Business lawyer > Accounting > Accounting and reporting > What administrative expenses include: accounting features, write-off methods

Paragraph 20 of PBU 10/99 determines that any enterprise has the right to independently determine in its accounting policies how to recognize expenses, including management expenses. They can become part of the cost by type of business activity: production or sale of goods, provision of services, performance of work (letter of the Ministry of Finance No. 07-05-06/191 dated 02.09.208). When developing accounting policies, you should be guided by the Instructions for the chart of accounts.

Administrative expenses

Administrative expenses

are the costs of managing an organization that are not directly related to the production process. Thus, if management costs can be associated directly with any production process, then these costs cannot be attributed to management costs, but are included in the cost of the corresponding products. For example, the salary of a workshop manager is included in the cost of products produced by that workshop. At the same time, the salaries of the general director, personnel department employees, etc. included in administrative expenses.

At the same time, administrative expenses can be included in the cost of production, but not directly, but by distribution among all types of products in proportion to an economically justified indicator (for example, wages of key production personnel or depreciation of production equipment, etc.).

Administrative expenses may include:

- Administrative expenses;

- maintenance of management personnel not directly related to the production process;

- depreciation and repair costs of fixed assets for management and general economic purposes;

- rental of general purpose premises;

- expenses for information, auditing, consulting, etc. services;

- other administrative expenses similar in purpose.

Management Cost Analysis

From the point of view of financial analysis, management expenses are classified as semi-fixed, because their value does not directly depend on the volume of output. An increase in production volumes leads to a decrease in the amount of management costs per unit of production, resulting in an increase in profit per unit of production due to positive economies of scale.

Information about the total amount of management expenses can be found in line 2220 of the income statement (income statement). More detailed information on management expenses is accumulated in accounting in account 26 “General business expenses”.

Still have questions about accounting and taxes? Ask them on the accounting forum.

Advertising campaigns

Advertising of goods is the main method of information influence on the buyer, allowing to improve the quality of sales. This part of the costs includes payment for any services related to the promotion of products on the market, be it printing booklets or decorating shop windows.

- with an income of no more than 30 million rubles, it is allowed to use 5% of its amount;

- if the company received 30–300 million rubles from sales, then it is possible to use 1.5 million + 2.5% of the amount of income exceeding 30 million for advertising purposes;

- if revenue exceeds RUB 300 million. maximum advertising costs will be 8.25 million rubles. + 1% of the amount exceeding 300 million rubles.

What do administrative expenses include: accounting features, write-off methods

Paragraph 20 of PBU 10/99 determines that any enterprise has the right to independently determine in its accounting policies how to recognize expenses, including management expenses. They can become part of the cost by type of business activity: production or sale of goods, provision of services, performance of work (letter of the Ministry of Finance No. 07-05-06/191 dated 02.09.208). When developing accounting policies, you should be guided by the Instructions for the chart of accounts.

What are administrative expenses and how do they differ from commercial expenses?

Management costs include costs that do not have a direct connection with the production or sale of goods, services, or work. If costs can be associated with one of the areas of business activity, they are considered commercial (for example, wages and deductions for the head of a production department).

Management costs can be included in the cost price if they are distributed in proportion to revenue across all types of manufactured products (sold goods, works, services). When developing an accounting policy, an enterprise (organization) must be guided by Law No. 129-FZ and paragraph 4 of PBU 1/2008.

The chart of accounts is developed on the basis of the Plan approved by the Ministry of Finance on October 31. 2000, and based on the scope of activity, legal form, scale and structure of the enterprise. The accounts that will be necessary to account for business activities are selected and supplemented with subaccounts and analytical accounts. If some accounts are not needed, they are not included in the work plan. Administration costs are always included in general business expenses (accounts 26 and 27).

What is included in management expenses

The composition of this type of costs largely depends on the field of activity, but in general, management costs include funds spent on:

- maintenance of buildings housing administrative personnel: human resources department, legal department, etc.

- salaries and deductions of administrative personnel

- purchasing equipment and office supplies for the office

- office staff business trips

- payment for communication services

Each enterprise can add or shorten this list if the specifics of business activity require it.

This could include spending on protective clothing and personal protective equipment, printing services, postal services, cleaning, disinfection of premises, maintenance of the yard and road, bathhouses or showers, canteen, and first aid station. This category also includes the costs of training and advanced training, and the search for new employees.

Reflection of management costs in accounting

Administrative expenses do not depend on the volume of business activity, so they cannot be written off to “Main production” at the end of the month (account 20). They are taken into account in “General expenses” (D 26).

Features of accounting are that there are two write-off methods:

Reflection in accounting

- traditional - are recognized as conditionally constant and are fully related to the full cost, carried out as K 26, D 90

- based on the division of administrative costs into semi-fixed and semi-variable

When using the second method, the reduced production cost is calculated, conditionally fixed expenses are written off to “Cost of sales” (D 90-2), that is, they are recognized as costs of the reporting period that reduce income.

There are 3 options for writing off the conditionally variable part:

- K 26, D 20 - if they relate to the main production

- K 26, D 23 - if they relate to auxiliary production

- K 26, D 29 - if they relate to service facilities or production

Administrative costs are included in the cost price after the sale of products (goods) and are written off to “Sales” (account 90). The income statement is reflected in line 040.

