In what currency can residents make payments?

Let's turn to Art. 140 of the Civil Code of the Russian Federation (hereinafter referred to as the Civil Code of the Russian Federation). According to the general rule established therein, all payments and settlements in Russia can be made in 2 ways:

- cash, in which the only acceptable means of payment are coins and banknotes of the Bank of Russia (Article 29 of the Law “On the Central Bank of the Russian Federation” dated July 10, 2002 No. 86-FZ, hereinafter referred to as Law No. 86-FZ);

- non-cash.

In both cases, the legislator designated the ruble as the main legal tender. All monetary obligations are expressed in rubles (Part 1, Article 317 of the Civil Code of the Russian Federation).

It is permissible to set the payment amount in foreign currency (FC), if in fact the settlement will be in rubles. Conversion into rubles by default occurs based on the official exchange rate valid on the day of payment (a different procedure can be agreed upon in the contract).

In addition, within a very narrow framework established by law, it is permissible to carry out settlements for obligations on the territory of the Russian Federation using IW, as well as payment documents in IW.

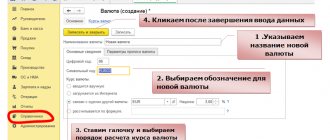

Introductory information

Let’s make a reservation right away: the algorithm below for reflecting exchange rate differences in tax accounting applies to supplies dated 2015 and later periods.

Previously, different rules were in force, according to which, for “foreign exchange” supplies paid in rubles, accountants showed in tax accounting not exchange rate, but amount differences (see “Starting 2015, tax and accounting rules will be brought closer to each other”). We would like to add that the amount differences on transactions concluded before 2015 must be reflected according to the previous rules. Accounting for exchange rate differences by the supplier depends on the moment at which the buyer paid for the delivery. Let's take a closer look at three possible options.

General procedure for non-cash currency payments

The specified procedure is defined in Art. 14 of the Law “On Currency Regulation...” dated December 10, 2003 No. 173-FZ (hereinafter referred to as Law No. 173-FZ). Residents have the right to make payments on their bank accounts in any foreign currency. It does not matter in what currency the bank account was opened - if the need arises, a conversion operation will be carried out at the rate of the corresponding bank.

For individuals, the procedure for making non-cash payments in the Internet is similar to the procedure for legal entities.

A number of by-laws establish features:

- purchases of foreign currency by legal entities and entrepreneurs (instruction of the Bank of Russia dated June 4, 2012 No. 138-I);

- payment in currency of the authorized capital of a credit organization (clause 4.3 of the Bank of Russia instructions dated 04/02/2010 No. 135-I).

The procedure for non-cash payments in foreign currency between residents

Residents can open foreign currency accounts in authorized banks of the Russian Federation without any restrictions. However, currency transactions between residents of paragraph 1 of Art. 9 of Law No. 173-FZ prohibits. But there are still a number of concessions regarding non-cash payments between them. These are the operations:

- on transfers of investment money and currency of the Russian Federation between residents’ accounts in banks located on the territory of the Russian Federation and abroad (subparagraphs “g” and “h”, paragraph 9, part 1, article 1 of Law No. 173-FZ);

- mandatory payments to budgets and settlements and transfers related to their execution;

- settlements and transfers of foreign currency for the purposes of carrying out the activities of diplomatic missions, consulates and other official representative offices of the Russian Federation, as well as those related to the maintenance of their employees;

- non-cash transfers between resident individuals from bank accounts outside the Russian Federation to Russian authorized banks;

- non-cash transfers between resident individuals who are also spouses or close relatives from bank accounts in the territory of the Russian Federation to banks outside its borders;

- settlements related to obtaining a commercial or bank loan from an authorized bank.

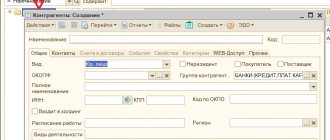

European Union supplier

The main reason for supplies from European countries is the proven quality of the product. But due to difficulties encountered in passing customs control of goods from the EU and sanctions, additional costs arose for the participation of intermediaries at various stages of clearance and transportation.

This leads to the fact that direct supplies from Europe for Russian companies become not only unprofitable, but also unprofitable.

The main problem that arises when arranging supplies from the EU is the collection and execution of all the necessary documents, of which there are 30 items, they must be translated into Russian, both technical and commercial. They will need to be submitted to the customs department along with a declaration of conformity.

One of the features of supplies of European goods compared to similar ones from Asia and the Middle East is inflated customs cost indices.

