Since contributions to the Social Insurance Fund for civil contracts, the object of which is the performance of work and the provision of services, are not paid, part of Appendix 2 to Section 1 of the calculation for them is not completed. However, other indicators regarding the number of insured persons and their characteristics must be filled out (see letter of the Federal Tax Service dated July 31, 2018 No. BS-4-11/14783).

Based on sub. 2 p. 3 art. 422 of the Tax Code of the Russian Federation are not subject to taxation of contributions for compulsory social insurance in case of disability and in connection with maternity, income under GPC agreements. Based on this, lines 010–070 of Appendix 2 to Section 1 regarding the reflection of the amounts of insurance contributions to the Social Insurance Fund should not be filled in regarding payments under GPC agreements.

At the same time, the requirement to fill out section 3 regarding personalized records applies to all insured persons for the last 3 months. This section must be completed even if there are both taxable and non-taxable payments. In addition, line 180 of subsection 3.1 of section 3 is also required to be completed, and it is necessary to record the attribute of the insured person. For income from civil contracts, you must indicate code 2.

GPC agreements in 1C: Salaries and personnel management 8th edition 3.1

Section “Personnel” - “Employees” - “Create”. To reflect the terms of the GPC agreement, it is necessary to create a document “Agreement (work, services)”, which is located in the “Salary” section.

Click on the “Create” button and select “Agreement (work, services)”. In the header of the document you need to indicate the employee - the performer of the work, whose data we previously entered into the “Employees” directory.

In the fields “Start date” and “End date” you should indicate the duration of the contract. In the “Payment method” field we indicate the terms of payment under the contract: - if you set the switch to the field “Once at the end of the month”, then payment for the work will be made once after the end of the contract; - the switch to the field “According to certificates of completed work” means that payment will be made the work will be carried out upon registration of the document “Acceptance Certificate of Completed Work”; - if the switch is set

What taxes does an organization pay under a GPC agreement?

Personal income tax

Under a civil contract, the company pays the contractor or performer a remuneration, from which, in accordance with paragraphs 1-4 of Article 226 of the Tax Code of the Russian Federation, personal income tax must be withheld.

How to pay personal income tax under a GPC agreement

It is necessary to calculate and withhold personal income tax under the GPC agreement for each payment. The type of payment (advance or full payment) and the date of payment do not matter. Remuneration paid to a citizen under a civil process agreement is recognized as his income on the day of payment or transfer in accordance with subparagraph 1 of paragraph 1 of Article 223 of the Tax Code of the Russian Federation.

Tax deductions under the GPC agreement

Standard tax deductions provided for in Article 218 of the Tax Code of the Russian Federation are also applicable for civil partnership agreements.

Upon a written application from a citizen with whom the company has entered into a GPC agreement, it must provide him with standard tax deductions.

But the organization does not have the right to provide a citizen working under a GPC agreement with property and social deductions. A person working under a GPC agreement can receive property and social deductions only through the tax office, by submitting a tax return. This procedure is provided for in paragraph 8 of Article 220 and paragraph 2 of Article 219 of the Tax Code of the Russian Federation.

Read about this topic

Re-qualification of a civil law contract into an employment contract

Insured person category codes for 2021: table with explanation

Note that until 2021, a similar section was contained in the RSV-1 calculation.

We recommend reading: The difference between tsn and tszh in the table

It was section 6

“Information on the amount of payments and other remuneration and the insurance period of the insured person”

. Section 3 of the new calculation of insurance premiums submitted to the Federal Tax Service contains personalized information for each employee.

I. O. of the employee completely according to the identity document; in line 110 - the employee’s date of birth according to his identity document; in line 120 - the numeric code of the country of which the individual is a citizen; in line 130 – digital gender code: “1” – male, “2” – female; in line 140 – code of the type of identification document;

Why in 1C: ZUP 3.1 “clean” GPC does not fall into the “Calculation of insurance premiums” in the first section of Appendix No. 2?

Persons insured in the field of OSS are listed in 255-FZ.

So, in particular, in subsection B of subsection 3.1 of the calculation, it is required to indicate the personal data of the employee to whom the income was paid, namely: in line 060 - TIN; in line 070 – SNILS; in lines 080, 090 and 100 - F.

In particular, these include:

- civil and municipal employees.

- persons working under an employment contract, including managers who are the only founders;

According to clause

Accordingly, the following are not subject to taxation of OSS contributions:

- GPC remuneration;

- reimbursement of expenses incurred by individuals.

