Form of the act

Typically, companies independently develop the form that will be used in a given situation.

Naturally, it must be approved by the manager. Most templates are designed according to the example of the TORG-16 form. However, this is not mandatory, because this requirement was abolished back in 2013. You also need to know that there are types of write-offs for which a specific form should be used. We can say that its choice largely depends on the purpose for which the document is being drawn up. In essence, the act is a statement indicating the material assets that were written off, the reasons and the date. Regardless of what form was used to draw up the document, its standard form must contain the following data:

- place and date of registration;

- list of commission members;

- characteristics of materials being written off;

- expert opinion;

- reasons for write-off;

- signatures of responsible persons and commission members.

( Video : “Errors when writing off materials in 1C”)

Normative base

Resolution of the State Standard of the Russian Federation dated 03.03.2003 N 65-st “On the adoption and implementation of the state standard of the Russian Federation” (together with “GOST R 6.30-2003. State standard of the Russian Federation. Unified documentation systems. Unified system of organizational and administrative documentation. Requirements to registration of documents”)

Resolution of the State Statistics Committee of the Russian Federation dated August 18, 1998 N 88 “On approval of unified forms of primary accounting documentation for recording cash transactions and recording inventory results”

Write-off procedure

Regardless of the reasons why there is a need to formalize the write-off of materials, you first need to convene a team of specialists who will act as a commission.

They will be the ones who will decide whether a write-off is really necessary. The employees responsible for the materials in question must be present here. Often these are financially responsible persons. Often the commission includes heads of structural divisions, accountants and other managers. A specially created group must familiarize itself with the materials, their technical condition, defects, malfunctions and damage. Having recorded all the characteristics, authorized persons sign the act, thereby confirming their consent to write-off. ( Video : “The nuances of writing off materials”)

Quite often in large corporations, the write-off procedure is carried out according to clear instructions that are developed specifically for these purposes. You need to understand that there must be good reasons for writing off materials. Moreover, they must be documented. Without this, the write-off procedure does not even begin. Often additional documents are attached to confirm the need to write off materials:

- Reports on products produced for a specific period;

- Documents confirming the fact of consumption of materials above the planned norm;

- Reports from responsible employees on the use of materials;

- Other accounting and financial documentation.

Reasons for writing off materials in the act

After the materials are written off, the financial condition of the company changes. Naturally, such a business transaction must be documented. One of the main points in the drafted act is to indicate the reasons why there was a need to write off materials. Naturally, the reasons must be adequate and compelling:

- transfer to a unit;

- damage to materials;

- the expiration date has expired;

- use of materials for equipment repair;

- sale;

- change in original characteristics.

This is not a complete list of reasons why it may be necessary to prepare this document. Often the reasons are determined by the characteristics of the material. For example, soft materials often fail due to natural wear and tear.

It is also worth noting that the created commission is obliged not only to confirm the legality of the write-off, but also to perform some other work. For example, specialists inspect materials to determine their cost. If they were damaged, the persons responsible for this are identified. Then the specialists must correctly draw up the write-off act and submit it to the head of the organization.

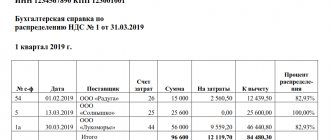

We draw up a certificate of accounts receivable - sample

The state of accounts receivable is one of the important factors in the effective operation of the enterprise as a whole. In essence, working capital necessary for the activities of the enterprise is accumulated in the remote control. Therefore, a good turnover of remote assets is the way to ensure that the company has its own working capital.

We recommend reading: Military service news

A unified regulation for remote control management is needed, first of all, if:

- There are a significant number of divisions or structural units of a company (or group), each of which has its own debtors.

- management companies in residential buildings.

- microfinance organizations;

- companies providing communication services on postpaid tariffs;

- The company has a large number of debtors. Examples of such companies include:

- microfinance organizations;

- companies providing communication services on postpaid tariffs;

- management companies in residential buildings.

How to draw up an act for writing off materials

The main feature of the document is to correctly enter all the data into it, without allowing any distortions.

For example, information about the company that has the materials on its balance sheet must be present here. In addition, all members of the created commission, their passport details and positions should be described in detail. Naturally, the commission is created after the head of the company issues a separate order. A senior specialist is selected. Particular attention should be paid to the column intended to indicate the materials being written off. If there are several of them, you can use a list for better perception. The description must be such that there are no difficulties in identifying the material. Opposite each material its cost is indicated. At the bottom of the document you should write down the total cost of all materials being written off. The reason why it was necessary to draw up this document is also noted.

In specially designated lines, each employee who is part of the commission is required to certify the document with his signature. This suggests that experts fully agree with the information provided. After this, the document is submitted for signature to the director of the company. After affixing the signatures, the act receives legal force. Based on it, accountants write off materials from the balance sheet of the enterprise. Naturally, such information is also displayed in tax accounting.

The document must have one copy. It is he who comes to the disposal of the accounting department, where it is further processed and the materials are written off from the company’s balance sheet. However, any interested party, which includes members of the commission, has the right to ask for a copy of the document for themselves. There is no urgent need to put stamps on the document. Information about the act is entered into a special journal of the enterprise, since it is an internal turnover document.

