The taxpayer replenishes the country's budget with his payments. Money goes to solving important problems. For example, the water resources that our country is rich in are exhaustible. If you do not use water within reasonable limits, and constantly pollute it with sewage, chemical, biological, and radioactive waste, then very soon the people's resource, the source of life, will become scarce.

To prevent this from happening, the procedure for calculating water tax is based on strict control of the activities of enterprises and organizations (including individual entrepreneurs) regarding water consumption and emissions into it. In addition to the long process of obtaining permits, companies must install special water intake meters. Each section, for example, of a river, has its own coefficient. In addition, in the territory of one region there may also be additional coefficients.

Plus coefficient per cubic meters of resource taken. Particular attention to mineral and healing springs. Individuals pay for water at a reduced rate at home, which is calculated by calculations using certain coefficients. A water tax is paid for the entire population of the city, village, and utility bills received. This is what Vodokanal does.

An environmental tax is levied for pollution of the external environment - air, water, land, subsoil. Each organization must obtain a license to emit a certain amount of pollutants of a certain hazard class. Citizens pay for garbage removal. This money is summed up and transferred to the tax account.

Current rates:

| Taxes | Current interest rate | Who is obliged to pay |

| On personal income tax | 13% for residents from salaries and dividends; 30% for non-residents with salary, 15% on dividends; IP – 13% | Individuals and legal entities |

| For property | Calculated based on cadastral value. Benefits are provided. The tax increases by 20% every year until 2025. For individuals - state. limit from 0.1% to 2% depending on the value of the property. There are benefits. For organizations, preferential limit is 1.1% =. Regulated by Ch. 30 Tax Code of the Russian Federation | |

| With simplified tax system | “Income” - 6% (maximum rate); “Income minus expenses” - maximum 15% | Legal faces |

| On UTII | From 7% to 15%, depending on the category of taxpayers | Legal faces |

| Water tax | The rate depends on the locality, region, water intake facility | Phys. persons pay according to the meter (utilities). Officially, taxpayers are organizations; |

| Calculated according to Article 346.39 of the Tax Code of the Russian Federation The rate depends on the coefficients: region, object, area of water resource, security object, volumes of water withdrawn | Legal entity whose activities are related to water intake | |

| Ecological | Rates are calculated by waste class (by toxicity) and for emissions into the atmosphere, water, and landfills | Organizations. Citizens pay a fee for garbage collection |

| Land | Based on cadastral value using the deflator coefficient, regional and other coefficients. | Individuals and legal entities in accordance with Art. 391 Tax Code of the Russian Federation |

| MET | Rates are in percentages (ad valorem) and in rubles per ton (specific). The tax is calculated based on a combination of different parameters in accordance with the Land Code and the Tax Code of the Russian Federation | Legal entities and individual entrepreneurs pay as subsoil users who have a license for their activities |

Payment of taxes occurs for the reporting period, which, according to the parameters established by law, occurs without fail after submitting reports for the month, quarter, or year. Taxpayer organizations are informed about all changes in an explanatory Letter. This document is sent only to those companies that are required to make payments according to their activities.

Transport tax

There will be no changes in this area, which is undoubtedly one of the most important, tax collection. Transport tax will continue to be mandatory for those citizens who own vehicles. This category includes not only passenger cars, but also:

- motor transport;

- trucks;

- buses;

- pneumatic transport;

- tracked transport;

- snowmobiles;

- watercraft;

- aircraft;

- other types of vehicles.

Regular contributions will continue to be collected in the established manner that is familiar to Russians. Regional government representatives will continue to monitor the implementation of this transport obligation.

As for rates: drivers can exhale, since there are no plans to increase tariffs, despite the protracted economic crisis and the general aggravated situation in the country. However, there will be no reduction either.

So let's rejoice in the absence of change

In view of the difficult economic events we mentioned earlier, it is not possible to completely abandon the transport tax in the conditions of today's Russian realities. According to statistics, transport fees fill the state budget with approximately 146 billion Russian rubles.

However, there will be some changes regarding the timing of payments. Thus, companies that have the organizational form of a legal entity will receive an obligation to pay the tax contribution before the first day of February 2021. In addition, they will also have to immediately transfer the advance payment for the subsequent reporting period to the state balance sheet.