These amounts are not reflected at all in Appendix No. 2 (neither on line 020, nor on line 030).

1 tbsp. 420 of the Tax Code of the Russian Federation, the object of taxation of insurance premiums is payments and other remuneration in favor of individuals insured under a specific type of insurance. GPC employees are not insured in the field of compulsory health insurance in case of disability and in connection with maternity.

Example of filling out the DAM for the 2nd quarter of 2018.

Let's look at a specific example of how to fill out the DAM for the 2nd quarter of 2021.

Section 3

Alternatively, you can start filling out the DAM from section 3, which will reflect individual information for each employee, as well as calculated remunerations and insurance contributions. This sheet must be completed for each individual with whom an employment or civil employment agreement has been concluded. Section 3 includes 2 pages, the first of which displays the employee’s personal information, and the second - the amounts of payments and insurance premiums.

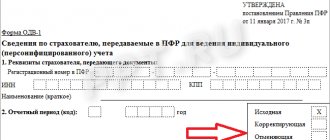

On page 010, you must indicate “0” if the DAM is surrendered for the first time during the specified period. If adjustment calculations are made, you must enter 1-, 2-, etc. on the line. depending on the correction number.

On page 020 the code of the billing period is written down, in our case - 31.

On page 030 the year is entered - 2021.

On page 040, you need to reflect the serial number of information about the employee. You can use a personnel number, but it is much more convenient to put exactly the serial number of the sheet of section 3, since, for example, workers under civil and industrial agreements do not have a personnel number at all.

On page 050 the date of transfer of the RSV is entered.

A sample of filling out the first page of Section 3 is presented below:

The second page of section 3 is for totals.

For each month, columns 220, 230 and 240 are used, arranged in a column.

In gr. 190, information is entered about the serial number of the three reporting months, in our case it will be 04, 05, 06.

In gr. 200 must reflect the category code of the insured person, which can be selected from this table. The most common is HP - hired employee.

In gr. 210 indicates the total amount of payments to the employee for the six months.

In gr. 220 the pension insurance base is entered within the limit.

This is interesting: Deposit agreement when purchasing a car, sample 2021

In gr. 240, contributions calculated from the specified base are recorded.

On page 230 payments to employees under the contract are entered. If there are none, you need to enter zeros.

In gr. 250 reflects the general values of the total indicators for the last 3 months.

An example of filling out the specified information is presented below:

Subsections 1.1 and 1.2 of Appendix 1 of Section 1

Subsection 1.1 is intended to reflect pension contributions, and subsection 1.2 is intended to reflect medical contributions.

On page 001, the tariff code is indicated in accordance with Appendix 5 of the Order of the Federal Tax Service of the Russian Federation dated October 10, 2016 No. ММВ-7-11/551. For organizations with a general tariff, code 01 is used.

Subsection 1.1 differs from subsection 1.2 by the inclusion of lines 021, 051, 061, 062, since they reflect information on contributions in excess of the established limit of the taxable base.

On page 030 in accordance with paragraph 1 of Art. 420 of the Tax Code of the Russian Federation indicates the specific amount of payments subject to contributions.

Line 040 reflects payments that are not subject to contributions.

On page 050 you need to indicate the taxable base for contributions.

On page 060 the amount of the contributions themselves is indicated.

In the DAM for the 2nd half of 2021, the total amount of contributions to mandatory pension insurance should be equal to the amount of contributions for all employees for each month. Otherwise, the tax authorities will not accept the DAM (Clause 7, Article 431 of the Tax Code of the Russian Federation). This reference ratio must be checked before submitting the calculation.

An example of filling out subsection 1.1 is presented below:

An example of filling out subsection 1.2 is presented below:

Appendix 2 section 1

This application shows calculations for social insurance contributions. In gr. 001 you need to put code 1 if there is a pilot project with the Social Insurance Fund in the region, and code 2 if employers pay benefits themselves and then reimburse them from the Social Insurance Fund.

Appendix 2 must be filled out in the same way as subsections 1.1 and 1.2 with some exceptions:

- in page 010 there is no need to indicate employees on civil and industrial contracts, since they are not insured;

- on pages 020 and 030 you need to indicate the remuneration paid to employees under GPC agreements;

- on page 070 you need to reflect expenses incurred at the expense of the Social Insurance Fund. In this case, the first 3 days of sick leave are not taken into account (Letter of the Federal Tax Service of the Russian Federation dated December 28, 2016 No. PA-4-11 / [email protected] ), since they are paid for by the employer. In addition, the amount is indicated taking into account personal income tax.

