

From 2021, the minimum level of earnings will be revised annually so that it is equal to the cost of living for the previous year (2nd quarter). According to officials, increasing the minimum wage will have a positive impact on the solvency of the population.

From May 1, 2021, the minimum wage has increased, reaching the subsistence level. It differs for different regions, but cannot be lower than the figure at the federal level.

Based on materials from investpad.ru

How often does the minimum wage increase?

Until 2021, the minimum wage in Russia was set according to inflation dynamics. The government reported that this has a positive impact on the federal budget. Therefore, the minimum wage did not change from the beginning of each year, but in January, June, July, May, September and other months.

According to Art. 133 of the Labor Code of the Russian Federation, the minimum tariff for calculating earnings directly depends on the cost of living, which did not meet the requirements of the code. This was explained by the fact that a gradual increase would not cause damage to the Russian economy. Thus, from April 2021, the minimum indicator has become equal to the PM indicator. Since the cost of the consumer basket, which is included in the vital financial minimum, increases annually, a decision was made to annually index the minimum wage in Russia.

Thus, in 2021, the base rate for calculating work remuneration was determined from the beginning of January. Now according to para. 2 tbsp. 1 Federal Law No. 82 of June 19, 2000 (as amended on December 25, 2018), the minimum wage in Russia is planned to be indexed according to the PM on January 1 of the corresponding year.

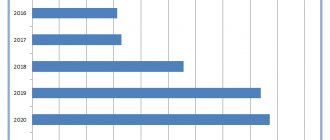

To track the dynamics of the minimum wage in Russia, a table of minimum wages by year has been developed

The economic situation in the country is improving

Reporting on the economic situation in the country, Minister of Economic Development Maxim Oreshkin noted that previously both experts and specialists from his department gave rather pessimistic forecasts. However, now we can say that they were not justified.

“Thus, in the second quarter of this year, economic growth accelerated to a level of 2.5 percent, and the inflation rate as of the beginning of last week was 3.2 percent. What has largely exceeded even our expectations is the growth in investment activity. The data shows growth at the end of the second quarter was 6.3 percent. This is very positive news, because implemented investment projects today mean more active economic growth tomorrow,” the minister said.

The head of the Ministry of Economic Development emphasized that the growth in income is not related to the situation in oil prices, but was achieved through an increase in labor productivity. The President noted that real incomes of citizens are recovering quite slowly, and consumer demand is growing at a low rate.

READ ON THE TOPIC:

In the second quarter of 2021, the cost of living will increase by 4.2%

“You spoke about the restoration of consumer demand.

Meanwhile, retail trade growth has recently amounted to only 0.7 percent, you should probably know this too,” the president addressed the minister. – Taking into account the exchange rate difference, imports are also growing. Manufacturers of domestic products are already feeling this, it is already visible on the shelves, it is already visible in the way retail chains behave. What do you think would be appropriate to do? What would you recommend as the leading economic department to the entire government, the entire economic bloc? – the president asked. Maxim Oreshkin responded that, in his opinion, the government is moving in the right direction, implementing a set of measures aimed at supporting investment activity and updating production. The minister considers the main task to be to ensure the competitiveness of Russian enterprises through the introduction of the latest technologies.

According to the minister, the task, of course, is to maintain the competitiveness of Russian industries, but I think this should be done not by reducing real incomes of the population, but primarily by investing in new equipment, introducing new technologies, digitalizing production, introducing new management technologies.

Federal limit in 2021

Since 05/01/18, the minimum wage in Russia has increased by more than 18% and amounted to 11,163 rubles. The value of the minimum wage was finally equated to the cost of living for the working population in the second quarter of last year. But individual constituent entities of the Russian Federation have established their own minimum wages, which are higher than in the country as a whole. Thus, in the Krasnoyarsk Territory, the largest region of Russia, this indicator has a number of features due to the geographical and climatic conditions of residence. According to the decision of the Constitutional Court, “northern” allowances and coefficients should be in addition to the federal minimum wage. Therefore, from September 1, 2021, the minimum wage in the Krasnoyarsk Territory was increased to 17,861 rubles, which is significantly higher than the total in the Russian Federation. But this position is also differentiated by territory of the region, taking into account the regional coefficients and percentage premiums established in the corresponding territory.

Responsibility

For wages below the minimum wage, fines are imposed without proper justification. The company, if the violation is the first, faces a fine from 30,000 to 50,000 rubles. If the violation is repeated – from 50,000 to 70,000 rubles. For an official, the sanctions are accordingly: a fine from 1000 to 5000 rubles. and from 10,000 to 20,000 rubles. or disqualification from one to three years. The same rules apply to an entrepreneur as to an official, only disqualification cannot be applied to an individual entrepreneur (clauses 1 and 2 of Article 5.27 of the Code of Administrative Offenses of the Russian Federation).

Election measure

Meanwhile, MSU professor Natalya Zubarevich, in her commentary to Gazeta.ru, agreed with the conclusions of the Ministry of Labor that the greatest burden will fall on the shoulders of regional budgets. According to her, the majority of state employees whose salaries are at the minimum wage level are tied to the regions. However, even raising their wages, according to the expert, these are too weak steps as a strategy to combat working poverty. According to Zubarevich, the increase in the minimum wage is too meager - it does not fight poverty, but only reduces its depth. Summarizing all this, the professor makes a clear conclusion that the decision to increase the minimum wage is a measure aimed at the reaction of the electorate . And given the minimal amount of expenses, the dubiousness of the result and potential risks, all this speaks of good pre-election PR.

This version is also supported by the fact that such equalization is also supported by business representatives. In particular, representatives of “Opora Rossii” have already spoken “in favor”, who made the only reservation - they insist on decoupling insurance payments from individual entrepreneurs from the minimum wage.

However, according to other representatives of the expert community, regardless of the goals of officials, the potential risks posed by the initiative of the Ministry of Labor and other aspects of this process, the main thing is at least partial legalization of salaries in envelopes. Both the budget and the employees themselves, whose pension accounts will receive additional pension points, will have a positive effect. Although, we must not forget about the risks, because where every 100 rubles are saved on wages, increasing the salaries of each employee by 1.7 thousand rubles, not even talking about increasing the volume of insurance payments, is a very serious problem. It is likely that this will cause a massive wave of workers switching to part-time work, part-time work, and even worsening shadow employment.

One way or another, politics in this context certainly could not have happened. Most experts, regardless of their political views and attitude towards equalizing the minimum wage and minimum wage, are unanimous in the opinion that the president and his team have begun preparations for the upcoming elections. The minimum wage will obviously be included in the election promises, although this topic itself cannot claim a leading position among them. The problem of the minimum wage is, of course, one of the socially sensitive topics, especially for part of the population on the verge of poverty. But its political weight increases significantly if the minimum wage is added to the problem of meager incomes and an appropriate standard of living for at least half of the country. If there are effective tools to influence the situation, it would be much more correct to focus attention on these things and ways to solve them.

Post your resume Add a vacancy