Thus, you need to remember that products of popular brands or technical developments may be registered as “intellectual property” when registering. And this will add additional documents, a license agreement, a receipt for payment of the license fee. This affects cargo from Europe. Among the countries of Asia and the Middle East, such a clause is rarely included in the declaration.

Payment under the contract to a foreign counterparty occurs in euros. To open a foreign currency account and transfer funds, you will need additional certificates from the bank and an explanation of the reason.

In case of errors in documents, a suspicious product or a discrepancy between the nomenclature and the actual one, customs has the right to detain the cargo until clarification.

The procedure for cash payments in national and foreign currencies in the Russian Federation

Special rules apply to individuals: they have the right to carry out the activities listed in paragraph 3 of Art. 14 of Law No. 173-FZ currency transactions in cash (for example, donating currency to a spouse or transferring it under a will, purchasing coins for a collection by numismatists, etc.).

The rules by which cash payments are made on the territory of the Russian Federation, both in the national and in the IW, are established by the instruction of the Bank of Russia “On making cash payments” dated October 7, 2013 No. 3073-U (hereinafter referred to as instruction No. 3073-U). They apply to individuals and a number of exceptional cases when a legal entity or entrepreneur has the right to spend cash in foreign currency (clause 2 of instruction No. 3073-U).

Clause 5 of Directive No. 3073-U allows for cash payments in national and foreign currencies between settlement participants and individuals in any amounts. But in the next paragraph, paragraph 6, limits are still established. They extend their effect to cash payments in the above-mentioned currencies made by legal entities and individual entrepreneurs, and are expressed in limiting the size of the amount - no more than 100,000 rubles. (for foreign currency - the equivalent amount at the Central Bank exchange rate on the date of cash payments). This is the so-called cash payment limit.

It works:

- for such calculations that are made within the framework of 1 agreement;

- fulfillment of civil obligations stipulated by the agreement that was concluded between the participants in cash payments and arising from it;

- issuance of cash by a credit institution, when such issuance is made upon request for the return of the balance of funds transferred to a special account with the Bank of Russia.

There are no exceptions in this case either. About them - in the last paragraph of paragraph 6 of instruction No. 3073-U.

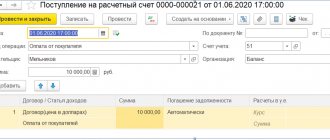

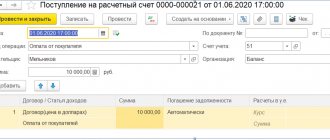

Postings to account “60.21”

By debit

| Debit | Credit | Content | Document |

| 60.21 | 52 | Transfer of funds from an organization’s foreign currency account to pay off debt to a foreign supplier under an agreement in foreign currency | Debiting from current account |

| 60.21 | 55.21 | Transfer of funds from a special account of the organization (letter of credit) to repay debt to a foreign supplier under an agreement in foreign currency | Debiting from current account |

| 60.21 | 55.24 | Transfer of funds from special bank accounts (except for letters of credit, check books, deposit accounts) to repay debt to a foreign supplier under an agreement in foreign currency | Debiting from current account |

| 60.21 | 60.21 | Transferring the amount of debt to the supplier from one contract in foreign currency to another contract in foreign currency | Debt adjustment |

| 60.21 | 62.21 | Offsetting the amount of debt of the supplier and buyer under contracts in foreign currency | Debt adjustment |

| 60.21 | 91.01 | Write-off of the amount of debt to the supplier due to the expiration of the limitation period under the contract in foreign currency. Recognition of other income | Debt adjustment |

By loan

| Debit | Credit | Content | Document |

| 000 | 60.21 | Entering initial balances: settlements with suppliers and contractors in foreign currency | Entering balances |

| 07 | 60.21 | Acceptance for accounting of equipment requiring installation received from the supplier under a contract in foreign currency | Receipts (acts, invoices) |

| 08.01 | 60.21 | Reflection of debt to the supplier for the purchased land plot under the contract in foreign currency | Receipts (acts, invoices) |

| 08.01 | 60.21 | Inclusion in the price of a land plot of additional expenses (services of third-party organizations) under an agreement in foreign currency | Receipts (acts, invoices) |

| 08.03 | 60.21 | Reflection of debt to the supplier for the purchased construction project under the contract in foreign currency | Receipts (acts, invoices) |

| 08.03 | 60.21 | Inclusion in the cost of the construction project of additional expenses (services of third parties) under the contract in foreign currency | Receipts (acts, invoices) |

