Composition of general business expenses Order of the Ministry of Finance No. 94n clearly establishes that account 26 in the accounting

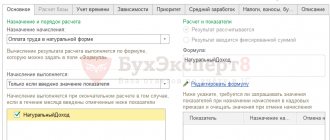

Salary in kind In order for the payment of wages in kind to be legal,

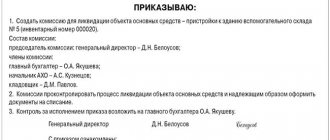

Fixed assets involved in the production process gradually lose their original characteristics. Under physical wear and tear

Tax audit risk criteria Timing of an on-site tax audit, procedure and timing of its conduct

Until relatively recently, the tax service did not allow full or partial repayment of the obligations of a business entity

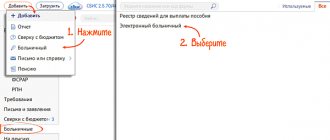

Sick leave Victoria Pechieva Expert, chief accountant with 12 years of experience Current as of April 4, 2020 Electronic

Calculation according to Form 6-NDFL is one of the “youngest” business reports. Therefore, it is according to

The taxpayer has the right to apply a zero rate (0%) when selling certain goods and services. For example,

Home / Taxes / What is VAT and when does it increase to 20 percent?

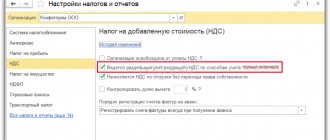

What is meant by a corrected invoice? In Ch. 21 of the Tax Code of the Russian Federation the term “corrected invoice”, so