Individuals, that is, ordinary citizens and individual entrepreneurs, will have to transfer funds using the details received from the tax service before the first of December next year. Let us remind you that in 2021 the payment deadline remained the first day of October. This means that vehicle owners will have much more time to accumulate the funds due for payment.

The tax rate will continue to be calculated according to the three main characteristics of the vehicle owned by the citizen. These include:

- the year the vehicle was produced at the plant;

- period of use of a specific vehicle;

- engine power (for cars it is measured in so-called horsepower).

Please note that, as before, the coefficient for calculating the amount of the fee will be differentiated according to each subject of the Russian Federation. In other words, different rates will apply in the regions, therefore, it will have to be clarified specifically for any city individually.

Those who decide to change their place of residence should be especially careful. As you move, your rate will also change.

Video - How much more expensive will it be to maintain cars in 2018?

Accounting policies for individual entrepreneurs and LLCs on OSNO

In the Russian Federation, accounting policy (AP) is understood as a description of methods for assessing, accounting for income and expenses, and accounting for other economic facts. The taxpayer chooses all these methods independently (clause 2 of article 11 of the Tax Code of the Russian Federation). It is permissible to choose accounting options from those methods that are possible under the Tax Code of the Russian Federation.

UP for tax accounting (Article 313 of the Tax Code of the Russian Federation) must be maintained by all taxpayers. The UP is approved by order of the individual entrepreneur or the head of the LLC.

Accounting policy on OSNO for individual entrepreneurs

In the Russian Federation, legislation provides for two types of management programs: accounting and tax.

Does an individual entrepreneur need an accounting software?

According to the legislation of Russia, individual entrepreneurs may not keep accounting records (subclause 1, paragraph 2, article 6 of the law on accounting dated December 6, 2011 No. 402-FZ) and the individual entrepreneur also does not have the obligation to maintain UE for accounting purposes

However, the individual entrepreneur has the right to draw up an UE for accounting and will be obliged to do this if the individual entrepreneur nevertheless decides to conduct accounting.

The individual entrepreneur conducting accounting will have to consolidate in the UE the accounting methods for objects for which there is more than one accounting method.

Why is individual entrepreneur tax accounting policy?

Individual entrepreneurs are required to keep tax records (Article 313 of the Tax Code of the Russian Federation), therefore each individual entrepreneur must form a tax management system.

In the UE for tax purposes, an individual entrepreneur can reflect the nuances of calculation for each tax with a focus on optimizing the taxation of his business.

The management program of different entrepreneurs largely depends on the type of activity and can differ significantly in volume and content.

Photo gallery: sample accounting policy of IP Vasilyeva on OSNO

Page 1

page 2

page 3

Accounting policy on OSNO for LLC

There is no standard accounting policy; the point of using the accounting policy is precisely to do it taking into account the specifics of your business and choose from those possible under the law those methods of maintaining tax accounting that are beneficial to the taxpayer.

The management program for the next year must be documented and approved by order of the director before December 31 of the previous year.

The formation of the management program and the choice of tax accounting methods and techniques is usually done by the chief accountant. But this can be done personally by a manager or an accountant from an audit company.

Most of the accounting rules that can and should be reflected in the UE are reflected in the Law “On Accounting” and in PBU 1/2008 “Accounting Policies of the Organization”

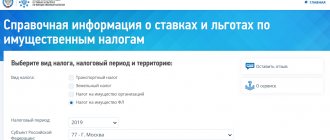

Property tax in the coming 2018

There will be many major changes in the property tax area in the coming year. First of all, this will happen due to the transition to assessing the value of housing based on cadastral value. We remind you that previously the assessment was made on the basis of the inventory value, which, compared to the market price of housing, was underestimated. This eased the burden of taxpayers, allowing them to pay feasible fees to the treasury. However, now the tax base for calculating deductions will be the cadastral value of the property, which is as close as possible to the market price of the property.

