In cases where the earned remuneration is not transferred to the employee’s bank card in a non-cash manner, but is issued at the cash desk, situations may always arise when the money is ready to be issued, but the person was unable to show up for it at the appointed time. The reasons may be different: absence due to illness, due to a business trip or due to other circumstances. What should a cashier or accountant do in such cases?

The legislation for this purpose provides for a procedure for depositing wages. Let's talk about how it should be carried out.

When, using the accrual method, should accounts payable for deposited wages be taken into account in income (clause 18 of article 250 and clause 1 of article 271 of the Tax Code of the Russian Federation)?

Where to store the deposited salary - in a bank or at a cash desk

If an organization has established a cash balance limit, then storing funds in the organization's cash desk in excess of the limit is not allowed. Within 5 days, starting from the due date for salary payment, there may be funds in the cash register that exceed the limit by the amount indicated on the payroll.

After this period, the cash register must remain within the approved limit, including deferred funds. If the limit is not exceeded, the money can be kept in the cash register; if it is exceeded, then the organization deposits the amount in excess of the limit to a current account.

Escrow money, taxes and fees

If finances for salary are received from a bank , personal income tax from them is transferred immediately upon receipt, on the same date (paragraph 1, paragraph 6, article 226 of the Tax Code of the Russian Federation), even before the salary sheet is opened for paying money to staff.

Proceeds in cash for payment of earned money allow personal income tax to be withheld when the money is given to workers (clause 4 of Article 226 of the Tax Code of the Russian Federation), and tax payments can be made on the day following the salary.

Contributions to various social insurance funds must be made regardless of the days of payment of salaries: for this, a mandatory period is provided, not exceeding the middle of the month following the salary period (Part 5, Article 15 of the Federal Law of July 24, 2009 No. 212-FZ). Depositing your salary does not affect these deadlines in any way.

How to deposit your salary correctly

Depositing funds differs from simple storage in the presence of an established procedure. The procedure is described in the Instructions of the Bank of Russia dated March 11, 2014 No. 3210-U and is as follows:

- On the last day of issuing money, the cashier makes an entry “deposited” in the payroll opposite the names of the employees who did not receive the money.

- After this, the cashier calculates the total amount of wages paid and deferred funds.

- In the final line of the payroll, the cashier indicates the amounts issued and deferred.

- The cashier checks the total amounts of paid and deposited salaries with the total amount on the payroll and signs if they agree.

- Next, the cashier passes the signed pay slip to his supervisor.

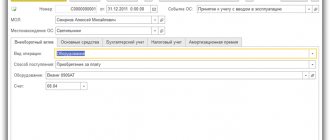

- The deposited wage amounts are recorded in the accounting entry Dt 70 Kt 76.04.

Only enterprises that issue wages to employees in cash through a cash register are faced with the deposit of funds intended for wages.

What to do with unclaimed wages?

The employee has three years to receive his deposited salary. The countdown begins from the next day after the date on which the company should have issued the salary. If the employee or his representative has not applied for a deposited salary within three years, the following actions must be taken.

In accounting, write off the amount as other income. To calculate the tax, include it in non-operating income. Prepare an inventory report, an accounting certificate and an order from the head of the organization to write off accounts payable.

Never miss a thing in payroll

“Accounting is a convenient program. Thanks to the developers. I have been working with Kontur for a long time. And it’s convenient to manage personnel; you’ll never miss anything in payroll. All reports reach the recipient on time. Everything is updated with the times. I really like it, everything is convenient. And when something is unclear, you can call - and they will always come to your aid. Thanks again to the developers."

Natalia Abbasova, accountant, senior Veshenskaya, Rostov region.

Deposit transactions

The following entries are used to account for funds:

- receiving cash for payment - Dt 50 Kt 51;

- issuing wages to employees - Dt 70 Kt 50;

- wages deposited (posting) - Dt 70 Kt 76.04;

- contribution to the current account of money in excess of the limit - Dt 51 Kt 50.

