Account balance sheet

The “Account balance sheet” report is intended for generating a balance sheet for a selected account for a certain period of time.

In terms of the information displayed, the report resembles a fragment of the Turnover Balance Sheet report.

The report can be generated with detail by subaccounts or by analytical accounting objects (subaccounts).

Data can be displayed with an additional breakdown by time periods: month, year, etc.

You can display the expanded balance in the report. In this case, the expanded balance is calculated for each grouping level and for the account as a whole.

Results

In 1C there are many options for obtaining data on accounts receivable in the required context. If detail is required (by counterparty, agreement), it is better to use the reports that we presented as accounting. If you need summary data that gives an overall picture and allows you to perform analysis, it is better to use reports from the “Manager” menu.

Sources: Order of the Ministry of Finance of the Russian Federation dated October 31, 2000 No. 94n

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Account Analysis

The “Account Analysis” report is designed to present data on turnover between the selected account and all other accounts for a certain period.

In terms of the content of the information displayed, the report is similar to the Account Turnover report. The difference lies in the form of presentation of information.

The report can be generated with detail by subaccounts or by analytical accounting objects (subaccounts).

Data can be displayed with an additional breakdown by time periods: month, year, etc.

You can display the expanded balance in the report. In this case, the expanded balance is calculated for each grouping level and for the account as a whole.

How to view the dynamics of accounts receivable for a period

Another useful summary report for debt analysis that “works” with deadlines is the report on the dynamics of receivables.

It is in the same subgroup as the report on debt maturities. The principle of setting the settings is also similar to the deadline report. Only when setting the interval, the period is set from the drop-down list: minimum - day, maximum - year.

The resulting report will present accounts receivable in the following context:

- changes in debt in a period (for example, with an interval of 1 day and a selected period of 1 month, the report will display a graph of daily changes in the volume of debit debts for the month);

- overdue and repayable debts on time (overdue debts will be highlighted in red in the report).

Read about the nuances of debt accounting in the article “How do settlements with debtors and creditors occur?”

Account card

The “Account Card” report is intended to present a sample of invoice correspondences, ordered by date, that relate to the selected time period and in which the selected account was used.

The structure of the report is similar to the Subconto Card report.

Each line of the report corresponds to one account correspondence. The report displays summary information: the initial balance of the selected account, as well as the final balance and total turnover.

Data can be displayed with an additional breakdown by time periods: month, year, etc.

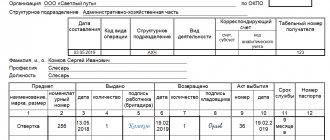

Wealth accounting card 0504043 (form)

If the first register of accounting for material assets is maintained by the accounting department, then form 0504043 is filled out directly by the financially responsible person according to warehouse accounting data and is used for accounting in places where assets are stored. This card is filled out for:

- materials,

- finished products,

- soft equipment,

- dishes,

- library items.

A separate sheet of card is created for each name, while a quantitative and total accounting card is created separately for each object. Also, the information entered by the financially responsible person in card 0504043 is checked, for example, by an accountant, and there is a separate last page in the form to mark the verification.

Form 0504043 can be found on our website using the link below.

You can also fill out this document.

Read about the rules for accounting for inventories for public sector employees in the article “Accounting for materials in budgetary institutions (nuances).”

And the basics of accounting for materials in non-governmental organizations can be found in the article “Accounting entries for accounting for materials.”

Subconto analysis

The “Subconto Analysis” report is intended to present data on the selected type of subconto: opening and closing balances, turnover for the period according to accounts. A report can be generated not only by a selected subconto or several subcontos, but also by a subconto value or a subconto value attribute.

The report is generated with details on accounts. The report settings allow you to specify additional detail for subaccounts.

Data can be displayed broken down by time periods: month, year, etc.

You can display the expanded balance in the report. In this case, the expanded balance is calculated for each grouping level.

You can set the following settings in the report:

- Indicators

- Grouping

- Selection

- Sorting

- Decor

- Additional data

- Diagram

Subconto card

The “Subconto Card” report is intended to present a sample of invoice correspondences, ordered by date, that relate to the selected time period and in which the selected type of subconto was used.

