Providing workers of certain professions with special clothing is the responsibility of the employer in accordance with the Labor Code of the Russian Federation (Article 221). Workwear includes clothing, shoes and special devices that protect against harmful and dangerous factors in the workplace. This is stated in the Ministry of Finance document No. 135n dated 12/26/02 (clause 2, 7), on the basis of which it is written off. The methodology for writing off workwear in accounting depends on the specifics of its registration and the reason for the write-off. In addition to natural wear and tear, premature damage, loss, and theft of workwear may occur.

How to create a commission for writing off inventory ?

Description of accounting entries

First, let's decide where exactly the purchased materials can be sent. They are capable of performing many functions, which are determined by the current needs of the enterprise:

Write-off in accounting

- Be the basis in production processes

- Function of auxiliary type parts for production

- They are used to create finished product packaging

- Application in the implementation of management processes, while meeting the needs of the administration

- Assistance when fixed assets are being liquidated and are being taken out of service

- Application in construction, after which fixed assets are created

Postings depend on how and why materials are released from the warehouse. Several notations are used for this.

Debit has the following signs:

- 91.2

- 44

- 26

- 25

- 23

- 20

Credit, accordingly, is indicated by just one digit – 10.

Sometimes it happens that materials are listed as property, but are actually missing, which leads to shortages. Such situations require the following designation - debit 94 and credit 10.

How to properly draw up an SZ?

An official memo as an independent type of document is not included in the All-Russian Classifier of Management Documents (OKUD). But it is often used in business practice. It is advisable to draw it up in accordance with the requirements of GOST R 6.30-2003 “Unified documentation systems. Unified system of organizational and administrative documentation. Requirements for document preparation."

The document we are talking about in this article is drawn up by the employee responsible for inventory items addressed to the head of the department.

It must contain a request for write-off. The basis for this must also be indicated and a complete list of material assets must be attached. SZ consists of the following columns:

- name of goods and materials,

- quantity,

- book value,

- inventory number.

Once completed, the document is submitted to the manager for signature. After its consideration, if a decision is made about the need for an inspection, the director issues and signs an order to conduct an inventory in the INV-22 form. It approves the composition of the commission, the timing of the inventory and indicates the property that should be checked. Based on the order, the inventory procedure begins. After it is completed, an act is drawn up, on the basis of which the damaged property is written off.

Sample memos

Let's look at several examples of the design of SZ. Thanks to the samples, you can independently draw up the document you need.

1. Trade organizations often have to get rid of damaged goods. In this case, store employees draw up a memo to write off the goods, which is submitted to the store director for signature.

2. In production, there may be a need to write off materials that are unsuitable for the manufacture of products. If for some reason the material cannot be used, a memo for writing off the materials is drawn up, sample:

3. Each employer is obliged to provide its employees with special clothing in accordance with the developed issuance standards. When worn out, work clothes are written off and the employee is given new ones in exchange. For this purpose, a memo for writing off workwear is filled out:

4. When performing work, employees use the company’s fixed assets, which also become outdated and need to be replaced. As a result, such property should be written off and workers should be provided with modern equipment. Below you can see what a memo for writing off fixed assets looks like, sample:

Write-off: how to register

Business transactions must always be accompanied by the documentation used in primary accounting. The rule makes no exceptions to the write-off procedure. In any organization, the manager has the right to determine for himself which papers will be used to organize primary accounting. Therefore, specific registration rules may differ from company to company.

The main thing is that the accounting policy contains information about the approved documentation. And monitor the presence of the mandatory details specified in the current legislation.

There are several standard forms, the use of which is permissible when writing off:

Warehouse write-off

- Invoices for the release of materials to third parties.

- Salary cards with certain limits.

- Invoice forms with a description of the requirement.

The organization can choose for itself which details are not needed and which ones will definitely be needed in a particular process.

The use of invoices with requirements allows you to organize accounting for the internal movement of material assets, with the participation of responsible persons or structural divisions.

Registration of invoices is the responsibility of the persons who deal with valuables. Only two copies are needed. The write-off is processed by one, and the second is needed for capitalization.

What documents are required for reporting:

1. Waste acceptance and transfer certificate. Contains information about who the waste was transferred to, in what quantity, and what further actions were taken with it. Required for reporting to the Department of Rosprirodnadzor for the Northwestern Federal District.

2. Certificate of presence/absence of scrap precious metals. Issued on the basis of a Certificate of special registration with the Assay Chamber of the Russian Federation. Necessary for the implementation of the Instructions on the procedure for recording and storing precious metals, precious stones, products made from them and maintaining records during their production, use and circulation, approved by Order of the Ministry of Finance of the Russian Federation dated August 29, 2001 No. 68n.

