We recommend filling out a declaration in the online personal income tax service.

Ivanov Ivan Ivanovich bought an apartment in 2012 for 2,200,000 rubles. In 2013, he applied for a property deduction and returned 91,000 rubles of income tax for 2012, i.e. from the maximum possible deduction of 2,000,000 rubles. used 700,000 rubles (Line 140 + line 240 of sheet And the last submitted 3-NDFL) In 2014, Ivanov I.I. submits a 3-NDFL declaration to receive the balance of RUB 1,300,000. (Line 260 of sheet I from 3-NDFL with the last submitted 3-NDFL). Let's help Ivanov I.I. fill out the declaration.

Software installation

- Visit the official website of the Federal Tax Service https://www.nalog.ru

- Select the section “Individuals”

- Find the “Software” section, select “Declarations”

- Select the year for which you are submitting a declaration, then select “Installation program. EXE extension", download the program and run

When you launch the program, you will see a list of tabs to fill out on the left, let’s go in order.

What is 3-NDFL?

3-NDFL is a declaration of income of individuals. According to current legislation, if a citizen is engaged in individual entrepreneurship or receives income in addition to his main place of work, he must submit this document to the tax service.

In addition to the fact that the declaration document serves to legitimize income, it may be required to obtain a tax deduction for the purchase of real estate. It can be submitted either in person to the Federal Tax Service or electronically.

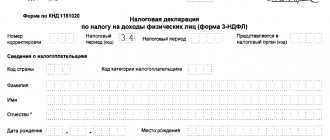

The personal income declaration consists of five pages:

- 1 page - information about the taxpayer is indicated, including full name, address and passport details;

- Page 2 - information about income and taxes is entered;

- Page 3 - calculation of the tax base;

- 4 page or sheet A - information about sources of income;

- Page 5 or sheet D1 - data on tax deductions for the purchase or construction of real estate.

3-NDFL is submitted until April 30 of the year following the one in which the property transactions were carried out. Let's say you purchased an apartment in September 2021 and want to get a refund for it. In this case, you need to declare income by April 30, 2020.

Income information

When working with the “Income received in the Russian Federation” tab, the most important thing is to carefully transfer into the program all the numbers and information specified in your 2-NFDL certificate.

How to do it:

- We check that income is taxed at a rate of 13%.

- Click the green “+” in “Payment Source”.

- In the window that appears, indicate the details of the employer who issued the certificate.

- Go below and fill out information about your income. A new entry is added using the “+” button. If your salary does not change by month, you can use the “Repeat Income” button (represents two pieces of paper). We copy all income figures and codes from the 2-NDFL certificate.

- If there are several certificates from different employers, we fill in the data for each of them separately, starting from point 2.

- At the bottom of the page in the “Total Amounts” the amount of total income received for the year is calculated automatically. You need to fill out the remaining three lines yourself. All the numbers are in the 2-NDFL certificate, you just need to rewrite them into the program. We calculate the total values for income received and taxes paid from several employers independently based on the amounts of all available 2-NDFL certificates for the year.

The completed page looks like this:

Object name code

Difficulties in filling out can begin literally from the first paragraph of sheet D1. Clause 1.1. (010) is listed as “Object name code” - what is it and what number should I put there? This indicates the type of real estate that was acquired by the taxpayer. Let's look at the possible code options:

- 1 - a citizen purchased a private house as an immovable property;

- 2 - a person bought an apartment;

- 3 - the buyer spent money on the purchase not of a whole object, but of a part of a house or, for example, a room in an apartment;

- 4 - the taxpayer is the owner of the immovable property by right of shared ownership;

- 5 - a plot of land was purchased for the construction of a private house;

- 6 - a citizen claims a tax deduction for the purchase of a land plot on which a building is already located;

- 7 - a tax refund is required both for the land and for building a house on it.

How to determine the value of a share in an apartment when selling

The optimal solution is to contact a specialized agency. The cost of services from such companies is usually low. No more than 3,000 - 5,000 rubles.

When choosing an organization, it is advisable to give preference to a large agency that has a license for this type of activity. A prerequisite is the conclusion of a contract with the organization. Preparation of documentation will take 3 – 5 days.

