So. Since you have reached this page, we can assume that the choice of tax regime has been made

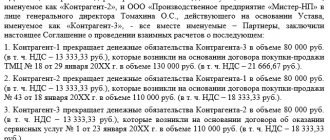

Set-off of mutual claims and VAT in 2020-2021 in the absence of termination of the agreement Currently

Decree of the Government of the Russian Federation dated 06.05.2008 No. 359 Approved by Decree of the Government of the Russian Federation dated 6

Try the online service Kontur.Accounting! Quick establishment of primary accounts Automatic payroll calculation Convenient online reporting Multi-user

06/09/2019 0 52 6 min. During maternity leave, any woman or baby

Account balance sheet The “Account balance sheet” report is intended for generating a balance sheet

Transport tax: what is it and who is obliged to pay it Important: payers are only

From 01/01/2020, in accordance with the new order No. 207n dated 11/29/2019, new

Grounds for forced collection of taxes from the debtor Every taxpayer - be it an organization, individual entrepreneur

Russian organizations, as well as foreign companies that are tax residents of the Russian Federation or operate through