Until relatively recently, the tax service did not allow the obligations of a business entity or other taxpayer to the budget and other creditors to be fully or partially repaid at the expense of financial resources belonging to third parties.

In addition, the tax service did not encourage payments by a business entity to repay tax and non-tax debts of third parties.

However, some provisions of current legislation still provide for such an option.

We are talking about Article 313, prescribed in the Civil Code of the Russian Federation.

This rule establishes and clarifies the procedure according to which a third party can pay the obligations of the debtor and taxpayer.

How to pay tax for a third party

In order to pay tax for a third party, the following rules must be observed:

- Any other person can pay tax on behalf of the taxpayer. There are no restrictions on who the third party should be in this situation. Such a payer can be either a legal entity or an individual. This person may have some direct relationship with the taxpayer, or be a third party.

- Paying tax in this way applies not only to tax payments, but also to insurance premiums (including penalties and fines on them). The only exception is insurance premiums for insurance against accidents and occupational diseases. An organization or entrepreneur can only pay for them independently.

- You cannot pay tax on any specific transaction for the sale of goods or services. For example, when purchasing goods from a seller, the buyer does not have the right to pay income tax on a specific transaction.

- The obligation to pay tax will be considered fulfilled at the time of submission to the bank of an order to transfer funds to the budget from the account of a third party, if it pays the tax for the taxpayer.

- The obligation to pay tax will be recognized as unfulfilled if the person who presented the order to the bank withdraws the order, or if the bank returns the unfulfilled order to such person, for example, in case of errors or insufficient funds in the account (

Transfer of payments for third parties

It should be noted that you can pay off for others not only current taxes, fees and insurance premiums, but also arrears on them for previous periods. In this case, no permission is required from the Federal Tax Service or funds.

After paying taxes for third parties, the payer does not have the right to demand a refund of the paid amount from the budget (clause 1 of Article 45 of the Tax Code of the Russian Federation).

Under the simplified tax system “income minus expenses”, the taxpayer will be able to take into account in his expenses the amount of taxes and contributions paid by another person only after he has reimbursed his debt to this person (clause 3, clause 2, article 346.17 of the Tax Code of the Russian Federation).

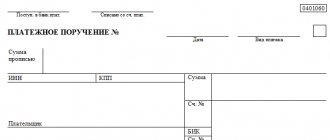

How to fill out a payment order to pay tax for a third party

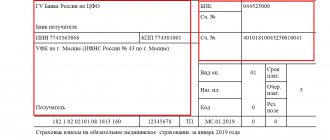

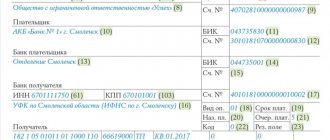

In order for the tax payment to be executed correctly in relation to the taxpayer for whom it is paid, it is important that the payment order be drawn up in accordance with the new rules for indicating information (Rule No. 58n dated 04/05/2017).

Important! Even if the tax was paid by a third party, the taxpayer needs to have a copy of the order confirming payment to eliminate possible tax questions.

The main difficulties when filling out a payment slip for tax transfers for another person may arise in relation to the payer’s details. Let's look at the main ones:

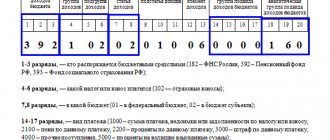

| Field | What to include | Other Features |

| 60 “TIN of the payer” | INN of the taxpayer, according to which the obligation to pay tax (insurance contributions) is fulfilled | If tax is paid for an individual without a TIN, then “0” is entered, and a unique accrual identifier (UIN) should be entered in the “Code” field. |

| 120 “Payer checkpoint” | Checkpoint of the taxpayer, according to which the obligation to pay tax (insurance contributions) is fulfilled | If the tax is paid for an individual, then “0” is entered, |

| 8 "Payer" | Information about the person making the payment | If a legal entity pays, then the name of the organization that fulfills the taxpayer’s tax obligations is indicated; If an individual entrepreneur or individual pays, then his full name is indicated; |

| 24 “Purpose of payment” | Indicate the TIN and KPP of the person making the payment | You must indicate the TIN and KPP first in the “Purpose of payment” field, while the values of the TIN and KPP are separated by “//”. Then information about the taxpayer for whom the obligation to pay tax is fulfilled is indicated: for individual entrepreneurs - full name, and in brackets “Individual Entrepreneur”, for individuals - full name and address |

| 101 “Payer status” | The status of the one whose tax liability is fulfilled. | Legal entity – “01” IP – “09” Individual – “13” |

Important! If an error was made when paying tax for a third party, which does not entail cancellation of the payment, then it can be clarified by writing a corresponding application to the tax authority. But the application must be submitted by the taxpayer himself, and not by the person who actually made the payment for it.

