Who should submit the report?

Reporting forms for property fiscal collection are provided by organizations recognized as taxpayers in accordance with Chapter 30 of the Tax Code of the Russian Federation.

Today, payers are recognized as organizations that have movable and immovable property on their balance sheet as part of fixed assets. Please note that this chapter has been amended. Starting from 01/01/2019, only real estate will be considered the object of taxation of the property fiscal tax. Movable fixed assets (transport, equipment, inventory) are exempt from property tax collection.

When is it not necessary to submit the declaration under consideration?

If an organization completely lacks fixed assets subject to property tax, then there is no need to submit such a declaration at all. For example, there is no need to submit a declaration when the company has exclusively movable fixed assets on its balance sheet.

Please note that starting from 2021, tax is paid only on real estate properties. You can find out about this in article number 80. You can find this point in paragraph 1 of this article. Additional information can be found in articles numbered 373 and 374. Entrepreneurs may also not submit a declaration, since in principle they do not need to pay this tax.

It should be remembered that the tax is calculated based on the cadastral value of the property. This is only done if the relevant law has previously been passed in your area. If a specific property does not fall within the scope of regional law, tax is charged on the residual value.

Which form to use

The tax return is submitted based on the results of the tax period. The tax period for property fiscal payment is a year.

The report form was approved by Order of the Federal Tax Service dated March 31, 2017 No. ММВ-7-21/ [email protected] It is for this that reporting for 2021 is provided. For information on how to fill out the form, read the article “Property Tax Declaration 2021: step-by-step instructions and sample filling".

What does the tax return form look like?

It should be noted that the tax service approved not only the new declaration form, but also the procedure for filling it out. This was approved by the corresponding order dated August 14, 2019 No. SA-7-21/405. It follows that for 2021 you will have to report using a new form.

As for the declaration form, it has undergone minor changes. The only thing that has changed is that the barcodes at the top of the title page and in other sections have been replaced. For example, in section 1, new lines were added to indicate tax payable and advance payments for the first quarter, 6 and 9 months. But in sections 2, 3 (intended for calculating the annual tax on real estate with an average annual and cadastral value) there is no longer a need to indicate advance payments.

Additionally, in section 2.1, new codes were added not only for aircraft, but also for watercraft. You can see all the differences between the old form and the new one in the table attached below.

Table of main changes in the tax return

| Document Sections | The form, which was previously approved by order of the Federal Tax Service dated 31.03.2017 | New form, which was approved by order of the tax service from 08/14/2019 |

| Front page | Barcode 0840 5012 | Barcode 0840 6019 |

| Section 1 (tax) | Barcode 0840 5029 It should be noted that this section completely lacks lines for entering advance payments that are accrued at the end of the reporting periods | Barcode 0840 6026 Additionally, separate lines were added for each OKTMO:

|

| Section 2 (tax on objects that are taxed at the average annual cost, or tax base) | Barcode 0840 5036 The section contains line 230, which specifies the exact amount of advance payments accrued at the end of the reporting periods | Barcode 0840 6033 The line for accrual of advance payments was excluded. But in line number 260, from now on only the exact amount of tax is indicated, which is calculated for twelve months |

| Section 2.1 (exact information about objects that are taxed at the average annual cost) | Barcode 0840 5043 There are no codes for aircraft or watercraft in line number 010 | Barcode 0840 6040 Additionally, new codes have been added to fill in line number 010:

|

| Section 3 (calculation of tax on an object that is taxed at the cadastral value) | Barcode 0840 5050 The section contains line number 110, which records the amount of advance payments accrued at the end of the reporting periods | Barcode 0840 6057 In the new form, the line intended to indicate accrued advance payments was excluded. Due to the changes made, line 130 now records only the amount of tax that was accrued for twelve months |

Property tax declaration: due date 2021

The deadlines for submitting reports, as well as advance payments, are prescribed in Article 386 of the Tax Code of the Russian Federation:

| Report | Reporting period | Submission deadline |

| Declaration | Year | No later than March 30 of the following year. |

| Tax calculation for advance payments | Quarter | No later than 30 calendar days of the month following the reporting quarter. |

If the day the report is submitted falls on a weekend or non-working holiday, then the last day of submission is postponed to the first next working day.

