The wage fund (WF) is all expenses for personnel wages, including bonuses, allowances, and compensation from any source of financing.

Using this indicator, wage costs for employees of different structural divisions and categories are analyzed, costs are adjusted and optimized, and rates, salaries, and prices are adjusted. It is from the amount of the fund that all payments provided for by law are calculated: pension contributions, insurance contributions, etc.

Payroll is an important tool for rationalizing enterprise expenses and stimulating employees.

What it is

Payroll – Payroll Fund, it represents all the amounts that employees of an enterprise receive in the course of their activities. With the help of payroll, expenses are kept track of for a certain time period. It includes expenses for staff salaries, as well as allowances, vacation pay and all types of social benefits.

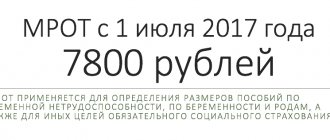

Payroll calculation is carried out taking into account a certain time period, for example, a month or a quarter. At the legislative level, a minimum level of payment is established, and the maximum is not limited and depends only on the employee himself.

The payroll changes depending on the situation in the services market, the level of inflation, labor costs and other factors. At the same time, the wage fund is the main part of the final cost of the organization.

Legal

Contents: Labor is the basis of human existence, both for an individual person and for society as a whole. At the same time, labor can be free, that is, participation, for example, in cleanup days, in the work of public organizations. But such work is only an addition to a person’s main labor activity, for which monetary or other material remuneration is awarded.

We recommend reading: The most mysterious crimes in the world

In other words, the end result of labor is payment. Remuneration is the remuneration that a person receives regularly for his work activity. Dear readers! Our articles talk about typical ways to resolve legal issues, but each case is unique. If you want to find out how to solve your particular problem, just call, it’s fast and free!

To calculate payment, the following categories are used: wage fund.

In the future - payroll; salary fund.

What does it include

Payroll is a wage fund and every employer should know what it includes, since incorrect calculation of indicators can lead to liability when inspected by regulatory authorities. Payroll includes:

- the amount of accrued wages;

- the final cost of products when labor is paid in kind;

- additional pay for additional work, including overtime or night shifts, as well as days off on holidays;

- all types of bonuses, including for long and continuous work experience;

- all types of payments for carrying out activities in hazardous conditions;

- payments for unworked time;

- expenses of funds to provide employees with free products, services, food, and accommodation;

- costs for the purchase of products issued to the employee free of charge, for example, uniforms. This type of expense can be replaced by the provision of cash or other benefits for the employee to independently purchase the necessary uniform;

- cash payments provided to an employee in connection with going on vacation, both main and additional or maternity leave. This also includes the amount of compensation for vacation that the employee has not previously used;

- payments in the form of remuneration for labor of minors;

- all expenses for medical and other types of examinations, as well as the performance of duties established at the state level;

- all types of compensation that are due to employees during the liquidation or reorganization procedure of an enterprise;

- payments for forced absence, transfer to a job with a lower level of pay, or for temporary disability, for example, due to illness;

- travel expenses. This also includes payments when working on a rotational basis and all delays that arose for reasons beyond the control of the employee;

- expenses for payment of certain types of pensions.

The manager must take into account all the expenses of the enterprise, which primarily go towards paying employees or creating conditions for their implementation, for example, payments for travel.

Taxes

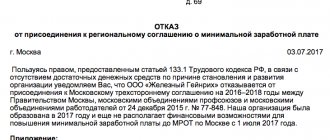

The payroll does not have taxes as such, but for various items, including the income of individuals, the tax is removed. The fund also includes permanent social payments.

Taxes and their size depend on whether the enterprise or organization has benefits. At the same time, payments will definitely be made in any case.

Contributions

All social contributions, including insurance and pensions, are paid to the fund. Each type of contribution has its own rate. All fees are required to be paid. For this reason, they are included in the fund, as well as in calculating the cost of products or services.