Some economists express the opinion that administrative costs can be written off on D 91 if there were no sales during the reporting period.

Disputes with the tax office most often arise over expenses for the services of management companies. If there is an agreement, a document confirming payment, and an acceptance certificate for work performed, there should be no claims. Tax authorities may consider this type of service to be economically unprofitable and aimed at tax evasion. Analyzing the decisions made by the courts in similar cases, we can conclude that most entrepreneurs manage to prove that such expenses are justified.

Financial analysis of management costs

Management costs in financial analysis are classified as semi-fixed, since their value does not depend on production volume. If the volume of products produced (sold) increases, profit per unit increases due to scale.

Difficult economic conditions force entrepreneurs to take a different look at the administration staffing table. Enterprise managers are trying to combine the functions of departments in order to reduce the number of employees. This allows you to reduce costs for salaries, rent, transportation, office equipment, and business trips. The amount saved is the amount of increased profit.

Some choose a different path - reducing wages, allowances and bonuses while maintaining the size of the administrative apparatus. This option is preferable because it does not increase the unemployment rate or reduce employee loyalty.

A good option is to transfer part of the office staff to the “home” mode, which allows saving on rent of premises, utility bills, and official transport. Almost all staff can work via the Internet.

Competent financial analysis allows you to use the optimization of administrative costs as a means of increasing profits. The funds saved on optimizing the management staff can be invested in development, reorganization, renewal, and innovation.

Noticed a mistake? Select it and press Ctrl+Enter to let us know.

What do enterprise management expenses include?

Management expenses represent the costs of running a company. They are separated from the costs of maintaining the production process. This is their main feature.

What are included in management expenses?

First, let's figure out what is not included in management expenses. They do not include any expenses related to production activities.

Let's look at an example. The workshop manager's salary is something that can be attributed to expenses for production processes. This is due to the specifics of the work of this specialist. It directly ensures production stability. The CEO's salary is already management expenses. The main difference between these costs is that production costs affect the cost of the final product, while management costs do not. However, the latter can be included in the cost indirectly.

Let's look at typical examples of management expenses:

- Expenses for administrative needs.

- Ensuring the work of managers.

- Depreciation and expenses for repairs of operating systems for management purposes.

- Renting premises for company activities.

- Expenses for the services of an auditor and consultant.

- Expenses for other administrative needs.

- Security.

- Costs of contacting third party companies.

- Personnel training.

- Entertainment expenses.

- Housing and communal services.

- Expenses for office, telephone communications.

UR have a conditionally constant value. That is, they practically do not change. The amount of spending can be predicted. This is due to the fact that the volume of management costs is not affected by the number of products produced. However, the expansion of production volumes leads to a decrease in the size of the SD per unit of product. For this reason, profit per unit of product produced increases.

ATTENTION! Information on the total volume of damages can be obtained from line 2220 of the loss report. Detailed information is contained in account 26 of accounting.

Types of SD and forms of their planning

Management expenses are not directly tied to sales figures or production volumes. The calculation is made without taking into account the dynamics of the enterprise's income. Most overhead expenses are included not in standardized, but in limited expenses. That is, a certain limit is set for them for a given period. Management expenses can be divided into two categories:

- Asset-linked. These are depreciation charges, expenses for the maintenance and repair of operating systems, premises, and rent.

- Linked to the development of enterprises. These include expenses for paying salaries to management personnel. This could include travel allowances and vacation pay. Planning such expenses is very difficult.

Management costs are constantly increasing. This must be taken into account when planning them. An increase in spending is necessary to ensure the efficiency of the company and maintain competitiveness. Indexing plays a vital role. Let's consider ways to plan SD:

- Traditional. This method was used in the Soviet Union, and therefore its second name is Soviet. It implies limiting the UR to a set percentage of the salary fund. This method is considered obsolete. This is due to the fact that it has many disadvantages. In particular, its use leads to a decrease in production efficiency. The traditional method is practically not used. It is not relevant for commercial production.

- Planning based on already achieved results. The method assumes an annual increase (indexation) of SD indicators. The increase is made based on the growth rate of expenses. The method in question is often used by commercial companies.

- Planning with a connection to the final result. This is the most effective method, which is used by key structures of highly developed countries.

The specific method is determined depending on the needs of the enterprise. In Russia, the second option is most popular.

Features of accounting for management expenses

The concept of management expenses is not contained in regulations governing accounting. Accounting for these expenses is determined in a practical way. In particular, UR are recorded in the line “Management expenses”, on account 26 (debit):

- DT KT02, 05 – depreciation calculation for fixed assets.

- DT26 KT04 – write-off of expenses for scientific and other research, the results of which will be used in further general economic activities.

- DT26 KT16 – write-off of deviations in the cost of fixed assets that were applied for general business needs.

- DT26 KT18 – VAT write-off.

- DT26 KT21 - the use of semi-finished products that were manufactured in production for general economic needs.

- DT26 KT23 – write-off of expenses of auxiliary production.

- DT26 KT29 – write-off of expenses of service farms.

- DT26 KT43 – write-off of the cost of finished products that are used for general economic needs.

- DT26 KT60, 76 – accounting for expenses for the services of auditors, consultants and other representatives of third-party companies.