In 2021 the deadlines are as follows:

- 1st quarter - 04/30/2020;

- half-year - 07/30/2020;

- 9 months – 10/30/2020;

- year - 03/30/2021.

Financial statements

Annual accounting consists of a balance sheet, a statement of financial results and appendices to them. If the statements are subject to a mandatory audit, then an auditor's report must be submitted along with them. All organizations submit reports to the Federal Tax Service, but they no longer need to be submitted to Rosstat. An exception is organizations whose reports contain state secrets.

Who is renting? Organizations under any taxation regime. Individual entrepreneurs are not required to keep records and may not submit reports.

Deadlines for delivery . Reports must be submitted within three months after the end of 2021, that is, by the end of March. Submit the audit report either along with the financial statements or within 10 working days from the date of its preparation.

Form and delivery format . You must report and submit your audit report electronically. We have collected the report forms in the article “Annual financial statements of the organization.”

What are the consequences of late submission of reporting forms?

If an organization does not comply with the deadline for submitting a property tax return, then it faces liability in accordance with Articles 119 and 119.1 of the Tax Code of the Russian Federation in the form of a fine:

- 200 rub. — for failure to comply with the electronic reporting form;

- 5% of the unpaid amount of the calculated payment to the budget based on unsubmitted reporting, but not less than 1000 rubles. and no more than 30% of the specified amount.

In addition, if a tax return is not submitted, the Federal Tax Service has the right to block transactions on the company’s bank accounts until the report is submitted to the inspectorate (clause 3 of Article 76 of the Tax Code of the Russian Federation). Blocking occurs if the delay is more than 10 days.

Transfer of reporting for the 2nd quarter 2021

Due to the self-isolation regime and non-working days declared by the President of the Russian Federation from March 30, 2021, many companies were delayed in sending reports for the past year and the 1st quarter of 2021. The government postponed the dates for their submission to a later date (Decree No. 409 of 04/02/2020) , but only for reports whose submission deadline fell in March-May 2021. We talked in more detail about the postponed deadlines in this article.

There are no postponements of reporting dates for the 2nd quarter of 2021 due to the announced coronavirus measures. Therefore, some taxpayers will almost simultaneously submit reports on some taxes for both the 1st and 2nd quarter (half year) of the current year.

New deadlines for submitting reports and paying taxes and contributions for the second quarter

In the article you will find deadlines for paying taxes and contributions, taking into account reliefs during the coronavirus pandemic for the second quarter of 2021, many useful links, as well as important recommendations from leading economist-consultant Tatyana Chapaeva.

In accordance with the decrees of the President of the Russian Federation dated March 25, 2020 No. 206, dated April 2, 2020 No. 239, and dated April 28, 2020 No. 294, non-working days were declared for the periods from March 30 to April 3, from April 4 to April 30, and from May 6 to 8. The deadlines for paying taxes and contributions have been postponed to the next working day, that is, May 12. Also, in connection with the decrees, reporting deadlines for many organizations were postponed.

Taxes and contributions for the second quarter of 2021 have been canceled for organizations and individual entrepreneurs included in the SME register as of 03/01/2020, whose main activity according to the Unified State Register of Legal Entities is in the List of affected industries (Part 1, Article 2 of Law dated 06/08/2020 No. 172-FZ ).

Table 1. Deadlines for payment of taxes and contributions for the second quarter of 2020

| No. | Taxes, insurance premiums | Deadlines for paying taxes and contributions |

| 1. | Insurance premiums | For April – 05.15.2020 For May – 06/15/2020 For June – 07/15/2020 |

| 2. | Personal income tax | Personal income tax on salaries, bonuses - no later than the day following the day of payment of these incomes to an individual |

| 3. | Personal income tax for individual entrepreneurs from their income on the OSN | Advance payment for half a year – 07/27/2020 |

| 4. | VAT | For the second quarter: 1st payment ‒ 07/27/2020 2nd payment ‒ 08/25/2020 3rd payment ‒ 09/25/2020 |