3. A certificate of scrap ferrous and non-ferrous metals extracted from waste, indicating the quantity and cost, taking into account the costs of extraction, as well as indicating the enterprise that has a license for the procurement of scrap metals, to which the recovered scrap was transferred.

4. Payment documents. If the above secondary resources were extracted from the transferred waste, the organization that disposed of the waste must transfer the funds received from the sale of such scrap to the account of the waste generator, unless otherwise provided by the disposal agreement.

What to do if not all materials are used?

It is usually assumed that after release the materials will be used immediately for their intended purpose, and therefore the operation is accompanied by the postings that were already mentioned earlier.

But this doesn't always happen. Especially if the enterprise is quite large. It happens that the transferred values are not used immediately. Then the new storage location replaces the old one. When releasing the bases, it is worth noting that they do not always know exactly in which production process the sources are used.

Warehouse with materials

Valuables that have already been released from the warehouse, but have not yet been consumed, cannot be classified as expenses for the current period. This applies to both accounting and tax reporting. Therefore, actions are required in a slightly different order than usual.

This situation leads to the fact that the issue and registration of materials become internal processes. By applying a separate subaccount to account 10, which may be called, for example, “Materials in the workshop.” When the month comes to an end, another document is drawn up. Usually this is an act with information about material costs. There you can already indicate the direction of use of the values. At the same time as this action, write-offs are being carried out. Thanks to such tracking, accounting reports become more reliable. There are fewer errors when calculating income taxes.

The rules apply not only to what is used for production processes, but also to property of any kind. For example, to stationery that is used by the administration. There is no need to issue materials “in reserve”; they need to be used immediately.

What you need to know about written-off property:

GOST 30772-2001 “Resource conservation.

Waste management. Terms and definitions" clause 3.12 Consumer waste

- remnants of substances, materials, items, products, goods (products or articles) that have partially or completely lost their original consumer properties for use for direct or indirect purposes as a result of physical or moral wear and tear in the processes of public or personal consumption (life activity), use or operation.

1.1. The written-off property is in fact removed from circulation. Its further use is impossible due to partial or complete loss of consumer properties, or obsolescence. This is what caused the write-off. And objects and products that have lost their consumer properties are waste (GOST 30772-2001). Accordingly, an organization that generated waste as a result of write-off of property is a waste generator.

1.2. Any actions performed with waste are regulated by the Federal Law “On Production and Consumption Waste” dated June 24, 1998 No. 89-FZ (hereinafter referred to as 89-FZ). Waste management is defined by 89-FZ as the activity of collecting, accumulating, transporting, processing, recycling, neutralizing, and disposing of waste. , and such activities are subject to licensing .

Federal Law “On Amendments to the Federal Law “On Production and Consumption Waste” ...” dated December 29, 2014 No. 458-FZ

Legal entities and individual entrepreneurs carrying out activities for the collection, transportation, processing, disposal of waste of hazard classes I - IV are required to obtain a license to carry it out before July 1, 2021. After July 1, 2021, carrying out this activity without a license is not permitted.

1.3. Legal entities (as well as individual entrepreneurs), in the course of their activities, waste of hazard classes I - V are generated, are obliged to draw up and approve the corresponding waste passports, and in the absence of a type of waste in the Federal Classification Catalog of Waste (hereinafter referred to as FKKO), are obliged to classify the corresponding waste to a specific hazard class.

(Article 14 89-FZ and paragraphs 7 and 10 of the Rules for certification of waste of I - IV hazard classes, approved by Decree of the Government of the Russian Federation of August 16, 2013 No. 712)

1.4. Temporary storage of waste until it is transferred to an organization engaged in collection, transportation, processing, disposal, neutralization and disposal is called “waste accumulation” and is also regulated by 89-FZ and is called waste accumulation. The maximum period for waste accumulation is 11 months.

About write-off standards for production

The legislation does not have strict and clear rules that would describe in detail the write-off process. It is usually said that it is necessary to rely on the volume of the production program and the standards according to the same document. The main thing is that the total amount of valuables does not become uncontrollable. And so that the norms themselves are officially approved.

Any expenses must be supported both economically and documented. The organization independently determines the standards according to which certain values are spent.

Write-off according to standards

For consolidation, you can use estimates, technological maps and similar documents. They are developed in departments that personally control the production process. After this, the papers are sent to the manager for approval.

