Horticultural non-profit partnerships are required to maintain accounting records, which are designed for small businesses in a simple accounting format. This form of business transactions is given in the instructions for maintaining zero reporting and using the appropriate registers for small businesses, adopted by representatives of the Ministry of Finance of Russia on December 22, 1996.

The Chairman of the SNT has the right to take over the responsibility for maintaining accounting records.

The Federal Tax Service is very wary of situations where the occupation of official positions of an accountant, chairman and other employees is carried out on a voluntary basis, without receiving monetary compensation. Amounts for the normal functioning of SNT are calculated through membership payments of participants of a particular partnership.

The amount of contributions is established according to the estimate proposed at the general meeting of representatives of the partnership or in the presence of a quorum, the required number of which is determined by the constituent documentation. The amount of such accruals is always set to calendar. Membership payments are made in the form of targeted income, not subject to taxation, however, SNT organizations must comply with the rules for conducting cash accounting transactions.

Too lazy to read?

Ask a question to the experts and get an answer within 15 minutes!

Ask a Question

Accounting statements of SNT

SNT financial statements are submitted once a year. If the partnership is not engaged in commercial activities, then only:

- balance sheet;

- “Report on the targeted use of funds” (if targeted funds were received or spent).

- If there is entrepreneurial activity in the SNT, a “Report on Financial Results” is added.

Forms of accounting reports are given in the order of the Ministry of Finance dated July 2, 2010 No. 66n (as amended by the order dated April 19, 2019 No. 61n). The Inspectorate of the Federal Tax Service SNT is required to submit reports for 2020 in electronic form - tax authorities do not accept paper accounting reports from the report for 2021 (Clause 5, Article 18 of Law No. 402-FZ dated December 6, 2011, as amended on July 26, 2019).

The deadline for submitting SNT accounting reports in 2021 has not changed - it must be sent to the Federal Tax Service no later than March 31, 2021. An additional copy is no longer required to be submitted to Rosstat.

Important changes to gardening partnerships from 2021

From January 1, 2021, all gardening partnerships in Russia are required to have bank accounts in order to conduct all payments by non-cash method. How much will market participants get from this?

Although there are several months left before the summer season, it is time for the owners of the treasured “six hundred square meters” to prepare for the “hot season” now. All contributions to the SNT (horticultural non-profit partnership) will now definitely go past the cash register, but not into the pocket of the chairman, but into the bank where the association must have an account. These are the requirements of the new law “On the management of gardening...” (217-FZ), which replaced the already outdated document of 1998.

The new edition assumes that absolutely all operations of gardening, gardening or dacha associations will become cashless, which can be considered an application to bring the “dacha” economy out of the shadows. The size of this informal sector is impressive.

In 2016, almost 13 million dacha plots and 76 thousand were registered in the country.

SNT, follows from the agricultural census of that year.

According to estimates by the Union of Gardeners of Russia, there are actually more gardening associations - about 100 thousand.

Approximately 20 million Russians are owners of land plots.

All of them are regularly required to pay fees for the maintenance of the general territory of the partnership - snow removal, security, garbage removal, water and electricity supply.

“On average, taking into account targeted membership fees, 0.5-1 trillion rubles per year can circulate in this segment”

, says Deputy Chairman of the Union of Gardeners of Russia Yuri Shalyganov. BCS Premier investment strategist Alexander Bakhtin gives a more modest estimate - 200-300 billion rubles annually.

Tax reporting SNT

The composition of SNT tax reporting is formed based on the applied taxation regime and the availability of taxable objects.

What kind of SNT reporting on OSNO is submitted to the Federal Tax Service in 2021:

- Income tax declaration (the form has changed from the report for 2020, approved by order of the Federal Tax Service dated September 11, 2020 No. ED-7-3/ [email protected] );

- VAT declaration (from the 4th quarter of 2021, an updated form will be used, in accordance with the order of the Federal Tax Service dated August 19, 2020 No. ED-7-3 / [email protected] );

SNT reporting on the simplified tax system:

- a simplified declaration submitted to the Federal Tax Service once a year (for the report for 2021, the previous form is valid, approved by Order of the Federal Tax Service dated February 26, 2016 No. ММВ-7-3/ [email protected] , but the adoption of a new form is expected)

A company fills out a VAT return using the simplified tax system only if it acts as a tax agent, for example, when leasing state property.

