The calculation of insurance premiums combines data on all types of deductions and is submitted to the Federal Tax Service in accordance with the requirements of Art. 431 Tax Code of the Russian Federation. Information about deductions for insurance for temporary disability and in connection with maternity (VNiM) is indicated in line 090 of Appendix 2 of Section 1 of the calculation. The indicator is final, the calculation of which takes into account the data of lines 060, 070, 080. To obtain the correct indicator of line 090, it is necessary to correctly enter into the calculation all the components of the amount involved in obtaining the total value.

Lines 070, 080 and 090

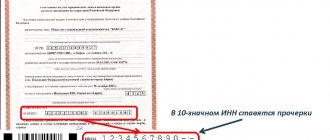

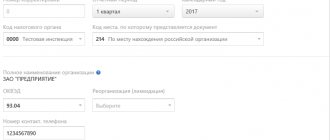

The calculation of insurance premiums in case of temporary illness and due to maternity is done in Section 1 of Appendix 2 of the calculation of insurance premiums. Its form was approved by order of the Federal Tax Service of Russia dated October 10, 2021 No. ММВ-7-11/551:

At the same time, filling out Section 1 of Appendix 2 involves entering indicators in lines 070, 080 and 090. This is the calculation of contributions taking into account the payment of insurance coverage, which raises the most questions in practice.

Explanations of the Tax Service of Russia dated August 23, 2021 No. BS-4-11/16751 remove a number of questions regarding filling out Appendix 2 of Section 1 of the RSV. And this is important, since Chapter 34 of the Tax Code of the Russian Federation does not cover this topic.

Data reporting period

Calculation line 090 does not indicate reimbursement data for expenses incurred before 2021. Information is presented only for the current calendar period. The final indicator is compiled from the data in boxes 060, 070, 080. Indicators are presented for the periods:

- From the beginning of the calendar year, accepted as the billing period.

- Last 3 months of the reporting period.

- Monthly for the last quarter of the period.

For example, when calculating the total data of window 090, the amounts of reimbursement of expenses of window 080 are used, received from the beginning of the reporting year, for the last 3 months with a monthly breakdown, but declared by the employer only in the billing period. Indemnities for earlier periods, despite the actual receipt to the policyholder's bank account, are not taken into account in the calculation.

Line 090

The indicators of line 090 of Appendix 2 to Section 1 represent the difference between the calculated contributions in the corresponding columns of line 060 of this Appendix and the costs incurred for the payment of insurance coverage in the corresponding columns of line 070 of Appendix 2 of Section 1 with an increase by the amount of expenses reimbursed by the FSS of Russia in accordance with the corresponding columns of line 080 .

Thus, we can derive the formula for line 090 of Appendix 2 to Section 1:

| LINE 090 = LINE 060 – LINE 070 + LINE 080 |

The Federal Tax Service explains that in line 090 the amount of contributions payable or the amount of excess of expenses incurred by the payer for the payment of insurance coverage over the calculated contributions is ALWAYS a positive figure. That is, the minus sign cannot be specified.

Another nuance concerns the payment attribute in Appendix 2 of Section 1. In line 090 it may have the following meaning:

| Sign | What does it mean | Condition |

| «1» | The amount of contributions to be transferred to the budget | The amount calculated using the above formula is ≥ 0 |

| «2» | The excess of expenses incurred by the payer for the payment of insurance coverage over the calculated contributions for illness and maternity | The amount calculated using the above formula is |

Also see “Control ratios for calculating insurance premiums (DAM) for 2017.”

Common mistakes when generating data

In the process of generating line 090 indicator data, inaccuracies are sometimes allowed. The total indicator may be incorrect due to incorrectly entered data on lines 060, 070, 080.

| Error | Correction procedure |

| The sum of the windows 060, 070 or 080 is indicated incorrectly | Generate correct indicators, submit updated calculations |

| Entering into the report information about the amounts compensated by the Social Insurance Fund for the previous tax period | Indicators not related to the period must be excluded from the calculation and updated data must be provided |

| The employer's expenses for the first 3 days of incapacity for work are included, paid at the expense of the company's funds | When the employer's expenses are included in the calculation, an underestimation of the amount of current contribution payments occurs, which the Federal Tax Service can detect during a desk audit. The amount of expenses of the first 3 days must be excluded from the calculation when submitting an adjustment |

In some cases, the error is identified by the taxpayer. If an error is detected by the Federal Tax Service, the company notifies the tax authority about the discrepancy in the data. The organization is obliged to provide updated data within 5 days after the Federal Tax Service Inspectorate sends a notification for an electronic reporting form or 10 days for calculations submitted on paper. If the deadlines for submitting clarifications are met, the date of submission of the calculation is considered to be the day of submission of the primary document.

Pilot project and line 070

The Russian Tax Service also focuses on the fact that in the regions participating in the pilot project of the Federal Social Insurance Fund of Russia, contribution payers do not fill out line 070 of Appendix No. 2 of Section 1 of the calculation of contributions.

Let us recall that, as part of the pilot project, the Social Insurance Fund pays social benefits directly from its budget without the participation of employers on the basis of Decree of the Government of the Russian Federation dated April 21, 2011 No. 294 “On the specifics of financial support, assignment and payment in 2012 - 2021 by the territorial bodies of the Social Insurance Fund of the Russian Federation”. Federation provides insurance coverage to insured persons for compulsory social insurance in case of temporary disability and in connection with maternity...".

Also see “FSS pilot project in 2021: which regions are included.”

Read also

20.09.2017

Adjusting indicators when an error is detected

When submitting an updated calculation, the presence of errors in section 3 is taken into account. Data on the movement of contributions is composed of the amounts of each employee, so the reason for erroneous data may be in personal indicators. If incorrect data is not included in the employee information, Section 3 will not be submitted. The remaining sections, even if there are no errors, are submitted in the adjusted calculation.