| 08.04 | 60.21 | Reflection of debt to the supplier for the purchased non-current asset (equipment) under the contract in foreign currency | Receipts (acts, invoices) |

| 08.04 | 60.21 | Inclusion in the cost of a non-current asset (equipment) of additional expenses (services of third parties) under a contract in foreign currency | Receipt of additional expenses |

| 08.05 | 60.21 | Reflection of debt to the supplier for the purchased intangible asset under the contract in foreign currency | Receipt of intangible assets |

| 08.08 | 60.21 | Reflection of debt to the supplier for completed research, development and technological work under the contract in foreign currency | Receipt of intangible assets |

| 10.01 | 60.21 | Receipt of raw materials and supplies from the supplier. Reflection of debt to the supplier under the contract in currency | Receipts (acts, invoices) |

| 10.01 | 60.21 | Receipt of raw materials and supplies from processing at planned cost. Reflection of debt to the supplier under the contract in currency | Receipt from processing |

| 10.01 | 60.21 | Inclusion in the cost of raw materials and materials of additional expenses (services of third-party organizations for transportation, storage, etc.) under the contract in c.u. | Receipt of additional expenses |

| 10.02 | 60.21 | Inclusion in the price of purchased semi-finished products, components, structures and parts of additional costs (services of third-party organizations for transportation, storage, etc.) under the contract in cu. | Receipt of additional expenses |

| 10.02 | 60.21 | Receipt of purchased semi-finished products, components, structures and parts from processing at the planned cost. Reflection of debt to the supplier under the contract in currency | Receipt from processing |

| 10.02 | 60.21 | Receipt of purchased semi-finished products, components, structures and parts from the supplier. Reflection of debt to the supplier under the contract in currency | Receipts (acts, invoices) |

| 10.03 | 60.21 | Inclusion in the price of fuel of additional expenses (services of third-party organizations for transportation, storage, etc.) under the contract in c.u. | Receipt of additional expenses |

| 10.03 | 60.21 | Receipt of fuel from refining at planned cost. Reflection of debt to the supplier under the contract in currency | Receipt from processing |

| 10.03 | 60.21 | Receipt of fuel from the supplier. Reflection of debt to the supplier under the contract in currency | Receipts (acts, invoices) |

| 10.04 | 60.21 | Receipt of reusable collateral packaging and packaging materials from the supplier in organizations engaged in production activities or provision of services. Reflection of debt to the supplier under the contract in currency | Receipts (acts, invoices) |

| 10.04 | 60.21 | Inclusion in the price of reusable collateral containers and packaging materials of additional expenses (services of third-party organizations for transportation, storage, etc.) under the contract in c.u. in organizations engaged in production activities or provision of services | Receipt of additional expenses |

| 10.04 | 60.21 | Receipt of reusable collateral packaging and packaging materials from processing in organizations engaged in production activities or provision of services. Reflection of debt to the supplier under the contract in currency | Receipt from processing |

| 10.05 | 60.21 | Receipt of spare parts from processing at planned cost. Reflection of debt to the supplier under the contract in currency | Receipt from processing |

| 10.05 | 60.21 | Receipt of spare parts from the supplier. Reflection of debt to the supplier under the contract in currency | Receipts (acts, invoices) |

| 10.05 | 60.21 | Inclusion in the cost of spare parts of additional expenses (third-party services for transportation, storage, etc.) under the contract in c.u. | Receipt of additional expenses |

| 10.06 | 60.21 | Receipt of other materials from processing at planned cost. Reflection of debt to the supplier under the contract in currency | Receipt from processing |

| 10.06 | 60.21 | Receipt of other materials from the supplier. Reflection of debt to the supplier under the contract in currency | Receipts (acts, invoices) |

| 10.06 | 60.21 | Inclusion in the cost of other materials of additional expenses (third-party services for transportation, storage, etc.) under the contract in c.u. | Receipt of additional expenses |

| 10.08 | 60.21 | Inclusion in the cost of building materials of additional expenses (services of third-party organizations for transportation, storage, etc.) under the contract in c.u. | Receipt of additional expenses |

| 10.08 | 60.21 | Receipt of construction materials from processing at planned cost. Reflection of debt to the supplier under the contract in currency | Receipt from processing |

| 10.08 | 60.21 | Receipt of construction materials from the supplier. Reflection of debt to the supplier under the contract in currency | Receipts (acts, invoices) |