A situation where existing standards are exceeded is acceptable, but each such case requires a separate indication of the reasons. For example, the explanation could be technological losses or the need to fix a defect.

It becomes the responsibility of managers and authorized persons to formalize decisions to exceed the current norm. To do this, a corresponding mark is placed on the primary accounting document. Otherwise, the write-off itself will not be recognized as legal. The cost price will be distorted, which leads to violations in accounting and tax reporting.

List of actions that will need to be performed after issuing a write-off act

To actually recognize the withdrawal of inventories, upon completion of the act, the accountant must formalize accounting for production.

Receipt of materials to the enterprise has the following classification:

- From suppliers for a fee.

- From our own production (production of material in-house).

- From the founders.

- When dismantling equipment.

- For barter transactions.

- Free receipt.

Based on the information specified in the seizure act and the balance sheet, the following entries are made:

- posting D94 K10 – reflects the accounting value of inventories that are subject to withdrawal;

- posting D20 K94 - shows the monetary value of deterioration or shortage of inventories (within the limits of reasonable natural loss);

- posting D20/2 K73 - shows the amount of compensation for the shortage to the guilty party (in the case when the number of units of written-off inventory exceeds the natural loss limit);

- posting D99 K10 - reflects the destruction of supplies as a result of a natural disaster;

- posting D99 K68 – restores VAT (value added tax) that was paid earlier;

- entries D91/2 K10 and D91/2 K68 – write-off of inventories under a free use agreement.

Moreover, before the accountant completes the posting indicated in the last paragraph, you need to draw up a large number of documents.

Namely:

- application for the release of materials;

- contract;

- waybill.

The nuances of writing off goods with rapid wear and tear and those that have already become unusable

While an organization is conducting its activities, it is often necessary to write off materials that have become completely unusable. The process is distinguished by its features in accounting policies. They depend on:

- Proof of the guilt of a specific employee or any other person that everything went wrong.

- Standards for writing off inventories. Are these standards exceeded or fully complied with?

Cleaning equipment

As for the price of damaged materials, it is written off within the limits of norms associated with natural loss. The process uses accounts that list production costs. The standards are exceeded if the presence of guilty persons is proven or there are additional costs.

The following addition is provided for those who work with the write-off of low-value, wear-and-tear goods. Accountants can write off the cost at the same moment when the object is put into operation. It is permissible to carry out so-called uniform accounting. But the application of the scheme is relevant in the case of items with a service life of 1 year or more. In the accounting policy it is necessary to write about which method is used in a particular case.

To distinguish between fixed assets and low-value assets, the legislation establishes a criterion for a price reaching up to one hundred thousand. But it does not work for accounting purposes. In this regard, in this regard, property whose value does not exceed 40 thousand rubles is considered to be of low value.

Inventory and household supplies are a group of items for which calculations are carried out using similar schemes. Legislatively, the composition of the group itself is not detailed. But in practice, this property includes:

- Equipment for cleaning the area, fire extinguishing equipment

- Electronic equipment such as cameras and video recorders

- Kitchen appliances

- Office furniture

We draw up an act of writing off valuables

The document must be drawn up collectively. This may be a permanent or temporary commission created in accordance with the order of the head. It includes an accountant, a financially responsible person, a warehouse worker and other employees at the discretion of management.

So, what details are required for the act of writing off valuables? Since this document is of fundamental importance specifically for accounting, the Accounting Law provides for the following elements:

- name of the document (act of write-off of valuables, act of write-off of goods, act of write-off of inventory items, etc.);

- date of document preparation. According to the accounting rules, the act must be drawn up when a business act is completed or immediately after its completion;

- name of company;

- members of the commission by name, indicating their position;

- name of the value, article number, quantity or weight, cost, reason for write-off;

- signatures of the commission members.

Since the act of writing off valuables is an accounting document, it is approved by the manager and signed by the chief accountant of the organization.

Why is the document needed?

The document is a tool for interaction between superiors and subordinates , as well as structural divisions of the organization with each other. The fact is that oral requests or wishes regarding the write-off of something may simply not be heard, and therefore not satisfied.

But if they are officially documented and then registered, the document will look more significant and will receive a certain legal force. Such a paper can be drawn up by any employee of the company.

Form for drawing up a write-off act

Each enterprise develops and approves the form for the act of writing off valuables independently.

The unified TORG-16 form can be used as a basis. An enterprise can draw up an act in the form of a summary statement, where material assets are entered in the order of write-off, indicating dates.

The form of the document used in the company must be approved and attached to the accounting policy.

For the operational application of the act, the policy defines the persons and units that use the form in document flow.