The structure of the report is similar to the Account Card report.

Each line of the report corresponds to one account correspondence. The report displays summary information: the initial balance of the selected account, as well as the final balance and total turnover.

Data can be displayed with an additional breakdown by time periods: month, year, etc.

main book

The “General Ledger” report allows you to display information for each account (subaccount) about the balance at the beginning and end of the period, the turnover of the account with other accounts (subaccounts) for the selected period of time. The report is generated based on accounting data.

The report is generated by clicking the Generate .

To generate a more compact report with a hidden header, click the Header .

Report generation parameters can be set using the Settings :

- In the Period , you can specify the period for generating the report: month, year, etc. If you need to display data in the report for periods in which there were no movements in the accounting accounts, then you need to check the All periods .

- To detail the data by subaccounts or by subaccounts of correspondent accounts, you need to select the By subaccounts or By subaccounts of correspondent accounts .

- To display the expanded balance, you need to select the Expanded balance . Additional parameters can be set on the Expanded balance , for example, specify by subaccounts or according to the account analytics, the expanded balance should be displayed in the report. By clicking the Default , you can fill in the settings that are set by default in the report and, if necessary, adjust them.

- When printing, you can display the data of each account (subaccount) on a separate sheet. To do this, you need to check the Split into sheets box .

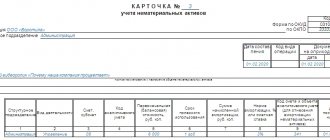

Card of quantitative and total accounting of material assets according to form 0504041

The quantitative and total accounting card, approved by order of the Ministry of Finance of the Russian Federation dated March 30, 2015 No. 52n, is used in government agencies to provide analytical accounting of the following assets:

- fixed assets;

- materials used in the manufacture of experimental devices;

- spare parts and components installed on vehicles to replace those that have failed;

- transferable badges of merit (awards, prizes, cups);

- inventory items in safekeeping;

- OS, MPZ on the way;

- materials;

- materials as customer-supplied raw materials;

- leased assets;

- assets for free use and storage.

Thus, f. 0504041 is used both for own assets and for those that are taken into account off the balance sheet.

This document is filled out by an accountant. First of all, you need to carry forward the balance to the beginning of the year. Then, during the period, data on the movement of the asset is entered into the card based on primary documents, and at the end of the period the balance is displayed. Receipts are indicated in the “Debit” column, disposals - in the “Credit” column. Information is filled in in rubles and in units of measurement. Information about the useful life of the asset and the expected write-off date is also provided.

A separate card is drawn up for each name. In addition, a separate card must also be filled out for each financially responsible person, even if the names of the assets under their control are identical. Also, for certain types of material assets, the following analytics are provided, listed in the table, that is, separate cards are compiled for each characteristic.

| Types of material assets | Characteristics |

| Valuables for rent | Lessor's inventory number |

| Non-financial assets in transit | Provider |

| Inventory in safekeeping | Owner |

| Provided raw materials and supplies | Customer, type, grade of materials and their location |

Form 0504041 is available on our website.

In addition, we suggest that you familiarize yourself with a sample of filling out this document.

If you need an example of filling out a book of accounting for material assets (f. 0504042), get free access to ConsultantPlus and go to the sample.

Express accounting check

An express check of accounting in the 1C Accounting 8 program helps to obtain summary or detailed information about the state of the information base data at any time.

An express check is a set of checks grouped by accounting sections. Each check ensures that there are no errors in the infobase data. Control may consist in compliance of credentials with certain provisions of the law or in compliance of data with internal algorithms embedded in the program.

As a result of the express check, a report is generated that shows the total number of checks performed and the number of checks during which errors were detected. The report can be printed or saved to a file.

The results of the express check can be displayed with details up to the accounting section or before each check. The report can show comments for each check performed:

- subject of control - what exactly the current inspection checks;

- the result of the check - whether errors were found during the check;

- possible causes of errors;

- recommendations for troubleshooting.

The list of checks performed can be limited ( Show/hide settings ). To prevent a check or check section from being performed, you need to uncheck the box.

Accounting for accounts payable of counterparties

Accounts payable means the organization's debt:

- to suppliers and contractors;

- to buyers on advances received;

- to employees of the organization;

- before the budget and extra-budgetary funds;

- before other creditors.

