Sick leave

Victoria Pechieva

Expert, chief accountant with 12 years of experience

Current as of April 4, 2020

Electronic sick leave for 2021 is used on the same basis as a paper certificate of incapacity for work. How can an employer connect to electronic document management with the Social Insurance Fund? How to correctly fill out an electronic sick leave and pay benefits? We will look at the answers to these and other questions in this article.

What is ELN?

ELN is an analogue of a regular sick leave. Filled out in specialized programs or directly in the personal account of the Social Insurance Fund. The innovation significantly simplifies the work of an accountant and his interaction with the Social Insurance Fund, and also allows you not to worry about possible errors and the presence of unreliable documents. In this regard, many organizations are gradually switching to ENL.

In this material we will tell and show how to generate an electronic sick leave and set up direct payments to the Social Insurance Fund in the program “1C: Salaries and Personnel of a Government Institution 3.1” (“1C: WKSU”).

You will learn:

- Why is an electronic sick leave better than a paper one?

- Key functions of ELN.

- How does the electronic sick leave system work?

- What is needed to work with electronic information in the program “1C: ZGKU 3.1”?

- How to set up electronic document management with the Social Insurance Fund?

- How to create a sick leave certificate in 1C?

- How to set up direct payments to the Social Insurance Fund in 1C:ZGKU 3.1?

Why is an electronic sick leave better than a paper one?

Electronic sick leave is generated in a medical institution in a special program, which allows:

- minimize errors that a medical employee may make when filling out the paper version;

- ELN cannot be lost, falsified or damaged, no special place is required for its storage;

- information from the electronic tax record is automatically loaded into the 1C program - the accountant does not have to waste time filling out sick leave manually, and the percentage of errors, and therefore FSS refusals when reimbursement of expenses, is also reduced to a minimum;

- After formation, the ELN falls into the single FSS database; to confirm expenses at the expense of the FSS, the employer will not need to provide supporting documents.

Request sick leave

- Go to the "Sick Leave" section.

- Click "Add", select "Sick Leave" and create an "Electronic Sick Leave".

- Specify the employee and check his details.

- Fill in the number of the certificate of incapacity for work and click “Request to the Social Insurance Fund”.

Within a few minutes, the FSS will send an electronic certificate of incapacity for work - the entry in the “Sick leave” section will have the status , and in the document itself “ Sick leave received

».

How does the electronic sick leave system work?

When registering an ELN, the employee must sign a written agreement at a medical institution, which, in turn, must be connected to the exchange of information with the Social Insurance Fund in order to be able to generate certificates of incapacity for work.

The operating algorithm of the FSS ELN is as follows:

- the doctor fills out the ENL, sends it to the FSS and gives the visitor the sheet number;

- the employee transfers the personal identification number to the accounting department of his company;

- an accountant in the 1C program sends a request to the Social Insurance Fund using the sick leave number;

- In response to the request, the FSS sends an electronic sick leave;

- the 1C program automatically downloads data from the electronic tax record and calculates the amount of the benefit;

- the employer pays the employee sick leave.

It is also worth mentioning separately the deadlines for paying sick leave. As soon as an employee has submitted the slip number to the company’s accounting department, it is required by law to calculate it no later than 10 calendar days. The amount of sick leave is subject to reimbursement with the withholding of income tax.

The payment, as already mentioned, is paid directly by the Social Insurance Fund if the company participates in the social insurance pilot project, which we will discuss in the article.

Underwater rocks

Changes in routine operations create resistance among processors. The introduction of ENL is not only a simplification in filling out data, but also an acceleration of processes, the formation of extensive statistics on enterprises, regions of Russia and the country as a whole.

Such a large-scale process involves pitfalls. The Foundation's programmers regularly analyze the situation and improve the exchange program.

It is more difficult for organizations with a large number of employees and a variety of reasons for applying to the Social Insurance Fund - not only for illness or pregnancy, but also for injuries. Therefore, there is no complete abandonment of paper sick leave certificates yet. Employers do not forget about the option of exchanging an electronic slip for a paper equivalent if it is impossible to process sick leave through an automated program.

Due to technical failures, the Social Insurance Fund is also unable to fully use the functionality of the Social Insurance Unified Information System.

So, what is needed to work with ELN in the 1C:ZGKU 3.1 program?

Let's move from theory to practice. Next, we will show how to generate an electronic sick leave and set up direct payments to the Social Insurance Fund in the 1C: Salaries and Personnel of a Government Institution 3.1 program.

If you submit reports through the 1C-Reporting service, then you already have insurance certificates and the Social Insurance Fund. All that remains is to download the FSS ELN certificate from the official website. Configuration and subsequent updating of FSS certificates will be performed automatically, without user assistance.

If you do not have a connection to the service and submit reports through other operators, in this case it is enough to connect electronic document management with the Social Insurance Fund.

