When a material benefit arises A material benefit (MB) is received by an individual (Article 212

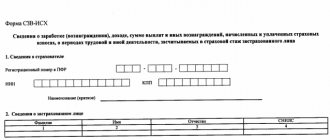

The calculation of insurance premiums combines data on all types of deductions and is submitted to the Federal Tax Service in

The procedure for the head of the tax authority to make a decision based on the results of consideration of tax audit materials is established by article

What is KBK and why is it needed? KBK is a budget classification code.

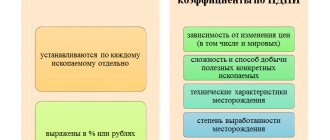

Payers of this tax must submit a declaration on mineral extraction tax. Draw up the declaration in the form approved by the order

New reporting form for 2021 for all employers With the beginning of 2021, insurance

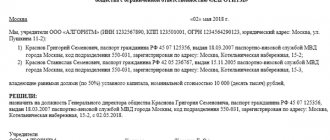

How to compose a document There is no unified form; a free one is used to create a document. Solution structure

Important components of a leasing agreement A leasing agreement is always drawn up in writing. It reflects

Any business is built on commodity-money relations, be it a physically tangible product or some kind of service.

Issuance for reporting from the cash register The first of the possible ways of issuing money to a business traveler is