Accordingly, persons to whom the organization has obligations (including the organization’s counterparties) are considered its creditors. Next, we will consider only the organization’s accounts payable to its counterparties.

The occurrence (increase) of accounts payable is always reflected in the credit of the account for settlements with counterparties, for example:

Debit 41.01 Credit 60.01 - goods received from supplier;

Debit 51 Credit 62.02 - an advance was received from the buyer for the upcoming shipment of goods (performance of work, provision of services);

Debit 51 Credit 66.01 - short-term loan received from the bank.

Repayment (reduction) of accounts payable is always reflected in the debit of the settlement account, for example:

Debit 60.01 Credit 51 - payment was transferred to the supplier for goods (work, services) received;

Debit 62.02 Credit 62.01 and Debit 62.01 Credit 90.01.1 - the buyer's advance payment for the shipment of goods (work, services) is credited;

Debit 66.01 Credit 51 - loan repaid.

To be reflected in the accounting (financial) statements of an organization, accounts payable are classified according to the following criteria:

- by expected maturity after the reporting date (short-term and long-term debt);

- according to the actual terms of fulfillment of obligations under the contract - normal (urgent) and overdue debt, including secured debt and expired debt.

Accounting for accounts payable in “1C: Accounting 8” (rev. 3.0) also depends on a number of settings, such as:

- keeping records of contracts;

- setting deadlines for repaying debts to suppliers;

- the ability to select specific documents when offsetting advances and repaying debts.

Some program settings are used only for making management decisions and do not affect accounting.

Deadlines for payment of debts to suppliers

If an organization keeps records of contracts, then the payment period to the supplier can be indicated directly in the contract card with the supplier. A single deadline for repaying the organization’s debt to all suppliers can be set in the Due date for payment of our debt to suppliers field of the Deadline for payment to suppliers register (Fig. 6). The register is accessed via the hyperlink of the same name from the Purchases section or from the Administration - Accounting Options section.

Rice. 6. Payment terms to suppliers

In this case, the payment period specified in the contract card takes precedence.

The payment terms established in one way or another for settlements with suppliers serve:

- to qualify the debt as overdue, which affects the accounting (financial) reporting indicators;

- for making management decisions.

Planning payment to suppliers

To control and manage payments to suppliers, in the functionality settings of “1C: Accounting 8” edition 3.0, on the Calculations tab, you should set the Planning payments to suppliers flag (see Fig. 3).

This functionality allows you to specify payment terms in settlement documents with suppliers (performers):

- Receipt (acts, invoices);

- Receipt of additional expenses;

- Receipt of NMA.

The Payment term detail is indicated in the Settlement form, which opens from the settlement document with the supplier via a link and is filled in automatically based on the payment term specified in the contract card with the supplier, or based on the Due date for payment of our debt to suppliers detail. If the term is not indicated either in the contract card or in general for suppliers, then the Payment term attribute will correspond to the date of the settlement document. Payment deadlines in settlement documents can be changed manually. Indicating payment terms in settlement documents with suppliers does not affect accounting and tax accounting and serves only for making management decisions.

When the Planning of Payments to Suppliers functionality is enabled, the Payment to Suppliers assistant is available in the program (Fig. 7), which is designed to automatically generate a list of payment orders for payment to suppliers. Processing is called from the form of the list of payment orders using the command Pay - Goods and services.

Rice. 7. Planning payment to suppliers

The assistant's header indicates the organization and bank account from which funds are planned to be debited. When performing processing, balances on accounts payable to suppliers are analyzed. For each debt (for each settlement document), the planned payment period is indicated. Additionally, the list includes planned payments to suppliers based on Invoices from suppliers documents that have the status Unpaid or Partially Paid. The list is displayed in chronological order in ascending order of payment terms (the most urgent payments are located at the top of the list). Billing documents associated with unpaid invoices from suppliers are displayed on one line.

In the Payment to suppliers form, you can change the payment deadline for one or more documents by first highlighting them with the cursor. The Change payment due date command opens a form for entering a new payment due date. You can also change the payment deadline for a document directly in the Payment due date field.