Regardless of the tax system used, SNTs submit the “Calculation of Insurance Contributions” quarterly (for the DAM for 2021 and beyond, a new form is used, approved by order of the Federal Tax Service dated October 15, 2020 No. ED-7-11/751). The report on the average headcount has been cancelled, starting with the report for 2021; now this information will be indicated in the DAM on the title page.

The obligation to submit land and transport tax declarations has also been canceled - they will not be submitted for 2021 (Law No. 63-FZ dated April 15, 2019). If SNT has land and vehicles on its balance sheet, the amounts payable are calculated by the Federal Tax Service based on data received from Rosreestr and the State Traffic Safety Inspectorate.

SNT is also required to fill out and submit:

- water tax declaration, if the partnership uses water that is subject to licensing (for example, a well is used to collect water),

- property tax declaration, if there are objects taxed at cadastral value.

Tax systems and accounting

There is no choice as such. In fact, you will have to decide between OSNO and simplified tax system. For convenience, given that not every partnership can afford an accountant, in most cases they use a simplified system. Here is a “profitable” or “expendable” option - they decide based on the ability to confirm all expenses.

By the way! Because SNT exists due to targeted revenues; confirmation of costs is a prerequisite. You will have to report not only to the state, but also to inspectors, auditors and, of course, members of the partnership.

Accounting from SNO does not change and is based on the principles of accounting for non-profit organizations. Most transactions are simple and are formed with the participation of account 86 “Targeted financing”.

Let's look at a few typical transactions:

- Target contributions D 76 K 86.3 have been accrued (the subaccount may be different, this is just a generally accepted numbering).

- Membership fees charged D 76 K 86.2.

- Receipt of membership or target contributions to account D 51 K 76.

- Payroll management (chairman, board members, chief accountant, etc.) – D 26 K 70.

- Salary of service personnel (janitors, watchmen, etc.) – D 20 K 70.

- Contributions for pension, medical and social insurance D 20, 26 K 69 have been accrued.

- Withheld from the income of employees personal income tax D 70 K 68.

- Wages paid D 70 K 51, 50.

Note! It is necessary to accept contributions to a current account, but it is not prohibited to withdraw funds received from the account to pay salaries or for other expenses.

- Funds were issued to accountable persons for the purchase of materials, payment for work or services D 71 K 51, 50.

- Materials, tools (low value), etc. were purchased. for SNT D 10 K 51, 50, 71.

- Paid for services or work D 20, 26 K 51, 50, 71.

- Accrued expenses for electricity, water supply and other similar expenses (including garbage removal) D 20 K 60.

- The above resources and services were paid to suppliers 60 K 51, 50, 71.

- Costs are reflected due to targeted financing D 86.2 (or 86.3 depending on the type of funds used) K 20, 26, 69, 10...

- If VAT is accounted for, then entries D 19 K 60 are added - tax accrual and D 68 K 19 - accepted for deduction.

If SNT conducts commercial activities (the proceeds from it should go to the main goals of the partnership), then the following transactions are present in the accounting:

- Proceeds from sales (provision of services, performance of work) D 62 K 90.1.

- VAT charged D 90.3 K 68.

- Payment received from buyer (customer) D 51, 50 K 62.

- Reflected expenses for commercial activities (cost price) D 90.2 K 20, 26, 69...

- The result D 90.9 K 99 when making a profit and D 99 K 90.9 when making a loss was generated and reflected on the appropriate accounts. The profit received is closed at the end of the year on account 84 (D 99 K 84), but since SNT's main activity is non-commercial, then retained profits are transferred to the target financing account by posting D 86 K 84, these amounts go to the goals of the partnership.

Accounting for fixed assets is carried out in the same way as for commercial organizations, using accounts 07, 08, 01 and 02. The acquisition of fixed assets through targeted contributions must also show an increase in the additional capital of the partnership, for which account 83 is used: D 86.3 K 83 - the increase is reflected DC at the expense of targeted funds spent on capital investments. When disposing of the corresponding fixed asset, posting is required - D 83 K 01.

What other reports do SNT submit?

Personal income tax reports, reporting to the Pension Fund and Social Insurance Fund

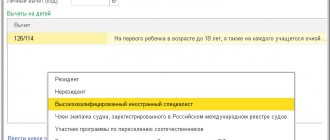

SNT does not always draw up employment or civil employment contracts with employees, making accruals and payments of amounts in favor of individuals. If there are employees on staff (for example, chairman, accountant, cashier), or SNT makes payments to individuals under GPC agreements, additional reports will be required.

