The purchasing organization can deduct VAT transferred to the seller (supplier, contractor) as part of an advance payment or partial payment (clause 12 of Article 171 of the Tax Code of the Russian Federation). But only if certain conditions are met and if the buyer does not use the VAT exemption.

After the supplier issues an invoice for the goods shipped (work performed, services rendered, property rights transferred), the organization will be able to accept VAT for deduction on a general basis. And the organization will restore the VAT accepted for deduction from the advance payment.

Accounting for advances from the seller

1. The following postings are made:

Dt 51 Kt 62 - prepayment received.

Dt 76 Kt 68 - VAT is reflected on the prepayment.

2. An advance invoice is being prepared (Article 169 of the Tax Code of the Russian Federation).

The supplier has 5 days to issue it. It is compiled in 2 copies: one for yourself, the second for the buyer. The rules for issuing invoices for advances received are regulated by Decree of the Government of the Russian Federation of December 26, 2011 No. 1137 (hereinafter referred to as Decree No. 1137).

For information on how to correctly fill out an advance invoice, see the material “Acceptance for deduction of VAT on advances received”

3. The advance invoice is recorded in the sales ledger.

The invoice is registered in the period in which the advance payment was received (clause 3 of the Rules for maintaining the purchase ledger, approved by Resolution No. 1137).

Next, the seller has 3 possible situations:

- there were no sales during the advance payment period;

- there was a sale during the period of transfer of the advance;

- the advance was returned to the buyer.

Option when there was no shipment during the advance payment period

The seller needs to enter the amount of the prepayment and VAT from the advance received in line 070 in columns 3 and 5, respectively, of section 3 of the VAT return (order of the Federal Tax Service of Russia dated October 29, 2014 No. MMV-7-3 / [email protected] ).

An option when the seller returned the advance to the buyer

- The seller accepts VAT on advances received for deduction (clause 5 of Article 171 of the Tax Code of the Russian Federation), making the following entries:

Dt 62 Kt 51 - refund of advance payment.

Dt 68 Kt 76 - acceptance of VAT on advances received for deduction.

- Reflects VAT for deduction in the purchase book.

- Fills out line 120 of section 3 of the VAT return.

Option for selling previously paid inventory items

- The seller accepts VAT from the advance received for deduction (clause 8 of Article 171 of the Tax Code of the Russian Federation), making the following entries:

Dt 62 Kt 90 - revenue received from sales.

Dt 90 Kt 68 - VAT is charged on sales.

Dt 68 Kt 76 - VAT on advances received is deducted.

- Shows the VAT deduction for advances received in the purchase book with the invoice number that was issued by the seller upon receipt of the advance.

- Fills out a declaration in which he enters the deduction on line 170 of section 3.

On the deadlines for accepting VAT for deduction, see the material “Deductions of “advance” and “agency” VAT cannot be postponed”

Note! Tax authorities believe that VAT is charged on advance payments received in any case, even if the periods of receipt of advance payment and sales coincide (letter of the Federal Tax Service of Russia dated July 20, 2011 No. ED-4-3/11684).

In addition, according to sub. 3 p. 3 art. 170 of the Tax Code of the Russian Federation, the seller, having sold goods and materials for an amount less than the advance payment, can deduct VAT only from the sale amount, and not from the entire prepayment.

For more information on the rules for deducting VAT on advances, see the material “Acceptance for deduction of VAT on advances received”

ConsultantPlus experts explained how to reflect advances received in the VAT return. Get trial access to the system and proceed to examples of filling out the report for free.

VAT recovery

The amount of VAT previously accepted for deduction from the transferred advance payment (partial payment) must be restored by the buyer (customer):

- after the receipt of goods (work, services, property rights) received on account of the transferred advance or partial payment. In this case, the buyer (customer) accepts for deduction the amount of VAT that is allocated in the invoice issued by the seller (performer) upon shipment. VAT must be restored in the quarter in which the buyer will have the right to deduct for goods (work, services, property rights) received as part of a previously transferred advance or partial payment;

- upon termination or change of the terms of the contract for the supply of goods (performance of work, provision of services, transfer of property rights), towards which the advance was transferred. In this case, the seller returns to the buyer the previously transferred advance or partial payment. VAT must be restored in the quarter when the terms of the contract were terminated or changed and the advance payment (partial payment) was returned.