The lines for which payment orders need to be generated should be marked with a flag. Payment documents are generated automatically using the Create payment orders command.

| How is planning of payments to suppliers organized in the 1C:Accounting 8 version 3.0 program? |

Management of offset of advances and debt repayment

In accordance with the legislation on accounting, advances (both received from the buyer and issued to the supplier) are accounted for separately from settlements (see Chart of Accounts for the accounting of financial and economic activities of organizations and Instructions for its application, approved by order of the Ministry of Finance of Russia dated October 31, 2000 No. 94n; clause 3 of the Accounting Regulations “Income of the Organization” PBU 9/99, approved by order of the Ministry of Finance of Russia dated 05/06/1999 No. 32n; clauses 3, 16 of the Accounting Regulations “Expenses of the Organization” PBU 10/99 , approved by order of the Ministry of Finance of Russia dated May 6, 1999 No. 33n).

In tax accounting for VAT, advances are also reflected separately (clause 3, clause 3, article 170 of the Tax Code of the Russian Federation).

By default, in “1C: Accounting 8”, for all documents of the accounting system, an automatic method is used for offsetting advances and repaying debts, the essence of which boils down to the following:

- upon receipt of payment from the buyer, the existing debt under the contract with the buyer is repaid in chronological order, and receipts in excess of the amount of the counterparty's debt under the contract are taken into account as an advance;

- when posting a sales document, available advances under the contract are counted in chronological order;

- when registering payment to the supplier, the existing debt to the supplier under the contract is repaid in chronological order, and the amount of payment in excess of the existing debt is taken into account as an advance;

- When posting a receipt document, existing advances under the agreement with the supplier are counted in chronological order.

If necessary (for example, under the terms of an agreement with a counterparty), the program can reflect the offset of advances (repayment of debt) for certain documents or not offset advances (not repay the debt). To take advantage of this opportunity, in the Main - Functionality section on the Calculations tab, you must set the Manage offsetting of advances against debt repayment checkbox (see Fig. 3). Please note that this functionality has a significant impact:

- to offset advances received from buyers and to repay buyers' debts;

- to offset advances issued to the supplier and to repay debts to suppliers;

- on the general state of mutual settlements under contracts with counterparties;

- for accounting of receivables and payables;

- to account for expenses (income) in accounting and tax accounting when forming reserves for doubtful debts;

- for VAT registration.

Details The method of offsetting advances is indicated in the Calculations form, which is opened by following the corresponding link from the sales document (see Fig. 4) or from the receipt document.

By default, the advance payment method is set to Automatic. When choosing the method of offset of advances By document, you must specify the Advance Document (several documents) and the Offset Amount.

If the Advance Offset Amount is not filled in, then when posting the sales document (receipt document), the maximum possible amount for the specified advance document is automatically offset. If the actual advance balance is less than the specified offset amount, an error message is displayed and the document is not posted. When you select the Do Not Offset method for offsetting advances, advances are not offset.

Details Debt repayment is indicated in the form of bank and cash documents. By default, the Debt repayment attribute takes the value Automatic. When choosing a method of debt repayment According to the document, you must indicate the sales document (receipt document) for which the debt should be repaid. If the Do Not Repay method is selected, the existing debt will not be repaid.

| 1C:ITS For more information about VAT calculations on advances, see the reference book “Accounting for Value Added Tax” in the “Instructions for Accounting in 1C Programs” section. |

| How to manage the offset of advances and debt repayment in “1C: Accounting 8” edition 3.0 |

In practice, quite often there are situations when the receipt of funds from the buyer and the shipment of goods to his address (performance of work, provision of services) occur within one day. And it happens that the organization pays money to the supplier and on the same day receives goods (work, services) from him.

To avoid unnecessary turnover in offsetting advances during the day, in “1C: Accounting 8” edition 3.0 you can use a special setting, which can be accessed from the Administration section using the hyperlink Posting documents. In the Posting documents form, you should set the Set document time automatically checkbox (Fig. 8).