Property tax is one of the main fees in the Russian Federation

So that you understand how this will affect the amount of tax deduction, let’s give a simple example: if you previously paid, for example, about 600 rubles to the treasury, now you will have to pay 6,000 thousand! Of course, the amounts will not necessarily correspond to the values we have named, and will not necessarily be rounded, however, the increase in the amount of tax collection will indeed be very, very noticeable.

The reform currently being carried out regarding the transfer to cadastral value will lead to the fact that the tax amount will range from 0.1% of the cost of housing to 2%. The period given for renewal is five full years. The formation of a set of cadastral values of taxpayers' real estate located in Russia will be based on independent assessments given by an expert commission.

Let's go through the list of property tax payers. They are the owners:

- construction projects that are not fully constructed and are intended to be residential;

- places for storing vehicles, that is, garages or places in specially designated parking areas;

- premises in apartment buildings, which include both the apartments themselves and only their parts - rooms;

- erected complex buildings, inside of which at least one room will be residential;

- buildings of a domestic nature, the area of which will be no more than 50 square meters, used for gardening or dacha work located on a land plot.

Property owners will be required to provide the Federal Tax Service with complete and truthful information regarding the real estate they own for verification. If this obligation is not fulfilled, then tax specialists will rightfully impose monetary sanctions in the form of a fine, the amount of which will be at least 20% of the actual amount of the tax collection. This rule only applies to property that is not included in the tax notice.

As for the benefits associated with the property tax, they remain the same and no changes are expected in 2021.

When selling real estate, citizens of the Russian Federation are required to make a payment in the amount of 13% of the cost of the apartment, however, only if they have not waited for the minimum period of ownership required by law:

- all residential properties purchased before 2021 are subject to a tenure period of 36 months, that is, three whole years;

- if the property was purchased after 2021, then this period will be 5 years.

Note! The countdown period is based on the date of registration of the object in the unified state real estate register. Consequently, the day specified in the contract is not taken into account.

As for prices, previously, in the contract, citizens could indicate the cost of housing much lower than it actually is. To avoid fraud associated with this possibility, the government took measures and decided: the officially indicated price cannot be less than 70% of the cadastral price of the property. Even if a different figure is specified in the contract, you will still have to pay the tax fee at a coefficient of 0.7 from the real estate title being sold.

There is an assumption that the government will decide to cancel the benefits associated with the period of ownership in 2021 completely, and the tax will have to be paid in any case, however, there is no real evidence of this fact yet.

The taxation of property of various organizations in 2021 will also undergo dramatic changes. The fact is that the conversion to cadastral value will be relevant not only for residential properties, but also for commercial premises. This means that not only their price will increase, but also the rent for premises. Now government structures have set themselves a very clear task: to fill the state registers of non-residential real estate. As for benefits for legal entities, the decision on their application in each individual region will be considered directly by local administrative authorities.

Benefits for legal entities are considered by local administrative authorities

Real estate sales tax for citizens

If earlier, before 2021, citizens had to pay 13% of the amount under the contract, or the cadastral value, multiplied by a reduction factor of 0.7 from the property sold (provided that the property was owned for less than three years), and after 2021 Since the beginning of 2021, the three-year period has been extended to five years; then, from the beginning of 2021, the tax benefit for exemption from sales tax after the expiration of the statute of limitations for the possession of a property is generally removed.

Even if a citizen has owned a property in 2021 for more than three or more than five years, he will be required to pay a tax on its sale in the amount of 13%. The letter of the Ministry of Finance of the Russian Federation No. 03-11-17/76399 dated June 25, 2017 tells us about this.

Taxation of individual entrepreneurs in 2021

The Ministry of Finance of the Russian Federation has developed a number of changes in the field of taxation for another category of the population, represented by individual entrepreneurs.

For those who have chosen a simplified taxation system, a maximum annual limit on incoming income has been introduced. It should be noted that the limit is very acceptable: it is 150 million units of Russian currency. According to statements by representatives of government agencies, the required limit will be valid directly from 2021 to 2021, that is, its relevance will last two years. The rates for the tax collections under consideration all remained the same, but the authorities of the regions of the Russian Federation, as before, received the right to reduce their value.