This procedure follows from the provisions of paragraphs 2 and 12 of Article 171, paragraph 9 of Article 172 and subparagraph 3 of paragraph 3 of Article 170 of the Tax Code of the Russian Federation.

If, on account of the received prepayment, the supplier ships goods, performs work, provides services, or transfers property rights in separate installments (in stages), then the buyer must recover input VAT in parts. Namely, in the amounts indicated in the invoices for each batch (stage). Similar clarifications are contained in letters of the Ministry of Finance of Russia dated July 1, 2010 No. 03-07-11/279 and dated January 28, 2009 No. 03-07-11/20.

An example of how input VAT is reflected in accounting when purchasing materials. The supply agreement provides for partial advance payment of materials to the seller in cash.

An agreement was concluded between Alpha LLC (buyer) and Torgovaya LLC (seller) for the supply of materials intended for use in production activities subject to VAT. According to the agreement, Hermes ships materials to Alpha on the terms of their partial advance payment. In March, Alfa transferred an advance in the amount of 118,000 rubles to the seller against the upcoming delivery. (including VAT – 18,000 rubles). In April, Alpha received materials supplied by Hermes. The cost of materials was 120,360 rubles. (including VAT – 18,360 rubles).

The following entries were made in the buyer's account.

In March:

Debit 60 subaccount “Settlements for advances issued” Credit 51 – 118,000 rub. – an advance payment has been made towards the upcoming supply of materials.

After receiving an invoice from the supplier for the amount of the advance:

Debit 68 subaccount “Calculations for VAT” Credit 76 subaccount “Calculations for VAT from advances issued” – 18,000 rubles. – VAT paid to the supplier as part of the advance payment is accepted for deduction.

In April:

Debit 10 Credit 60 subaccount “Payments for materials” – 102,000 rubles. – materials are capitalized;

Debit 19 Credit 60 subaccount “Payments for materials” – 18,360 rubles. – VAT on capitalized materials is taken into account;

Debit 76 subaccount “Calculations for VAT on advances issued” Credit 68 subaccount “Calculations for VAT” - 18,000 rubles. – VAT previously accepted for deduction has been restored;

Debit 68 subaccount “Calculations for VAT” Credit 19 – 18,360 rub. – accepted for deduction of VAT on capitalized materials;

Debit 60 subaccount “Payments for materials” Credit 60 subaccount “Settlements for advances issued” – 118,000 rubles. – the advance payment transferred to the supplier is credited;

Debit 60 subaccount “Payments for materials” Credit 51 – 2360 rub. (120,360 rubles – 118,000 rubles) – the debt to the supplier is repaid.

Situation: does the successor - the VAT payer - need to restore the tax that the reorganized organization previously accepted for deduction on the advance payment issued? The assignee received the products on account of the advance payment.

Answer: yes, it is necessary.

In tax relations, all rights and obligations related to the activities of the reorganized organizations are transferred to the legal successors. This follows from the provisions of Article 50 of the Tax Code of the Russian Federation.

Having received products that the reorganized organization paid in advance, the assignee has the right to deduct VAT charged to him by the seller (clause 2 of Article 171 of the Tax Code of the Russian Federation). However, this right is inextricably linked with the obligation to restore the tax that was accepted for deduction from the advance amount (subclause 3, clause 3, article 170 of the Tax Code of the Russian Federation). After all, advance payment for goods (work, services) and their receipt to the buyer are components of one and the same operation, forming one object of taxation. Namely, the transfer of ownership of products from the seller to the buyer (clause 1 of Article 146 of the Tax Code of the Russian Federation).

The fact that in the advance form of payments the tax base is determined twice (clause 14 of Article 167 of the Tax Code of the Russian Federation), and the fact that the transaction was started by one organization and completed by another, does not matter in the situation under consideration. The buyer has the right to deduct VAT in relation to one taxable item only once. Therefore, having capitalized the goods (work, services) shipped as an advance payment, the buyer-legal successor is obliged to restore the amount of VAT accepted for deduction by the reorganized organization.

Buyer's actions when making an advance payment

The buyer, by virtue of clause 12 of Art. 171 of the Tax Code of the Russian Federation can accept advance VAT for deduction if:

- there is a correctly executed invoice;

- there is a document confirming payment;

- The contract specifies the possibility of prepayment.