An example of filling out Appendix 2 is presented below:

Appendix 2 continues below:

Appendix 3

The application is necessary to detail information on employee benefits. If they have not been paid, you do not need to fill out the form.

On pages 010 and 011, benefits are recorded for citizens of Russia and from the EAEU countries (clauses 12.6, 12.7 of the Order of the Federal Tax Service of the Russian Federation dated October 10, 2016 No. ММВ-7-11/551).

Lines 020 and 021 record benefits for temporarily staying foreigners.

An example of filling out Appendix 3 is presented below:

Section 1

This section is intended to display information on contributions for transfer to the Federal Tax Service based on the results of the 2nd quarter of 2021.

First, you need to write down the OKTMO code, and then the amount of contributions for each individual BCC, more details about which can be found in this article. Amounts must be indicated separately for the total calculation period from the beginning of the year, and, in addition, for each month of the reporting period (second quarter).

This is interesting: Sample contract with a doctor consultant 2021

An example of filling out section 1 is presented below:

Section 1 continues below:

Title page

Information about the company is filled out on the title page, including name, INN, KPP, OKVED code.

In the “adjustment number” column, you must enter 0 if a primary calculation is submitted. Then indicate the billing period code - 31, year - 2021, code for the location of the company - 214.

The full name and signature of the director, as well as the date of formation of the DAM, are indicated in the lower left part of the title page. If the report is signed not by the director, but by an authorized representative, a copy of the supporting document must be attached.

An example of filling out a title page is presented below:

How to fill out section 3 in the calculation of insurance premiums in 2021

It does not matter whether during this period there were payments and rewards in favor of such individuals.

This was noted by specialists of the Federal Tax Service of Russia in a letter dated December 28, 2018 No. To work effectively in the program “1C: Salaries and Personnel Management 8” edition 3.1, we recommend going through “.”

That is, if, for example, in January, February and March 2021, an employee under an employment contract was on leave without pay, then this should also be included in section 3 of the calculation for the 1st quarter of 2021.

Since during the designated period of time he was in an employment relationship with the organization and was recognized as an insured person. Of course, it is necessary to formulate section 3 for persons in whose favor in the last three months of the reporting period there were payments and remunerations under employment or civil law contracts (clause 22.1 of the Procedure for filling out calculations for insurance premiums, approved by order of the Federal Tax Service of Russia dated October 10, 2021 No. MMV -7-11/551). Let us assume that during the reporting period a civil contract (for example, a contract) was concluded with an individual, but the person did not receive any payments under this contract, since the services (work) have not yet been provided (performed).

We recommend reading: Where can I complain about the store manager?

Features of a civil contract

A civil contract (CLA) is concluded for the duration of the execution of the agreed amount of work or provision of services. Its parties are the customer and the performer. Legal relations that arise within the framework of such an agreement are regulated by the provisions on the work contract and on the provision of paid services, in accordance with Chapter. 37, 38, 39 Civil Code of the Russian Federation. By concluding such an agreement, the contractor undertakes to perform a certain amount of work or provide services according to the customer’s instructions using his own materials and his own funds. However, cases are allowed when the customer supplies the contractor with his own materials and provides him with his equipment. In this case, they talk about a contract with the customer's dependency. Upon completion of the work or full provision of services, the parties to the contract draw up an act on the completion of work or provision of services, in accordance with which the contractor is paid a remuneration. Household contract workers do not obey the work schedule in force in the company and the orders of its management. They are not included in the staff and do not bear disciplinary liability and cannot be sent on business trips. But, boss. Contractors bear full financial responsibility in accordance with the concluded agreement, while the liability of an ordinary employee is limited by the norms of the Labor Code of the Russian Federation.

Gph calculation of insurance premiums

In the article we will tell you about insurance premiums for civil contracts and consider the calculation procedure. To calculate payment in the directory, you must select the item corresponding to the concluded contract: 251 “Under a contract” or 252 “Under a service contract”, or others. Such accruals are not subject to contributions to the Social Insurance Fund, so the employee will not be automatically taken into account in the calculation (if you have specified the type of order). The calculation of insurance premiums (hereinafter referred to as the calculation) for the first half of 2021 must be submitted to the Federal Tax Service no later than July 31.

