Civil Code of the Russian Federation). Therefore, duties and other payments paid by the organization in accordance with Art. 15

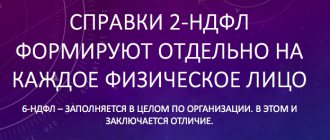

Organizations and entrepreneurs that are tax agents must annually provide information on income according to

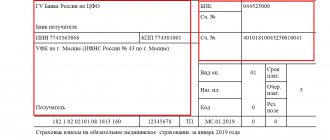

Payments for insurance premiums are a document by which the payer instructs the bank to make a transfer

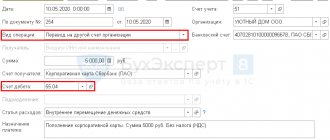

Accounting for settlements with accountable persons - postings Requirements for registration of cash transactions, including

Payments for insurance premiums are a document by which the payer instructs the bank to make a transfer

Deductions for children under personal income tax in 2021: changes, sizes and provision Children's taxes

Home / Tax changes / Tax changes in 2021 General changes Violations of regulations

Article updated: November 25, 2021 Author of the article Marina Afanasyeva Tax consultant with 4 years of experience

Fixed assets are company assets that serve for a long time and can only be replaced with others.

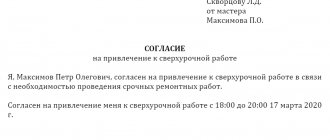

Work activities sometimes involve situations where the employer is forced to go beyond the established normal hours