Having transferred the advance, the buyer:

- Makes the following entries:

Dt 60 Kt 51 - advance payment is transferred.

Dt 68 Kt 76 - advance VAT is deducted.

- Enters VAT deductions from advances issued in the purchase book with the invoice number issued by the seller.

- Reflects advance VAT on line 130 of section 3 of the VAT return.

- Restores advance VAT during the sales period: Dt 76 Kt 68.

- Reflects VAT restoration in the sales book.

- Reflects in the declaration VAT on advances on line 090 of section 3 (at rates 10/110 and 20/120).

On the issue of filling out line 090 of the declaration, see the material “How to fill out line 090 of section 3 of the VAT declaration”

See also: “Acceptance for deduction of VAT on advances issued”

When “advance” VAT cannot be deducted

Failure to comply with one of the listed conditions deprives the buyer of the right to deduct VAT on advances issued.

The buyer does not have the right to deduct VAT from advances issued to the seller for future deliveries even in the case where the advance payment has been made but is not provided for by the contract.

As practice shows, tax authorities most often refuse to deduct VAT, citing an incorrectly completed invoice.

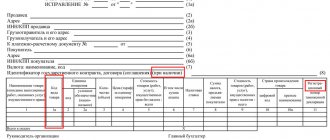

Therefore, the buyer should check whether the invoice for the down payment has been correctly issued. Such a document is drawn up by the seller within 5 days from the date of receipt of payment (clause 3 of Article 168 of the Tax Code of the Russian Federation). The rules for filling out an advance invoice are defined in clause 5.1 of Art. 169 of the Tax Code of the Russian Federation and indicate that it is mandatory to fill out in such a document:

- date of issue of the invoice and its serial number;

- name, address and identification number of the seller and buyer;

- payment and settlement document numbers;

- names of goods supplied (work performed, services rendered or property rights transferred);

- payment amounts;

- tax rate (for advance payments, VAT calculations are carried out only at calculated rates of 10/110 or 20/120, clause 4 of Article 164 of the Tax Code of the Russian Federation);

- the amount of tax charged to the buyer.

Thus, the deduction of “advance” VAT may be refused if the seller indicates in the advance invoice not the estimated VAT rate, but a straight rate (10 or 20%), or does not put dashes in lines 3, 4 and columns 2–6, 10 and 11, or will not fill in some details.

You can learn about what errors do not lead to a refusal to deduct VAT from the material “What errors in filling out an invoice are not critical for VAT deduction?” .

When there is no need to charge VAT on advances received

A taxpayer may not charge VAT on an advance received in the following cases:

- when receiving an advance on non-taxable transactions (Article 149 of the Tax Code of the Russian Federation);

- if advances are made for operations the place of implementation of which is not the territory of the Russian Federation (Article 147, Article 148 of the Tax Code of the Russian Federation);

- the seller does not pay VAT as a “special regime” (Chapter 26.1–26.5 of the Tax Code of the Russian Federation);

- the seller is exempt from paying VAT (Articles 145 - 145.1 of the Tax Code of the Russian Federation);

- an advance payment was made for transactions with a VAT rate of 0% (clause 1 of Article 164 of the Tax Code of the Russian Federation);

- the advance payment is transferred for operations for which a long production cycle is provided - more than six months (clause 13 of article 167 of the Tax Code of the Russian Federation).

For information about who is not considered a VAT payer, see the material “Who is a VAT payer?”

In what reporting documents is it recorded?

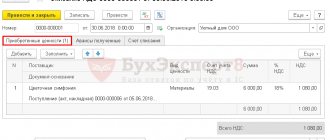

After the prepayment for the transaction has been made and the ASFs have been created, they need to be registered.

For this purpose, as already mentioned, purchase/sales books held by the buyer and supplier are used.

Also, instead of using books, it is possible to register accounts using electronic programs (for example, 1C). How to reflect the receipt of these documents will be described below.

At the same time, regardless of the method used to prepare invoices, the period for their registration should not exceed five days from the date of receipt (in some cases determined by law - within a month).