| 5. | Profit | When paying only quarterly advance payments: for the first half of the year - 07/28/2020 When paying monthly advance payments with an additional payment at the end of the quarter: for April 2021 - 04/28/2020 for May 2021 - 05/28/2020 for June 2021 - 06/29/2020 additional payment for the first half of 2021 - 07/28/2020 When paying monthly advances based on actual profit: for April 2021 - 05/28/2020 for May 2021 - 06/29/2020 for June 2021 - 07/28/2020 |

| 6. | UTII | For the second quarter – 07/27/2020 |

| 7. | simplified tax system | Advance payment for half a year - 07/27/2020 |

| 8. | Unified agricultural tax | For the first half of the year - 07/27/2020 |

| 9. | Trade fee | For the second quarter – 07/27/2020 |

| 10. | Property tax | Term according to the legislation of the region of the Russian Federation |

| 11. | Land tax | Term according to the legislation of local authorities of the Russian Federation |

| 12. | Transport tax | Term according to the legislation of the region of the Russian Federation |

The exemption does not apply to VAT, as well as personal income tax and income tax paid by the tax agent.

For contributions to compulsory medical insurance, compulsory medical insurance and VNiM, a 0% tariff is set for all payments in the second quarter. Show the payments themselves in the calculation of contributions for the half-year (Article 3 of Law No. 172-FZ dated 06/08/2020).

Table 2. Deadlines for submitting reports in the second quarter of 2020.

| No. | Type of reporting | Report submission deadline |

| 1. | 4-FSS in electronic form | For the half year ‒ 07/27/2020 |

| 2. | 4-FSS on paper | For the half year ‒ 07/20/2020 |

| 3. | SZV-TD | Upon hiring or dismissal - no later than the next working day In other cases - the 15th day of the next month: for April – 05/15/2020 for May – 06/15/2020 for June – 07/15/2020 |

| 4. | RSV | For the half year ‒ 07/30/2020 |

| 5. | SZV-M | For April – 05.15.2020 For May ‒ 06/15/2020 For June ‒ 07/15/2020 |

| 6. | 6-NDFL | For the half year - 07/31/2020 |

| 7. | VAT declaration | For the second quarter ‒ 07/27/2020 |

| 8. | Income tax return | For the half year ‒ 07/28/2020 |

| 9. | Declaration on UTII | For the second quarter ‒ 07/20/2020 |

You will find deadlines for submitting reports on all taxes and contributions in the Accountant’s Calendar.

Recommendations for paying taxes and contributions and filling out reports for the second quarter of 2021.

- Deadlines for payment of insurance premiums and submission of reports to the Pension Fund, Social Insurance Fund and tax office

The deadline for payment of insurance premiums from payments to individuals for each month is no later than the 15th day of the next month (clause 1, clause 1, article 419, clauses 1, 3, article 431 of the Tax Code of the Russian Federation, art. 3, clause 1, art. 5, paragraph 4, article 22, paragraphs 1, 9, article 22.1 of Law No. 125-FZ).

If the 15th falls on a weekend or non-working holiday, pay contributions no later than the next working day (clause 7, article 6.1 of the Tax Code of the Russian Federation, clause 4, article 22 of Law No. 125-FZ).

SMEs as of March 1, 2021 , engaged in areas of activity affected by the spread of coronavirus, the deadline for payment of contributions from payments to individuals is extended (clauses “b”, “c” of paragraph 1 of the Decree of the Government of the Russian Federation of 04/02/2020 No. 409):

- for March - May 2021 - for six months;

- for June - July 2021 - for four months.

The deadlines have also been extended for organizations included in the register of socially oriented NPOs receiving support in connection with the spread of coronavirus (paragraphs “b”, “c”, paragraph 1, paragraph 1(2) of the Government of the Russian Federation of April 2, 2020 No. 409) .

The amounts of insurance premiums, the payment period of which has been extended, must be transferred monthly in the amount of one twelfth no later than the last day of the month. You need to start with the month following the month in which the payment deadline, taking into account the extension, occurs (clause 1(1) of the Decree of the Government of the Russian Federation dated 04/02/2020 No. 409).