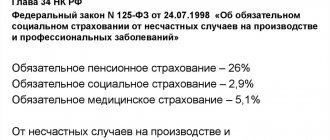

Insurance premiums: payment for third parties is possible

Until 2021, the law of July 24, 2009 No. 212-FZ did not allow the possibility of paying insurance premiums for other persons. Since 01/01/2017, the situation has changed - Law No. 212-FZ ceased to apply, contributions came under the control of the Federal Tax Service, plus the innovations introduced into the Tax Code of the Russian Federation by Law No. 401-FZ (clause “g”, clause 6 of Article 1 of the law) No. 401-FZ).

In 2021, you can transfer for third parties (clause 9 of article 45 of the Tax Code of the Russian Federation):

- "pension contributions,

- compulsory medical insurance contributions,

- contributions in case of illness and maternity.

This does not apply only to contributions for “injuries”, which remained under the jurisdiction of the Social Insurance Fund, which means that the provisions of the Tax Code of the Russian Federation do not apply to them. The policyholder must pay “traumatic” contributions to the Social Insurance Fund himself.

Agreement between the taxpayer and a third party

The legislation does not establish strict requirements on exactly how the relationship between the taxpayer and the person paying the tax for him should be formalized. However, an agreement or other documentary evidence between the two persons in this situation must be drawn up.

The type of agreement can be one of the following: (click to expand)

- If the third party is a debtor of the taxpayer, then a contract of agency or an agreement to transfer tax for the taxpayer is concluded. One option may also be to write a letter to the debtor asking him to pay the tax to pay off the debt;

- If there are no contractual relations between two persons, then a loan agreement is concluded for the amount of the tax. The agreement can be either interest-free or interest-bearing;

- If the third party is the founder, then the following types of agreement can be concluded: loan, gift or interest-free targeted financing.

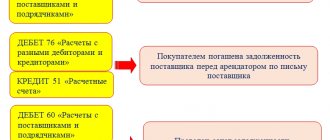

Results

The fact of payment for a third party by posting is reflected in the accounting of both the payer, the creditor, and the debtor. The payer first reflects the transfer of money to the creditor for the debtor at his request, and then carries out offsets (if he himself owed money to the supplier). If there was no debt initially, it closes the resulting debt upon receipt of money or other assets from the supplier (debtor). The debtor and creditor use accounting accounts in this operation, depending on the type of debt and other accounting and legislative nuances.

All transactions on accounting accounts must be supported by documents, so it is important to formalize agreements in writing and create a complete package of papers (payment orders, letters, contracts, etc.).

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Each medal has...

...its other side. Yes, and regarding our topic this statement also applies. If we reflect on this issue, there remains a strong feeling that regular payments by third parties of taxes accrued to the company may cause some suspicion on the part of the Federal Tax Service. The main reason for suspicion may be the obvious “interdependence” between enterprises, which in theory could become a reason for another tax audit. Federal Tax Service inspectors most likely come to clarify why a seemingly independent company, which is expected to have at least “average” turnover in the region, is not able to fulfill its tax obligations? Moreover, today we are dealing with an “untested” technique, which is currently used only in extreme cases. Legal entities and the Federal Tax Service have not yet had time to “hit the mark” in this matter, therefore, there is still a high probability that payments may go “in the wrong place.” Still, all innovations are perceived with caution and are developed with difficulty, but this is rather our national trait and, unfortunately, there is no escape from this yet.

Possible risks

Such almost circular debt repayment is characterized by a considerable number of risks:

- The primary debtor sending the letter will refuse to acknowledge his request and that the debtor has made payment on his debt. The counterparty will have to repay the debt again.

- The counterparty will make the payment, however, after the creditor writes off his debt, he will return the funds on the basis of an erroneous payment. You will have to pay the debt amount again.

- The creditor files a claim with the primary debtor that payments have not been made even though payment was made by a third party.

Rules for writing a letter of request for debt repayment

The request letter must include the following information:

- Name of the legal entity entrusted with covering the debt. This is so important because even if the legal entity does not put the required mark in the payment order, using the details it will be possible to prove the purpose of the payment.