In this regard, we will clarify an important question: how to fill out the calculation form if a civil contract has been concluded with an employee? There were no amounts of insurance contributions for additional social security in the billing period in our organization, so this table remains empty. But the amount of insurance contributions for compulsory social insurance for

Where to find codes of insured persons

All codes of insured employees that may be required when calculating insurance premiums can be found in the classifier, which is approved by Pension Fund Resolution No. 2p. This classifier is a table that contains the code, its decoding, as well as the necessary notes.

In addition to the codes of insured employees, this classifier includes:

- Codes of special working conditions and territorial conditions;

- Special codes assessment of working conditions;

- Codes of grounds for calculating the length of service and for calculating early pensions.

Personnel accounting and payroll calculation in 1C 8.3 ZUP 3.1

Therefore, I recommend that you read the previous articles. So let's talk about premium settings first.

Firstly, we need to correctly set up the accounting policy in the program for calculating insurance premiums in the information about the organization. To do this, go to the Settings section - directory Organization details, our organization “Alpha” will open and on the Accounting policies and other settings tab, click on the Accounting policies link.

Now, in the window that opens, you need to select the type of insurance premium rate. By default, the program sets the tariff applied when

“the main taxation system, except for agricultural producers”

. This type of tariff can be changed by selecting from the appropriate list.

In our example, we will apply exactly this tariff - Organizations using SOS, except for agricultural producers. Here you should also indicate the rate of contributions to the Social Insurance Fund NS and PZ (Social Insurance Fund for Accidents and Occupational Diseases).

Expansion and revision of the regulated report “Calculation of insurance premiums” for civil insurance contracts subject to FSS and FSS NS (for ZUP version 3.1.8.246)

No configuration changes required!

(To be on the safe side, you can first create a DAM without an extension by removing it from the base, and then add an extension and form a DAM with an extension).

Which sections of the RSV should I fill out?

The RSV includes a title page and 3 sections, the 1st of which contains 10 applications, and the 2nd - one application. The title page, section 1 (subsections 1.1, 1.2 of appendix 1, appendix 2) and section 3 are required for completion by organizations and individual entrepreneurs that have hired employees.

This is interesting: Lease agreement with a minor, sample 2021

Other sheets need to be completed only if necessary, for example:

- if benefits were paid, you need to fill out Appendix 3 of Section 1;

- if the company has established harmful and dangerous working conditions, you need to fill out subsections 1.3.1, 1.3.2 of Appendix 1 of Section 1;

- if an organization uses reduced rates for calculating insurance premiums, you need to fill out appendices 5, 6, 7 of section 1, depending on the basis for paying insurance premiums.

How the tax office checks the RSV

The tax office checks whether the amount of pension contributions for the 2nd quarter matches the personal accounting information. If there is a discrepancy, it is necessary to correct the error (clause 7 of Article 431 of the Tax Code of the Russian Federation).

Tax officials also check the consistency of the individual information provided with the Federal Tax Service database. If there are errors, the RSV must be retaken.

In order to determine the correctness of calculation of insurance premiums, inspectors add the amount of calculated contributions for the 2nd quarter to the amount for the 1st quarter. If the result is less than the total amount, you need to look for and correct the error.

What is the difference between an offset scheme and a direct payment system?

In the first case, the employer serves as an intermediary between the state and the citizen, who receives temporary disability benefits while officially employed by him. This happens as follows - social benefits are initially paid by the employer, who can then reimburse their expenses by contacting the Social Insurance Fund. Among the advantages of such a system is its familiarity to the population and the absence of the need to control the issuance of benefits separately, but there are also disadvantages:

- benefits depend on the employer (if he does not have money for payments, the incapacitated employee will be left with nothing and will be forced to go to court);

- the offset scheme creates problems for employers, which makes them even more diligent in hiding income and the number of employees;

- the presence of an intermediary extends the payment process.

As an alternative, there is a direct payment system, according to which the employer does not participate in the distribution of benefits. Money for socially vulnerable categories of the population comes directly from the state, which is beneficial for all parties:

- the employer will not be able to appropriate the benefits to himself;

- those who are unable to work will receive their money faster, regardless of the profitability of their place of work;

- the employer will be less biased towards employees on benefits (for example, pregnant women on maternity leave).

In all respects, the direct issuance system is more beneficial for everyone - therefore, the FSS plans to transfer all subjects of the Russian Federation to it.