Determination of net assets

The regulations for calculating the net asset indicator are given in the Order of the Ministry of Finance dated August 28, 2014 No. 84n. The legal act specifies that the amount of net assets subject to regular analysis is reflected in the financial statements. The calculated value is taken from line 1600 of the balance sheet; it must be adjusted downward by the amount:

- current liabilities of the company;

- outstanding debt of the founders for contributions to the authorized capital at the time of drawing up the report;

- In the form for calculating net assets with a minus sign, data on future income, expressed in the form of gratuitously received assistance, is entered.

Certificate of net assets: form and content

Since a unified form for the certificate has not been approved at the federal level, the Company retains the right to present information in free form. However, a certificate of net assets, a sample of which is approved by the meeting of members of the Company, must contain:

- legal name of the Company,

- document registration data,

- time of determining the net asset value;

- financial information on the amount of net assets, with a breakdown of current and non-current assets;

- information about the period for which the financial statements data were used to prepare the certificate;

- signatures of officials.

Calculation form structure

The concept of net assets covers the entire range of property involved in turnover in the process of core business, the source of payment for which was:

- own funds;

- borrowed resources with a long repayment period.

Law No. 14-FZ dated 02/08/198 approved the norm for including in annual reporting information on net assets, the nature of their changes and the reasons for negative trends (if any). To do this, a form for calculating the net asset value is first filled out. The results of settlement operations can be demanded by internal and external users:

- owners and management of the company;

- credit structures when assessing the client’s solvency;

- potential investors when deciding on financing a business project;

- insurance companies at the stage of determining the risk factor under the insurance contract.

There are no legal requirements for the execution of calculation and analytical procedures for the structure of assets and liabilities. The form for calculating net assets (2020) can be drawn up on the basis of the template proposed in Order of the Ministry of Finance No. 10n and FCSM No. 03-6/pz, dated January 29, 2003. The regulatory document has lost its relevance, but the sample document given in it can be used by entities management.

The calculation form template must contain the following information:

- the procedure for distributing assets into homogeneous groups;

- grouping diagram of balance sheet liability indicators;

- the value of each cost parameter;

- the form for net assets must necessarily reflect the total amounts for each group of funds and the overall valuation of the entire complex of resources.

The content and formulas used in the analysis process are approved by Order No. 84n dated August 28, 2014. The result should be guided by the rule that the amount of assets exceeds the size of the authorized capital. If this control ratio is violated, it is necessary to take emergency measures to improve the financial position of the company - increase the estimated value of assets or reduce the amount of capital shown in the statements. The value of working capital can be influenced by revaluation or contributions from the founders.

If you find an error, please select a piece of text and press Ctrl+Enter.

General concept of net assets

Assessing the performance efficiency and successfully planning the work of modern companies is impossible without analyzing their economic indicators. One of the most important values among such indicators is the value of net assets (NA).

The value of net assets is the difference between the value of all the organization’s assets (property, land, cash, etc.) and the sum of all its liabilities (debts for taxes and payments to the budget, loans, etc.). To put it simply, net assets are those company funds that will remain after repaying debts to creditors.

Find out what the minimum possible size of an organization's net assets is in the Ready-made solution from ConsultantPlus. Access is completely free.

The calculation of net assets is mandatory once a year and is reflected in the annual financial statements on line 3600 of Section 3 of the Statement of Changes in Capital. It is also done when necessary to obtain information about the current financial situation, to pay interim dividends or the actual value of the share to the participant.

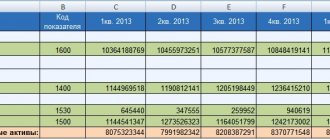

Balance sheet structure.

* — balance line 1170 – Financial investments section Non-current Assets;

**- balance sheet line 1530 – Deferred income section Current Liabilities

Net assets: what line of the balance sheet is this?

When filling out annual reports, the accountant must reflect net assets in the form Report on changes in capital (OKUD 0710003) Appendix No. 2 to Order of the Ministry of Finance of the Russian Federation dated July 2, 2010 No. 66n.

How to calculate the net asset value according to the balance sheet 2019-2020 (formula)

To find out this, let us turn to the order of the Ministry of Finance of Russia dated August 28, 2014 No. 84n, which provides the procedure for calculating net assets.

What is the difference between this procedure and the one that was in effect previously, read in the material “A new procedure for calculating net assets has been approved .

It is valid for companies of the following forms of ownership:

- joint stock companies (public and non-public);

- limited liability companies;

- state and municipal unitary enterprises;

- cooperatives (industrial and housing savings);

- business partnerships.