Some organizations and individual entrepreneurs included in the SME register as of 03/01/2020, whose main activity according to the Unified State Register of Legal Entities is in the List of affected industries, apply reduced rates of insurance premiums for compulsory health insurance, compulsory medical insurance and VNIM in the amount of 0.0% in relation to payments and other remunerations for individuals accrued for April, May, June 2020 (Part 1, Article 2, Article 3 of Federal Law No. 172-FZ dated 06/08/2020). Accordingly, they do not transfer contributions for this period.

4-FSS

As a general rule, policyholders submit a 4-FSS calculation to the territorial body of the FSS of the Russian Federation at the place of their registration (including through the MFC) according to the deadlines (Article 3, paragraph 1 of Article 24 of Law No. 125-FZ, Section IV of the Administrative Regulations of the FSS of the Russian Federation for the provision of public services for receiving 4-FSS).

If this figure exceeds 25 people, then the 4-FSS calculation must be submitted electronically (clause 1 of article 22.1, clause 1 of article 24 of Law No. 125-FZ).

Form 4-FSS is given in Appendix 1 to Order of the FSS of the Russian Federation dated September 26, 2016 No. 381 (as amended on June 7, 2017), and the procedure for filling it out is in Appendix 2 to this order.

See more details:

- How to fill out 4-FSS for the first half of 2021

- Sample of filling out the calculation according to Form 4-FSS for the first half of 2020.

SZV-TD

Form of information on the work activity of a registered person - SZV-TD (approved by Resolution of the Board of the Pension Fund of the Russian Federation dated December 25, 2019 No. 730p).

Starting from 2021, you must submit a new form to the Pension Fund - SZV-TD for each employee for whom you made an entry in the “Work Information” section of the work book (for example, when hiring, dismissing or transferring). You must also submit the SZV-TD upon receipt of an application to continue maintaining the work record book or to refuse it (clause 1.4 of the Procedure for filling out the SZV-TD).

Deadline for submitting SZV-TD (Government Decree No. 590 dated April 26, 2020, Article 11 of Law No. 27-FZ):

- upon hiring or dismissal - the next working day;

- in other cases - the 15th day of the next month.

For employees with whom nothing happened in the past month, do not submit the form in 2021.

You will find it useful: SZV-TD: examples of filling and deadlines

RSV

Fill out the calculation of insurance premiums according to the form approved by Order of the Federal Tax Service of Russia dated September 18, 2019 No. ММВ-7-11 / [email protected] The procedure for filling it out is given in Appendix 2 to this order.

Helpful instructions:

- How to fill out the DAM for the first half of 2021

- Coronavirus: how to fill out the RSV with reduced tariffs

- Sample of filling out a calculation of insurance contributions to the tax authority for the first half of 2021.

SZV-M

Information on the SZV-M form must be submitted in the form approved by Resolution of the Board of the Pension Fund of the Russian Federation dated 01.02.2016 No. 83p.

See more details: SZV-M in 2021: how to fill out and submit

Deadlines for payment of personal income tax and submission of the 6-personal income tax declaration

For organizations that did not work in accordance with the decrees of the President of the Russian Federation from 03/30/2020 to 05/08/2020 (inclusive) due to coronavirus, the first working day, that is, the deadline for transferring personal income tax on wages for March paid in April, is 05/12/2020.

When transferring personal income tax at the end of the quarter, form 6-NDFL is submitted only in electronic form through TKS channels, if in the tax (reporting) period income was paid to 25 or more individuals. If the income is paid to 24 persons or less, then the institution has the right to independently decide how to submit the report: on paper or in electronic form (clause 2 of Article 230 of the Tax Code of the Russian Federation).

Personal income tax for individual entrepreneurs from their income on the OSN

The deadline for paying advance payments for the first quarter, half a year, 9 months, as well as tax for the year no later than (clauses 6, 8, Article 227 of the Tax Code of the Russian Federation): 25th day of the first month following, respectively, the first quarter , half a year, nine months of the tax period.