- An obligation that is transferred to a third party. In particular, you need to disclose its details: details of the agreement on the basis of which the debt arose, its amount.

- If the third party is a debtor of the enterprise (as is the case in most cases) and the funds paid by him go towards his debt, it is recommended to also indicate this in the letter. This is beneficial to both the first and second parties. The company has a greater chance that the counterparty will agree to such a transaction. The debtor can be sure that the payment will actually go towards the obligations and the creditor will not oblige him to repay the debt.

- The debtor to whom the letter is sent may not know all the intricacies of drawing up a payment order. It is also advisable to mention them. In particular, specify the need to indicate the purpose of the payment - repayment of the debt of another company.

ATTENTION! The letter of request must be signed by the head of the enterprise or a person with appropriate authority. The presence of a signature is of interest to the debtor, since it proves that the order actually took place.

IMPORTANT! The payment is made by a third party, and therefore the company does not have direct access to documents confirming the payments made. However, their presence is necessary to prove repayment of the entire amount of debt. Therefore, it makes sense to request a copy of the payment order from the debtor. The paper must be marked with execution from the financial institution.

Example of a letter of repayment of obligations

General Director of Prodvizhenie LLC I.P. Ufimtsev Chelyabinsk, st. Kirova 1, no. 1 From the General Director of Oliva LLC V.V. Ripak Chelyabinsk, st. Vorovskogo, 6

Ref. dated June 20, 2021 No. 363

LETTER about transferring money towards debt

We have a debt to Oliva LLC in the amount of 200,000 rubles. We ask you to pay off the debt of Oliva LLC in the amount of 200,000 rubles. Details for payments: TIN 11133355443 KPP 7657488956 OGRN 10754754785 r/s 407657776544878558654 in the Chelyabinsk branch of the Sberbank of Russia K/s 6655999996665555700088 BIK 066468888886

Transfer of payment using these details will mean the termination of the debt of Prodvizhenie LLC to Oliva LLC in the amount of 200,000 rubles.

In the instruction, we ask you to mention the purpose of the funds: “Payment for the rental of premises for Oliva LLC under agreement No. 10 dated July 10, 2021 in the amount of 200,000 rubles is not subject to VAT.” We also urge you to send us a copy of the payment order. The document must bear a mark from the banking institution regarding execution.

General Director of Oliva LLC Ripak /V.V.Ripak/

Payment accounting

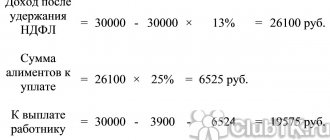

Payment of tax by a third party suggests that one company becomes liable to another. Funds are provided on the basis of a loan agreement. In the future, they must be returned by the taxpayer. The tax amount will not be considered an expense of the company, since there is no decrease in assets. The funds will be returned, and therefore the organization’s capital is not reduced. The taxpayer is provided with an interest-free loan, and therefore it will not be included in financial deposits. This is due to the fact that paragraph 2 of the Accounting Regulations PBU 19/02, established by Order of the Ministry of Finance No. 126 of December 10, 2002, is not implemented.

The loan will be included in accounts receivable. For this reason, in accounting it must be recorded as the debit of account 76 and the credit of account 51. When the taxpayer returns the funds, the company will not generate income. Postings when paying tax payments for another person will be as follows:

- DT76 KT68. Fixation of an interest-free loan in the structure of tax payments.

- DT51 KT76. The funds were returned.

The transactions are confirmed by the loan agreement.

conclusions

If we analyze all the information we have prepared, it turns out that this innovation is quite positive. The ability to pay taxes to third parties will once again avoid getting into a situation where, due to unnecessary delays in payments, an account is blocked or when the head of an organization has to “collect” money from everywhere just to pay off his tax obligations. It's good to have such an opportunity. At the same time, it is worth remembering the undesirable consequences of abuse of this opportunity, which can bring a lot of trouble to the business entity and its management. Still, we recommend that companies use this “option” at least once in order to test the effectiveness of this technique in practice. If it works, consider that you already know exactly what to do in a critical situation.

We wish you good luck and see you again!

