Transportation of cargo of all types by a third-party carrier is carried out in accordance with the contract and is subject to mandatory documentation. For this purpose, two forms are used: consignment note and delivery note. Both are used today, although since 2013 the TTN has been excluded from the list of mandatory documents for accounting for cargo transportation. The forms duplicate each other in many respects, but there are also differences. Is it possible to replace one form with another or should they be included in the package of transportation documents at the same time? What is the position of the regulatory authorities and how does it fit with the practice of accounting for cargo transportation?

Question: When selling furniture accessories (handles, pads, holders, etc.), the seller issued us a bill of lading and a delivery note in form N 1-T. He did not indicate the cost of the goods in the TTN. Can we accept such a TTN? View answer

What is TNN

This is accompanying documentation designed to monitor compliance with the rules for transporting goods and materials. Accordingly, the form is used in cases where these services exist in principle. That is, we are considering a situation where company A orders delivery from manufacturer B. If the delivery of products is carried out by company B, as an additional option, which is already included in value terms in the general price list, then we do not need the document. After all, no separate services were provided. Also, if company A itself picks up the product, loads it onto trucks and sends it to a warehouse or point of sale for receipt, there is no need for paper. After all, again no services were provided.

In what cases will we need it, and this aspect largely determines how TTN differs from TN. Namely, it is the presence of a third party providing transportation services. When this new variable appears in the equation, the document becomes necessary. But not necessary, because the order of the Ministry of Finance of 2013 actually abolished the mandatory nature of the order. Now it is quite possible to replace the document with a new analogue, which we will discuss separately below.

It should also be taken into account that the form must be filled out as the main document when transporting cargo by road. If valuables are sent via trains, ships, or planes, then there is no reason to fill it out. Therefore, in the case of the standard version, it is necessary to register this option using trucks.

When is it issued?

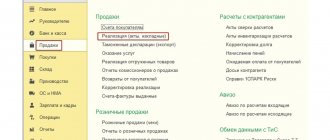

To simplify document flow, a single form of a universal transfer document has been developed. UPD can be used by both organizations and individual entrepreneurs. Its application is possible under any taxation system.

- supply of goods, services or performance of work;

- transfer of property rights of use.

Benefits of use:

- reduction of document flow;

- a unified style and form of registration of various accounting documents such as TORG-12, M-15, transfer acts, TTN;

- reduction of time for registration, processing, verification of all types of documents when there is a single form;

- a single document reduces the risk of discrepancies in numbers and details between documents for one economic transaction;

- reducing costs for paper and archival storage space.

What it is

There is serious confusion on this issue. Let us immediately clarify that an abbreviation often means two documents that are completely different in type and purpose. And they do not correlate with each other in any way. Let's deal with both cases step by step.

The difference between a transport bill of lading and a consignment note, or consignment note, is that the consignment note is, in fact, a new analogue of accompanying papers for cargo transportation. It has been introduced since 2013. And now it is predominantly the main one. This is a more modern and correct option. The differences lie in the fact that in the new form there is, in principle, no product section. After all, logically, it is not needed; inventory and materials are not registered on paper. This is simply accompanying documentation that confirms the fact of delivery and the performance of transport services. And it cannot be the basis for financial statements - only in terms of transportation costs, if any. However, the law currently allows for both options.

But the difference between a consignment note and a transport bill of lading is on a completely different level. The first case is confirmation that inventory items have been capitalized and accepted, registered, and placed in the buyer’s warehouse or point of sale. That the shipper honestly fulfilled the terms of the transaction and provided the required quantity of products specified in the contract. This paper has nothing to do with transportation. And it is already a primary accounting document. Accordingly, no matter what transportation confirmation option the buyer or supplier uses, this does not relieve the responsibility for reporting at the time of acceptance of goods and materials. The result is a simple algorithm; it is permissible to select any variation (if there is no direct prohibition by law in this case) of the accompanying documentation. But at the same time, financial statements must always be available.