| 10.09 | 60.21 | Receipt of construction materials from processing at planned cost. Reflection of debt to the supplier under the contract in currency | Receipt from processing |

| 10.09 | 60.21 | Receipt of construction materials from the supplier. Reflection of debt to the supplier under the contract in currency | Receipts (acts, invoices) |

| 10.09 | 60.21 | Inclusion in the cost of inventory and household supplies of additional expenses (services of third-party organizations for transportation, storage, etc.) under the contract in c.u. | Receipt of additional expenses |

| 10.10 | 60.21 | Inclusion in the price of special equipment and special clothing of additional expenses (services of third-party organizations for transportation, storage, etc.) under the contract in c.u. | Receipt of additional expenses |

| 10.10 | 60.21 | Receipt of special equipment and special clothing from the supplier. Reflection of debt to the supplier under the contract in currency | Receipts (acts, invoices) |

| 10.10 | 60.21 | Receipt of special equipment and special clothing from processing at the planned cost. Reflection of debt to the supplier under the contract in currency | Receipt from processing |

| 19.01 | 60.21 | Reflection of the amount of VAT on purchased fixed assets under the contract in currency | Receipts (acts, invoices) |

| 19.02 | 60.21 | Reflection of the amount of VAT on acquired intangible assets under the contract in foreign currency | Receipt of intangible assets |

| 19.03 | 60.21 | Reflection of the amount of VAT on purchased inventories (except containers), goods under the contract in foreign currency | Receipts (acts, invoices) |

| 19.04 | 60.21 | Reflection of the amount of VAT on work performed, services provided under a contract in foreign currency | Receipts (acts, invoices) |

| 19.08 | 60.21 | Reflection of the amount of VAT on purchased construction projects under a contract in foreign currency | Receipts (acts, invoices) |

| 20.01 | 60.21 | Inclusion of third party services into the costs of main production. Reflection of debt to the supplier for production services provided under the contract in foreign currency | Receipts (acts, invoices) |

| 20.01 | 60.21 | Reflection of debt to the supplier for rendered production services for processing under the contract in foreign currency | Receipt from processing |

| 23 | 60.21 | Inclusion of third-party services into auxiliary production costs. Reflection of debt to the supplier for production services provided under the contract in foreign currency | Receipts (acts, invoices) |

| 25 | 60.21 | Inclusion of third-party services into general production costs. Reflection of debt to the supplier for services rendered under the contract in foreign currency | Receipts (acts, invoices) |

| 26 | 60.21 | Inclusion of services from third parties in general business expenses. Reflection of debt to the supplier for services rendered under the contract in foreign currency | Receipts (acts, invoices) |

| 29 | 60.21 | Including the services of third-party organizations in the expenses of servicing industries and farms. Reflection of debt to the supplier for services rendered under the contract in foreign currency | Receipts (acts, invoices) |

| 41.01 | 60.21 | Inclusion in the price of goods of additional expenses (services of third-party organizations for transportation, storage, etc.) under the contract in c.u. | Receipt of additional expenses |

| 41.01 | 60.21 | Receipt of goods. Reflection of debt to the supplier under the contract in currency | Receipts (acts, invoices) |

| 41.02 | 60.21 | Inclusion in the price of goods of additional expenses (services of third-party organizations for transportation, storage, etc.) under the contract in c.u. (retail, accounting at acquisition cost) | Receipt of additional expenses |

| 41.02 | 60.21 | Receipt of goods at the retail outlet. Reflection of debt to the supplier under the contract in foreign currency (retail, accounting at acquisition cost) | Receipts (acts, invoices) |

| 41.04 | 60.21 | Inclusion in the price of purchased products of additional expenses (third-party services for transportation, storage, etc.) under the contract in c.u. | Receipt of additional expenses |

| 41.04 | 60.21 | Receipt of purchased products. Reflection of debt to the supplier under the contract in foreign currency | Receipts (acts, invoices) |

| 41.11 | 60.21 | Receipt of goods at the retail outlet. Reflection of debt to the supplier under the contract in foreign currency (retail, accounting at sales cost) | Receipts (acts, invoices) |

| 41.12 | 60.21 | Receipt of goods at a manual point of sale. Reflection of debt to the supplier under the contract in foreign currency (retail, accounting at sales cost) | Receipts (acts, invoices) |

| 44.01 | 60.21 | Inclusion of third-party services into distribution costs. Reflection of debt to the supplier for services rendered under the contract in foreign currency in organizations engaged in trading activities | Receipts (acts, invoices) |