Rice. 8. Setting up document posting

When using this setting, documents are recorded during the day in accordance with strictly defined times, and payment to the supplier and buyer is always reflected later than the receipt and sale of goods. Thus, this setting allows you to avoid unnecessary turnover in offsetting advances during the day (if documents are posted in the correct chronological sequence during the day).

| How to avoid unnecessary turnover in offsetting advances during the day in “1C: Accounting 8” edition 3.0 |

Accounting for received and issued security for obligations

“1C: Accounting 8” supports accounting for security of obligations (payments) under contracts. To make this feature available to the user, in the functionality settings on the Calculations tab, you should set the Accounting for collateral for obligations and payments flag (see Fig. 3).

For contracts with secured obligations, you can specify additional information:

- type of security;

- parties to the transaction;

- currency;

- value in currency.

This information is primarily intended for generating reports from the borrower to the bank, but can also be used for additional analytics of the status of settlements with the counterparty.

For more information on how the provision of obligations is supported in “1C: Accounting 8” edition 3.0, see the article “Securing obligations in “1C: Accounting 8”.

Please note that for the purposes of creating reserves for doubtful debts, the program does not take into account the presence of collateral (guarantees, collateral, sureties, etc.) under the agreement with the buyer, that is, it does not check whether the receivables are truly doubtful.

You can set up such a check in the program indirectly through the value of the indicator The payment term has been established under the agreement in the agreement card with the counterparty. If the organization has received security for the debt from the buyer or it has confidence in its solvency, then to exclude this debt from the calculation of reserves for it, it is enough to indicate in this indicator a obviously long payment period (in calendar days).

Report “Analysis of the state of tax accounting for income tax”

The report is intended to identify possible errors in tax accounting data and take into account differences in the valuation of assets and liabilities.

The report contains an analytical analysis of the state of tax accounting and accounting for differences in the valuation of assets and liabilities, which is carried out by comparing data from accounting, tax accounting and accounting for differences in the valuation of assets and liabilities.

The report needs to be generated only after performing routine month-end closing operations.

The report indicators are grouped by economic content and presented in the form of graphic diagrams (block diagrams). Connections between blocks are reflected by arrows. The arrows illustrate the “transition” of value from one accounting object to another. The arrows come from blocks symbolizing objects being written off (their value decreases) and enter blocks symbolizing objects whose value is increasing.

Connections between circuits are indicated in two ways:

- using automatic transitions from one scheme to another;

- on the general diagram.

The transition from one scheme to another is made by double-clicking on the block with the indicators of interest. If the decoding of the requested indicator does not imply a transition to another scheme, then a transaction report opens, containing all the accounts for which this indicator was generated. Each account can be detailed by documents. To do this, you need to select the Expand by command panel documents checkbox. The document can be opened directly from the report and adjusted if necessary.

A general picture of the location of the schemes and the connections between the schemes can be found in the section “Structure of the tax base”. The structure of the tax base is available when opening a report and using the button of the same name on the command panel of any scheme and decoding table. Using the structure of the tax base, you can go to the accounting section of interest.

The “Production” diagram reflects production costs for the production of finished products and services provided to third-party customers. Expenses attributed to the cost of services provided to in-house production units are not reflected in the report.

In the “Cost of Assets” diagram, in the block “Cost of goods, RBP, written off as expenses and depreciation”, the value of assets written off for reasons other than sales (write-off for own needs, write-off for other expenses, returns to suppliers, etc.) is reflected. .

On the “Expenses for ordinary activities” diagram, in the block “Cost of goods, RBP, written off as expenses and depreciation”, the cost of assets written off as expenses for ordinary activities is reflected.

In the “Expenses for ordinary activities” diagram and in the “Production” diagram, a discrepancy between the data in the “Direct costs” block for multi-process production is allowed if at some production stage the reclassification of costs from direct to indirect and vice versa is allowed. The same rule applies to the “Indirect costs” block.

In the “Tax” diagram, the analysis of the state of tax accounting is carried out by comparing the amount of income tax according to tax accounting data (profit statement) and according to accounting data, taking into account the recognition and write-off of permanent and deferred tax assets and liabilities (profit and loss statement). If the amount of income tax according to accounting data coincides with the amount of income tax according to tax accounting data, then tax accounting is regarded as correct.