Do you want to implement Warehouse 15? Get all the necessary information from a specialist.

Thank you!

Thank you, your application has been accepted!

At the same time, there is another interesting nuance that shows what a transport and consignment note is; the differences can be traced in the number of copies. In the first option we will need only three samples. One remains with the shipper, the second is transferred to the buyer. The remainder goes to the transportation company. But in the case of the old T-1, you will need four copies. Also, one each for the buyer and seller, but two remain with the transportation company.

Mandatory TN details

Filling out the form of this invoice is regulated by the Album of unified forms of primary accounting documentation, articles of the Tax Code and the article “On Accounting”.

It is imperative to check the availability of such information in the technical specifications:

- the invoice form must be drawn up exactly at the moment of receipt of the goods: the date must be real;

- in the column “Shipping organization” indicate the full or generally accepted abbreviated name, bank details.

The TN sample is called TORG-12. This form is not mandatory for formalizing economic relations. Organizations have the right to develop their own TN forms. But they must comply with tax requirements and be as clear as possible for all participants in the transaction.

To avoid misunderstandings and additional questions, it is better to use the unified TN form - TORG-12. It is available to everyone and most accountants are guided by it.

The consignment note has the following mandatory details:

- header – the name of the participants in trade relations (supplier, recipient and payer);

- the basis on which information about the contract or order for the supply of goods is placed;

- TN number and the date of its preparation, which is the date of the purchase and sale;

- supplier code according to OKUD and OKPO;

- The basis of the technical specification is a table that shows the name of the product, its description, cost, quantity, and so on.

At the bottom of the TORG-12 form, information is placed about the persons who conducted the transaction, their personal signatures, as well as seals of organizations.

The date and signatures of the parties are placed at the bottom of the invoice

What information is included?

So, the old-style form is divided into two sections. The first – commodity contains the following items:

- The number of goods and materials delivered by the entity.

- The amount of money spent on the purchase.

- Total weight.

- Nomenclature.

The second section contains:

- Information on loading and unloading activities.

- Stops along the route, partial shipments, if any.

- Information on packaging and storage conditions, as well as transportation.

- Details and data for calculation. This includes the amount of money spent on the trip, fuel, expenses, wages of all employees participating in the procedure, drivers, loaders, forwarders.

As you can understand, the first section certainly cannot be called strictly necessary. After all, all the indicated information will still be copied in the financial statements. And rewriting information several times is not a very logical process. In this case, the section can in principle be considered useless. After all, capitalization cannot be carried out based on the completed lines.

Therefore, it was decided to get rid of the section in a new format. And now it is clearly visible how the waybill differs from the goods transport bill. Plus, two new points have been added to the updated variation, which are really important. The first is the full amount of ATP without gradations. To make it convenient to make calculations. And the second concerns the route. The entire trajectory of freight transport is registered. This is fundamentally significant when it comes to inventory items that require a delicate approach. Fragile materials and dangerous goods. It is very important to determine a route so that the road situation does not provoke additional shaking, which will ultimately damage the cargo.

How is a universal transfer document drawn up?

The UPD was developed on the basis of an invoice, therefore it includes the following data:

- serial number and actual date of compilation;

- information about the seller and buyer (name of organization, legal address, tax identification number/registration number);

- name and address of the shipper and consignee;

- identifier of the government contract, the agreement on the basis of which the transaction was carried out;

- surname and initials (first name, patronymic), positions and signatures of those who completed the business transaction (sale of goods/services) and those responsible for its execution;

- line “to the payment document” (filled in if an advance was received);

- name of the product/service;

- unit of measurement of goods/services (kg, liter, etc.);

- quantity of goods/services;

- cost per unit of product/service;

- currency in which settlements are made;

- excise tax data, if it is an excise product;

- tax rate;

- the total amount of tax due;

- the total cost of all goods/services supplied;

- country of origin of the goods, if this is the subject of the transaction;

- customs declaration number (if the product is of foreign origin).