For individual entrepreneurs included in the register of SMEs on March 1, 2021 and operating in sectors of the economy affected by the spread of coronavirus, the deadline for paying the advance payment for the second quarter and first half of 2021 is extended by 4 months (clause “a”, clause 1 of the Resolution Government of the Russian Federation dated April 2, 2020 No. 409).

6-NDFL

The 6-NDFL calculation is filled out in accordance with the procedure approved by Order of the Federal Tax Service of Russia dated October 14, 2015 No. ММВ-7-11/ [email protected] (as amended on January 17, 2018).

You might be interested in:

- How to fill out 6-NDFL for the first half of 2021

- Sample of filling out the 6-NDFL calculation for the first half of 2021.

Deadlines for tax payment and submission of VAT returns

The payment deadline for SME entities engaged in particularly affected sectors of the economy does not apply to VAT (clause 1 of RF Government Decree No. 409).

Organizations and individual entrepreneurs included as of 03/01/2020 in the register of small and medium enterprises, whose main activity according to the Unified State Register of Legal Entities is in the List of Affected Industries, are not exempt from paying VAT for the second quarter of 2021 (Part 1, Article 2 of Law dated 06/08/2020 No. 172- Federal Law).

The VAT declaration form and the procedure for filling it out were approved by Order of the Federal Tax Service of Russia dated October 29, 2014 No. ММВ-7-3/ [email protected] (as amended on November 20, 2019).

See more details:

- How to fill out a VAT return 2020

- Sample of filling out a VAT return for the second quarter of 2020.

Deadlines for tax payment and submission of income and

SMEs as of March 1, 2021 , engaged in areas of activity affected by the spread of coronavirus, the deadline for making advance payments is extended (clause “a” of clause 1 of the Government of the Russian Federation of 04/02/2020 No. 409):

- for four months - monthly and quarterly payments for the second quarter of 2021. A number of organizations are exempt from making these payments.

The list of such areas is approved by the Government of the Russian Federation (clause 1 of the Decree of the Government of the Russian Federation dated April 2, 2020 No. 409).

The following organizations are exempt from paying advance payments for four, five and six months of 2020 minus previously accrued amounts of advance payments for the reporting period of three months (clause 1, part 1, article 2 of Federal Law No. 172-FZ of June 8, 2020):

- SMEs that are included in the unified register of SMEs based on tax reporting for 2021 and operate in industries most affected by the spread of coronavirus;

- a number of non-profit organizations included in the register of socially oriented NPOs;

- centralized religious organizations and religious organizations included in their structure, as well as socially oriented NGOs established by them;

- non-profit organizations included in the register of non-profit organizations most affected by the spread of coronavirus infection.

The income tax return form and the procedure for filling it out were approved by Order of the Federal Tax Service of Russia dated September 23, 2019 No. ММВ-7-3/ [email protected]

Learn more:

- How to fill out an income tax return for the first half of 2020.

- Sample of filling out the income tax return for the first half of 2020.

Deadlines for payment and submission of UTII declaration

SMEs as of March 1, 2021 , engaged in areas of activity affected by the spread of coronavirus, the deadline for paying the tax is extended (clause “a”, clause 1 of the Decree of the Government of the Russian Federation dated 04/02/2020 No. 409):

- for four months - for the second quarter of 2021. A number of organizations are exempt from paying tax for this period.

Organizations that are included in the unified register of SMEs on the basis of tax reporting for 2021 and operate in industries most affected by the spread of coronavirus are exempt from paying UTII for the second quarter of 2021 (Clause 7, Part 1, Article 2 of the Federal Law dated 06/08/2020 No. 172-FZ).

The declaration form and the procedure for filling it out were approved by Order of the Federal Tax Service of Russia dated June 26, 2018 No. ММВ-7-3/ [email protected]

You will need:

- How to fill out the UTII 2020 declaration

- A sample of filling out a UTII tax return by an organization for the second quarter of 2021.

Deadlines for tax payment and submission of declarations according to the simplified tax system

SMEs as of March 1, 2021 , engaged in areas of activity affected by the spread of coronavirus, the payment deadline is extended (clause “a”, clause 1 of the Government of the Russian Federation of 04/02/2020 No. 409):

- advance payment for the first half of 2021 - for four months.

