Often individual entrepreneurs and commercial organizations have to resolve the issue of filing a zero declaration for missing items.

For whom the new FSBU 5/2019 “Inventories” was issued? Federal standard 5/2019 was approved by order of the Ministry of Finance dated

What is deferred payment to a supplier? When we talk about deferred payment to a supplier, then

Reporting 2020 Alexey Borisov Leading expert on labor relations Current as of January 13, 2021

Every company, when starting its activities, asks itself which taxation system to choose. For this

Determination of net assets Regulatory provisions for calculating the net assets indicator are given in the Order of authorship

Hello. In this article we will talk about what a markdown of goods is and for

IT and SHE: what is it and how to calculate Deferred tax assets (DTA) and

Accounting for software under the simplified tax system: postings Accounting for software of a company is regulated by basic standards of accounting

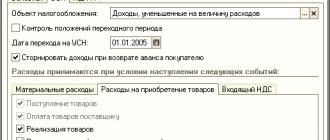

Many organizations and entrepreneurs operate under the simplified tax system and pay a single tax to the state. His appearance