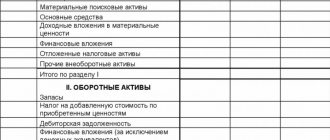

Who must submit the report Reporting forms for property fiscal tax are provided by organizations recognized as taxpayers

A separate division of a legal entity located outside its location is an object in which

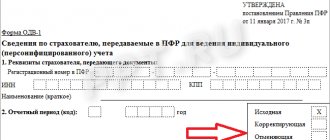

When providing information, starting from 2002, the policyholder (employer) fills out: form SZV-4-1 when providing

What are inseparable improvements to property, apartments - differences from separable ones In accordance with the article

One of the criteria for determining the amount of depreciation is the useful life (SPI) of the main object in question.

A high degree of liquidity of the enterprise’s balance sheet characterizes the developed financial intelligence of the company’s management and indicates

The current form of the VAT return for 2021 was approved by order of the Federal Tax Service of Russia dated October 29, 2014 No.

Russia has experienced many pension reforms, each of which completely changed the approach to the calculation procedure

When calculating compensation for unused vacation, it is often difficult to determine the calculation period

Working hours Denis Pokshan Expert in taxes, accounting and personnel records Current on 10