The data in the act includes the following information:

- Date and place of compilation.

- Composition of the commission involved in the preparation of the document. Signatures indicating the data are placed at the end of the act.

- A list of material assets indicating the name, article or internal nomenclature number, unit of measurement, quantity, price, total write-off cost.

- Reasons for write-off.

- Conclusion of the commission.

- Details of the manager approving the act. Indicate the position, surname with initials, date of approval of the document.

When approving the act, the manager determines the source of write-off of valuables - from expenses or profit remaining after taxation. Determining the source serves as an important source of information for tax purposes. Material assets written off for internal needs do not participate in determining the tax base.

Rules and nuances of drawing up a document for write-off

When removing inventory items from the balance sheet, it is very important to correctly indicate their value.

To do this, an accountant can use the following features:

- average cost;

- the cost of all units separately;

- cost of the first batch received or manufactured (FIFO method).

What information needs to be reflected?

It is worth noting that such a memo must contain a clearly stated reason for writing. However, you should not present the essence in a dry and official tone. It's best to use a loose narrative with plenty of specifics.

The contents of the document can be divided into two parts:

- A preamble that briefly outlines what prompted the writer to write the paper and send it to a specific addressee.

- The second part, which is the main one. It is much larger than the first and contains a clearly defined request or proposal. In this fragment of the document you can present an analysis of the situation, draw conclusions or summarize.

Each organization has its own sample of writing a note, but the content remains the same everywhere.

Form form

The basis for drawing up an act for writing off inventory items is the established form TORG-16, which was approved by Resolution No. 132 of the State Statistics Committee of the Russian Federation dated December 25, 1998.

However, the development of a specific form that will serve as the best example of a write-off act for a given enterprise is the responsibility of the chief accountant. To do this, he takes a ready-made template that best meets all the requirements for a particular organization. At the final stage, the accountant adapts the sample, taking into account the actual state of affairs, and draws up a ready-made act for write-off.

About the nuances of the write-off procedure

The cost of materials largely determines how much the work itself, where these objects are used, will cost. This is especially important for those objects that belong to the elite category. When an organization draws up an estimate, it is important to lay down certain standards associated with costs.

Inventory commission

Standards for estimates are a whole set of data on prices, where items are combined into separate categories. This is necessary in order to understand how much certain actions will cost.

The estimate norm is all the resources in the aggregate established for the adopted meter in various types of work. Estimated standards perform one main function - calculating the amount of resources that are normally required to complete a particular process.

But the documents are drawn up on the basis that normal conditions are observed during the implementation of the project, and that no external factors complicate this process. If any complications are present, then special coefficients are simply added to the documentation to the calculation results. The coefficients themselves are described in legislative norms.

Estimated standards are:

- Regional.

- Departmental.

- Federal.

Users can create their own database. To determine the cost in construction, several generally accepted methods are used. Some of them are transferred to other directions.

- Resource method. All costs in this method are simply summed up in physical terms with current prices. Among the indicators used, it is worth noting:

- Consumption of materials with components.

- The period during which machines are used in construction.

- Labor intensity.

An organization can use its own information to calculate the required level of parameters. It is allowed to rely on collections in the relevant industry, and standard prices on the corresponding basis.

- Basis-index calculations. In this method, the cost of construction is determined in its own way. To obtain the result, experts add up the prices of all types of building materials, which can be called consolidated. The resulting amount is multiplied by indices after recalculating the base prices into current ones.

- Resource-index methods. The resource method determines the total using basic prices. Then multiplication by indices is carried out, bringing the cost to the modern level.

- Basic compensation option. The cost of work and expenses is summarized at a basic level. To these are added additional costs associated with the fact that market indicators have changed quite significantly.

- Using data about objects that have already been built.

Without books and newspapers

Citizens often hide savings in books, and it is in the volumes of Tolstoy, Mayakovsky or Nekrasov that robbers look for money first. And, if the one who hid the savings is not the owner of a huge library, burglars always find “treasures”.

It is not recommended to store money in books (and newspapers) also because the pages in them do not have a protective coating, that is, the ink can be imprinted on the banknote.

It is optimal to keep paper savings in a glass jar, which should be closed with a plastic lid. And bonists (people who collect valuable banknotes) use special vacuum packaging to store money: weak.

Write-off of materials: detailed instructions

Materials are inventories that are purchased by an organization. These are the means to obtain products and service the production process. To display such reserves, account 10 is almost always used. Subaccounts are opened for it. To display the movement of fixed assets, you can also use accounts 15 or 16. Materials are written off if a shortage or damage is detected. Or when objects fail severely enough and are deemed unsuitable for further use.