Organizations are exempt from making an advance payment for the first half of 2021, reduced by the amount of payment for the first quarter of 2021, in accordance with clause 6, part 1, art. 2 of Federal Law dated 06/08/2020 No. 172-FZ.

Deadlines for payment of unified agricultural taxes

SMEs as of March 1, 2021 , engaged in areas of activity affected by the spread of coronavirus, the payment deadline is extended (clause “a”, clause 1 of the Government of the Russian Federation of 04/02/2020 No. 409):

- advance payment for the first half of 2021 - for four months.

Organizations and individual entrepreneurs that are included in the unified register of SMEs on the basis of tax reporting for 2021 and operate in industries most affected by the spread of coronavirus are exempt from paying an advance payment for the first half of 2021 (Clause 5, Part 1, Article 2 Federal Law dated 06/08/2020 No. 172-FZ).

Trade fee payment deadline

The deadline for payment of the trade fee is no later than the 25th day of the month following the expired quarter (Clause 2 of Article 417 of the Tax Code of the Russian Federation).

In Moscow, the deadline for payment of the trade tax for the first quarter of 2020 has been extended until December 31, 2021 (inclusive) (clause 2 of Moscow Government Resolution No. 212-PP dated March 24, 2020 (as amended on May 27, 2020) “On measures of economic support in conditions of high alert mode")

Deadlines for payment of corporate property tax

The deadlines for paying taxes for the year and advance payments based on the results of reporting periods are set by the authorities of each region of the Russian Federation themselves (Article 379, clauses 1, 2 of Article 383 of the Tax Code of the Russian Federation).

Regions may not introduce advance payments (clause 3 of Article 379, clause 6 of Article 382 of the Tax Code of the Russian Federation).

In Moscow, advance payments must be made no later than 30 calendar days from the end of the reporting period (Parts 1, 2, Article 3 of Moscow Law No. 64 dated November 5, 2003).

The deadline for paying the advance payment for the second quarter of 2020 in Moscow is extended until December 31, 2021 (inclusive) for organizations - owners of buildings, structures and premises used to accommodate retail, catering or consumer services, as well as for management companies of closed mutual funds, which include the specified objects, if (clause 5.1.3 of Moscow Government Decree No. 212-PP dated March 24, 2020):

- work at these facilities has been suspended in accordance with clause 3.2 of the Decree of the Moscow Mayor;

- if such real estate is leased, it is also necessary to reduce the rent for tenants by at least 50%, but not less than twice the amount of corporate property tax, land tax, land rent for this property for the period from the 1st day of the month suspension of work until the last day of the month of its completion, but not earlier than July 1, 2020.

The same extension is provided for organizations - owners of buildings, structures and premises used to accommodate hotels, as well as for management companies of closed mutual funds, which include these objects (clause 5.2.3 of Moscow Government Decree No. 212-PP dated March 24, 2020 ). If such real estate is leased, then the terms are extended subject to a reduction in rent for tenants by at least 50%, but not less than twice the amount of corporate property tax, land tax, land rent for this property for the second quarter of 2021 .

SMEs as of March 1, 2021 , engaged in areas of activity affected by the spread of coronavirus, the following terms for advance payments are established (clause “a”, paragraph 1 of the Decree of the Government of the Russian Federation dated April 2, 2020 No. 409):

- for the second quarter of 2021 - no later than December 30, 2020.

Some organizations are exempt from paying taxes and advance payments for the period of ownership from April 1 to June 30, 2020, as an object of taxation of the organization in accordance with clause 9, part 1, art. 2 of Federal Law dated 06/08/2020 No. 172-FZ).

submission of land tax declarations

The deadlines for paying taxes for the year and advance payments based on the results of the first, second and third quarters are set by local authorities (Article 393, paragraph 6 of Article 396, paragraphs 1, 2 of Article 397 of the Tax Code of the Russian Federation).

They may not introduce advance payments (clause 3 of Article 393, clause 9 of Article 396 of the Tax Code of the Russian Federation).