- DT26 KT68 – tax assessment.

- DT26 KT69 – calculation of contributions for pension or health insurance.

- DT26 KT70 – accrual of earnings for management staff.

- DT26 KT71 – write-off for general business expenses generated by reporting employees.

- DT26 KT76 – provision of services for general business needs.

- DT26 KT79 – general business expenses generated at the head office and received by branches, aimed at the autonomous balance.

- DT26 KT94 – write-off of shortages and expenses from damage to material objects.

- DT26 KT96 – formation of reserves for future expenses for general business expenses.

- DT26 KT97 – write-off of expenses for upcoming periods.

Let's consider the entries on the credit of account 26:

- DT76 KT26 – compensation for damage that was previously taken into account as part of general business expenses.

- DT86 KT26 – write-off of expenses using money allocated for targeted financing.

- DT90 KT26 – writing off expenses that are on account 26 to the debit of account 90.

Each of the postings must be confirmed by primary documentation. If primary documents are missing, the inspection authorities will have questions. For each transaction, the transaction amount is indicated.

Tax accounting

Any company expenses, including management expenses, are taken into account for tax purposes. To be taken into account, they must meet the following conditions:

- The costs are rational from an economic point of view.

- Expenses are confirmed by primary documentation. All expenses are included in tax accounting only on the basis of information from accounting.

- The main purpose of expenses is the profit of the enterprise in the future.

Expenses will be reflected in the period to which they belong.

FOR YOUR INFORMATION! When tax accounting for management expenses, specialists have many questions. For example, many do not know whether the following UR periods are considered expenses if there is no profit. When analyzing tax regulations, we can conclude: UR for tax purposes are recognized only in expenses of the current reporting period. In accounting, the company independently determines the procedure for recognizing expenses and records this in its accounting policies.

Tax accounting

Any company expenses, including management expenses, are taken into account for tax purposes. To be taken into account, they must meet the following conditions:

- The costs are rational from an economic point of view.

- Expenses are confirmed by primary documentation. All expenses are included in tax accounting only on the basis of information from accounting.

- The main purpose of expenses is the profit of the enterprise in the future.

Expenses will be reflected in the period to which they belong.

FOR YOUR INFORMATION! When tax accounting for management expenses, specialists have many questions. For example, many do not know whether the following UR periods are considered expenses if there is no profit. When analyzing tax regulations, we can conclude: UR for tax purposes are recognized only in expenses of the current reporting period. In accounting, the company independently determines the procedure for recognizing expenses and records this in its accounting policies.

Administrative expenses: account

Administrative expenses: account

Related publications

Accounting for administrative and commercial expenses is carried out separately from other costs. The procedure for distinguishing expense transactions according to their belonging to one category or another is fixed by the accounting policy.

What is included in management expenses

The rules for recognition and division of costs are fixed in PBU 10/99. The managerial type of expenses includes funds allocated to pay office staff, pay off obligations on bills for communication services, security alarms, housing and communal services, etc. Administrative expenses include a wide range of costs that are not directly related to the production of products, they are not used in the process of activities in the field of trade or services.

Examples of this type of cost could be:

- paid bills for office supplies;

- conducting seminars and trainings for company employees;

- entertainment expenses;

- depreciation charges for fixed assets used at administrative facilities;

- maintenance and repair of equipment intended for operation by management personnel.

Everything that relates to management costs can be included in the cost of production in two ways:

- write-off as goods manufactured by the enterprise are sold;

- write-off of the full amount of costs incurred, linked to the period of their occurrence.

How are selling expenses different from administrative expenses? The need for the former is determined by the trading activities carried out by the company, the latter are needed to maintain the administrative apparatus of the company. Business expenses may include funds transferred to packaging suppliers, payment for services for packaging products, loading and delivery. Management costs are characterized by predictability, their predicted volume can be approximately calculated, commercial expenses are characterized by dependence on the number of products produced and sold.

Administrative expenses - accounting account and typical entries

For expenses related to management needs, synthetic accounting account 26 “General business expenses” is intended. It is active, the balance formed on it must be written off monthly.

Typical entries to reflect incurred management costs:

- D26 - K21 - shows the valuation of semi-finished products of own production, which were used for the needs of the administrative facility;

- D26 – K43 – the price of consumed finished products is included in management expenses;

- D26 – K60 or 76 – services received from third parties are taken into account;

- management accounting of labor costs is carried out using entries D26 - K70 in relation to accrued earnings and D26 - K69 in terms of insurance premiums.

Accountable amounts related to administrative expenses are reflected as D26 - K71. If part of the management costs is transferred to branches (provided that they were initially incurred by the parent company), then correspondence is drawn up between debit 26 and credit 79. Deficiencies are written off by posting D26 - K94.

There are two methods for further writing off administrative expenses.

The first method assumes that the costs of maintaining the company’s administration, according to the requirements of accounting policies, are subject to partial inclusion in the cost of production. The accounting entries will be as follows:

- D20 – K26 for allocating part of production costs;

- when a company specializing in the service sector writes off administrative expenses, the posting looks like D29 - K26;

- when calculating the cost of products of auxiliary production, administrative expenses will be transferred through correspondence D23 - K26.

At the next stage, when selling goods, the accumulated cost, including management costs, is written off to account 90.