Request sick leave

- Generate a “Sick Leave” document in one of the following ways:

- in the “Reporting” or “Accounting/Reporting” section (depending on the configuration), click “Create”, select “Benefits and sick leave”, and then the “Sick leave” form; Which configuration should I choose?

- in the “Reporting/Benefits and Sick Leave” or “Accounting/Reporting/Benefits and Sick Leave” section (depending on the configuration), click “Create” and select “Sick Leave”.

- Indicate the employee for whom the sick leave is issued and check the details.

- In the line “Certificate of incapacity for work”, fill in the ELN number and the date of provision. If the sick leave is generated according to the Social Insurance Fund, the number will be filled in automatically. Click “Request to FSS”.

Within a few minutes, the FSS will send an electronic certificate of incapacity for work - the entry in the “Reporting/Benefits and Sick Leave” section will have the status , and in the document itself “ Sick leave received

».

If you are subscribed to receive sick leave from the Social Insurance Fund, the document will be generated automatically and will be marked with the icon. Open it in the “Reporting/Benefits and Sick Leave” section.

If you calculate your salary in VLSI, you can also create sick leave in the “Employees/Salary/Sick Leave and Benefits” section.

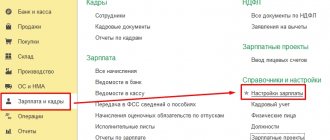

How to set up electronic document management with the Social Insurance Fund?

To start document flow with the Social Insurance Fund, you must:

- on the main panel in the “1C: ZKGU 3.1” program, go to the “Settings” block;

- then select “Organizations”;

- in the window that opens, select the “EDO” tab;

- then go to the “Electronic document flow with the Social Insurance Fund” tab;

- the required certificates will be filled in in the window that appears;

- check the box “Use electronic document management with FSS authorities”—after that, we will then have the opportunity to fill out the data (Fig. 1).

Fig.1. Exchange settings with FSS

The policyholder certificate is a personal certificate of the responsible person of the organization. For example, directors or accountants who have the right to sign reports to the Social Insurance Fund.

The FSS ELN certificate is downloaded from the official website. The resulting certificate must be installed and opened. After that, click the “Save and Close” button.

Dispatch

To check and send a document, you need to open the document viewing page and select “ Check and send” :

After checking:

- If violations are found, correct them. To do this, close the window with the scan results, correct the violations (they are highlighted in red) and check again:

- If there are no violations, you must sign the file with a valid electronic signature certificate and click “Send the document to the FSS":

The file will be sent to the regional office of the FSS. The status of the electronic certificate of incapacity for work can be tracked on the document flow page.

Sending multiple emails

Sick leave can be sent en masse. To do this, on the page with a list of documents, you need to go to the “ Details and settings” , then click “ Enable bulk sending mode” . It will be enabled for the organization as a whole, meaning it will apply to all users.

In the same section, if necessary, you can disable the bulk sending mode.

First, the service shows documents for the last 4 days for which they are available. If necessary, you need to select a different date and also enable the No Errors . A send button will appear - in the image it is “ Send 2 documents to the FSS” . After clicking it, the system will transfer the user to the electronic signature selection window.

How to create a sick leave certificate in 1C?

To check the operation of the electronic sick leave in 1C, you need to create a new document “Sick Leave”. You can find it in the “Salary” or “Personnel” block in the “1C: ZKGU 3.1” program (Fig. 2).

Fig.2. Creating a new document “Sick leave” in “1C:ZKGU 3.1”

We fill out standard fields, such as: “Month”, “Employee” and “LN number” (certificate of incapacity for work). After that, using the “Get from the Social Insurance Fund” button, we receive data on disability (Fig. 3).

Fig.3. Button “Receive from FSS” in “1C:ZKGU 3.1”

Data about the medical organization is loaded automatically. In order to view this information, you need to click on the link (Fig. 4).

Fig.4. Link “Information about the medical organization” in “1C:ZKGU 3.1”

To create an “ELN Register”, you need to go to the “Reporting, Certificates” tab, then go to “1C-Reporting” (Fig. 5).

Fig.5. Creation of an ENL register in the 1C-Reporting service

Next, the report should be filled out, checked for completion of the required fields and sent to the Social Insurance Fund.

Ready! At this point, setting up and sending the ENL to the FSS from 1C is completed. This function will allow you to significantly reduce the time required to enter primary documentation and eliminate possible errors in calculations. Now let's move on to direct payments to the Social Insurance Fund.

Loading ELN from file

To download an electronic sheet, proceed as follows:

- Select “ Download electronic sick leave” :

- Click "Load manually from file with ELN":

- Select Continue .

- Select the previously created file and click Open . A file can contain multiple documents.