From the story of one accountant

One accountant we know well told an interesting story about the payment of taxes by third parties. The situation is that the director has many legal entities that he actually manages himself. Moreover, he has the status of an individual entrepreneur. Previously, if he needed to pay taxes, he had to withdraw funds from one company through our accountant, and then deposit them into the bank account of another organization. Then they safely paid all taxes assessed to them. Now he does not need to carry out any complex operations. He simply instructs our accountant to make payments, say from Yablochko LLC in favor of GruntPlastInvest LLC and in the purpose of payment write something similar to “Income tax for individuals from wages for May 2021 for the Limited Liability Company “GruntPlastInvest” " In general, everything is solved. Or there is another case when the director himself transfers money to pay tax charges from his personal funds (not from the individual entrepreneur’s account). This option is also possible. “The state benefits when taxes are paid on time and large fines are assessed for mistakes,” jokes our contact person. Actually, this is why the Federal Tax Service has become more loyal to such actions. By the way, earlier in Article 45 of the Tax Code of the Russian Federation, even before all the changes, the payment of taxes by third parties was categorically prohibited.

We dare to assume that the current innovations will be used by the heads of organizations to fulfill their debt obligations within the pool of “relatives”; they will pay taxes for their companies and at the same time they are unlikely to help their colleagues or counterparties. Although... But we still haven’t come across such stories in more than six months. Moreover, we don’t often come across stories from colleagues in which this topic appears at all. How do you ask: “Marya Ivanovna, does your company pay taxes for your contractors”? We hear the answer: “Who would pay for us”! Okay, at least they take the questions with a smile. So all is not lost.

Does the recipient need confirmation?

Sometimes the recipient counterparty requires a letter from the payer, with whom it is not bound by contractual obligations, to offset the payment to the debtor in order to insure itself against claims from the transferring company. Such an action is justified if the payment document contains incomplete data that does not allow an unambiguous interpretation of what the money was received for. However, the very fact of transfer of funds (with a full and accurate breakdown for whom and against what obligations it is paid) serves as a sufficient basis for their offset against the debtor. Therefore, demanding such a letter from an essentially stranger seems unnecessary.

It would be more correct (if the organization nevertheless decides to further protect itself) to take a letter from its counterparty - the buyer with a request to allow payment not to himself, but to a third party with a detailed indication of who will pay and for what, in what amount.

This procedure and already established business practice show that there is nothing terrible or illegal when payment is made by a third party. This can even be convenient for the parties to the agreement - funds arrive faster, bypassing additional transactions in the participants’ accounts, and if properly executed, neither the parties nor the tax inspectorates will have any claims.

Main features of the operation

The Civil Code of the Russian Federation does not say anything about the procedure for processing debt payment by a third party. The algorithm used was formed by practice. It consists of the following stages:

- The company sends a letter to its debtor with a request to pay his debt.

- The debtor transfers his funds to the main creditor. The order specifies the appropriate purpose of the payments - payment for the debtor.

A letter of request and an order with an appropriate note are all confirmation that the company has paid the debt for another organization. The presence of these documents is important, since without them, the company that paid off the debt can begin to collect the paid funds from the recipient. The basis is the enrichment of the creditor resulting from an erroneous payment. Without supporting documents, both the main debtor and his creditor bear the risks. If the company begins to collect funds, the debtor will have to pay the debt to the creditor himself.

IMPORTANT! An entrepreneur cannot control what a third party indicates in his payment order. Therefore, it is doubly important to draw up a letter of request and take confirmation of its receipt. The paper will serve as proof of the operation. Proper documentation is a way to reduce all possible risks.

Accounting

Let's look at the postings used using the example from the above letter of request. Oliva rents premises for 200 thousand rubles excluding VAT. She shipped products to Prodvizhenie LLC in the amount of 200,000 rubles. The cost of the goods was 160,000 rubles. A letter requesting payment of Oliva's debt was sent. The payment has been made. Both parties chose the simplified tax system, and therefore they do not pay VAT. Let's look at the entries in the accounting book of Oliva LLC:

- DT62 KT90-1. Amount: 200,000 rubles. Explanation: total debt of Promotion.

- DT90-2 KT41. Amount: 160,000 rubles. Write-off of the cost of goods transferred to Promotion.

- DT44 KT60. Amount: 200,000 rubles. Reflection of debt to the lessor of Oliva.

- DT60 KT62. Amount: 200,000 rubles. Amortization .

ATTENTION! The last entry is made only after receiving the primary document, that is, a copy of the payment order. The records should mention primary documentation confirming the operations performed.