ACCOUNTING CARTRIDGES FOR PRINTERS

S.A. Ratovskaya, expert consultant at the Publishing House "Accountant's Adviser"

When working with printers and other printing office equipment, an institution has to periodically purchase cartridges. In addition, cartridges sometimes need to be repaired. Many institutions resort to refilling and remanufacturing services for cartridges.

Features of purchasing cartridges

The print cartridge is actually one of the replaceable parts of the printer. The production of cartridges is carried out by the same companies that produce the printers themselves. Cartridges from the printer manufacturer are called original, and all others are called non-original. If the office equipment is new, then the original cartridge is supplied with it. After the original cartridge has served its purpose, the institution has a choice: - purchase a new original cartridge; — purchase a new non-original cartridge; — refill an empty cartridge. Each of these options has its pros and cons. Purchasing original cartridges allows you to maintain the warranty on the printer, since the use of non-original spare parts can lead to refusal of warranty repairs in the event of a printer breakdown. However, the cost of original cartridges is often comparable to the cost of the printer itself, while non-original cartridges are much cheaper. When buying non-original cartridges, you may also encounter a low-quality product or a counterfeit. The best way to save money is to refill the cartridge.

Material recycling act form C-7

A situation often arises when an enterprise has some specific components on its balance sheet. But there is a need to make certain materials from them. In this case, it becomes necessary to draw up a processing act, which indicates the characteristics of the received material, notes the presence of defects, etc. Naturally, signatures in the document are affixed after a thorough inspection of the material and determination of the clear amount of materials intended for processing.

Sample

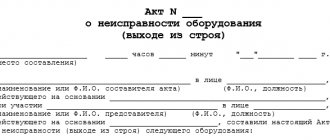

Act of writing off materials that have become unusable

There are a huge number of reasons why materials can lose their original characteristics. Naturally, they are not suitable for further use. This may be the fault of those responsible, or natural wear and tear. If expensive materials are written off, such a decision can be made by the director, chief accountant, or head of the department. The fact that the materials are unsuitable is also confirmed by the commission members. In addition, the cost of each material and the total amount for which the write-off occurs is indicated here. It is also necessary to indicate in what quantity the material is written off. At the discretion of the inspectors, additional information can be indicated in the document. Usually there are special graphs for this.

Sample

In what order is the amount of material costs determined?

As the date of implementation of most types of material expenses, the Tax Code (clause 2 of Article 272) provides for the date of transfer to production.

When determining the amount of material costs, their amount should be reduced by the cost of materials not used at the end of the month, that is, remaining in the operational stock at the on-site or workshop warehouse, at workplaces (clause 2 of Article 318, Article 319 of the Tax Code of the Russian Federation). Read about the assessment of inventories when they are written off in the article “Methods for estimating inventories” .

Certificate of write-off of consumables

The form in which this document is drawn up is developed by firms independently.

However, information that should be present in the primary documents should be included here. It must be remembered that on the basis of the write-off act, accounting employees write off the costs of materials that were spent for certain purposes. As in any act that is intended to be copied, there must be information about the members of the inspection team, their conclusion, and characteristics of the materials. In addition, the reasons why the write-off occurs are also indicated. It is worth noting that such an act is drawn up not only to indicate this information in reporting documents. A document confirming the write-off of consumables allows company managers to track exactly how materials are consumed.

Purpose of materials consumption

When creating this document, free form is used. However, there must be information here that is mandatory. This is data about the department that used the materials. As for the purpose of the expenses, there are certain inaccuracies.

On the one hand, no rules indicate that the absence of a spending purpose in a document is considered a violation. But on the other hand, you need to understand that the act is drawn up after the material has been used. It is logical to assume that the goal should be clear. Accordingly, the field intended to indicate the purpose of material consumption should be filled out.

If you specify a specific purpose, it will be much easier to prove expenses. If you do not indicate the purpose, the document indicating the write-off of materials is impersonal. Based solely on its contents, it is impossible to determine for what work and in what quantity the materials were used.

Sample

Act on write-off of materials for equipment repair

Quite often, if any equipment at an enterprise breaks down, they repair it themselves. In addition, repair work can be carried out by a contractor. Often, materials that are on the organization’s balance sheet are used for this purpose. Naturally, after repair work is completed, the materials used must be written off. In this case, a corresponding act is drawn up.

Purpose of material consumption

When filling out the act, it is recommended to indicate detailed information in this column. For example, equipment was reconstructed and modernized. This can be any other action aimed at increasing the operational life of the equipment and improving its technical characteristics. The document should indicate not only the purpose, but also the specific materials that were used in this repair.

Sample

Who signs the act of writing off materials?

To confirm the legality of writing off materials that are registered with the organization, a special commission is formed. Usually its composition is appointed by the head, this includes department managers, the chief accountant, and employees responsible for these materials. If particularly complex materials are to be reviewed, a highly specialized specialist should also be present. The commission is formed by order of the head. In addition, other company employees may be part of the inspection team. After the inspection, all members of the commission must sign the act. After this, it is submitted for signature to the head of the organization.

What to do after registration

Now you need to write off the funds according to the financial statements:

- D94-K10 . This posting will reflect the amount of write-off of material assets. You can use the drawn up act and rewrite the specified amount, having double-checked everything first.

- D20-K94 . This reflects the amount of losses due to inadequate quality or damage, but not exceeding the amount of the maximum allowable loss. The basis may be an accountant’s certificate or report data. If the total amount exceeds the permissible values, then subaccounts are created instead of line D20.