With the second method of accounting for management expenses, posting a write-off will immediately transfer them to account 90: D90 - K26.

Management expenses in financial statements

All transactions performed by an enterprise in a specific period must be reflected in the financial statements. The Balance Sheet form shows the final account balances as of a certain date, and the Financial Results Statement form indicates cumulative data.

Administrative expenses in the balance sheet are not an independent line, but a component sum of other lines, depending on which account the debit was made to at the end of the month. The identification of the management type of costs in reporting is carried out in line 2220 of the Financial Results Report, provided that the second accounting method is used. When administrative expenses are determined, the formula for calculating them for reporting comes down to an analysis of credit turnover on account 26 in combination with the debit of account 90.

Management budget

When forming a forecast for income and expenses for different areas of spending, it is recommended to calculate standard values or set limits for reporting periods.

The budget can be prepared using one of three methods:

- Traditional, using the linking of the administrative expense limit to the general wage fund (the method is considered obsolete).

- Indexation method - data from the reporting year is taken as a basis and increased by a certain percentage.

- Focus on results - the amount of funds allocated for management needs directly depends on the expected and achieved results of the enterprise.

What do business expenses include?

Selling expenses include the costs of selling products, which are collected in account 44. Read more about what is included in a company's selling expenses below.

Selling and administrative expenses are...

The company must disclose information about commercial and administrative expenses in the financial results report:

- line 2210 indicates commercial expenses;

- line 2220 - administrative expenses.

Neither the Tax Code of the Russian Federation nor other regulations contain a clear formulation of what exactly should be classified as commercial expenses and what should be classified as management expenses. In practice, selling and administrative expenses are the company’s expenses reflected in accounts 44 and 26, respectively.

What are management costs?

Administrative expenses include amounts generated on account 26 and associated with the maintenance of the company’s common property and the organization of its activities. A distinctive feature of such expenses is that they are not directly related to production, provision of services or trade. An example of management expenses would be the following expenses:

- on guard;

- payment for the Internet, housing and communal services and communications;

- entertainment expenses;

- salaries of accountants, lawyers, personnel officers and other administrative and management personnel;

- labor protection and seminars for workers;

- stationery.

Administrative expenses can be included in the cost of production as products are sold. Then the accountant must write them off by posting to the debit of account 20 (23 or 29) and the credit of account 26.

The second way to account for administrative expenses is to attribute them in full to the cost of the reporting period in which they arose. In this case, the accountant will post Dt 90 Kt 26.

The chosen procedure for accounting for management expenses must be specified in the company’s accounting policy (clause 20 of PBU 10/99).

Learn more about account 26 from the publication “Account 26 in accounting (nuances).”

What are included in business expenses?

Unlike administrative expenses, selling expenses include company costs that are associated with production or trading activities. For companies operating in the manufacturing sector, commercial expenses will include expenses for packaging products, their delivery to the buyer’s warehouse, advertising events, etc.

The commercial expenses of a trading company include the costs of transporting and storing goods, wages, rent or maintenance of buildings where trade is carried out, advertising, entertainment expenses, etc.

We will tell you how to properly arrange entertainment expenses in this article.

What are the business expenses of companies involved in agricultural procurement and processing? These are expenses for the maintenance of procurement and receiving points, the maintenance of livestock and poultry (Order of the Ministry of Finance dated October 31, 2000 No. 94n).

In accounting, commercial expenses are collected in the debit of account 44. In this case, there are 2 ways to take such expenses into account in cost:

- Write off completely by posting Dt 90 Kt 44.

- Write off partially to account 90. In this case, according to the chart of accounts (order of the Ministry of Finance of the Russian Federation dated October 31, 2000 No. 94n), you need to distribute:

- costs of packaging and transportation between types of products sold (for manufacturing firms);

- transportation costs between goods sold and warehouse balances at the end of the month (for trading companies);

- commercial expenses - in the debit of account 15 and account 11 (for those companies engaged in the procurement and processing of agricultural products).

The company indicates the chosen method of distribution in its accounting policies.

Whether business expenses are reflected in the balance sheet, see this article.

Results

The legislative acts of the Russian Federation do not contain a clear list of commercial costs. Based on the established practice of Russian accounting, commercial expenses should be attributed to account 44. Based on this principle, commercial expenses can be recognized as those costs that are listed in the instructions to the Chart of Accounts in the description of account 44.

For more information on how an organization can create its own working chart of accounts and which accounts to include in it, read this publication.

Accounting 26 for dummies: examples and postings

Accounting account 26 is general business expenses or indirect costs, used in almost every enterprise, with the exception of state budgetary and credit organizations. In this article we will look at the main nuances of this account, its properties, typical transactions and examples of use in accounting.

Account 26 in accounting

General business expenses include all costs for administrative needs that are not directly related to production, provision of services or performance of work, but relate to the main type of activity.

The list of general business expenses depends on the profile of the organization and is not closed, according to the recommendations for using the chart of accounts.

The main general operating costs can be identified:

- Administrative and management expenses

- Business trips;

- Salaries of administration, accounting, management personnel, marketing, etc.;

- Entertainment expenses;

- Security, communication services;

- Consultations of third-party specialists (IT, auditors, etc.);

- Postal services and office.