The blocks illustrate the value of the organization's assets, liabilities, income and expenses according to the following data:

- accounting (yellow background),

- tax accounting (blue background),

- accounting for permanent differences in the valuation of assets and liabilities (pink background),

- accounting for temporary differences in the valuation of assets and liabilities (green background).

If for the indicators of one block the rule “ Value assessment according to accounting data = Value assessment according to tax accounting data + Permanent and temporary differences ” is not followed, then the block is surrounded by a red frame. This is a signal of accounting errors. It is recommended to consider the history of the formation of block indicators, find out the reason for non-compliance with the rule and eliminate it.

The report is not intended to analyze data on income and expenses related to activities with a special taxation procedure. With the exception of those expenses that are classified as activities with a special taxation procedure, as a result of distribution according to income received. The report is not intended to analyze income that is not taken into account when determining the tax base (Article 251 of the Tax Code of the Russian Federation).

What is account 41 in accounting

41 account “Goods” is an account that shows the cost reflection of the material assets available to the organization, and their movement - receipt and write-off. 41 accounting accounts are used when maintaining accounting records for organizations engaged in the resale of various products (food, non-food stores), and catering establishments.

Scheme of goods movement at the enterprise

However, its use is possible in enterprises that carry out production activities. In this case, one of the subaccounts 41 is opened to account for products purchased for the purpose of sale, as well as for accounting for components, the cost of which is compensated separately by the buyer.

Report “Analysis of the state of tax accounting for VAT”

The report is intended for checking in the 1C Accounting 8 program the correctness of filling out the purchase book, sales book and VAT declaration. The report shows the amount of VAT accruals and deductions by type of business transaction.

The report needs to be generated only after completing regulatory VAT operations.

The report consists of a general scheme of the tax base and explanations of individual blocks of this scheme.

To return to the report scheme from the transcripts, click the Tax base structure .

Each block reflecting the accrual or deduction of VAT contains two indicators:

- amount of calculated VAT (yellow background),

- amount of uncalculated VAT (gray background).

If a block contains entries with errors, a red exclamation mark is displayed next to it.

The sum of each report block can be decrypted.

What is it used for?

41 accounting accounts are used to reflect the cost of products intended for sale. The following types of expenses may be included:

- the cost of purchasing goods from the supplier;

- paid customs duties for clearing products at customs (if they crossed the state border);

- transport costs;

- payment to intermediaries;

- other expenses that are directly related to the purchase of goods.

Also, VAT may be included in the cost if the company operates under the simplified tax system.

When retailing goods, they are taken into account in accounting in various ways:

- At purchase prices. In this case, the cost of the product includes its price minus indirect tax (VAT) and all expenses that the company incurred in purchasing it. These could be, for example, procurement costs or transport costs.

- At the selling price. In this case, the goods are recorded in accounts at cost, including trade margins. Only enterprises engaged in retail trade can keep records using this method. The trade margin is reflected in the account. 42 and is written off from there when the goods are sold.

Selling price

- At discounted prices. All goods are accepted at certain discount prices. The difference between the purchase price and the accounting price is reflected in the account. 15, and the goods are written off through the account. 16.

Important! The accounting method must be reflected in the accounting policy of the enterprise.

Report “Availability of invoices”

The report is designed to monitor the availability of invoices received from suppliers.

When generating a report, you can set the following parameters:

- Availability of invoice - possible values: Yes - when building the report, documents for which invoices are generated are taken into account,

- No - documents for which invoices were not generated are taken into account,

- It doesn’t matter - all documents that can be used to generate invoices are taken into account.

- Depending on the value of the Selection , the report is generated either based on the documents specified in the List of documents , or based on all documents except those specified in the List of documents .

The results of report generation are displayed in the Result :

- Document-basis - displays the document on the basis of which the invoice is generated.

- Invoice – an invoice generated on the basis of a document. If the invoice details are specified directly in the base document, then the name of the base document is displayed.

- Posted —indicates that the invoice has been posted.

Errors in analytical accounting of materials

Gross deviations from accounting rules are not welcomed by either the accountant or the inspection bodies. If you strictly adhere to the order, the probability of making even a non-critical mistake will approach zero. While working, you need to pay close attention to:

- Checking the completeness, accuracy and reliability of the capitalization of inventory items;

- The time frame within which the movement of materials is recorded;

- Primary documents for compliance with registration requirements (are there any errors or forgeries);

- Timely transmission of reports from storekeepers and accountable persons in compliance with the document flow schedule.