Sick leave

Sick leave is included in the payment fund there and is taken into account when calculating costs. At the same time, insurance payments for sick leave are no longer included in the organization’s payroll.

Benefit

Benefits, including child care, are not included in the payroll. This applies to all types of benefits.

Personal income tax

Personal income tax is included in the fund without fail. The payroll must take into account all personal income taxes during the billing period.

Vacation pay

Each employee's vacation pay, like all other regular payments due, is paid into the wage fund.

What does not apply

It is worth noting that income coming from third party sources should not be taken into account in the calculation. So the payroll does not include:

- one-time bonuses accrued every year;

- expenses for sick leave payments arising after the third day of illness of the employee;

- payments transferred monthly to women who give birth until the child reaches the age of 1.6 years;

- all expenses incurred during the sending of an employee for training or retraining and transferred by bank transfer;

- all funds received or spent from third-party sources of income;

- financial assistance, which is provided after a written request from the employee;

- payment of dividends to employees.

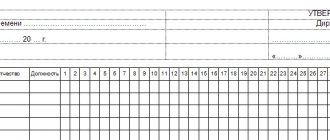

When calculating payroll, you need to be guided by the data recorded in the time sheet, salary slips and staffing schedule of each employee. With their help, you can calculate payroll for any period, including an hour, which is especially necessary if you have a large staff of workers.

Financial assistance to employees: accounting and taxation

The article from the magazine “MAIN BOOK” is current as of September 4, 2015. T.V.

Tarasova, chief expert consultant of TLS-GROUP CJSC Sometimes employers financially help their employees who find themselves in a situation that requires large expenses. What can be recognized as material assistance, and how can it be correctly taken into account for tax purposes?

Further, we will talk exclusively about payments to employees, which are in no way related to their work activities, do not depend on the results of their work, and are designed to support the employee in some special situations. For example, in the event of the death of a family member of an employee, or the birth of a child, it is necessary to carry out expensive treatment for the employee or his relatives.

Only such payments can be subject to a certain preferential taxation procedure, which we will consider below.

How is it different from the Payroll Fund?

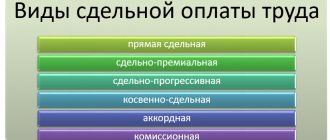

The wage is the amount that an employee receives for work performed or time worked. It is calculated using the tariff rates established at the enterprise.

In this case, the FZP includes:

- labor costs in any form;

- additional payments, including bonuses and allowances;

- compensations due to employees working in difficult or harmful conditions.

At the same time, the federal wage does not take into account the costs of social benefits. The wage fund includes a larger list of expenses, including the wage fund itself.

How to calculate

When calculating payroll, you need to select one of the periods for calculation:

- annual;

- monthly;

- day;

- hourly.

The most popular period is the annual period. To calculate payroll, there is no single, mandatory formula, but most often the following is used for calculation:

FOT=NW×SCH×12

Where:

| NW | average salary per month |

| midrange | average number of employees |

SP can be obtained if the final amount of all payments and accruals that are part of the payroll is divided by 12. SP is calculated by adding the number of all employees for each day of the month and dividing the number of calendar days.

To calculate the annual value, you need to repeat the steps for the period from January to December, then add the resulting numbers and divide by 12.

For example:

If SZ = 350 thousand rubles. taking into account allowances and additional payments, and SCH = 20, then payroll = 350 × 20 × 12 = 84,000 thousand rubles.

What is the formula and how is the wage fund calculated?

If we compare this totality with the wage fund (WF), then the latter will be part of the payroll. The main difference between the FW is that this fund includes only those payments that are directly related to the labor operations performed by employees and their results.

NOTE! These funds will match if the organization's employees do not receive any payments other than salaries. The importance of payroll as an economic category, in addition to directly accounting for necessary expenses, helps in solving many management tasks, such as: analysis of personnel costs of different structural divisions; adjusting the company's general expenses; a certain role in increasing profitability and reducing expenses; adjustment of product costs and, as a consequence, the company’s pricing policy;

Estimate

Payroll estimates are most often used as a planning element in large organizations that employ workers with the appropriate level of qualifications and maintain an approach to planning characteristic of the times of a planned economy.