Results

The amount of net assets is one of the most important indicators of the financial viability of an organization. The higher it is, the more successful the organization and the more attractive it is for investment. Only an organization with high net assets can guarantee the interests of its creditors. This is why it is necessary to be very careful when assessing the value of a company's net assets.

Sources:

- Order of the Ministry of Finance of Russia dated August 28, 2014 No. 84n

- Federal Law of 02/08/1998 No. 14-FZ “On Limited Liability Companies”

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Net Asset Value Analysis

It is easy to conclude that when analyzing net assets, the output should be positive. A negative one will indicate that the company is unprofitable and with a high degree of probability in the near future may become completely insolvent, that is, insolvent. The only exception can be a recently opened company, since during its existence the invested funds did not have time to justify themselves and did not generate income for objective reasons. Thus, the dynamics of calculating net assets is one of the key indicators of the company’s financial condition.

Note that when calculating and assessing net assets, the authorized capital of the company plays an important role. If the amount of net assets exceeds the amount of the authorized capital, this indicates the well-being of the company. If the net assets at some stage become less than the amount of the authorized capital, this indicates the opposite: the organization is operating at a loss.

What consequences await the company if net assets are less than the authorized capital, read here.

Let us repeat: this situation is acceptable only for the 1st year of the company’s operation. However, if after this period the situation does not change in a positive direction, the company’s management is obliged to reduce the size of the authorized capital to the amount of net assets. If this figure is equal to or less than the minimum indicators established by law, the issue of closing the enterprise should be raised (clause 4, article 30 of the Law “On LLC” dated 02/08/1998 No. 14-FZ).

Find out what ways to increase net assets and avoid closing a company from the Ready-made solution from ConsultantPlus by getting trial access to the system.

Read more about the consequences of negative NAV values in the material “What are the consequences of negative net assets?” .

Calculation example

The net asset indicator, otherwise called net worth, is one of the key indicators in the activities of any commercial company. The annual average can be either positive or negative. The latter indicates that the company has practically no own funds and is completely dependent on creditors.

Both for potential investors and for regular creditors, this state of affairs is an alarming sign. Sometimes presenting a balance sheet with negative NA can lead to serious consequences, including the liquidation of the enterprise. Moreover, Article 20 of Federal Law No. 14 dated 02/08/1998 states that if the private equity capital becomes less than the minimum authorized capital, then the limited liability company is subject to liquidation. In such moments of crisis, the value of the NA can be increased. There are several ways to do this:

- in line 1310 indicate the size of the authorized capital, which the founders can increase if they make additional contributions (additional issue);

- line 1350 of the balance sheet indicates additional capital. It can also be increased by revaluing the organization’s intangible assets and fixed assets;

- the founders can also make a contribution to replenish the reserve capital, which is displayed on line 1360 of the balance sheet;

- writing off overdue accounts payable will help quickly increase the NAV, but at the same time will lead to an increase in the income tax base;

- deferred income can also be increased if the founders or other persons transfer property to the organization free of charge. However, it will be possible to avoid an increase in income tax only if the benefactor owns at least 50% of the authorized capital or shares of the enterprise.

Obviously, if necessary, you can choose and implement the most acceptable method from the above. Although such, in fact, an artificial increase in the NAV will not lead to an increase in the company’s welfare. In practice, this negative indicator is acceptable only for newly created enterprises, since there is an objective reason why the invested funds simply have not yet had time to pay for themselves and generate income - this is time.

General concepts

Successful business conduct is impossible without a detailed analysis of the financial and economic indicators of the economic activity of an economic entity. In order to assess the property and financial position of an organization and make the right management decisions in a timely manner, it is necessary to determine important solvency and profitability ratios. One of the key calculation indicators is the calculation of the value of net assets on the balance sheet.

The organization's net assets (NA) are the amount of funds of an economic entity, determined by calculation, which will remain at the disposal of the company after full repayment of debt obligations. In other words, the value of net assets is calculated as the arithmetic difference between the total indicators of the company’s property, material and financial assets and assumed liabilities.

Formula for calculating net assets

The key procedure for calculating the value of net assets on the balance sheet is determined by the Ministry of Finance of the Russian Federation and is presented in a separate order No. 84n dated August 28, 2014. Please note that previously a different procedure was in effect, but it is not currently used.