Important! Applying for an assessment will require the availability of all documents for the apartment. Therefore, it is necessary to contact a specialized company before contacting a real estate agency.

No specific order of use

The order of use means the existence of an agreement with the co-shareholder or a court decision on the use of the apartment. The measure can be applied to housing that is divided into shares. If the part corresponds to one of the rooms, then the citizen receives the right to use the specific room on a permanent basis, as well as common areas.

Often citizens do not have such a document, since it is impossible to determine the procedure for use in a one-room apartment. Therefore, the citizen will legally own the share, but will not be able to move into the premises.

With a specific procedure for use

If you have a document defining the procedure for using the object, it is easier to sell a part. Therefore, the cost of the share will be higher.

The presence of a document implies the possibility of free access to the apartment. This increases the priority of housing in the real estate market.

Type of ownership of the object

Let's move on to the next paragraph 1.2. (020), which is called “Type of ownership of the object”. Here the situation is a little simpler, since the declaration form itself indicates the decoding of the digital code:

| Code | Type of property | Explanation |

| 1 | Individual | To be completed in the case of sole ownership of a real estate property. Let's say the apartment was received under a purchase and sale agreement, and only one owner is indicated in the documents confirming the right of ownership. |

| 2 | Total share | Placed if the apartment or house has several owners, whose shares are determined. Most often, objects are transferred to shared ownership after privatization. In this case, each owner knows his share in square meters. |

| 3 | General joint | This option is also used when the property has several owners, but the difference with the previous form is that the owners’ shares are not determined. This option occurs mainly when spouses buy an apartment. |

| 4 | Property of a minor child | A citizen under the age of 18 cannot submit a declaration independently and receive a deduction for it. All procedures are carried out for him by his parents or legal guardians. |

Document verification

After filling in all the proposed fields, we start checking the correctness of the document.

At this stage, the program can find errors and typos: incorrect TIN indication, date discrepancies, etc. If they are absent, the program will report the successful completion of the scan. Now let's see what the final document will look like when printed. To do this, click on “View”.

On the 2nd page of the document that appears there will be a decree indicating the amount that will actually be returned to the applicant this year, on the 6th - the balance that will carry over to the next period. It will need to be indicated when filling out the declaration next year.

Taxpayer attribute

Clause 1.3. (030) is called “Taxpayer Attribute” and characterizes the person who submits the application to the tax authority. According to the law, an application for a tax refund can be submitted not only by the owner of the apartment. Let's figure out who it could be and what code needs to be specified:

- 01 - this code must be indicated if the application is submitted directly by the owner of the purchased residential premises;

- 02 - value is entered if the declaration is provided by the owner’s spouse;

- 03 - numbers for parents of a minor owner;

- 13 - if the taxpayer purchased an apartment in common shared ownership for himself and his minor child;

- 23 - if the taxpayer acquired real estate in the shared ownership of a spouse and a minor child.

Based on the above codes, we can conclude that if a person bought an apartment for himself and is its sole owner, then in column 010 he indicates the number 2, in column 020 - the number 1, and in column 030 - the number 01.

Another option is the husband and the wife purchased a house in common shared ownership, the application is submitted by the wife personally for herself. In this case, in paragraph 010 she indicates the number 4, in paragraph 020 - the number 2, and in paragraph 030 - 01.

In addition to the above codes, the declaration must indicate complete information about the purchased real estate. Firstly, the full address is entered there. Secondly, the date of registration of ownership of the apartment or house. Thirdly, the amount paid for the purchase or construction of a house. If the property was taken out on a mortgage or loan, then the interest on the loan is indicated. Next, the tax deduction is calculated and the amount that must be returned to the taxpayer is indicated.

It depends on the correctly completed declaration whether a tax deduction will be made or not. Errors and corrections are not allowed. If, after a detailed analysis, a person applying for a deduction still has doubts about what to enter in this or that column, then the most reasonable option would be to contact a tax consultant who can help with filling out the declaration.

Sale of a share without valuation

Determining the cost of an apartment as a whole is not difficult. There are several ways.

| No. | Way |

| 1 | Contacting a specialized organization |

| 2 | Analysis of similar offers on the market |

Moreover, the value can be set by the owner on his initiative. The only limitation is the need to sell the property for at least 0.7 of the cadastral value. Otherwise, you must pay increased tax.