- Repair and depreciation of non-production fixed assets;

- Rent of non-industrial premises;

- Budget payments (taxes, fines, penalties);

- Other:

Organizations not related to production (dealers, agents, etc.) collect all costs on account 26 and subsequently write them off to the sales account (account 90).

Important! Trade organizations may not use account 26, but assign all expenses to account 44 “Sales expenses”.

Let's consider the main properties of account 26 “General business expenses”:

- Refers to active accounts, therefore, it cannot have a negative result (credit balance);

- It is a transaction account and does not appear on the balance sheet. At the end of each reporting period it must be closed (there should be no balance at the end of the month);

- Analytical accounting is carried out according to cost items (budget items), place of origin (divisions) and other characteristics.

Typical wiring

Account 26 “General business expenses” corresponds with the following accounts:

Table 1. By debit of account 26:

| Dt | CT | Wiring Description |

| 26 | 02 | Depreciation calculation for non-production fixed assets |

| 26 | 05 | Depreciation calculation for non-production intangible assets |

| 26 | 10 | Write-off of materials, inventory, workwear for general business needs |

| 26 | 16 | Variance in the cost of written-off general business materials |

| 26 | 21 | Write-off of semi-finished products for general business purposes |

| 26 | 20 | Attribution of costs (work, services) of the main production to general economic needs |

| 26 | 23 | Attribution of costs (work, services) of auxiliary production to general economic needs |

| 26 | 29 | Attribution of costs (work, services) of service production to general economic needs |

| 26 | 43 | Write-off of finished products for general business purposes (experiments, research, analyses) |

| 26 | 50 | Decommissioning of postage stamps |

| 26 | 55 | Payment of expenses (minor work, services) from special bank accounts |

| 26 | 60 | Payment for work and services of third parties for general business needs |

| 26 | 68 | Calculation of payments of taxes, fees, penalties |

| 26 | 69 | Deduction for social needs |

| 26 | 70 | Calculation of wages for administrative, managerial and general business personnel |

| 26 | 71 | Accrual of travel expenses, as well as accountable expenses for small general business needs |

| 26 | 76 | General expenses related to other creditors |

| 26 | 79 | General business expenses associated with the organization's divisions on a separate balance sheet |

| 26 | 94 | Write-off of shortages without perpetrators, except for natural disasters |

| 26 | 96 | Assigning general business expenses to the reserve for future expenses and payments |

| 26 | 97 | Write-off of a share of future expenses for general business expenses |

Table 2. For the credit of account 26:

| Dt | CT | Wiring Description |

| 08 | 26 | Attribution of general business expenses to capital construction |

| 10 | 26 | Capitalization of returnable waste and unused materials written off as general business expenses |

| Write-off of general business expenses when closing the month, that is, where account 26 is written off | ||

| 20 | 26 | For main production |

| 21 | 26 | For the production of semi-finished products |

| 29 | 26 | For service production |

| 90.02 | 26 | Performed work and services for third parties |

| 90.08 | 26 | On the cost of sales when using the direct costing method |

Closing 26 accounts

Closing account 26, that is, writing off all general business expenses, is performed in several ways:

- Included in the cost of production through production accounts if products are produced;

- Referred to as cost of sales when providing services or work;

- Referred to the current expenses of the reporting month using the direct costing method:

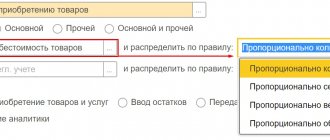

Important! The write-off method, as well as the basis for the distribution of general business expenses, must be fixed in the accounting policies of the organization.

In this case, general business expenses are written off in shares, taking into account the distribution base, into production accounts and may remain on product cost accounts (for example, when producing products under account 43 “Finished Products”) or production accounts (for example, work in progress under account 20 “Main Production” ) at the end of the reporting period.

Main types of cost distribution bases:

Get 267 video lessons on 1C for free:

- Free video tutorial on 1C Accounting 8.3 and 8.2;

- Tutorial on the new version of 1C ZUP 3.0;

- Good course on 1C Trade Management 11.

- Revenue

- Product output volume

- Planned cost of production

- Material costs

- Direct costs

- Salary and so on

When closing the month, the following transactions are generated, for example:

| Dt | CT | Wiring Description |

| 20 | 26 | General business expenses for main production were written off |

| 23 | 26 | General business expenses for auxiliary production were written off |

General business expenses are distributed to the cost of production (production accounts) according to the specified distribution and analytical accounting base:

Therefore, general business expenses are written off:

- In full - if one product is produced (no analytics);

- Distributed across all types of products in proportion to the selected base - if several types of products are produced and calculated in the context of analytics.

LLC "Horns and Hooves" produces hats and shoes, the production of which is carried out at a planned cost. In an organization, direct expenses are reflected in account 20 “Main production”, and indirect expenses in account 26 “General business expenses”.

The accounting policy states:

- General business expenses are written off against the cost of production.

- The distribution base is material costs.

In November 2021, direct expenses amounted to RUB 51,040.00:

- For headwear – RUB 28,020.00. of them:

- Material costs – RUB 15,000.00.

- For the production of shoes - RUB 23,020.00. of them:

- Material costs – RUB 10,000.00.

indirect costs – 18,020 rubles.

- 3/p administrative staff – RUB 10,000.00.