The adjustment number is entered in an incremental manner, taking into account previously submitted clarifications. Submission of updated data is carried out at the place of registration of the enterprise.

The determination of the territorial body for submitting the calculation is indicated in the letter of the Federal Tax Service dated August 17, 2017 No. ZN-4-11/ [email protected]

If a separate structure of the organization has changed its location during the billing period, having registered the change of address in the prescribed manner, the calculation is submitted at the new location. There is no need to confirm the data; information about changes in data is transmitted by the territorial offices of the Federal Tax Service. The calculation indicates a new checkpoint assigned by the Federal Tax Service to a separate division.

Acting State Advisor of the Russian Federation, 2nd class N.S. Zavilova.

Example of indicator calculation

When calculating, data on payments to employees, the base received, accrued contributions, and benefits provided are used.

The company Smena LLC was registered in March 2021. In March, the company made contributions to VNiM in the amount of 8,600 rubles, expenses amounted to 2,450 rubles. In the reporting period for the 1st quarter of Smena LLC, data on the movement of contributions is indicated by the lines:

- 060 – 8,600 rubles;

- 070 – 2,450 rubles;

- There is no value in line 080.

- In 090, the difference between data 060 and 070 is 6,150 rubles.

Window indicator 090 is set to “1”, confirming the amount calculated for payment. The amount is transferred to section 1 of the calculation.

Answers to frequently asked questions

Question No. 1: Is it possible not to include information about the sole director (founder) in section 3 of the primary (zero) calculation of the investment fund?

It is forbidden. The sole founder (director) is included in the number of insured citizens. A section is being drawn up on it. 3, even if his earnings were not accrued.

If there were no payments in a particular period, a zero calculation of SV with zero indicators is submitted. Thus, the obligated person confirms that there were no taxable payments or remuneration in a specific period. Accordingly, there are no amounts for general mandatory contributions.

Question No. 2: What to do if an employee does not have SNILS? In this situation, is it possible to submit the SV calculation without it?

No, because a personal account in SSOPS (SNILS) is a mandatory element of personalized section 3. Therefore, if it is absent or indicated inaccurately, the Federal Tax Service will not accept the calculation. The employer should send such an employee to the pension fund branch at the place of residence for SNILS. Alternatively, the employee can apply there independently.

What expenses does the Social Security Fund reimburse and how to get the money?

Before we tell you how to reflect compensation from the Social Insurance Fund in 2020 in the RSV, let us remind you: payers have the right to reduce social insurance contributions by the amount of expenses in the form of payment of the following benefits:

- on disability;

- for pregnancy and childbirth;

- for child care;

- in connection with the birth of a child;

- for burial.

If the amount of payments exceeds the amount of accrued social contributions, the organization has the right to apply for compensation to the Social Insurance Fund. This situation is possible if an employee goes on maternity leave in a company whose number of employees is small. In large companies, the cost of paying benefits exceeds the amount of assessed contributions in those months when amounts are paid for a large number of sick leaves.

To receive the excess payments for social insurance benefits over contributions, you must submit to the territorial office of the Social Insurance Fund:

- statement;

- sample of filling out the FSS calculation certificate for 2021 with a transcript;

- documents confirming the payment of benefits (for example, sick leave, calculation of payments for it, a copy of the work record book or employment contract).

The forms of application, certificate of calculation and breakdown of expenses are established by Letter of the Social Insurance Fund dated December 7, 2016 No. 02-09-11/04-03-27029. After submitting all documents within 10 days, the Fund will make a decision on compensation of costs and transfer funds to the company’s account. If the Fund has questions about reimbursed benefits, the review period is extended to allow for a desk or on-site review.

But it’s not enough to receive compensation, use the algorithm to fill out the calculation of insurance premiums for 2021 with compensation from the Social Insurance Fund, and report correctly so that the inspectors don’t have any questions.

An example of filling out line 030 of the calculation of insurance premiums in Appendix 1 to Section 1

The form for calculating insurance premiums (reporting according to KND 1151111) was approved by order of the Federal Tax Service of the Russian Federation dated October 10, 2016 No. ММВ-7-11/551. It reveals the procedure for completing settlements for all policyholders. The calculation contains three sections. Section 1 (Appendices 1 and 2) and Section 3 are required to be completed by all fee payers. Section 2 is intended for heads and members of farms (peasants). Section 1 of Appendix 1 shows the calculation of the amounts of insurance contributions for compulsory pension and health insurance.

Line 030 of the calculation of insurance premiums in Appendix 1 reflects the income received by employees over the last three months and since the beginning of the year (Article 420 of the Tax Code of the Russian Federation). Let's look at the contents of line 030 of the calculation of insurance premiums using the example of filling out reports for 9 months of 2018.

Taiga LLC paid its full-time employees the following salaries:

- for July - 110,785 rubles;

- for August - 109,352 rubles;

- for September - 110,875 rubles.

Financial assistance was also provided to an employee for the birth of a child in September in the amount of 20,000 rubles. and temporary disability benefits in July in the amount of 1,101 rubles. In addition to full-time employees, there are persons who provide services (perform work) under civil contracts. Their payments amounted to 15,850 rubles. monthly this quarter. Accordingly, line 030 appendix 1 of subsections 1.1. and 1.2 contains the following data:

Don't know your rights? Subscribe to the People's Adviser newsletter. Free, minute to read, once a week.

- column 3 (for July) - 127,736 rubles;

- column 4 (for August) - 125,202 rubles;

- column 5 (for September) - 146,725 rubles;

- column 2 (for three months) - 399,663 rubles;

- Column 1 (for the billing period as a whole) = Column 2 + Column 1 of reporting for the half-year.