UPD contains all the necessary information:

- title “Universal transfer document”;

- real compilation time;

- name of the organization (company, individual entrepreneur, other);

- type of activity (sale of goods/services);

- quantitative characteristics (unit of measurement);

- officials, indicating the names, responsible for the performance of work, services, transportation of goods and their signatures;

- universal transfer document, which is used instead of a consignment note

- universal transfer document (UDD)

If the UPD has “status 1” and performs the functions of an invoice and a primary accounting document, then all columns must be completed.

If the UPD has “status 2” and performs the functions of only a primary accounting document, filling out all the points is not necessary.

In particular, do not need to be filled out:

- tax rate;

- excise tax data;

- line “to the payment document”;

- country of origin of the goods;

- customs declaration number (if the product is of foreign origin).

Consignment note or consignment note, when a specific type is needed

Now the Ministry of Finance has almost officially canceled the old option. At the same time, some fiscal authorities, which simply for unknown reasons decided not to rebuild, still require T-1. In fact, if such claims are received, you can safely seek legal protection. After all, this is illegal. TN completely replaces the analogue in almost all cases. There is only one option when TTN will be a necessary choice. And by law it cannot be replaced by an analogue. This is the transportation of ethyl alcohol and alcohol-containing products. Here the law actually prescribes the strict use of TTN. But this is the exception rather than the rule.

Rules for filling out the UPD, which replaces only the invoice (or act)

In the universal transfer document with status 2, you can omit filling in fields that are mandatory exclusively for the invoice. It is permissible to either leave such rows and columns empty or put a dash in them.

This applies to line (7) “To the payment and settlement document”, to columns 6 and 7, intended for the amount of excise duty and tax rate, and to columns 10, 10a and 11, intended for information about the country of origin of the imported goods and the customs declaration.

It is possible that UTD with status 2 will be companies or entrepreneurs that are not VAT payers. In this case, column 7 “Tax rate” and column 8 “Tax amount presented to the buyer” do not need to be filled out.

Then, despite the name “invoice”, the universal document will not entail the obligation to calculate and pay VAT.

Also, UPD with status 2 can be filled out by consignors, principals and principals who transfer their goods to commission agents, agents or attorneys for sale to third-party clients. Such a universal document will act as a “primary document” confirming the transfer of values without transfer of ownership of them.

In this case, in line (8) “Base for transfer (delivery) / receipt (acceptance)” you must indicate the agreement for the provision of intermediary services. And lines (2), (2a), (2b), (6), (6a) and (6b), intended for information about the seller and buyer, do not need to be filled out.

Recommendations for filling out other UPD details are given in Table 1.

Recommendations for filling out some UPD details

The difference between TN and TTN

We have dealt with the formal difference. And the difference has already become obvious. But now let's go through the specific points within the sections to clearly identify the differing aspects. And understand which variation will really be more convenient.

Product section

In the outdated version, this point is described in full. We can track the range of goods and materials, the specific number of commodity items, types of cargo transported, weight. And also in terms of value. Moreover, both the total amount and the price for specific products are written down. But according to the new version, this information is basically missing. They are lowered, because in fact there is no need for this. Possible damage or deficiencies will be identified during capitalization, which is based on other permitting papers.

Signature of authorized persons for the release of goods and materials

Another clear distinguishing point. It is present in TTN. Accordingly, the specialist responsible for this operation or the chief accountant must put his signature there. There is no such need for TN; persons, in principle, may not be present during this procedure.

Line 5

This is a new product used in TN. In fact, the shipper's recommendations are written there. He tells you which transport is best to choose, its quantity, carrying capacity, optimal route, conditions for transportation, for example, temperature. In fact, the manufacturer, who perfectly understands what products he has created and what weak points they have, gives advice on how not to lose quality during the cargo transportation process. And this is valuable information, but based on it you can actually create optimal conditions, select suitable cars, and plan a route. And also use specialized personnel if necessary. This is a clear indicator of the difference between a consignment note and a commodity transport bill, TNN. This option is more profitable for the buyer, because there is a chance that the goods and materials will arrive safely without damaging the packaging or reducing the shelf life of the product.