The final document for calculating wages can be considered a payroll, which indicates the amount of payments due to the employee minus the deductions made.

When paying for labor from the cash register, the payroll is handed over to the cashier, who determines whether there is enough cash to pay the salary and, if there is not enough, then orders the missing amount from the bank.

The entry for the deposit of wages (Dt 70 Kt 76.04) is made only in cases where the salary is paid in cash and is not received for a good reason. Failure to pay earned money through the fault of the employer is a violation of the law with mandatory payment of compensation for the delay.

There can be no escrow when transferring money from a checking account to an employee's bank account.

What is the point of depositing?

According to the law, the employer can choose the method of paying remuneration earned by employees:

- non-cash payments that do not require the personal presence of employees,

- cash payment according to the statement.

In the latter case, it is assumed that this occurs at the place of work, and non-working hours of the staff will not be spent on travel in order to receive the finances they deserve.

If the worker did not have time to go to the cashier, personally sign the statement and collect his money at the appointed time, and did not instruct anyone to do this in his place, the unissued salary must be deposited.

Depositing is an accounting reflection in the primary accounting documentation of salary amounts as not issued to the employee.

How to release deposited wages

The deferred money is issued immediately as soon as the employee applies for it. The appeal can be written or oral, its procedure is established in each organization.

Deposited wages were issued from the cash register, posting:

Dt 76.04 Kt 50.

If there is not enough money in the organization’s cash desk to give to employees, then the cashier orders it from the bank and receives it in cash at the cash desk:

Dt 50 Kt 51.

Where is salary deposit reflected?

According to the terms of paragraph 7, clause 18 of the Procedure for conducting cash transactions, the deposited amount must be entered into the register. It is drawn up by the cashier (according to subparagraph “b” of paragraph 18 of this Procedure).

There is no generally accepted form. The form under code 0504047 is often used. It is contained in the order of the Ministry of Finance of the Russian Federation dated September 23, 2005 No. 123n. The register includes the employee’s personnel number, full name, and deposited funds.

The register is completed after each payment when individual employees have not received the money.

However, Directive No. 3210-U does not require the registration of a register of deposited funds (as opposed to the Procedure for conducting cash transactions, which was in force before). And yet, on the initiative of the cashier, it is used in the organization and makes it possible to track every time which employee did not take the money.

Let us clarify that money must be paid once every half month. This condition is contained in Article 136 of the Labor Code of Russia.

In the register according to the form from order No. 123n there is no column for recording the number of the expenditure order. It is drawn up when the money previously deposited is paid out. This column exists in the book of analytical accounting of deposited salaries, allowances and scholarships. Its form under code 0504048 is also stipulated by the same order.

There they reflect information about the deposited salary during the year. There are 12 columns (according to the number of months) for recording the payment of deposited money. The place corresponding to the month of issue of the deposited salary is taken. If there are still unpaid funds after the end of the year, such information is transferred to a new ledger.

This book starts for a year. There, each employee is assigned his own line. It contains the personnel number, full name, and deposited funds.

In the columns “Attributed to the account of depositors” the year, as well as the month of formation of the deposited debt, the data of the statements and the deposited money are recorded. In the “Paid” columns, opposite information about the person, enter the details of the expense order and the money issued for a specific month.

Are small businesses required to deposit wages?

According to clause 2 of Bank of Russia Directive No. 3210-U dated March 11, 2014, individual entrepreneurs and small businesses may not set a cash limit.

Consequently, they are not obliged to hand over unpaid wages to the bank, but can keep them in the cash register. However, if there is unpaid remuneration under the employment contract on time, the deposit posting must be completed. Failure to pay wages within the terms established by the employment contract entails liability for the employer, including criminal liability. If the payroll is not marked with o and the entry Dt 70 Kt 76.04 is not made, upon inspection this will be classified as a delay in payment of labor due to the fault of the employer, and the head of the company will be held accountable and will pay a fine.

How to generate income tax?

The procedure for writing off amounts of deposited salary in tax accounting depends on the method by which the company calculates income tax.