Each case will be considered individually

The funds received as a pension for each individual entrepreneur in 2018 will amount to a little more than 24 thousand Russian rubles. They will have to be paid to the state without fail. For medical insurance, the payment amount will be 5 thousand units of Russian currency.

Now government structures are working to consider a legislative project that involves exempting the entrepreneurial layer of the population from payments directly related to the minimum wage (minimum wage), which increases annually. However, the application of the required bill will be largely disadvantageous for people building their own businesses, so its adoption will most likely not take place.

What taxes does an individual entrepreneur pay on the simplified tax system?

The article will be useful to those who are just thinking about starting a business, as well as citizens who are afraid to work legally for fear of exorbitant tax fees.

More than 50 regions collect taxes to the Russian budget less than Dagestan alone receives from it

At the beginning of 2021, it became known that the conditions for subsidies to the regions would be tightened. For subsidies to equalize budgetary security in 2018-2020. will account for more than 40% of the transfer from the federal budget (about 2 trillion rubles). Thirteen regions will receive half of the assistance, with Dagestan receiving the most. It remains the most subsidized region, and will receive 66.2 billion rubles from the federal budget this year.

Let us note that 57 regions of Russia collect less taxes to the federal budget than Dagestan alone will receive. For comparison, the latter collected 14% more last year, but only 9.2 billion rubles. That is, the volume of Moscow transfer to Dagestan is 7.2 times higher than its own federal taxes. If we talk about all taxes and fees, then Dagestan collected 32 billion rubles last year, of which 22.7 billion rubles remained in the republic, that is, 70%, while in Tatarstan this proportion is the opposite). Thus, the volume of federal assistance is twice as much as everything that Dagestan can collect.

Land tax in 2021

The cost of land plots in the coming year will also be assessed according to the cadastral characteristics. To do this, it is necessary to estimate the market value of the site. Unfortunately, there is an opinion among taxpayers that the cost assessment by bureaucrats is often biasedly inflated. The price is determined by the cadastral chamber and its specialists. Their decision regarding the determination of the price of the plot can only be challenged in court. However, there is a real danger of losing and incurring losses associated with paying for the costs associated with the trial.

The amount of payment due to the state in 2021 will increase by as much as 20%, and its growth will continue immediately until 2020. The main argument of government structures in favor of such an increase is the assumption that the filling of regional budgets, increased through transfer to cadastral value, will have a very positive effect on the development of the infrastructure of each residential locality.

By the way, this filling will increase approximately 6-8 times

Salary increase

In addition, the main legislative body of Russia is currently considering a presidential law on gradually increasing the minimum wage to the subsistence level.

As previously announced, starting from the new year the minimum wage is expected to increase to almost 9.5 thousand rubles. There is a high probability of an increase of more than 3% in child benefits. Accordingly, the volume of tax payments at a constant rate of 13% of personal income tax will increase.

The tax itself will no longer be levied on one-time targeted payments under social assistance programs made through:

- local budgets;

- budgets of Russian regions;

- federal budget;

- off-budget funds.

Experimental holiday tax in 2018

According to a new government decree, 2021 will be the year the launch of an experimental tax levy - the so-called holiday tax. Its introduction will be carried out in the four most popular resort areas of the Russian Federation today.

Table 1. Popular resort areas in Russia

| Zone | Photo |

| Crimean peninsula | |

| Altai region | |

| Stavropol region | |

| Krasnodar region |

It is to these warm and sunny areas of the country that Russian citizens flock during the hot summer and early autumn months. It should be noted that their patriotism is truly admirable: not only has it been very expensive to vacation in their homeland for a long time, now they will have to pay an additional tax fee.

That’s right, payments for vacation will be made by tourists coming from:

- other regions of Russia;

- foreign countries.

Many Russian citizens consider this newly introduced fee a return to the past. The thing is that it already existed in our country, during its Soviet existence. It came into force in December 1991 and was then repealed in 2004.

However, the resort fee is a unit of global practice. It is also used in such developed countries as:

- Germany;

- Spain;

- Italy;

- France;

- as well as from other leaders of domestic tourism.