In Moscow, the deadlines for paying land tax are as follows (clauses 1, 2, article 3 of the Moscow Law of November 24, 2004 No. 74):

- advance payment based on the results of the second quarter - no later than the last day of the month following the reporting period.

The deadline for paying the advance payment for the third quarter of 2020 in Moscow is extended until December 31, 2021 (inclusive) for organizations - owners of buildings, structures and premises used to accommodate retail, catering or consumer services, as well as for management companies of closed mutual funds, which include the specified objects, if (clause 5.1.3 of Moscow Government Decree No. 212-PP dated March 24, 2020):

- work at these facilities has been suspended in accordance with clause 3.2 of the Decree of the Moscow Mayor;

- such objects are leased, it is also necessary to reduce the rent for tenants by at least 50%, but not less than twice the amount of corporate property tax, land tax, land rent for this object for the period from the 1st day of the month of suspension work until the last day of the month of its completion, but not earlier than July 1, 2021.

The same extension is provided for organizations - owners of buildings, structures and premises used to accommodate hotels, as well as for management companies of closed mutual funds, which include these objects (clause 5.2.3 of Moscow Government Decree No. 212-PP dated March 24, 2020 ).

Some organizations are exempt from paying taxes and advance payments for the period of ownership from April 1 to June 30, 2020, as an object of taxation of the organization in accordance with clause 9, part 1, art. 2 of Federal Law dated 06/08/2020 No. 172-FZ).

A land tax return for 2021 and subsequent tax periods will not be submitted.

Deadlines for tax payment and reporting on transport tax

The deadlines for paying tax for the year and advance payments based on the results of the first, second and third quarters are established by the authorities of the region of the Russian Federation (Article 360, clause 2.1 of Article 362, clauses 1, 2 of Article 363 of the Tax Code of the Russian Federation).

Regional authorities may not introduce advance payments (clause 3 of Article 360, clause 6 of Article 362 of the Tax Code of the Russian Federation).

organizations included in the register of SMEs as of March 1, 2021, engaged in areas of activity affected by the spread of coronavirus, the following deadlines for payment of advance payments are established (clause “a”, clause 1 of Decree of the Government of the Russian Federation dated April 2, 2020 No. 409):

- for the second quarter of 2021 - no later than December 30, 2020.

Some organizations are exempt from paying taxes and advance payments for the period of ownership from April 1 to June 30, 2020, as an object of taxation of the organization in accordance with clause 9, part 1, art. 2 of Federal Law dated 06/08/2020 No. 172-FZ.

A declaration on transport tax and land tax for 2020 and subsequent tax periods is not submitted.

note

For failure to submit a declaration or for filing it late, fines are applied, which are provided for by the Tax Code of the Russian Federation, as well as the Code of Administrative Offenses of the Russian Federation.

If a declaration for any tax is not submitted on time - 5% of the tax not paid on time, payable according to the declaration, for each full or partial month of delay. The maximum fine is 30% of the tax not paid on time, the minimum is 1,000 rubles. (Article 119 of the Tax Code of the Russian Federation).

If the SZV-M report is submitted to the Pension Fund not on time or with errors - 500 rubles. for each person whose information was submitted late or in error (Article 17 of Law No. 27-FZ).

An entrepreneur can only be brought to tax liability under clause 1 of Art. 119 of the Tax Code of the Russian Federation. An administrative fine is not applied to him (note to Article 15.3 of the Code of Administrative Offenses of the Russian Federation).

In addition to fines, your bank accounts and electronic money transfers may be blocked if you are late with the declaration by more than 10 working days (Clause 6, Article 6.1, Clause 1, Clause 3, Clause 11, Article 76 of the Tax Code of the Russian Federation).

Transfer of taxes and contributions in violation of the deadline leads to the accrual of penalties (Article 75 of the Tax Code of the Russian Federation, Article 26.11 of the Federal Law of July 24, 1998 No. 125-FZ).