- Insurance premiums – RUB 3,020.00.

- Premises rental – RUB 5,000.00.

According to the distribution base for material costs:

Important! Also in the accounting policy, you can indicate non-distributable general business expenses, which will be written off immediately to current expenses in Account 90.08.

If the accounting policy specifies the write-off method “to cost of sales,” then the following transactions are taken into account when closing the period:

| Dt | CT | Wiring Description |

| 90.02 | 26 | General business expenses are written off as the cost of services and work |

In this case, costs can also be taken into account in terms of analytics.

If the accounting policy specifies the “direct costing” write-off method, then general business expenses are taken into account as semi-fixed and when closing the period they are reflected in the following entries:

| Dt | CT | Wiring Description |

| 90.08 | 26 | General business expenses are written off as cost of sales |

In this case, the amount of costs is written off in full in each reporting period.

Examples of using account 26 “General business expenses”

Let's look at the above wiring using examples.

LLC "Horns and Hooves" produces products, the production of which is carried out at a planned cost. In an organization, direct expenses are reflected in account 20 “Main production”, and indirect expenses in account 26 “General business expenses”.

The accounting policy states:

- General business expenses are written off against the cost of production.

- The distribution base is the planned cost.

In November 2021, direct expenses amounted to RUB 88,040:

- 3/p production employees – RUB 20,000.00.

- Insurance premiums – RUB 6,040.00.

- Material costs – RUB 62,000.00.

Indirect costs – RUB 13,020:

- 3/p administrative personnel – RUB 10,000.00;

- Insurance premiums – RUB 3,020.00:

| date | Account Dt | Kt account | Amount, rub. | Wiring Description | A document base |

| Output | |||||

| 16.11.2016 | 43 | 40 | 85 000 | Release of finished products (at planned cost) | Production report, invoice on acceptance of products to the warehouse |

| 16.11.2016 | 20 | 10 | 62 000 | Write-off of materials | Request-invoice |

| Payroll for production workers | |||||

| 30.11.2016 | 20 | 70 | 20 000 | Salary accrued | Time sheet, payslip |

| 30.11.2016 | 70 | 68 | 2 600 | Personal income tax withheld | |

| 30.11.2016 | 20 | 69 | 6 040 | Insurance premiums accrued | |

| Payroll for administrative and management personnel | |||||

| 30.11.2016 | 26 | 70 | 10 000 | Salary accrued | Time sheet, payslip |

| 30.11.2016 | 70 | 68 | 1 300 | Personal income tax withheld | |

| 30.11.2016 | 26 | 69 | 3 020 | Insurance premiums accrued | |

| Closing the month | |||||

| 30.11.2016 | 20 | 26 | 10 000 | Closing account 26 (salaries) | |

| 30.11.2016 | 20 | 26 | 3 020 | Closing account 26 (insurance premiums) | |

| 30.11.2016 | 40 | 20 | 101 060 | Write-off of the actual cost of production (26,040.00 (Labour) + 62,000.00 (Material costs) + 13,020.00 (General expenses)) | |

| 30.11.2016 | 43 | 40 | 16 060 | Adjustment of product cost to actual value | |

Important! If PBU is used, and general business expenses are taken into account in tax accounting as indirect expenses (established in the accounting policy), then temporary differences (TD) also arise:

| VR/NU | Account Dt | Kt account | Amount, rub. | Wiring Description |

| VR | 20 | 26 | 10 000 | Closing account 26 (salaries) |

| WELL | 90.08 | 26 | 10 000 | |

| VR | 90.08 | 26 | -10 000 | |

| VR | 20 | 26 | 3 020 | Closing account 26 (insurance premiums) |

| WELL | 90.08 | 26 | 3 020 | |

| VR | 90.08 | 26 | -3 020 | |

| WELL | 40 | 20 | 88 040 | Write-off of the actual cost of production |

| VR | 40 | 20 | 13 020 | |

| WELL | 43 | 40 | 3 040 | Adjustment of product cost to actual value |

| VR | 43 | 40 | 13 020 |

Horns and Hooves LLC provides security services. General business expenses are written off immediately to the cost of security services.

In November 2021, general business expenses amounted to RUB 23,020.

- 3/p personnel – RUB 10,000.00;

- Insurance premiums – RUB 3,020.00;

- Premises rental – RUB 10,000.00:

| date | Account Dt | Kt account | Amount, rub. | Wiring Description | A document base |

| 24.11.2016 | 26 | 60 | 10 000 | Rent accrued | The act of providing services |

| 26.11.2016 | 62 | 90.01 | 30 000 | Revenue accounting | The act of providing services |

| 90.03 | 68 | 5 400 | VAT charged | ||

| 30.11.2016 | 26 | 70 | 10 000 | Salary accrued | Time sheet, payslip |

| 30.11.2016 | 70 | 68 | 1 300 | Personal income tax withheld | |

| 30.11.2016 | 26 | 69 | 3 020 | Insurance premiums accrued | |

| Closing the month | |||||

| 30.11.2016 | 90.02 | 26 | 23 020 | Write-off of general business expenses to cost of sales posting | |

LLC "Horns and Hooves" produces products. In an organization, direct expenses are reflected in account 20 “Main production”, and indirect expenses in account 26 “General business expenses”.

