The article discusses the procedure for reflecting transactions related to deductions from employee salaries of amounts according to

Author of the article: Anastasia Ivanova Last modified: January 2021 17909 For individuals and civilians

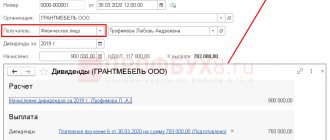

In this article we will look at how to calculate dividends in 1C 8.3 Accounting 3.0. Suppose

Kontur.Accounting is a web service for small businesses! Quick establishment of primary accounts, automatic calculation of taxes, sending reports

Home / Taxes / What is VAT and when does it increase to 20 percent?

Which depreciation group does the Server belong to? Some experts classify servers as OKOF code 320.26.20.13

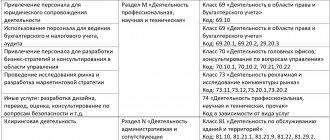

The services of recruitment agencies are needed both by ordinary citizens who want to find a job, and by organizations that

The UTII interest rate 2021 is 15%: this is established at the federal level. But regional authorities

Payment for sanatorium-resort treatment for an employee is financial assistance from an employer who is ready to spend money on recovery

Benefit for movable property: before and after 2018 According to the general rules, everyone is taxed