This formula for net assets on the balance sheet is applicable to the following range of economic entities:

- public or non-public joint stock companies;

- state or municipal unitary enterprises;

- limited liability companies;

- production cooperatives or housing cooperatives;

- business partnerships.

Net assets formula:

- JSC - the amount of non-current and current assets of an economic entity as of the reporting date;

- DE - debt of the founder incurred to the enterprise for the formation of the authorized capital;

- FOR - debt on own shares generated upon issue;

- OB - the sum of the company's short-term and long-term liabilities;

- DBP - future income in the form of state financial support or gratuitous transfer of property assets.

How to calculate net assets according to balance sheet lines?

To calculate the net asset value on the balance sheet, the calculation lines use the following:

Calculating the amount of net assets in the balance sheet (the lines indicated above) using a pencil calculator is not enough. This calculation must be documented. However, a unified form for reflecting calculated data is not provided for in Order No. 84n. Organizations are required to independently develop a form and regulate it in their accounting policies.

Note that before the approval of Order No. 84n, the old form was in force (Order of the Ministry of Finance of the Russian Federation No. 10 and the Federal Commission for the Securities Market of Russia dated January 29, 2003 No. 03-6/pz). In the new instructions, the Russian Ministry of Finance has not prohibited the use of this form, therefore, firms can use it to prepare calculations of net assets in the balance sheet (the document lines contain all the necessary information).

Calculation scheme

In 2014, a scheme for calculating net assets, defined by law, appeared (Order of the Ministry of Finance of the Russian Federation dated August 28, 2014 N 84n). As before, the balance sheet data is taken as a basis and liabilities are subtracted from assets. However, the debt of the founders in contributions, the cost of shares purchased from shareholders, capital and reserves, and deferred income do not need to be taken into account, since they are not directly related to either the actual property or the debt of the enterprise.

Ah = A - ZS, where

- A - assets;

- ZS - borrowed funds.

Objects on off-balance sheet accounts are not accepted for accounting, namely:

- material assets that the enterprise has accepted for safekeeping;

- reserve funds;

- goods accepted for commission;

- strict reporting forms, etc.

Also, the authorized, additional and reserve capital, deferred income, uncovered profit or loss are not included.

The size of the authorized capital cannot be greater than net assets. If, after reconciling the balance, this is not the case, then its value must be reduced to their size. However, it cannot be less than 10,000 rubles established by law. Otherwise, the enterprise will be liquidated.

In the enterprise's balance sheet, net assets are indicated in line 3600.

Table 1. What is taken into account when calculating net assets

| Intangible assets | Long-term liabilities for loans and credits |

| Fixed assets | Other long-term liabilities |

| Construction in progress | Short-term liabilities for loans and credits |

| Profitable investments in material assets | Accounts payable |

| Early and short-term financial investments | Debt to participants (founders) for payment of debts |

| Other noncurrent assets | Reserves for future expenses |

| Other current liabilities | |

| VAT on purchased assets | |

| Accounts receivable | |

| Cash | |

| Other current assets |

Although the framework is general, valuation methods may also depend on the company's activities and legal form. So, for example, management companies must take into account the Decree of the Government of the Russian Federation of December 27, 2004 N 853. Brokers, mutual funds, and commodity exchanges must take into account the Order of the Federal Financial Markets Service of the Russian Federation of October 23, 2008 N 08-41/pz-n.

How to calculate net assets on a balance sheet, example

Let's look at a specific example of how to calculate net assets on a balance sheet.

Vesna LLC prepared annual financial statements, including a balance sheet in the OKUD form 0710001.

Based on the balance sheet data, the following calculations were made:

NA = (13,800 +19,283 – 0) – (12,930 – 0) = 20,153 rubles.

Analysis of indicators

Having completed the arithmetic calculations, we move on to analyzing the result obtained. With a positive amount of net assets in the balance sheet, we can conclude that the company is profitable and has high solvency. And, accordingly, the higher the indicator, the more profitable the enterprise.

Negative net assets are an indicator of the low solvency of an enterprise. In other words, a company with a negative NAV will most likely go bankrupt soon; the company will simply have nothing to pay off its debts. However, in such a situation, exceptional circumstances must be taken into account. For example, the company has just been formed and has not yet covered its costs, or the company received a large loan for expansion.

An increase in net assets can be achieved by increasing the authorized, reserve or additional capital or by reducing the founder’s debts to the enterprise.

General concept of net assets

Assessing the performance efficiency and successfully planning the work of modern companies is impossible without analyzing their economic indicators. One of the most important values among such indicators is the value of net assets (NA).