The accounting policy states:

- General business expenses are written off using the direct costing method.

In November 2021, direct expenses amounted to RUB 88,040:

- 3/p production employees – RUB 20,000.00;

- Insurance premiums – 6,040.00 rubles;

- Material costs – RUB 62,000.00.

Indirect costs – RUB 13,020:

- 3/p administrative personnel – RUB 10,000.00;

- Insurance premiums – RUB 3,020.00:

| date | Account Dt | Kt account | Amount, rub. | Wiring Description | A document base |

| Output | |||||

| 16.11.2016 | 43 | 40 | 85 000 | Release of finished products (at planned cost) | Production report, invoice on acceptance of products to the warehouse |

| 16.11.2016 | 20 | 10 | 62 000 | Write-off of materials | Request-invoice |

| Payroll for production workers | |||||

| 30.11.2016 | 20 | 70 | 20 000 | Salary accrued | Time sheet, payslip |

| 30.11.2016 | 70 | 68 | 2 600 | Personal income tax withheld | |

| 30.11.2016 | 20 | 69 | 6 040 | Insurance premiums accrued | |

| Payroll for administrative and management personnel | |||||

| 30.11.2016 | 26 | 70 | 10 000 | Salary accrued | Time sheet, payslip |

| 30.11.2016 | 70 | 68 | 1 300 | Personal income tax withheld | |

| 30.11.2016 | 26 | 69 | 3 020 | Insurance premiums accrued | |

| Closing the month | |||||

| 30.11.2016 | 90.08 | 26 | 10 000 | Closing account 26 (salaries) | |

| 30.11.2016 | 90.08 | 26 | 3 020 | Closing account 26 (insurance premiums) | |

| 30.11.2016 | 40 | 20 | 88 040 | Write-off of the actual cost of production (26,040.00 (Labour) + 62,000.00 (Material costs) + 13,020.00 (General expenses)) | |

| 30.11.2016 | 43 | 40 | 3 040 | Adjustment of product cost to actual value | |

You must be logged in to post a comment.

This site uses Akismet to reduce spam. Find out how your comment data is processed.

Source: https://buhspravka46.ru/buhgalterskiy-plan-schetov/schet-26-v-buhgalterskom-uchete-dlya-chaynikov-primeryi-i-provodki.html

Management expenses. Line 2220

This line reflects information on expenses for ordinary activities related to the management of the organization (clauses 5, 7, 21 PBU 10/99).

What are management costs?

The following expenses may be included in management expenses (Instructions for using the Chart of Accounts):

— for the maintenance of general business personnel not related to the production process;

— depreciation and expenses for repairs of fixed assets for management and general economic purposes;

— rent for general purpose premises;

— costs of paying for information, auditing, consulting, etc. services;

— taxes paid by the organization as a whole (property tax, transport tax, land tax, etc.);

- other expenses similar in purpose that arise in the process of managing the organization and are determined by its maintenance as a single financial and property complex.

Administrative expenses accounted for on account 26 “General business expenses”, in accordance with accounting policies, can be monthly (clause 9, 20 PBU 10/99, Instructions for using the Chart of Accounts):

1) written off as conditionally constant in the debit of account 90 “Sales”, subaccount 90-2 “Cost of sales”;

2) be included in the cost of products, works, services (i.e. written off as a debit to accounts 20 “Main production”, 23 “Auxiliary production”, 29 “Service production and facilities”).

Note!

General business expenses of construction organizations can be included in the cost of work under construction contracts only if their reimbursement by the customer is provided for (clause 14 of PBU 2/2008).

The specifics of including management expenses in the cost of sales are established by industry methodological instructions, recommendations, guidelines (clause 10 of PBU 10/99, Letter of the Ministry of Finance of Russia dated April 29, 2002 N 16-00-13/03).

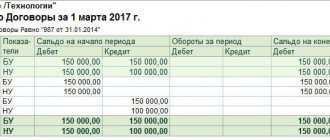

What accounting data is used when filling out line 2220 “Management expenses”?

The value of the indicator in line 2220 “Administrative expenses” (for the reporting period) is determined on the basis of data on the total debit turnover for the reporting period on account 90, subaccount 90-2, in correspondence with account 26 (if such a procedure for writing off administrative expenses is provided for by the organization’s accounting policy) . The resulting amount of management expenses is indicated in the Statement of Financial Results in parentheses.

Option 1. The accounting policy of the organization provides for the inclusion of management expenses in the cost of sales in full in the reporting period for their recognition as expenses for ordinary activities.

Line 2220 “Administrative expenses” = Turnover on the debit of subaccount 90/2 and the credit of account 26

Option 2. The organization’s accounting policy provides for the inclusion of management expenses in the cost of products, works, and services.

Line 2220 “Administrative expenses” = -

The indicator for line 2220 “Administrative expenses” (for the same reporting period of the previous year) is transferred from the Statement of Financial Results for this reporting period of the previous year.

Example of filling out line 2220 “Management expenses”

Indicators for subaccount 90-2 account 90 in accounting (in correspondence with the credit of account 26): rub.

| Turnover for the reporting period (2014) | Sum |

| 1 | 2 |

| 1. By debit of subaccount 90-2 in correspondence with account 26 | 6 345 970 |

Fragment of the Financial Results Report for 2013

| Explanations | Indicator name | Code | For 2013 | For 2012 |

| 1 | 2 | 3 | 4 | 5 |

| Administrative expenses | 2220 | (15 780) | (10 132) |

Solution

Administrative expenses amount to 6346 thousand rubles.