The tax will be imposed on all tourists who visit the above resort areas of the country. The category of beneficiaries will include all its traditional representatives, that is:

- minor citizens;

- military veterans;

- students studying in higher educational institutions;

- people with disabilities;

- other similar categories.

The amount of the tax fee for vacation has not yet been determined, however, the amount of deduction is expected to be 100 rubles for one day of stay in an official accommodation facility. By the way, it is possible that rates will vary depending on the season. In addition, their education will be influenced by such nuances of citizens’ travel as:

- purpose of arrival;

- the significance of the area where the tourist is vacationing;

- other, not yet indicated nuances.

One of the most important problems regarding the application of the required tax levy is that it is necessary to remove from the “shadow” such tourist accommodation facilities as guest houses that are not officially registered, beds for private citizens, for example, old people living on pensions. Finding such places to stay overnight in a resort town is easy.

To do this, you just need to ask the locals and they will definitely show you the way

The ongoing experiment causes mixed feelings among taxpayers. On the one hand, the practice is global, which means it takes place. On the other hand, vacationing in your homeland has long become impossibly expensive. And if this price is now added to the need to pay several thousand rubles per family for a standard vacation period, most likely citizens will move to their dachas or go abroad.

Resort fee

But what about ordinary citizens? The legislator did not ignore them either.

From May 1, 2021, for individuals visiting the Crimea, Krasnodar, Altai and Stavropol Territories, the so-called. resort fee.

The size of the resort fee from 2021 and the procedure for collecting it will be determined by each region independently. According to the law, the amount of the fee cannot exceed 50 rubles per day per person (in 2021 - 100 rubles), and its payment will most likely be made at the hotel.

Minors, participants of the Great Patriotic War, Heroes of the USSR and Russia, combat veterans, low-income people, disabled people of groups I and II, persons staying in the region for less than 24 hours will not be affected by the changes in legislation - they will not have to pay a new fee.

Personal income tax in the coming year of the yellow dog

The budget is filled with the help of tax levies, which are paid by residents of our country, as well as individual businesses and organizations. Each collection brings a certain amount of money into the state treasury. According to the degree of budget filling, personal income tax is one of the most important and abundant.

Changes in personal income tax are still only predicted

The standard rate for personal income tax (personal income tax for short) is 13%. The levy applies to any income received by citizens. Please note that income does not necessarily mean only cash receipts. Property objects are also considered income, so you often have to pay money to the treasury upon receipt.

The rumors circulating around personal income tax in 2021 are disappointing. Citizens began to sound the alarm, because they say that income tax collection will rise by several percent. This concern is justified primarily by the fact that in the conditions of not increasing wages, as well as the ever-increasing prices of housing and communal services, the rising cost of food, clothing, medicine and other goods, another significant piece will be taken away from the monthly payment received at the main place of employment .

They say that until elections are held in the country, no changes will be announced, since the tax increase will have a very negative impact on the image of the government. However, after that we can expect some changes.

As representatives of government agencies say, increasing the tax rate on personal income is a necessary measure, since in times of crisis the country needs money circulation. Despite the unpopularity of such a measure, it will have to be accepted.

However, by the end of 2021, residents of our country will most likely begin to be charged at an increased rate. Thus, the Ministry of Finance of the Russian Federation states that raising it by 2% from the current value will ensure the flow of an additional half a trillion Russian rubles into the state treasury per year.

It should be noted that the 13% rate is not the only relevant rate for tax collection on the income of an individual. In addition to this, the following tariffs also apply.

- 30% is paid by citizens who do not have resident status in relation to our country. Having the required status means staying on the territory of Russia for at least 183 days in a consecutive 12 month period. Please note that this period has nothing to do with the calendar year; the year will be calculated from consecutive monthly periods.

- The personal income tax paid when receiving a prize in a promotion or event of a similar nature also increases compared to our usual rate of 13%, and becomes equal to 35%. Read about this in our special article.

Citizens are especially concerned about payments related to wages. Thus, a significant portion of 13% was taken away from the salary received at work each month, which then went to the state.

To make it clearer, let's give an example. Imagine that the salary at your workplace is 30 thousand rubles. Now every month you will not receive the specified amount in your hands, but only 87% of it. To get the tax amount, you need to multiply the salary by a rate of 13%. As a result, we receive 3 thousand 900 rubles. The amount is not small, especially considering that the situation in the country, as we have already mentioned, is difficult.