The absence of a systematic recalculation and comparison of inventory accounting transactions, a regular report from the storekeeper to the accounting department about the presence of balances, mis-gradations, surpluses or shortages leads to chaos in accounting and losses for the enterprise as a whole.

Report “Tax Audit Risk Assessment”.

The form contains report management commands, a “quick” user settings field, and a report result field.

When opened, the “quick” user settings field displays the current list of parameters (the current settings option) by which data can be selected for generating a report. The list of “quick” user settings includes only those parameters that are defined for this during configuration, as well as those for which the “ Quick access ” mode is specified in the user settings of each such parameter. By checking or unchecking options, and changing comparison conditions and comparison values, you can quickly obtain different slices of data.

To edit the full list of current settings, execute the “ Settings ” command. In the form that opens, the selection conditions for generating the report are created. The list may contain additional parameters.

To use existing settings, execute the command “ All actions - Select setting ”. In the list, select the desired setting and click the “ Select ” button. The selection command is present only if the report or configuration has the “ Storage of custom report settings ” property set.

The report may contain several options for report settings defined during configuration. To select the desired option, use the “ Select Option ” command. In the list, select the desired option and click the “ Select ” button. The list will contain those settings that were previously saved by the “ All actions - Save settings ” command.

If the values of all parameter settings are intended to be used to build a report in the future (possibly if the user has the “ Save user data ” right), then a version of these settings can be saved. To do this, execute the command “ All actions - Save option ”. In the form that opens, specify the name of the option and click the “ Save ” button.

If you need to change an existing option, run the command “ All actions - Change option ”. In the form that opens, select an option and click the “ Select ” button. Make the required changes and save the result.

If changes have been made to the “quick” user settings field and you want to return to the “standard” values (values that are saved for the current settings option), run the command “ All actions - Set standard settings ”.

To build a report, click the “ Generate ” button.

The result is displayed in the field of the spreadsheet document. In the upper part of which the values of the selection parameters used for this construction are indicated.

The report result can be saved in the 1C Accounting 8 program and also printed.

Next Previous

These features are available to both users of local versions and cloud solutions, for example 1C:Fresh, 1C:Ready Workplace (WWW) . To purchase boxed versions or rent the 1C:Accounting 8 program in the cloud, please call +7(499)390-31-58, or e-mail: [email protected]

We recommend that you read the sections

Directories. Documentation. Operations.

| How to create a user with “Administrator” rights in 1C Accounting 8.3 |

| Standard accounting reports in 1C Accounting |

| Preparing to work with 1C Accounting |

| Preparation of regulated reporting |

How to Track Debt by Debt Age

You can track the debts of suppliers and buyers by timing. Since receivables are most often generated by a group of buyers, let’s look at the report using its example.

Note! Receivables may also appear for suppliers, for example, when they work on an advance payment basis. Then you can generate a report on them through “Settlements with suppliers”.

Output to report:

Menu “Manager” - subgroup “Settlements with customers” - report “Customers’ debt by debt terms”.

The report form that appears must be configured - click on the “Show settings” button and set:

- Intervals in which you need to generate a report (distribute debts), for example:

- debt period up to 7 days;

- debt period from 8 to 15 days and so on.

Important! You can set any values by adding or deleting rows at intervals in the report settings tab.

- Grouping (similar to accounting reports).

- Selection (similar to accounting reports).

Important! Once the report parameters have been set, you can fix them so that the report can then be automatically built according to the specified principles. To do this, without leaving the settings menu, click the “Save settings” button.

After setting the settings, set the date on which the report should be generated and click “Generate”. In the resulting table, debt data will be divided into columns with designated debt intervals.

The report can be presented in the form of a summary chart for the designated intervals of debt occurrence. To do this, check the box in the report form in the lower left corner:

| V | Diagram |

Read about how to set up accounting policies in 1C here.

If you have access to ConsultantPlus, find out how to analyze accounts receivable. If you don't have access, get a free trial of online legal access.