How to reflect VAT when receiving an advance payment when switching to the simplified tax system from the special tax system and vice versa

According to Art. 346.12 of the Tax Code of the Russian Federation, a taxpayer using the simplified tax system does not pay VAT, with the exception of certain cases. Consequently, in a situation where the seller charged VAT on the simplified tax system on the amount of advances received, and then switched to the simplified tax system, after which he carried out the sale, there are no grounds for deducting VAT. But he will not need to charge VAT on the shipment either.

If the seller, on the contrary, worked under the simplified tax system and then switched to the general regime, he will have to charge VAT on sales, but it will not be possible to reduce the tax base by the amount of the previously received prepayment (letter of the Ministry of Finance of Russia dated July 30, 2008 No. 03-11- 04/2/116).

On the consequences of the transition from the simplified tax system and to the simplified tax system, see the material “VAT upon transition to the simplified tax system from OSNO: accounting and restoration of tax”

Responsibility of the seller who does not charge VAT on advances received

Art. 122 of the Tax Code of the Russian Federation introduced liability for incomplete payment of VAT in the event of an understatement of the tax base. The amount of the fine according to this norm can range from 20 to 40% of the underpaid tax amount, depending on the intentionality of the violation.

For information on the consequences for late payment of VAT, see the material “What is the liability for late payment of VAT?”

Find out when to pay VAT on an advance payment to a buyer of waste paper in ConsultantPlus. If you don't have access yet, get a free trial online.

Introduction

Today, on the Internet and even in specialized magazines, you can easily find information on how to prepare a VAT Declaration in the 1C: Accounting 8, edition 3.0 program. Also, many resources have published articles about the organization of VAT accounting in this program and about the existing VAT accounting checks in the program and ways to find errors.

Therefore, in this article we will not once again describe in detail the principles of organizing VAT accounting in 1C: Accounting 8; we will only recall the main points:

- For VAT accounting, the program uses internal tables, which in 1C terms are called “Accumulation Registers”. These tables contain much more information than in the postings on account 19, which allows you to reflect in the program

- When posting documents, the program first performs movements in the registers, and based on the registers it generates postings for accounts 19 and 68.02;

- VAT reporting is generated ONLY according to register data. Therefore, if the user enters any manual entries into VAT accounts without reflecting them in the registers, these adjustments will not be reflected in the reporting.

- To check the correctness of VAT accounting (including the correspondence of data in registers and transactions), there are built-in reports - Express check of accounting, VAT accounting analysis.

However, the average accountant user is much more accustomed to working with “standard” accounting reports - Balance Sheet, Account Analysis. Therefore, it is natural that the accountant wants to compare the data in these reports with the data in the Declaration - in other words, check the VAT Declaration for turnover. And if the organization has simple VAT accounting - there is no separate accounting, no import/export, then the task of reconciling the Declaration with accounting is quite simple. But if some more complex situations arise in VAT accounting, users already have problems comparing data in accounting and data in the Declaration.

This article is intended to help accountants perform a “self-check” of filling out the VAT Return in the program. Thanks to this article, users will be able to:

- independently check the correctness of filling out the VAT Declaration and compliance of the data in it with accounting data;

- identify places where the data in the program registers diverges from the data in accounting.

Results

Accounting for VAT when receiving advances is of great importance for the seller, because by charging and paying VAT on advance payment amounts, the taxpayer reduces the tax burden in future periods, since he then accepts the accrued VAT as a deduction.

For the buyer, on the contrary, the transfer of an advance makes it possible to reduce the tax burden in the current tax periods. However, if for the buyer claiming a deduction for advance VAT is a right, then charging VAT for the seller is an obligation, failing which he may be held liable.

Sources:

- Tax Code of the Russian Federation

- Decree of the Government of the Russian Federation of December 26, 2011 N 1137

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Refund of advance

Registration by the seller

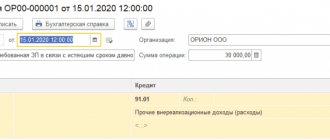

In accounting, the following entry is provided for such an operation:

Debit 62 (advance) – Credit 68.

After the seller has received the advance, he needs to prepare an advance invoice and register it in the sales book. Invoice data is reflected in the quarter in which the advance payment is received. After the seller registers it, he is obliged to transfer the copy to the buyer. Invoice processing lines, registration and transfer to the buyer - 5 days after receiving partial payment.

The advance payment is recorded in section 3, line 070 of the VAT return for the quarter in which it was transferred.