In addition, since the tax scale is the same for everyone, it turns out that the wealthy layer of the country’s population and the unsecured, even socially unprotected, pay the same. As a result, the first group live as before, and this is good, but the second group is on the verge of poverty.

However, the development of progressive differentiation of rates depending on the wealth of each individual citizen is a prospect so vague that it is not even seriously discussed at government meetings. So we cannot expect any relief from the tax burden of citizens in the area of personal income tax.

Preliminary forecasts indicate that the personal income tax rate will be raised to 15%, paid from the income received by each citizen. At the same time, it is also possible to reduce other tax fees, which will indirectly affect the welfare of taxpayers.

There is also a possibility that residents of the Russian Federation will have the opportunity to apply a minimum tax deduction when assessing personal income tax. Its size will be equal to the subsistence minimum.

However, most likely, only socially vulnerable categories of the population will be able to obtain the right to use

In addition, a bill has been submitted for consideration that proposes to exempt citizens whose wages are less than 15 Russian rubles from paying personal income tax in full. He also calls for increasing the rate for those citizens who have so-called incomes above the norm.

More precisely, this project will presumably be implemented as follows:

- those citizens whose income is from 180,000 to 2,400,000 rubles will have to pay a tax fee of 13%;

- for people whose income will range from 2,400,000 to 100,000,000, they will make payments to the treasury in the amount of 30% of the income received, as well as make a fixed annual payment, the amount of which is 289,000;

- those persons who receive an annual income of more than 100 million rubles will be required to make payments to the treasury for personal income tax, the amount of which will be 29,600,000 units of national currency, in addition, they will have to deduct 70 from that part of the income, which exceeded the 100 million limit.

Domestic experts predict that such active changes related to personal income tax will only lead to citizens starting to look for legal and illegal loopholes to hide funds. The shadow sector of the economy, which is currently very large, may grow even more, which will not improve, but will only worsen the Russian economic crisis.

Reporting procedure for individual entrepreneurs and LLCs on OSNO

The reporting of LLCs and individual entrepreneurs working for OSNO may differ depending on the types of taxes.

Reporting of individual entrepreneurs working at OSNO

Let's talk about reporting on those types of tax payments that are relevant to all entrepreneurs using OSNO.

Table: the simplest reporting option - individual entrepreneurs without employees

| Tax | Submitting reports to the Federal Tax Service | Tax payment deadline |

| VAT | The declaration is submitted quarterly. The report can only be submitted in electronic form before the 25th day of the first month of the next quarter (Article 174 of the Tax Code of the Russian Federation) | Monthly equal installments in the next quarter |

| Personal income tax | An individual entrepreneur fills out form 3-NDFL () once a year and submits it annually no later than April 30 of the following year. Important: the 13% personal income tax rate is provided only for residents. If the individual entrepreneur is a non-resident, the personal income tax rate will be 30%. | Advance payments (Article 227 of the Tax Code of the Russian Federation): 1) for January - June - no later than July 15 - half of the annual amount as calculated by the Federal Tax Service; 2) for July - September - no later than October 15, ¼ of the annual amount; 3) for October - December - no later than January 15 of the following year - ¼ of the annual amount of advance payments. |

| Property tax for individuals | Paid in the amount of 0.1–2% of the value of fixed assets, if any. This expense item cannot be optimized, since assets are valued at cadastral value. However, the amount of this tax reduces the amount of net profit of the individual entrepreneur, and, accordingly, the amount of personal income tax. | No later than December 1 of the year following the expired tax period (Article 409 of the Tax Code of the Russian Federation) |

Important: the 3-NDFL declaration was amended by order of the Federal Tax Service dated October 25, 2017 No. ММВ-7–11/ [email protected] These changes are effective from February 18, 2018 and apply to reporting for 2021.

Changes made to:

- title page - it does not indicate the taxpayer’s address, only the telephone number;

- sheet D1 for deductions for the construction or purchase of real estate - instead of the address of the object, its cadastral number and information about the location are provided;

- Sheet E1 for standard and social calculations.