Another interesting aspect also appears. In case of problematic situations, it will always be possible to clearly track who is to blame. If recommendations were not given, or the carrier followed them exactly, but the goods and materials were damaged, the manufacturer is clearly to blame. He simply failed to correctly describe the transportation standards. But if the drivers and loaders simply did not follow the specified recommendations, then the blame lies entirely with them. And complaints should also be directed towards the mediator.

Page 14

Another innovation that contains fields for writing information about changes to the upload. That is, if a force majeure situation occurred when the trucks simply could not be provided on time, or the shipment date was changed. And what happens most often is that the unloading address changes, and it turns out that the previously indicated warehouse is completely full of products, and it is necessary to transport them to another. It is worth remembering that the completed field will become the basis for increasing (or decreasing) the amount of the final calculation. After all, it often turns out that the new delivery point is much further from the poisoner’s point. And you will have to travel an extra few hundred kilometers. And these are additional costs for the transport company.

UPD and SSF

Invoice is an NU document. It confirms the release of goods to the buyer, the provision of services to him, the performance of work on operations subject to VAT, and is not used anywhere else. SChF details contain information:

- about the subject of the transaction;

- about his country of origin;

- about the amount;

- on the quantitative characteristics of a business transaction;

- about the tax rate;

- about excise tax;

- about the relevant group of goods;

- allowing taxpayers to be identified.

The information contained in the SSF is used for VAT calculations and control of these transactions. When registering the release of goods, an accounting document is attached to the SChF: delivery note, delivery and acceptance certificate, etc.

The Universal Transfer Document (UDD) is a form created on the basis of the SSF. All information from the SSF is reflected in the UPD.

For convenience, the “invoice area” is highlighted with a dark outline. In addition, the UPD contains information on the issue of goods and materials (act, bill of lading, partially - TTN, document on issue of materials f.

M-11, etc.), i.e. information when the shipment was made, which official took responsibility for it and signed it, and on the basis of which agreement the shipment was made.

UPD can be used both in BU and NU. The nature of use is marked with a number (1 or 2) - on the left side of the form, at the top:

- With status 1, the UPD acts as both an invoice and a document confirming the transfer.

- With status 2, the UPD is filled out only as a BU document.

It is obvious that SSF can be replaced by UPD with a simultaneous reduction in document flow. However, complete replacement in accounting practice does not occur. There are objective reasons for this.

Do I need to prepare two documents at once? Is it possible to replace them?

We looked at the specifics of the contents of the papers. It has already become clear to many which option is preferable, TTN or TN, and what to prescribe is now also no secret. But the question remains: does it make sense and is it worth combining both variations at once? From a practical point of view, the question is not without logic. After all, the new variation contains a lot of points that were not there before. But in fact, the law simply does not provide for such a procedure. There is only one option available to choose from. At the same time, a replacement is actually possible; a waybill is provided without any problems instead of an analogue. But not the other way around. You can only replace the old form with a new one, there is no reverse procedure.

However, there is only one case when such regulations are not implemented. Namely, as we have already clarified, working with alcohol-containing products. Considering the fact that in our country a huge number of fraudsters are trying to sell counterfeit goods, the measures here are more stringent. And the product section becomes simply necessary to accurately track the possibility of forgery or lack of certification.

Signing

Officially, the UPD template has 5 columns for signing the document by the seller. But not all fields must be signed.

- If it is used only in the status of primary documentation, then two signatures are sufficient: from the head of the organization and the chief accountant.

- If the UPD is used as a replacement for TORG-12 and an invoice, then there will also be the signatures of the person who shipped the goods, the signature of the person responsible for registering the fact of economic life on the part of the seller.

There will also be signatures from the buyer: the person who received the goods and is responsible for the economic part.

Is TTN always needed?