| 44.02 | 60.21 | Attribution of third-party services to business expenses. Reflection of debt to the supplier for services rendered under the contract in foreign currency in organizations engaged in industrial and other production activities | Receipts (acts, invoices) |

| 50.23 | 60.21 | Receipt of monetary documents to the organization's cash desk from the supplier under an agreement in foreign currency | Receipt of cash documents |

| 60.21 | 60.21 | Transferring the amount of debt to the supplier from one contract in foreign currency to another contract in foreign currency | Debt adjustment |

| 76.22 | 60.21 | Reflection of the amount of the claim presented to the foreign supplier under the contract in foreign currency | Debt adjustment |

| 97.21 | 60.21 | Inclusion of the cost of services (values) into future expenses. Reflection of debt to the supplier under the contract in currency | Receipts (acts, invoices) |

Making payments in foreign currency abroad

The procedure for settlements through accounts opened outside the Russian Federation is stipulated by the legislator in Art. 12 of Law No. 173-FZ.

According to the general rule, paragraph 6 of Art. 12, without any restrictions, settlements can be made between residents (legal entities and individuals) with funds credited to their accounts in banks outside the Russian Federation. But there are still a number of exceptions. Their complete list is given in paragraph 1 of Art. 9 of Law No. 173-FZ.

At the same time, the legislator provided for a number of exceptions to the established ban. As for currency transactions between residents outside the Russian Federation, these exceptions are listed in clause 6.1 of Art. 12 of Law No. 173-FZ.

The resident must notify the territorial tax authority (at the place of his/her own registration) about all actions with the investment account on a bank account outside the Russian Federation (opening, closing, changing details).

Settlements between residents and non-residents in foreign currency: features and nuances of the procedure

Art. 6 of Law No. 173-FZ allows for currency transactions between residents and non-residents. However, not without some reservations. They are listed in Art. 11 of the said law, namely:

- Only specially authorized banks can carry out the procedure for the purchase and sale of investment money and checks (including traveler's checks) with the nominal value indicated in them, expressed in foreign currency.

- When buying and selling foreign currency in cash, as well as checks with an IW face value, the currency regulation authority (Central Bank of the Russian Federation) imposes special requirements on credit institutions regarding the preparation of documents (for example, see Article 20 of Law No. 173-FZ).

In addition, the separate rules by which cash payments are made in the currency of the Russian Federation and foreign currency between resident legal entities and non-residents are discussed in Part 2 of Art. 14 of Law No. 173-FZ.

Risks when buying an apartment on your own

Real estate purchase and sale transactions involving non-residents and foreigners have become a source of significant financial risks, along with the legal defects of the real estate itself. At the same time, both sellers of Russian real estate and buyers do not pay any attention to the danger posed by the seemingly “formal” stage of a real estate transaction – settlements under the contract. For violations of currency legislation when paying for an apartment in Russia, it ranges from 75 to 100% of the transaction amount. Moreover, depending on the specific circumstances, both parties to the transaction - both the seller and the buyer - may be subject to this fine.

Principle of repatriation

The special conditions regime applies when making payments by residents in the IV within the framework of foreign trade activities (Article 19 of Law No. 173-FZ). This is the so-called principle of repatriation, which imposes certain responsibilities on residents (Parts 1 and 1.1 of this article):

- ensuring receipt of currency (national and foreign) due in accordance with the terms of agreements and contracts;

- repatriation to the Russian Federation of funds paid by non-residents for goods, work, services and information that were never imported into the Russian Federation, fulfilled, transferred (failure to fulfill this condition even provides for liability under Article 193 of the Criminal Code of the Russian Federation).

VAT payment

If payment on an invoice concerns the supply of goods, provision of services or performance of work abroad, it is necessary to pay VAT to the budget of the Russian Federation. In this case, the money is not collected from the foreign partner, but from the resident of the Russian Federation - the money is withheld at the time of transfer according to the recipient’s details.

Moreover, the requirement applies to both individual entrepreneurs working on the simplified tax system and legal entities on the special tax system. Therefore, when making calculations, it should be taken into account that 18% is added to the amount specified in the contract or invoice to pay Russian taxes.

Legal entities on the OSN are allowed to reflect this expense item in the VAT return in order to subsequently return it from the country’s budget in the form of a tax deduction. Individual entrepreneurs operating at a rate of 15% (that is, income minus expenses) can record the amount in the “expenses” section to reduce the final tax amount. However, you should still prepare and submit a VAT return on time.