Reporting provided by individual entrepreneurs on OSNO to the tax authorities:

- reporting on “salary taxes” to the pension fund and social insurance fund - quarterly. Since 2021, a monthly report to the Pension Fund has been added - SZV-M, and since 2021 a single social contribution has been introduced, which will combine the reports RSV-1 and 4-FSS. From January 1, 2017, this report must be submitted not to the Pension Fund and Social Insurance Fund, but to the Federal Tax Service. But you will still need to submit a report on contributions for injuries to the Social Insurance Fund;

- book of accounting of income and expenses and business transactions of individual entrepreneurs to the tax office - once a year;

- declaration 3-NDFL - once a year (until April 30);

- VAT return - every quarter (until the 20th of the next month);

- declaration 2-NDFL - once a year (until April 1 of the next year);

- declaration 6-NDFL - every quarter (until the last day of the month following the reporting quarter) and annually until April 1 of the following year.

- the 4-NDFL declaration with information about the expected profit is submitted only by: newly registered individual entrepreneurs within 5 working days of the month following the month in which the first income was received; existing individual entrepreneurs with an increase or decrease in income by 50% of the previous year’s income.

- land tax declaration to the tax office - once a year (until February 1);

- transport tax declaration to the tax office - once a year (until February 1).

Video: individual entrepreneur reporting on OSNO

LLC reporting on OSNO

LLCs operating for OSNO, by default, do not have an exemption from the main types of taxes or from those taxes that these LLCs are required to accrue and pay due to the characteristics of the business (for example, excise taxes or water tax).

Therefore, LLCs submit to OSNO a full set of reports required by the Tax Code of the Russian Federation.

Zero reporting on OSNO

If during the reporting period an individual entrepreneur or LLC had no activity, no income received and no movement in accounts, no one canceled the obligation to submit reports.

If an individual entrepreneur or LLC did not have any activity in the reporting period, such a taxpayer has the right to report for this period by submitting a Unified (simplified) tax return () to the Federal Tax Service.

Reporting must be done by the 20th day of the month following the end of the quarter.

If the zero report is not submitted in a timely manner, a fine will be assessed for violation of record keeping.

Corporate income tax

Legal entities pay income tax to the state treasury at a fixed rate, which currently amounts to 20% of the funds received by them. Let us remember that profit is not income, that is, the proceeds of an enterprise, but money earned, from which all production costs have been subtracted.

Let's give an example. You run a store where you sell vegetables and herbs that you grow yourself. Let’s assume your revenue for a certain tax period amounted to 50 thousand rubles. In the process of arranging greenhouses and growing vegetables, as well as for the purchase of packaging and other necessary production expenses, you previously paid about 25 thousand rubles. To calculate the taxable base (profit), you need to subtract expenses from revenues. We will receive: 50-25 = 25 thousand - the net profit of your vegetable shop.

The changes regarding the income tax did not affect the rate itself, but the distribution of the proceeds collected from the taxpayer. Now the federal budget gets 3% of the amount received, while the remaining 17% goes to the regional treasury.

Corporate income tax 2018

In addition, in 2021, local authorities received the right to independently differentiate rates in each individual situation. In the new year, everything will remain the same, however, representatives of some categories of taxpayers will have the opportunity to work at a minimum rate. Previously it was 13.5%, now it is 12.5%.

Corporate income tax plays a major role, however, in some specialized taxation regimes it is not deducted to the treasury, since they require simplified accounting. Let's talk about this in detail in a special article.

But for two more regions of the Volga Federal District - those that received new governors - the volume of subsidies was increased by 15%

At the same time, subsidies to 15 regions increased almost exactly 15%, including two regions of the Volga Federal District: the Kirov region (subsidies increased from 10 to 11.5 billion rubles) and Mari El (by almost 1 billion rubles: from 6 to 6.9 billion ). Note that in these regions the dependence is quite high. Last year, the Kirov region collected 38.2 billion rubles in taxes, retaining 25 billion rubles, and received subsidies amounting to 26% of all collections. Mari El collected 19.3 billion rubles (keeping 12 billion rubles for itself), and received subsidies amounting to 31.17% of all fees. Apparently, in their case, the new government played a role - both in Mari El and in the Kirov region, new governors took office not so long ago and did not yet have time to break the woods (that is, collect loans) to spoil relations with the Ministry of Finance of the Russian Federation.