The value of net assets is the difference between the value of all the organization’s assets (property, land, cash, etc.) and the sum of all its liabilities (debts for taxes and payments to the budget, loans, etc.). To put it simply, net assets are those company funds that will remain after repaying debts to creditors.

Find out what the minimum possible size of an organization's net assets is in the Ready-made solution from ConsultantPlus. Access is completely free.

The calculation of net assets is mandatory once a year and is reflected in the annual financial statements on line 3600 of Section 3 of the Statement of Changes in Capital. It is also done when necessary to obtain information about the current financial situation, to pay interim dividends or the actual value of the share to the participant.

Responsibilities of enterprises to comply with the adequacy of net assets

The legislation on business companies contains a number of norms that regulate the behavior of enterprises depending on the size and dynamics of the private equity. The main control mechanisms are summarized in tabular form below.

Control of net assets

| Description of Responsibility | Norms |

| The company is obliged to provide any interested party with access to information about the value of its net assets | Clause 3 of Art. 35 of Law No. 208-FZ, clause 2. Art. 30 of Law No. 14-FZ |

| If the value of the company's net assets remains less than its authorized capital at the end of the financial year following the second financial year or each subsequent financial year, at the end of which the value of the company's net assets was less than its authorized capital, the company no later than six months after the end of the corresponding financial year must make one of the following decisions: | Clause 6 of Art. 35 of Law No. 208-FZ, paragraph 4 of Art. 30 of Law No. 14-FZ |

| 1) on reducing the authorized capital of the company to an amount not exceeding the value of its net assets; | |

| 2) on the liquidation of the company | |

| If at the end of the second financial year or each subsequent financial year the value of the net assets of the JSC is less than the minimum authorized capital (for JSC 100 thousand rubles, LLC and non-public joint stock company - 10 thousand rubles, Article 26 of Law No. 208- Federal Law, clause 1 of Article 14 of Law No. 14-FZ), the JSC must make a decision on its liquidation no later than six months after the end of the financial year | Clause 11 art. 35 of Law No. 208-FZ |

| A JSC does not have the right to declare the payment of dividends on shares (pay declared dividends on shares) if, on the day such a decision (payment) is made, the value of the JSC’s net assets is less than its authorized capital, reserve fund and the excess of the liquidation value of the issued preferred shares over the par value determined by the charter, or will become less than their size as a result of this decision (payment of dividends) | Clauses 1 and 4 of Art. 43 of Law No. 208-FZ |

| An LLC does not have the right to make a decision on the distribution of its profits among the company's participants (to pay profit to the company's participants) if, at the time of making such a decision (payment), the value of the LLC's net assets is less than its authorized capital and reserve fund or will become less than their size as a result of this decision ( payments) | Clauses 1 and 2 of Art. 29 of Law No. 14-FZ |

| The amount by which the authorized capital of the company is increased at the expense of the company’s property must not exceed the difference between the value of the company’s net assets and the amount of the authorized capital and reserve fund of the company | Clause 5 of Art. 28 of Law No. 208-FZ, paragraph 2 of Art. 18 of Law No. 14-FZ |

How to calculate the net asset value according to the balance sheet 2019-2020 (formula)

To find out this, let us turn to the order of the Ministry of Finance of Russia dated August 28, 2014 No. 84n, which provides the procedure for calculating net assets.

What is the difference between this procedure and the one that was in effect previously, read in the material “A new procedure for calculating net assets has been approved .

It is valid for companies of the following forms of ownership:

- joint stock companies (public and non-public);

- limited liability companies;

- state and municipal unitary enterprises;

- cooperatives (industrial and housing savings);

- business partnerships.

According to Order No. 84n, to calculate the company’s net assets, the value of liabilities must be subtracted from the value of assets. The formula used for this is:

NA = (VAO + OJSC – ZU – ZVA) – (DO + KO – DBP),

NA - net assets;

VAO - non-current assets of the organization;

OJSC - current assets of the organization;

ZU - the debt of the founders to the organization to fill shares in the authorized capital;

ZBA - debt incurred during the repurchase of own shares;

DO - long-term obligations;

KO - liabilities of a short-term nature;

DBP - future income (in the form of government assistance and gratuitous receipt of property).

To calculate net assets, you can also use the data contained in the company's balance sheet. To calculate the value of net assets on the balance sheet, the formula can be modified:

NA = (line 1600 – ZU) – (line 1400 + line 1500 – DBP).

For more information about the values given in this formula, read the article “Net assets - what is it in the balance sheet (nuances)?” .

