From 01/01/2020, in accordance with the new procedure No. 207n dated 11/29/2019, new BCCs for insurance premiums began to apply from 2020.

The accrual and payment of SV is regulated by the Tax Code (Chapter 34 of the Tax Code of the Russian Federation), 125-FZ of July 24, 1998, 179-FZ of December 22, 2005.

All SVs are paid according to the tariffs determined for each type of payment in accordance with current legislation. Find out more about how rates and benefits are set.

IMPORTANT!

From April 1, 2021, reduced tariffs will be introduced for small and medium-sized businesses. The new tariff of 15% applies only to the amount of workers’ earnings exceeding the minimum wage. But the BCC for insurance premiums for April 2021 remained the same. Read more in the article: “Anti-crisis measures during coronavirus quarantine: rights and responsibilities of organizations.”

Deadlines for payment of insurance premiums

Insurance premiums are paid at the end of each month no later than the 15th day of the following month. Contributions for compulsory pension, medical insurance, in case of temporary disability and in connection with maternity (VNiM) must be transferred to the tax authorities, and “traumatic” contributions - to the Social Insurance Fund of the Russian Federation. If the payment deadline falls on a weekend or non-working holiday, it is postponed to the next working day.

In addition, the deadline for payment of insurance premiums, except for contributions for injuries, is postponed if its last day falls on a day recognized as a non-working day in accordance with the act of the President of the Russian Federation (Clause 7, Article 6.1 of the Tax Code of the Russian Federation).

For organizations included in the register of SMEs as of 03/01/2020 and engaged in the areas of activity most affected by the spread of coronavirus, the deadline for payment of contributions from payments to individuals was extended (Resolution of the Government of the Russian Federation dated 04/02/2020 No. 409):

- for March - May 2021 - in general for 6 months. And if such a SME operates in an industry from the List given in clause 4 of the Decree of the Government of the Russian Federation dated November 7, 2020 No. 1791, then for it the deadline for paying contributions from payments for March 2021 has been extended by 9 months (clause 1 of the Decree of the Government of the Russian Federation dated 07.11.2020 No. 1791);

- for June - July 2021 - for 4 months.

The deadlines have also been extended for organizations included in the register of socially oriented NPOs receiving support in connection with the spread of coronavirus.

Amounts of insurance premiums, the payment deadline for which has been extended, must be transferred monthly in the amount of 1/12 no later than the last day of the month. You need to start with the month following the month in which the payment deadline, taking into account the extension, occurs.

Deadlines for payment of insurance premiums in 2021 (excluding transfers):

- for December 2021 - 01/15/2020

- for January — 02/17/2020

- for February - 03/16/2020

- for March - 04/15/2020

- for April - 05/15/2020

- for May - 06/15/2020

- for June - 07/15/2020

- for July - 08/17/2020

- for August - 09/15/2020

- for September - 10/15/2020

- for October - 11/16/2020

- for November - 12/15/2020

- for December - 01/15/2021

KBK PFR for individual entrepreneurs

In addition to changes in the KBK, businessmen were affected by the following innovations:

- the procedure for conducting calculations and paying contributions of various types has changed;

- the amount of fixed-type payments in the “for oneself” category has increased (Federal Law No. 335 of November 27, 2021);

- The rules allowing the calculation and transfer of insurance premiums have become different.

The changes affected the codes that govern payments for reporting periods after 2021. The way the description of one of the new codes is worded can also add to the confusion. Previously, we were talking about two BCCs, one of which was intended for paying contributions on income not exceeding 300 thousand rubles, the other - for making 1% of the amount exceeding the amount of 300 thousand.

Elena Smirnova

Pension lawyer, ready to answer your questions.

Ask me a question

In the new text of the document, the clause regarding the payment of 1% has disappeared, so there is no exact information about the BCC yet. Many entrepreneurs have already contacted the Ministry of Finance to obtain clarification on this issue.

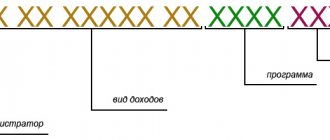

The BCC for payments related to the pension insurance of the individual entrepreneur himself (based on the minimum wage) will be as follows: 182 1 0210 160.

How to fill out a payment order for payment of insurance premiums

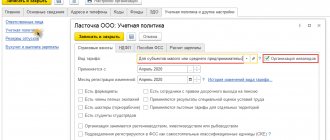

When filling out payment slips for the transfer of insurance premiums to the tax authorities, in field 101, companies making payments to individuals must indicate payer status “01”.

Individual entrepreneurs indicate one of the following values in this field:

- 09 - taxpayer (payer of fees) - individual entrepreneur;

- 10 - taxpayer (payer of fees) - a notary engaged in private practice;

- 11 - taxpayer (payer of fees) - lawyer who established a law office;

- 12 - taxpayer (payer of fees) - head of a peasant (farm) enterprise.

These provisions are provided for by Order of the Ministry of Finance of the Russian Federation dated November 12, 2013 No. 107n.

When transferring contributions for accident insurance, “08” is entered in field 101.

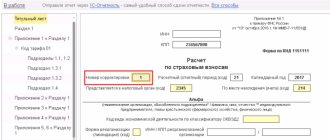

The BCC is entered in field 104. In this field you need to indicate the value of the budget classification code of the Russian Federation established for the payment of the corresponding type of insurance premiums.

The purpose of payment and other necessary information are indicated in field 24. This field should reflect the type of insurance premiums and the period for which they are paid. When paying “traumatic” premiums, you can indicate the registration number of the policyholder in the Federal Social Insurance Fund of the Russian Federation.

In fields 106–109 of the payment order for the transfer of accident insurance contributions, “0” must be entered.

When transferring contributions to the tax authorities, you must reflect on the payment slip:

- “TIN” and “KPP” of the recipient of funds - the value of the “TIN” and “KPP” of the relevant tax authority that administers the payment;

- “Recipient” is the abbreviated name of the Federal Treasury authority and in brackets is the abbreviated name of the tax authority that administers the payment.

In field 106, when transferring the current payment, the TP is entered, in field 107 - the month for which contributions are paid (for example, MS.11.2020).