- With the accrual method, the deposited salary is included in expenses in the same month when it was accrued.

- With the cash method, the amount of the deposited salary is included in expenses only at the time of its payment. Then, in the month the salary is accrued, a deductible temporary difference arises and a deferred tax asset is created, which will be written off after the salary is issued.

Today, most companies have salary project agreements with banks with the transfer of money to employee cards, and salary deposit transactions rarely occur.

Kontur.Accounting is a web service in which you can easily conduct accounting, calculate salaries (and arrange salary deposits), and submit reports. Get to know the service's capabilities for free for 14 days!

Try for free

Drawing up a register of deposited amounts

If there is an unclaimed balance on the statement, the cashier makes an entry opposite the recipient's last name in the place where the signature “deposited” was entered. At the end of the payment statement, the amounts actually paid to employees and subject to deposit are indicated. Based on the transaction performed, the cashier must draw up a register of deposited amounts or make an entry in a previously opened document.

The register indicates:

- Enterprise data used in internal circulation.

- Date of document creation.

- The issuance period for which the balance of uncollected funds arose.

- Number and date of the statement on which the payment was made.

- Information about the employee - position, full name, personnel number.

- Amount deposited.

- The resulting total for the registry.

- Information about the cashier who performed the transaction.

- Information about the cash settlement service for which the depositor is issued.

The register is signed by an official of the cash register and certified by the chief accountant. Based on the register data, an expenditure cash order is drawn up for the issuance of funds from the cash register.

There is currently no requirement to compile a register, but businesses continue to use the form to simplify accounting and control over deposited amounts. If there is no register in the document flow, the data is recorded in the accounting book. The journal calculates the debit and credit balances at the end of the month.

Accounting

When depositing amounts of wages, the company forms an account payable to the employee.

Accounting for amounts of deposited wages:

- During the storage period, accounting of amounts not received is kept on accounting account 76-4.

- After the end of the three-year period, the amount is transferred to 91 accounts.

- Accounting is maintained in the appropriate cash register, which indicates:

- Cash expense registration number and amount of deposited wages;

- Date of occurrence of accounts payable to the employee.

The register is opened for one calendar year , and the balances at the end of the reporting year are reflected in the balance column at the beginning of the year in the new cash register of the depositor for the next year.

In the balance sheet, deposited debt should be reflected in the line payables, and not payables to other counterparties.

It is worth noting that accounting for wages under employment agreements is also reflected in account 76, and the accountant needs to carefully monitor the separate maintenance of this wages and deposited amounts, since these expense items are reflected differently in the balance sheet.

Special cases

The employer is required to pay the deposit upon the employee's first application. If the requirement is not met and the employer delays payment or refuses payment, the employee has the right to seek legal assistance from the labor inspectorate or the judicial authorities for administrative proceedings.

The manager should pay special attention to the accounting of the deposit and strictly control its issuance. If these requirements are unlawfully fulfilled, the authorities monitoring the activities of enterprises may bring the organization to administrative liability.

How to deposit a fired employee's salary

You cannot write off the deposited salary of a fired person before the statute of limitations expires. In this case, the standard 3 years work (Article 196 of the Civil Code).

The limitation period from Art. 392 of the Labor Code is not relevant if a person did not come for payment upon dismissal and did not provide information about an account with a credit institution for the transfer of funds.

The limitation period starts from the day the salary is deposited - that is, from the day that follows the day of dismissal of the employee if he is absent on the day of dismissal (under the terms of Part 1 of Article 140 of the Labor Code of the Russian Federation).

If neither the employee himself nor his authorized representative has requested a deposited salary within 3 years, for tax purposes it must be included in non-operating income (according to clause 18 of Article 250 of the Tax Code of the Russian Federation).

In the financial statements, debt is written off in the debit of account 76 “Settlements with various debtors and creditors”, subaccount “Settlements on deposited amounts” and in the credit of account 91 “Other income and expenses”, subaccount “Other income”.