Expert opinion

Stanislav Evseev

Lawyer. Experience 12 years. Specialization: civil, family, inheritance law.

The situation with shares is more complicated. As practice shows, most owners, when putting part of their housing up for sale to third parties, determine the cost based on the total price of the apartment. For example, a citizen sells 1/3 share in an apartment worth 3,000,000 rubles. He sets the price at RUB 1,000,000.

This part is called ideal. It is almost impossible to receive it when selling an apartment not in full, but in shares.

Realtors recommend setting the price 20–30% below the ideal share. But even in this case, a quick sale is not guaranteed.

In [current_date format='Y'] year, the real estate market is oversaturated with offers for the sale of shares in an apartment. It is popular, and the main reason for the excess supply is the unreasonably inflated price.

As a rule, inflated pricing is formed by real estate agencies. When visiting an organization, the specialist immediately directs the seller to the maximum cost.

However, this price is not guaranteed. The property remains unsold for 6 – 12 months. After which the agency offers to significantly reduce the cost. The owner, wanting to sell part of the property, agrees.

In order not to waste time on useless waiting, you can evaluate the share yourself. Let's look at how to do this.

An example of filling out a Declaration for Deduction for an Apartment Joint Ownership 2021

Deduction for the purchase of housing in shared or joint ownership. A taxpayer can receive a property deduction when purchasing housing or its construction in accordance with paragraph 2 of paragraph 1 of Article 220 of the Tax Code of the Russian Federation, in the amount of expenses actually incurred.

From January 1, 2014 From January 1, 2014, a tax deduction is provided in the amount of expenses actually incurred by the taxpayer for new construction or the acquisition in the territory of the Russian Federation of one or more objects of property specified in paragraphs. 3 p. 1 art. 220 of the Tax Code of the Russian Federation, not exceeding 2,000,000 rubles (clause 1, paragraph.

3 tbsp. 220 of the Tax Code of the Russian Federation). Moreover, since 2014, from Art.

If one of the spouses takes advantage of the right to deduction, but the second does not do so for some reason, the latter retains his right to return the tax in the future for subsequent home purchases. Example. Peter and Svetlana, being married, decided to purchase a residential building for 2,100,000 rubles.

Submitting 3-NDFL when selling real estate

It is important to immediately mention that the general order of the Federal Tax Service No. ММВ-7-11/671 does not regulate the filling out procedure for citizens of retirement age. By law, they are required to draw up a declaration and subsequently submit it in general form (when a pensioner is considered the owner of a specific property for less than 3 years).

The Tax Code allows you to reduce the amount of tax deducted (in some cases completely eliminates it) using a tax deduction. However, the return is submitted even if the full amount of the fee has been covered. All information is strictly reflected in the reporting documentation.

New declaration for personal income tax compensation when purchasing an apartment

Appendix 7 contains data on the purchased property - cadastral number and date of registration of ownership of the apartment. Line 080 records the amount of costs that the applicant can reimburse for the completed transaction.

In the example, this amount is equal to the deduction balance of RUB 1,020,000. Columns 140 and 150 indicate the amount of compensation that the applicant can submit based on the results of 2021 - this amount is limited by the amount of annual income (RUB 818,900).

The balance of the unused deduction, carried over to the next year, is indicated in line 170 (RUB 201,100).

The balance of the benefit as of 2021 was RUB 1,020,000. (2,000,000 – 980,000). The use of the deduction is limited not only by legal limits, but also by the income of the property owner in the reporting period in question.

In 2021, the applicant received a salary in the amount of 818,900 rubles, on which tax was paid in the amount of 106,457 rubles. (818,900 x 13%), other types of deductions were not applied. That is, the 3-NDFL declaration for the purchase of a second apartment (new form), filed in 2021.

, will contain a deduction amount equal to 818,900 rubles, and she will receive 106,457 rubles in her hands.

We recommend reading: Photo size for student ID

Property tax declaration 2021: step-by-step instructions and sample filling

Lines 020-130 - indicate the cost of the investment in column 3 as of the reporting date (the beginning of each month). The information must correspond to accounting data. If the company has the right to benefits (preferential assets), then they should be registered in the appropriate lines of column 4.