There will be no fine for non-payment of advance payments or late payment of the tax correctly calculated in the declaration (letter of the Ministry of Finance of Russia dated 05/24/2017 No. 03-02-07/1/31912, Federal Tax Service of Russia dated 09/07/2018 No. SA-4-7/17429).

On the website of the Federal Tax Service of Russia you can check whether you are exempt from paying taxes and contributions for the second quarter: https://service.nalog.ru/subsidy/

useful links

- ACCOUNTANT CALENDAR FOR 2021

- ACCOUNTANT CALENDAR FOR THE III QUARTER 2021 (MOSCOW)

- Coronavirus: tax write-off for Q2 2021

- Filling out declarations for the second quarter of 2021. Tax officials explained how companies fill out declarations and what individual entrepreneurs do not pay

- How to get a deferment (installment plan) for paying taxes and insurance premiums during the COVID-19 coronavirus pandemic (SARS-CoV-2 virus)

Reporting period for property tax: nuances

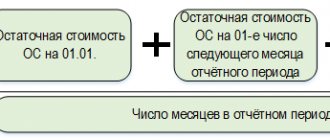

In general, the establishment of a reporting period depends on the method of calculating property tax:

Subscribe to our newsletter

Yandex.Zen VKontakte Telegram

- When determining tax based on the book average value of property, the reporting periods are:

- 1st quarter;

- half year;

- 9 months.

- If the tax is calculated based on the cadastral value of the property, then the reporting periods are the 1st, 2nd and 3rd quarters.

The average annual value of property is established on the basis of the company's accounting documents. The cadastral is determined by Rosreestr and requested through established channels in the department.

In 2021, the advance payment was submitted to the Federal Tax Service 3 times:

- until May 2 - for the 1st quarter (for both methods of calculating tax);

- until July 31 - for the six months (at the average value of assets) or the 2nd quarter (at the cadastral price);

- until October 30 - for 9 months (average price), 3rd quarter (cadastral price).

These reporting periods are essentially quite similar, but the difference between them predetermines differences in the methods of tax calculation.

How to calculate the base according to cadastral valuation

Calculation based on cadastral value is even simpler. The regional database records the values of the cadastral value of specific real estate objects. This value is subject to updating, that is, it is periodically recalculated taking into account assessment data. The list of objects whose taxation is based on cadastral value is published annually at the beginning of the reporting period (year).

To calculate the advance, the contractor opens the legislative list, finds the object and identifies the current cadastral value. The value calculated for the current period remains unchanged throughout the year. If the object belongs to preferential property, then all the required benefits are applied to the estimated value. The calculation of the advance payment for cadastral value is differentiated in proportion to the share of ownership (for objects in shared ownership) and location (for assets located in different regions).

How to divide property for calculation

In 2021, the procedure for calculating property taxes has changed significantly. Now the calculation (taxable) base does not include movable property. The calculation reflects information only on immovable fixed assets.

In the new reports, there is no need to divide fixed assets into movable and immovable property. But property assets will still have to be divided, and according to this principle:

- By type of calculation. The advance payment is calculated based on the average annual and cadastral value of the property. For this purpose, the report provides various sections.

- At the location of the real estate. If the assets of the enterprise are located on the territory of various municipalities. They will have to be divided according to OKTMO code, and reports and taxes will have to be sent to various territorial tax departments.

- According to tax rates. The calculation must be carried out for all types of rates applied to the payer’s tax objects.

- By types and amounts of benefits applied. Some property assets are taxed at reduced rates or are completely tax-free. The scope of benefits is set by local legislators. All types of preferential property must be reflected in separate calculation columns.

Before submitting reports, the responsible executor studies regional standards, and only after that he calculates the value of the property.

Before November 1: claim your right to tax benefits

Art. 407 of the Tax Code of the Russian Federation contains a list of grounds for obtaining tax benefits. If you have such a right, then you must submit an application to the tax office and indicate the object for which you want to receive a benefit. In this case, it is necessary to submit documents confirming the right to it. Remember this. After November 1, the application will no longer be accepted, and the benefit will be applied to the object whose tax amount is the highest.

What subtleties do you need to know about the tax on the sale of an apartment?

What is the tax on the sale of an apartment obtained after demolition?