A fragment of the Income Statement will look like this.

Digital library

According to the instructions for using the Chart of Accounts, management expenses include the following types:

· depreciation charges for complete restoration and repair costs of fixed assets for management and general economic purposes;

· rent for general business premises;

· expenses for payment of information, audit and consulting services;

· other expenses similar to their intended purpose.

As previously noted, general business expenses are reflected on account 26 in correspondence with the credit of inventories accounts, settlements with personnel for wages, settlements with other organizations, etc.

The expenses recorded on account 26 are indirect expenses, that is, expenses associated with the production of several types of products. At the time of their occurrence, indirect costs cannot be directly attributed to the cost of a certain type of product (work, service) and therefore must first be collected in a specific account and then distributed between types of product (work, service). The basis for the distribution of general business expenses between types of products, works, services can be: direct costs, direct material costs, wages of production workers, etc.

The distribution of general business expenses is reflected in accounting by posting:

As a result of the distribution of general business expenses on account 20, the full actual cost of finished products is formed.

The method we described for writing off general business (administrative) expenses to the cost of production is traditional for Russian accounting.

In this case, they talk about valuing finished products at a reduced (incomplete) production cost. Note that when applying this method, general business expenses will be written off to the sales account even in the absence of actual sales of products (works, services) in the reporting period. In this situation, at the end of the month, account 90 will have a debit balance equal to the amount of general business expenses, which should be written off to account 99 “Profits and losses.”

Rice. 5.5 Scheme for writing off costs when forming partial costs:

The choice of method for writing off general business expenses must be reflected in the accounting policies of the organization.

Let's consider an example of registration in accounting of transactions for the sale of products (works, services) when using various methods of writing off general business expenses.

Source: https://libraryno.ru/5-13-spisanie-upravlencheskih-rashodov-na-sebestoimost-realizovannoy-produkcii-buhfinuch2/

Management expenses: composition, accounting, analysis

Articles on the topic

Administrative expenses are expenses that are in no way related to production activities. For example, administrative staff salaries, office maintenance and servicing, postal and advertising costs. In this article we will look at what else is included in management expenses, how to reflect them in accounting and determine the financial result.

In this article you will learn

:

What are administrative expenses

Management costs are those costs of an organization that cannot be associated with the production process, that is, they are not involved in the production of goods or services. For example, if employees of a production workshop received wages, then this expense item is included in the cost of production, and the salary of the chief accountant should be included in management expenses, since he is not involved in production. If costs can be attributed to at least one of the organization’s production areas, then they are already considered commercial. Management costs can be included in the cost of production, but not all at once, but by distribution among all types of manufactured products in proportion to revenue for a certain period (month, quarter, year). See also how to calculate the cost of production: calculation formulas, cost distribution methods.

Download and use it

:

How it will help

: plan administrative and management expenses and minimize the risk of including unreasonable costs in the budget.

What is included in management expenses

This list is not complete; it can be supplemented with certain items depending on the specifics of the organization’s activities (for example, maintaining a canteen, medical center, security, cleaning the area in front of the building, etc.).

Read also

: Techniques for managing administrative and management expenses

How it can help: In many companies, planning administrative and management expenses drags on for months. But even during this time, it is not always possible to develop a reliable budget, since the approval process involves a large number of participants, each of whom tries to approve, or in other words, “push through” additional cost items. Nevertheless, it is quite possible to draw up a realistic budget for these expenses, and deviations in it will not exceed 5–10 percent.

How it will help

: Two-thirds of your colleagues monitor the company's key financial indicators weekly and spend half their working day doing so. We learned how to turn an accounting program into a convenient system for monitoring and managing your business with your own hands.

Accounting

Despite the fact that administrative expenses are not directly related to the main production activities of the enterprise, they are reflected in the expense accounts, namely, in account 26 “General business expenses”. There are two ways to write them off:

1. They are recognized as conditionally constant and written off at the end of the month to the cost of production. For this purpose, the following entry is made in the accounting registers: Debit 90 “Sales” Credit 26 “General expenses”. This procedure must be specified in the organization's accounting policies. Posting means that administrative expenses are written off to the cost of goods manufactured in the month in which they are included in the expenses of ordinary activities.

Product delivery costs

The difficulty of accounting for transportation costs is that it is necessary to carefully monitor the terms of the supply agreement. There is the concept of free place, which characterizes the point of delivery of goods made at the expense of the seller. Most often, companies use 4 types of transportation:

- pickup (or ex-warehouse of the seller) - delivery costs are borne by the buyer;

- ex-carriage of the place of departure - costs are distributed between the buyer and the customer;

- ex-warehouse of the customer - the cost of delivery is fully paid by the supplier;

- ex-carriage of destination – costs are charged in part to both the customer and the seller.

It is possible to apply other terms of payment for transport services provided for in the contract. It is worth remembering that part of business expenses can only include those amounts that are paid entirely at the expense of the enterprise. If the buyer plans to reimburse costs, then they do not participate in the formation of the cost and are taken into account on account 62.