We fill in the cost according to the cadastre, and if there are benefits, we record the information in the appropriate reporting lines. Then indicate the bet size. Finally, we enter the total amount of the obligation calculated for the entire calendar year. Below we indicate the amount of advance payments already transferred to the budget during the year.

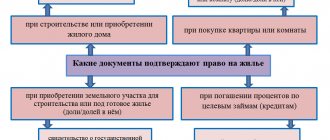

The process of filling out 3-NDFL for 2021 when purchasing an apartment

There are many different nuances that depend on the social status of the buyer and seller. For example, it matters who buys housing and from whom. After all, a property-type deduction will not be available if you purchase a home from a close relative.

- Agreement on the purchase of housing in various forms (purchase or sale, etc.).

- Documents about payments made - checks.

- Ownership of real estate is a certificate of state registration.

- Agreement on the transfer or acceptance of housing.

- Statement of proper distribution between husband and wife.

- Mortgage agreement and certificate of interest that was paid.

Sample of filling out a declaration for an apartment

Description of the example: Ivanov I.I. sold to Petrov A.A. apartment for 2,000,000 rubles. which I owned for less than three years. Ivanov I.I. There are documents confirming the costs of purchasing this apartment in the amount of 2,500,000 rubles. Accordingly, he will be able to reduce taxable income from the sale of an apartment by this amount, and he will not have to pay tax.

Officially employed citizens of the Russian Federation in accordance with clause 1 of Art. 220 of the Tax Code of the Russian Federation have the right to receive a property deduction.

That is, by receiving official income taxed at a rate of 13%, they can return part of the funds spent on the purchase of residential real estate.

But in order to do this, it is very important to find out how to fill out the 3-NDFL declaration when buying an apartment. You also need to familiarize yourself with a number of conditions under which receiving funds is possible.

Filling out 3-NDFL in the program - Declaration - when applying for a deduction for the purchase of an apartment

Filling out an income tax return using special software is the second most popular way to prepare 3-NDFL to receive a tax deduction. Let us consider in detail how to fill out 3 personal income taxes in the “Declaration.2020” program when applying for a property deduction for expenses on purchasing an apartment or building a house.

Common shared ownership with a statement on the distribution of expenses

– this type of property is indicated when purchasing an apartment after 2014, when spouses want to distribute the deduction in a proportion different from the shares they own. As a rule, this happens if one of the spouses does not work and cannot receive his share of the deduction, or the income of the second spouse allows him to receive the deduction immediately.

How to fill out the 3-NDFL declaration to receive tax deductions, form and sample in 2021

This declaration is a generalized source of information about the amounts of income received, the tax withheld from this income, the amount of deductions, etc. And on its basis, in the presence of supporting documents, the tax authorities make a decision on granting a deduction and refunding money from the budget.

To submit a declaration in electronic form, an electronic signature issued by a specialized certification center is required. To submit a declaration through the “Taxpayer Personal Account” service, you must first obtain a password and access for the user of your personal account from the tax office at your place of residence.

The procedure for filling out an application for a tax deduction and a 3NFDL declaration

Russian legislation provides for the refund to an individual of part of the income tax paid. To get your money back, you must correctly fill out an application to the tax authority and a 3-NDFL declaration for a tax deduction for 2021, filled out according to the sample.

- donations to charitable organizations;

- payment for your own education or full-time education for a family member under a contract with an educational institution;

- payment for medical services received personally or by relatives, under a contract;

- additional payments for the funded part of the taxpayer’s pension;

- contributions to non-state pension provision for oneself, or family members, or close relatives.

Example of personal income tax declaration 3 for the second year for deduction for an apartment 2020

Reasons for filling out 3-NDFL again when buying an apartment No. Situation Explanation 1 The apartment cost less than 2 million rubles This means that the remaining deduction amount (Apartment prices MINUS 2 million rubles) automatically transferred to indefinite future tax periods. When you purchase your next home, you can use the remainder of this deduction.

For a tax refund when buying a home and a mortgage. Sample (example) of filling out a declaration for a tax refund (property deduction) when buying or constructing a home, for example, when buying an apartment, and paying interest on a mortgage (payment of mortgage interest) in PDF format.