Please note that it is not enough to simply do the calculation on a calculator; it must also be formalized. There is currently no approved form. Companies must develop a form for calculating net assets for 2019 - 2021 independently and approve it as an annex to their accounting policies. However, earlier, before the publication of Order No. 84n of the Ministry of Finance dated August 28, 2014, the form given in the appendix to Order No. 10 of the Ministry of Finance of the Russian Federation and the Federal Commission for the Securities Market of Russia dated January 29, 2003 No. 03-6/pz was used to calculate net assets. The form of this form lists all the indicators that are required to calculate net assets even now, therefore we consider its use acceptable (after its approval in the accounting policies of the organization).

You can download this form on our website:

Net Asset Value Analysis

It is easy to conclude that when analyzing net assets, the output should be positive. A negative one will indicate that the company is unprofitable and with a high degree of probability in the near future may become completely insolvent, that is, insolvent. The only exception can be a recently opened company, since during its existence the invested funds did not have time to justify themselves and did not generate income for objective reasons. Thus, the dynamics of calculating net assets is one of the key indicators of the company’s financial condition.

Note that when calculating and assessing net assets, the authorized capital of the company plays an important role. If the amount of net assets exceeds the amount of the authorized capital, this indicates the well-being of the company. If the net assets at some stage become less than the amount of the authorized capital, this indicates the opposite: the organization is operating at a loss.

What consequences await the company if net assets are less than the authorized capital, read here.

Let us repeat: this situation is acceptable only for the 1st year of the company’s operation. However, if after this period the situation does not change in a positive direction, the company’s management is obliged to reduce the size of the authorized capital to the amount of net assets. If this figure is equal to or less than the minimum indicators established by law, the issue of closing the enterprise should be raised (clause 4, article 30 of the Law “On LLC” dated 02/08/1998 No. 14-FZ).

Find out what ways to increase net assets and avoid closing a company from the Ready-made solution from ConsultantPlus by getting trial access to the system.

Read more about the consequences of negative NAV values in the material “What are the consequences of negative net assets?” .

Why are calculation results needed?

The amount of assets must be calculated once a year. This is necessary for the following purposes:

- Control over the financial condition of the structure. The result of the calculations allows us to understand the efficiency of the structure. The size of the NAV is compared with the volume of the authorized capital. If the NAV is greater than the authorized capital, this indicates the normal position of the company. If the capital exceeds the amount of capital, then measures must be taken immediately to correct the situation. If this ratio does not change over the course of two years, the entrepreneur must either reduce the authorized capital or liquidate the organization.

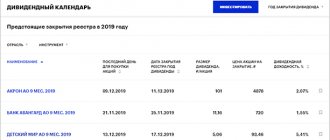

- Dividend payment. According to Article 29 of the Federal Law No. 14 dated 02/08/1998, dividends can be distributed only after an analysis of the economic condition of the company. In particular, it is necessary to identify the ratio of MC and NA. If the latter value is less than the authorized capital, dividends cannot be paid.

- Determining the real value of a share. The real value of the LLC founder's share is the volume of net assets corresponding to the size of the share in question. This definition is specified in paragraph 2 of Article 14 of the Federal Law of 02/08/1998 No. 14.

- Increase in capital. The capital can be increased at the expense of either the organization’s personal property, or additional contributions from participants, or funds from third parties, if permitted by the Charter. The increase can only be carried out by the amount of the difference between the NA and the size of the authorized capital.

- Reducing the Criminal Code. Sometimes the Criminal Code must be reduced without fail. The decision to reduce capital is made based on the volume of net assets and their ratio to the capital.

Almost every organization is faced with the need to determine the size of its net assets.

In what cases is the calculation made?

NA must be calculated in the following cases:

- Purchase by an LLC of a participant’s share at his request in the event that the share cannot be acquired by third parties according to the Charter.

- The company’s purchase of the share of a participant who voted at a meeting against the implementation of a major transaction or change in the size of the authorized capital.

- Exclusion of a participant from the company with the subsequent transfer of his share to the LLC.

- The participant is required to pay creditors with his share.

- It is required to determine the financial condition of the company.

- A decision is made to pay dividends.

- Reduction or increase of capital.

The size of assets is the most important indicator for any business entity. Regular calculation of the parameter under consideration provides a number of advantages for the company: reliability, strengthening market positions, increasing opportunities to attract resources, sustainability. Open data on private equity is the confidence of counterparties in the solvency of the organization.