- Check details of the downloaded file:

- the service will issue a warning if a document with the same sick leave number has already been created. You must select Update to replace the information in the already created document with the information from the file.

- Click Upload Documents . When loading, a new document is generated or a previously created one is updated (if the “ Update” ).

- Open the ELN and check. If necessary, missing data should be corrected or supplemented.

- Check and send ELN.

How to set up direct FSS payments?

First, let's figure out what the “FSS Pilot Project” is and what is it used for? In essence, this is an experimental innovation that involves the payment of social benefits without the participation of the employer.

If your organization is a participant in the pilot project, then to start working with this function it must be activated in the organization's accounting policy. To do this, let's go to:

- section: “Settings – Organizations – Accounting policies” (Fig. 6);

- in the subsection “Benefits at the expense of the Social Insurance Fund”, put a tick, confirming that your organization is registered in the region;

- We indicate the date from which payments will be valid.

Fig.6. Setting up Social Insurance Fund Payments in the organization’s accounting policy in “1C:ZKGU 3.1”

After completing this setup, when generating a sick leave certificate, you will see that the line where the benefit was previously calculated at the expense of the Social Insurance Fund is empty (Fig. 7).

Fig.7. Certificate of incapacity for work in “1C: Salaries and personnel of a government institution 3.1”

In addition, another tab “FSS Pilot Project” has appeared. In it, you can create an employee’s application for payment of benefits and give it for signature (Fig. 8).

Fig.8. Processing “Application for payment of benefits” in “1C:ZKGU 3.1”

Then go to your “workplace” for FSS payments. This section allows you not only to record data on sick leave and applications, but also to track the status of sent registers, as well as enter information about reimbursed funds into the information database.

To do this, open the section: “The main thing is Benefits from the Social Insurance Fund.” Next you will see 3 columns:

- sick leave;

- employee statements;

- registers of applications (Fig. 9).

Rice. 9. Workplace “Benefits at the expense of the Social Insurance Fund” in “1C:ZKGU 3.1”

You have already done the first and second points. All that remains is to create a register of applications and send it directly, if you have 1C-Reporting connected, or upload it and send it through other programs.

It is worth noting that not all benefits will be paid from the Social Insurance Fund. The exceptions are:

- funeral benefit;

- allowance for caring for disabled children.

The benefits listed above will be paid at the expense of the employer, so you will need to enter data in your “workplace” on the “Reimbursement of organization expenses” tab (Fig. 10)

Fig. 10. Tab “Reimbursement of expenses of the organization” in “1C:WKGU 3.1”

Filling out and sending the ELN Register to the FSS

Initial completion and submission of the ENL Register

The ELN register for sending to the FSS can be filled out automatically by clicking the Fill :

This includes all ENL that have not yet been sent to the FSS:

You can see exactly what data will be transferred by double-clicking on the desired Registry :

- about the employee's insurance experience,

- about the paid period,

- about possible conditions of calculation,

- about average daily earnings,

- about the basis for calculating average earnings,

- about the amount of benefits at the expense of the employer,

- about the amount of benefits at the expense of the Social Insurance Fund.

After preparing the Register, it can be completed and sent to the FSS in one of the following ways:

- Method 1: if connected 1C-Reporting, That Registry can be automatically sent to the FSS using the button Send the Register to the FSS

- Method 2: if 1C-Reporting NOT connected, then Registry uploaded to an external file using the Upload – Write file button

and then it is sent using third-party systems (Kontur, VLSI, etc.)

the Registry status will be automatically established . Starting from ZUP version 3.1.10, after receiving a response from the FSS, based on the status of each Sick Leave, of the Register is “calculated” . For example, when part of the sick leave is not accepted by the FSS, then the Registry Status is set as Partially accepted by the FSS :

If the exchange occurs through external files, then the state of the Registry after it is changed only manually:

The Registry can have several states:

- Accepted by the FSS - then editing the Register is closed.

- Partially accepted by FSS – if part of the benefits is not accepted due to any errors. When creating a new Registry For sending, only new or not yet accepted sick leave records are sent to it using the button Fill:

an error appeared

when trying to resend the Register In ZUP 3.1.10, the status of sending the electronic medical record is saved for each “sick leave”, so no problems arise. - Not accepted by the FSS - you need to correct errors in the electronic registration form and repeat sending them through the new Registry .

Determining the need to re-send the electronic tax record due to changes in the primary data

Starting from ZUP 3.1.10, if any changes have occurred the Sick Leave the ENL Register for sending to the Social Insurance Fund using the Fill :

Possibility of selecting ELN

Starting from ZUP 3.1.10 in the ELN Register for sending to the Social Insurance Fund, using the Select , a special selection form opens - Information about ELN , in which you can see the status of sending information on the Sick Leave :

Did the article help?

Get another secret bonus and full access to the BukhExpert8 help system for 14 days free of charge