Online magazine for accountants

E2 Expenses or losses on transactions with securities/derivative financial instruments, including on an individual investment account Articles 214.1, 214.3, 214.4, 214.9 of the Tax Code of the Russian Federation Subclause 11.3 of Sheet 3 Expenses of participation in investment partnerships Articles 214.5 and 220.1 of the Tax Code of the Russian Federation Clause 7.3 of Sheet I Professional deductions and some others Article 221 and sub. 1 and 2 paragraphs 1 art. 220 of the Tax Code of the Russian Federation Subparagraph 3.2 of Sheet VPparagraph 4 of Sheet D2Subparagraph 8.1 of Sheet G Property deduction for expenses for new construction or acquisition of an object, provided in the reporting period by a tax agent (employer) on the basis of a notification from the Federal Tax Service Article 220 of the Tax Code of the Russian Federation Subparagraph 2.5 of Sheet D1 Property deduction for expenses for the payment of interest on: • targeted loans/credits from credit and other organizations of the Russian Federation; • loans for refinancing (on-lending) of loans/loans for new construction or acquisition of an object.

- We check the total amount of income with the information specified in the 2-NDFL certificate;

- We check the taxable amount of income with the information specified in the 2-NDFL certificate;

- We check the calculated tax amount with the information specified in the 2-NDFL certificate;

- We check the withheld tax amount with the information specified in the 2-NDFL certificate;

- Section “Deductions” Now let’s move on to the most interesting part – the “Deductions” tab. Input is carried out on four tabs intended for:

- standard tax deductions (sheet G);

- social tax deductions (sheet G2 and G3);

- property tax deductions (sheet I);

- reflection of losses on transactions with securities.

Download the program Declaration 2021

The program is distributed free of charge, you can download it from the tax service website. The downloaded file is installed on the computer in a traditional way in a few minutes. Next, you need to open the program and make sure that it was prepared on January 13, 2021, that is, adapted for submission in the current year 2021.

The program has several tabs that you can navigate between in the menu on the left. You should fill out the necessary tabs, save the entered information, check the correctness of the format, and then print a paper version or save it in xml format for submitting the completed 3-NDFL declaration through the taxpayer’s account.

Each sheet is signed by the taxpayer or his representative, depending on who submits the declaration to the Federal Tax Service.

At any time, you can see what 3-NDFL looks like when completed by clicking on the “View” button in the top menu of the program.

.

The declaration is formed according to a new form approved for 2021 by Order No. ED-7-11 / [email protected] dated 08/28/2020.

.

The new form features barcodes and a separate sheet for creating a tax refund application, which is very convenient. In addition, the procedure for filling out 3-NDFL for individual entrepreneurs is changing.

Document, information about which is needed on sheet D1

On page D1 in paragraph 1.7, you must indicate the date the taxpayer received the right to ownership of the property, the deduction for which is claimed in this 3-NDFL form.

Without this document, the process of calculating property compensation cannot be carried out. At this point, the individual must put in the first two cells the day he received the right to own the property, after the dot in the other two cells - the month, and after another dot - the year, for which as many as four cells are allocated.

For example, if a taxpayer purchased real estate with the help of a loan and began paying interest on it even before the completion of the stage of registration of such a document as ownership, then he can reimburse the tax on this expense. However, this can only be done after he receives a document certifying his right to own the property.

COOPERATION AND ADVERTISING ON THE SITE

In addition, a separate section of the 2-NDFL certificate indicates standard, social and property deductions received from the tax agent. You need to run the downloaded file, select a location for installation and follow the prompts. No special knowledge is needed; the “3-NDFL Declaration 2017” program installs it just like any other.

Welcome to Elena Kruzhilina, tax consultant. We will continue to fill out the 3-NDFL tax return in the free program “Declaration-2012”.

Deductions

The last section is used to claim deductions for children (“Standard”), medical treatment, education, charity, insurance (“Social”), home purchases and mortgage interest, and investment losses.

The tax report must be saved and printed in two copies using the “Save” and “Print” buttons:

The declaration must be submitted to the Federal Tax Service at the place of registration by May 3, and the tax must be paid by July 15, 2021. Along with the declaration, it is necessary to provide copies of documents confirming the completion of the real estate sale transaction, expenses incurred, as well as their originals for verification by a tax inspector.