Of the necessary devices for carrying out the operation, only the act of writing off materials is noted, together with a certificate of the corresponding content, transmitted to the accounting department.

When valuables are written off, the creation of a special commission is mandatory. It must include persons with standard financial responsibility. It is the members of this commission who draw up the write-off act. The following few points must be included in the document in any case:

Write-off in the program

- Quantitative and price characteristics, amounts.

- The reason why valuables need to be written off.

- The name of the materials themselves.

- Personal information of each member of the commission.

In addition, all participants sign the document. You cannot do without indicating the date by which the procedure was carried out.

Separate entries are made when the materials are already considered written off.

- K94 – if everything happens within the limits of natural decline.

- D20 – information on main production.

- K10 – to reflect the value of materials on the balance sheet.

- D94 – Shortage, loss of specific properties of an item.

Postings in case of damage and loss

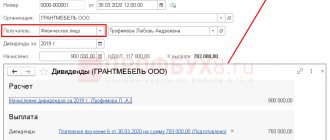

If the workwear is damaged or lost before the date of its write-off, a posting is made Dt 94 Kt 10. In the absence of an identified culprit, its cost is included in other expenses Dt 91-2 Kt 94. If the fault of the employee to whom the workwear was issued is established: Dt 73 Kt 94. Repaid such debt from wages, deposited into the cash register or into the company's current account (Dt 70, 50, 51 Kt 73).

Briefly about the main thing

Write-off of workwear is carried out from account 10 BU, in the context of sub-accounts - at the time of issue or in equal shares during the period of operation. An organization can also account for workwear in account 01 as fixed assets, during long-term use, taking into account the limit on the cost of fixed assets. Here the write-off occurs through the depreciation mechanism.

The issuance and write-off of workwear is carried out according to inter-industry, sectoral or intra-organizational standards. The latter must be justified by the results of an independent assessment of working conditions. The main primary document when writing off workwear is the write-off act of the same name. The organization has the right to use unified forms for this purpose, as well as to develop the form of the act independently.

The act is the result of the work of the commission, which makes a decision on complete write-off or on the subsequent capitalization of rags and other goods and materials resulting from the destruction of written-off workwear.

Making a write-off order

If the write-off process is associated with the fixed assets of the enterprise, then filling out the order becomes the next step after the inventory is completed. Based on the results of this procedure, it is necessary to clarify the list of valuable items, the further use of which is impossible. Usually these are items that are broken or obsolete.

An employee with appropriate authority is responsible for preparing the order. For registration, it is allowed to use company letterheads. The document is subject to mandatory registration.

The following items must be present on any form:

- Header with the name of the document itself.

- Clarification, indication of the reason why the commission was created.

- Information about the responsible persons and those who are members of the commission.

- Separate allocation of a responsible person appointed by the chairman of the regulatory body.

The order can describe the responsibilities that are transferred to employees checking material assets. After registration, the director approves the document and certifies it with his signature. All persons participating in the procedure must put their signatures on the order. The number along with the date of compilation is written at the top.

Top

Write your question in the form below

General principles for writing off workwear in an organization

The write-off of workwear is subject to a certain procedure. First, protective kits are subject to inventory, during which the number of kits in kind and according to accounting data, actual and standard service life are compared, the quality of protective clothing, the possibility of further use, and the possibility of using waste after write-off are assessed.

How to write off workwear in accounting when dismissing an employee ?

Based on the results of the inventory, a write-off act is drawn up, which is signed by the commission and subsequently approved by the manager.

Workwear is written off according to the standards established by the organization. Their calculation is made on the basis of the Rules of the Ministry of Social Development No. 290n dated 01/06/09, which regulate the issuance of special clothing to employees at the intersectoral level. According to this document, issuance standards can be applied:

- standard (Order of the Ministry of Labor No. 997 dated 09/12/14);

- industry-specific (each industry has its own regulatory document);

- adopted in the organization based on the decision of the manager.

What is the procedure for writing off workwear and registering the write-off , including the act of writing off PPE?

The administration has the right to establish increased standards for the issuance and write-off of workwear, but they must be justified (clause 6 of intersectoral rules No. 290n) by a special independent assessment of working conditions and reflected in the LNA. Arbitrarily established increased standards for write-off of workwear may cause a conflict with regulatory authorities. The Ministry of Finance also reminds of the need for an independent assessment (Letter No. 03-03-06/1/59763 dated 11/25/14).

How to reflect the write-off of workwear whose useful life exceeds 12 months before the end of this period due to physical wear and tear?