In most modern enterprises, this document is practically not used or is used under a different name.

Typically, the payroll estimate is used to identify all areas in which the enterprise's funds are spent, as well as the exact amount of all components of the payroll. The estimate is most often drawn up taking into account not only the main elements of the wage fund, but also including all payments and benefits of a social nature.

Most often, estimates are calculated for one year, including a breakdown by months and quarters.

Planning procedure

Planning is an important task for every enterprise, since payroll takes into account the bulk of the organization’s expenses.

The planning itself can be carried out using the following algorithm:

- collect information about the structure of the organization, the number of employees and their movement, the average wage and planned production indicators;

- carry out a study of the staffing table and internal local acts that are related to the payroll;

- forecast the average number of employees for the planning period;

- select a planning structure and draw up an estimate;

- calculate payroll.

During the planning procedure, it is necessary to take into account current indicators, as well as the future direction of the organization’s development, including possible changes in wages or the number of employees.

Timely planning will allow you to have full control over your payroll and conduct timely analysis.

Financial assistance for vacation in accordance with the Labor Code of the Russian Federation

The concept of “financial assistance for vacation” does not exist in the current legislation, and accordingly, the obligation of employers to pay such benefits is not provided.

As a rule, the benefit acts as a monetary incentive for an employee for the conscientious performance of his duties and remains at the discretion of the company’s management.

According to the Labor Code, the right to receive financial assistance arises only when the obligation and conditions for the provision of such payments are reflected in the internal local acts of the enterprise. Contents of the article According to the current legislation of the Russian Federation, benefits can be defined as financial assistance in cases where they: are not taken into account in local acts as payment for labor activities; are not regular; do not depend on the results of the employee’s work; are not employee motivation.

Usage Analysis

The analysis is directly related to the planning procedure. It is necessary to fully identify how much the planned indicators diverged from the actual ones.

If a discrepancy was identified in favor of the enterprise itself, then the size of the payroll can be reduced next year, otherwise it is necessary to find out all the reasons for the discrepancy.

This procedure is especially necessary in large enterprises, in which, due to a crisis or other unforeseen circumstances, the discrepancy between the planned and actual indicators can amount to several million.

The analysis allows the company to provide stable payment of wages to employees, regardless of force majeure.

Certificate of monthly

A certificate of monthly payroll may be needed if:

- the loan is being processed;

- the bank requested data to confirm the legality of the company’s actions, that is, to confirm that all funds withdrawn are credited to the employees’ account;

- inspection is carried out by employees of the Federal Tax Service or insurance funds.

This certificate may reflect payroll data not only for a specific month, but also for other periods. In addition, it may reflect planned indicators. However, there is no single form for this document, which allows the organization to use a company letterhead.

Sample form.

Regardless of the type of activity of the company, it is obliged to pay workers involved in production.

Payroll allows you to reflect all the company’s expenses for its employees, including wages and social benefits. With the help of payroll, the manager will be able to competently formulate the company's budget, which will prevent the possibility of bankruptcy.

Components of the wage fund (WF) in 2021

In addition, reserves for payments and ways to reduce expenses from the Fund can be identified. Additionally, the study will help determine whether salaries are increasing or decreasing in general and how effective bonuses are. The analysis is carried out only on the basis of documentation, which can come from the accounting department, from personnel officers, or statistics are used. Responsibility for ensuring that the analysis is carried out can be transferred to different persons, and if the company is small, then this function can be performed by the manager or chief accountant.

But with a large staff, it is quite possible to hire an economist or analyst who will study all the documents and then present the results.

It is better to entrust this task to experienced and qualified specialists, since you can get confused already at the stage of analysis directions.

If discrepancies arise, analysts will be able to determine what factors caused this, how much the plan was violated, and what needs to be done to prevent similar situations from occurring in the future, or to at least reduce the deviations in volume.