Definitely no. Moreover, a new variation is now more often used. True, as already mentioned, some fiscal authorities traditionally require an outdated copy. But these claims can be safely ignored. The law will be on your side. Even if they try to apply some sanctions against you or complain to the competent authorities, don’t worry. Resolve the issue through legal proceedings.

It is worth considering that accounting papers still remain necessary, even if the old form of accompanying documents is not used. But we have already explained what the difference is between the TN, consignment note and the TN, commodity-transport document. The differences lie in the fact that these are, in principle, different types of documentation with different purposes. And by definition they cannot replace each other. After all, when you visit a clinic, a compulsory health insurance policy cannot be replaced with a pension certificate, right?

To automate and simplify all processes related to the capitalization of inventory items, it is worth using competent software. The same as it provides.

Do you want to implement “Store 15”? Get all the necessary information from a specialist.

Thank you!

Thank you, your application has been accepted.

Electronic consignment note TORG-12

Primary documents can be prepared not only in paper, but also in electronic form (Part 5, Article 9 of Law No. 402-FZ).

Read about what signature you need to use for electronic documentation here.

For the electronic consignment note, a format has been approved for transmission via TCS ( from July 1, 2017 - Federal Tax Service order dated November 30, 2015 No. ММВ-7-10/ [email protected] ), which allows not only to establish an electronic exchange of invoices with counterparties, but also to submit invoices in electronic form at the request of tax authorities.

Filling rules

So:

- All items are filled in sequentially. Those fields where information is not needed (for example, there have been no changes to the unloading address) remain empty and no dashes are added.

- You should enter information strictly according to the sample.

- The old form is filled out in four versions, and the new one only in three.

- The product section is specified exclusively by the sender of the goods.

Sample filling by the shipper

Let's look at an example of how a seller should fill out a paper.

Sample filling by the cargo carrier

Now let’s turn our attention to the requirements for a transport company. The freight forwarder or driver usually works with the sample.

Basic requirements for filling out the TN

There are a number of rules that must be followed when filling out a delivery note. They are designed to simplify the procedure for receiving and transferring material assets.

- telephone numbers, address and other necessary information;

- the “Base” field provides information about the document that created the basis for the transaction and shipment of goods;

- laws allow minor changes to be made to the invoice that do not affect required fields.

The delivery note must be kept in the organization for 5 years. A sample of filling out the TN at the link:

https://base.consultant.ru/cons/cgi/online.cgi?req=doc;base=LAW;n=23886;fld=134;dst=100161,0;rnd=0.2148351106913211#1

Sample of filling out the TN

Key Requirements

Remember that the content in any case should reflect the following aspects:

- Complete information about the cargo. But the cost or nomenclature is needed only in its old form.

- Information about the transport that carries out cargo transportation.

- Details and price aspect of payment for the services of the delivery company.

- All the necessary information about the parties to the transaction, the carrier, the buyer and the seller.

- List of documents used as supporting documents.

What is it for?

Commodity transport is a unified document. Designed to accompany the goods during transportation from the seller to the buyer. It does not matter who carries out the transportation: the seller, the buyer or a hired carrier.

The document is printed in 4 copies (1 copy for the seller, the second for the buyer, and two more forms for the cargo carrier). The completed document is used both to confirm the accounting of the movement of inventory items and for payments for road transportation.

- The consignee needs the document to verify the list of shipped goods with the list in the document.

- The shipper needs the TTN to obtain documentary evidence of the transfer of the cargo to the driver and its acceptance by the recipient.

- The carrier records in the document the fact of transportation of goods.

Filling procedure

In principle, there are no strict requirements. But there is a practice for conveniently entering information:

- Sender information.

- Recipient details.

- Description of the cargo.

- List of accompanying papers.

- Other sections.

Now it has become clear whether in a particular case we need a transport or a consignment note, the difference is obvious.

The first option is almost always recommended. But it is worth remembering that in practice, fiscal authorities are sometimes against this kind of innovation. Number of impressions: 3041