To the Federal Tax Service for Income Tax:

- Calculation of 6-personal income tax - for 4 quarters. 2021, the previous form is filled out (as amended by the order of the Federal Tax Service dated January 17, 2018 No. ММВ-7-11 / [email protected] ); from 1 sq. 2021, a new form is used (from the order of the Federal Tax Service dated October 15, 2020 No. ED-7-11 / [email protected] );

- 2-NDFL certificates (for 2021, certificates are submitted for the last time; information on accruals to individuals from 2021 will be reflected in the 6-NDFL annual report).

Personalized accounting information is submitted to the Pension Fund:

- SZV-TD - about labor activity (if there are personnel events recorded in the electronic work book in the reporting month);

- SZV-M - about insured persons (for employees who worked in the reporting month under GPC or labor contracts);

- SZV-STAGE - an annual report on the insurance experience of each insured person. If there are no employees, the report is still submitted to the chairman of the SNT (in this case, monthly SZV-M reports must also be submitted to the chairman).

In addition, all SNTs report quarterly to the Social Insurance Fund. For the report for 2021, the previous form of calculation for contributions to “injuries” 4-FSS, approved. by order of the FSS dated 06/07/2017 No. 275. A new form is expected for reporting for the periods of 2021.

Also, once a year before April 15, the Fund waits for confirmation of the main type of activity (form approved by Order of the Ministry of Health and Social Development dated January 31, 2006 No. (as amended on January 25, 2017).

Gardening partnerships law in 2021 - what does an accountant need to know?

In Russia, a new Federal Law No. 217 “On Gardening Partnerships” has come into effect in the 2021 edition. He changed the lives of gardeners, gardeners and... accountants.

Although the difference between SNT and ONT is insignificant, the chief accountant is responsible for collecting and spending money from gardeners, as well as calculating land tax, signing contracts with service companies, and licensing wells. From January 1, 2021, gardening partnerships have only two organizational and legal forms: a gardening non-profit partnership (SNT) and a gardening non-profit partnership (ONT).

At the same time, they are forms of real estate owners' partnerships (TSN). Dacha partnerships, cooperatives and other methods of association no longer exist.

The main difference between SNT and ONT is the possibility of constructing permanent buildings and structures on the land plots of the owners: Gardeners from SNT can erect capital construction projects on the land: houses, garages, bathhouses, sheds, carports, greenhouses and gazebos. If the house on the site meets the housing requirements, you can register in it, even if the property is located outside the village.

If the construction of an object with an area of >50 sq.m. only in plans, you need to get a technical plan.

Gardeners from ONT cannot install capital construction projects on their plots. This is the difference between SNT and ONT.

On the territory of the garden you can build a shed, a temporary shed, a booth, a toilet - anything that does not have a foundation.

Waste hazard class

All waste that can be generated on the territory of our country was classified and placed in a single list of FKKO - the Federal Classification Catalog of Waste. Having studied this document, we can identify several types of garbage usually generated by SNT.

| No. | Name of waste | FKKO code | Hazard Class |

| 1 | Sediment from storage tanks in mobile toilet cabins. | 7 32 280 01 39 4 | 4 |

| 2 | Liquid waste generated after cleaning in mobile toilet cabins. | 7 32 221 01 30 4 | 4 |

| 3 | Unsorted waste from office and household premises (with the exception of large items). | 7 33 100 01 72 4 | 4 |

| 4 | Street trash. | 7 31 200 01 72 4 | 4 |

| 5 | Waste from road cleaning (near curbs). | 7 31 205 11 72 4 | 4 |

| 6 | Unsorted household waste (except for bulky waste). | 7 31 110 01 72 4 | 4 |

| 7 | Bulky household waste. | 7 31 110 02 21 5 | 5 |

| 8 | Mercury lamps, mercury-quartz lamps, fluorescent lamps that have lost their consumer properties. | 4 71 101 01 52 1 | 1 |

| 9 | Construction garbage | 8 90 000 01 72 4 | 4 |

Particularly dangerous waste on this list are broken light bulbs of various types; they are classified as first class. But even for less hazardous waste you will have to issue a passport, since all of them are classified as class 4.

Who is required to report?

Russian statistics established reports for 2021, who submits them, in a separate Federal Law No. 282-FZ of November 29, 2007. So, in accordance with Art. 6 and 8 of the law, the following are required to report:

- state authorities, as well as local governments;

- legal entities officially registered on the territory of the Russian Federation;

- branches, separate divisions and territorial representative offices of Russian organizations;

- branches and representative offices of foreign companies operating in the Russian Federation;

- individual entrepreneurs.