There were no changes in the list of the most subsidized regions. After Dagestan comes Yakutia, it will receive 47 billion rubles this year (6.7% more), then Kamchatka (its subsidies were cut by 5% - will receive 37.4 billion rubles), Chechnya (will receive 12.4% more - 30.4 billion rubles) and the Altai Territory (its subsidies were cut by 1% - it will receive 26.8 billion rubles). In the top 10 you can find both Bashkortostan and Crimea, where the volume of subsidies was increased by 15% - it will receive 20.3 billion rubles this year.

Value added tax next year

Changes in tax legislation also affected the fee, the payer of which is companies selling any product. Despite the fact that they are responsible for paying value added tax, indirectly the entire burden falls on the shoulders of tax payers. The fact is that the products on which additional costs are imposed are purchased by ordinary citizens. Knowing this, companies selling goods include in the cost of products not only their own surcharge, but also the amount of tax due.

Let's take a closer look at how and who will be affected by the VAT innovations.

The most stunning news regarding the changes in this area is that as 2021 approaches, some purchasers will be forced to play the role of tax agents.

This applies primarily to goods represented by scrap metal, that is, to:

- used aluminum and other metals with their alloys;

- non-ferrous and ferrous metal waste;

- raw skins of skinned animals.

All of the listed types of goods in our country were previously exempt from paying the required tax fee, however, now the person purchasing them is obliged to calculate value added tax. However, this rule does not apply to ordinary individuals, but to individual and legal entities that acquire the above names.

In addition, some intermediary companies are excluded from the list of tax agents. These include:

- telecom operators, the list of which is listed in the Federal Law on the Russian payment system;

- subjects of the national payment system.

There are three main rates for value added tax:

- the standard rate is 18% of the markup on the product;

- if the transaction performed is excluded from the list of those subject to 18% taxation, then the rate will be 10%;

- in all other cases the rate will be 0%.

The requested tariffs remain the same and continue to apply.

In addition, from the first of January of the next year, tax payers forever lose the right to receive a deduction in the form of input VAT on those categories of goods that were purchased using public funds.

As for operations carried out for the sale of re-exported goods, in 2021 the rate on them is reduced to zero. However, only on the condition that the goods have already undergone all customs procedures specified by law.

In addition, a much larger number of people have acquired the right to receive VAT at a zero rate. It will also be possible to waive the zero rate for the required tax levy on exports in the coming 2021.

Changes in tax legislation will affect all Russian citizens

Pension Fund

Contributions to the pension fund are perhaps the largest. After all, after retirement, the state will have to support you for quite a long time. Or hasn't it been long enough? In general, to provide you with a decent old age. The guarantee of a good pension is a regular salary and a long work history, well, or a separate bank account, as Zhora did, because with his stressful work it is not at all a fact that he will last until retirement. Government agencies persistently urge workers not to accept salaries in envelopes, otherwise all they can provide you with is nothing. So your employer sends 22% of everything there - for the benefit of society, and Zhora says goodbye to 11,000 rubles and her brand new belt.

Let's sum it up

Tax rates in 2021, like other nuances in the field of tax legal relations, will undergo serious changes. For some segments of the population they will seem too harsh, others, perhaps, on the contrary, will be happy with their introduction. Only one thing can be said for sure: in order to obtain accurate data on government decisions made regarding the taxation system and their smallest details, it is necessary to wait until the coming year. Let's hope it brings only good things.

Review: Major changes to tax legislation in 2018

Increase in EUNI

The above changes will mainly affect representatives of large and medium-sized businesses. However, the next unpleasant “bell” rang out for small businesses.

From the beginning of the year, new coefficients for UTII - or simply “imputed” - come into effect. The rate calculation system is quite complex and depends on a number of factors. But we can already say that in the coming year, on average, those imputed will pay the state almost 4% more.

This type of tax was last increased in 2013.