A year has passed since control over the payment of insurance premiums was again transferred to the Federal Tax Service. According to officials, the administration of contributions by tax inspectorates has a much better effect on their collection. The Social Insurance Fund was left only with the collection of contributions in case of injuries and occupational diseases of workers. How to calculate and pay insurance premiums in 2021 - we will tell you all the changes and the latest news on this topic.

Approach to calculating insurance premiums in 2018

In 2021, insurance premiums, as before, are calculated based on:

- accruals in favor of individuals;

- established limits of the taxable base;

- insurance premium rates;

At the same time, the interest rate of the tariff directly depends on the amount subject to insurance premiums. Thus, before we present tables with premium rates for 2021, let us comment on the above-mentioned components.

Accruals in favor of “physicists”

In 2021, all employers are required to pay contributions to pension, social and health insurance from employee payments.

Insurance premiums in 2021 are required to be calculated on remunerations paid in cash and in kind:

- employees within the framework of labor relations;

- the head of the organization - the only participant, regardless of the existence of an employment contract with him;

- performers under civil contracts, the subject of which is the performance of work or provision of services;

- performers under copyright agreements.

Amounts not subject to insurance premiums in 2021 are given in Article 422 of the Tax Code of the Russian Federation.

Example

In 2021, the tax base for contributions has not changed. To calculate the base, you must first add up all payments that relate to the object of taxation. The list of such payments is listed in paragraph 1 of Article 420 of the Tax Code of the Russian Federation. For example, salary. Vacation pay.

Then you need to subtract non-taxable payments from the resulting value. For a list of such payments, see Article 422 of the Tax Code of the Russian Federation. For example, state benefits, financial assistance in the amount of up to 4,000 rubles. in year.

Limits and taxable base in 2021

In 2021, the maximum base for calculating insurance premiums has become larger. See “Maximum base for calculating insurance premiums from 2021.”

Base for calculating insurance premiums in 2021: table

| Contributions | Base | |

| 2017 | 2018 | |

| For compulsory pension insurance | 876,000 rub. | RUB 1,021,000 |

| For compulsory social insurance in case of temporary disability and in connection with maternity | 755,000 rub. | 815,000 rub. |

| For health insurance | Not approved | |

Contribution rates in 2021: table

The tariffs for pension, medical and insurance contributions for temporary disability and in connection with maternity will not change in 2021 (Federal Law No. 361-FZ of November 27, 2017). So, if an organization or individual entrepreneur does not have the right to use reduced tariffs, then in 2018 it is necessary to charge contributions at the basic tariffs. They are listed in the table:

| Type of contributions | Base in 2021 | Rate within the base | Rate over base |

| Pension | RUB 1,021,000 | 22% | 10% |

| For social insurance in case of temporary disability and maternity | 815,000 rub. | 2,9 % (1,8 %) | |

| Medical | Not installed | 5,1 % | |

The general contribution rate in 2021 is 30% (Articles 425, 426 of the Tax Code of the Russian Federation):

- 22% – for pension insurance;

- 5.1% – for health insurance;

- 2.9% - for social insurance. In this case, the amount of contributions to be paid depends on whether the income exceeded the established limit or not.

The 30% rate will be valid until 2021 inclusive (Articles 425, 426 of the Tax Code of the Russian Federation). The extension of the tariff is provided for by Federal Law No. 361-FZ dated November 27, 2017.

Keep in mind

Each policyholder calculates the limit separately. If an employee joined a company in mid-2021, then do not take into account the income that he received from another employer in the limits.

New reporting on contributions

Although from 2021 all functions for monitoring the payment of contributions (except for contributions for injuries) will be transferred to the Federal Tax Service, there remains reporting that must be submitted to the funds.

To the Pension Fund :

- monthly SZV-M - no later than the 15th day of the month following the reporting month (previously it was until the 10th);

- once a year, personalized accounting information (SZV-Experience) - no later than March 1, 2021 for 2021.

To the Social Insurance Fund :

- updated form 4-FSS, deadlines are the same - no later than the 20th day of the month following the reporting quarter (on paper) and no later than the 25th day for electronic reporting (if the number of employees is more than 25 people).

to the tax office , which combines information that was previously included in the RSV and 4-FSS forms. A single calculation of contributions must be submitted no later than the 30th day following the reporting period (clause 7 of Article 431 of the Tax Code of the Russian Federation).

Basic insurance premium rates in 2021

Below is a table with the main rates of insurance premiums in 2018:

| Index | Tariff in 2021 |

| For compulsory pension insurance (within 1,021,000 rubles) | 22% |

| For compulsory pension insurance (over 1,021,000 rubles) | 10% |

| For compulsory social insurance in case of temporary disability and in connection with maternity (within 815,000 rubles) | 2,9% |

| For compulsory social insurance in case of temporary disability and in connection with maternity in relation to foreigners and stateless persons temporarily staying in the Russian Federation (except for HQS) (within 815,000 rubles) | 1, 8% |

| For compulsory social insurance in case of temporary disability and in connection with maternity (over 815,000 rubles) | 0 % |

| For compulsory medical insurance (except for foreigners and stateless persons temporarily staying in the Russian Federation, as well as HQS) | 5,1 % |

Income tax

This tax is paid at the expense of the employee and is officially called Personal Income Tax - Personal Income Tax. Its size is calculated as a percentage relative to wages and is:

- 13% - for a citizen of the Russian Federation or a foreigner, but staying on the territory of the Russian Federation for more than six months (183 days);

- 30% - for a foreign citizen staying in the country for less than 183 days;

- 35% - tax on other payments qualified as material benefits, applies to everyone, regardless of citizenship.

Reduced insurance premium rates

In 2021, the preferential categories of policyholders who are entitled to pay premiums at reduced rates do not change.

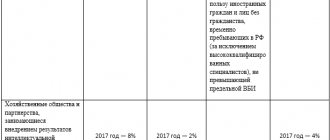

| Conditions for applying the reduced tariff | Insurance premium rates, % | ||

| pension insurance | social insurance | health insurance | |

| Business entities and partnerships that practically apply (implement) the results of intellectual activity, the exclusive rights to which belong to their founders (participants): - budgetary or autonomous scientific institutions; – budgetary or autonomous educational organizations of higher education | 8,0 | 2,0 | 4,0 |

| Organizations and entrepreneurs who have entered into agreements on the implementation of technology-innovation activities and who make payments to employees working: – in technology-innovation special economic zones; – in industrial and production special economic zones | |||

| Organizations and entrepreneurs who have entered into agreements on the implementation of tourism and recreational activities and who make payments to employees working in tourist and recreational special economic zones, united by a decision of the Government of the Russian Federation into a cluster | |||

| Russian organizations that work in the field of information technology and are engaged in: – development and implementation of computer programs and databases; – provision of services for the development, adaptation, modification of computer programs, databases (software and information products of computer technology); – installation, testing and maintenance of computer programs and databases | |||

| Organizations and entrepreneurs with payments and remunerations for the performance of labor duties to crew members of ships registered in the Russian International Register of Ships (except for ships for storage and transshipment of oil and petroleum products in Russian seaports) | 0 | 0 | 0 |

| Organizations and entrepreneurs on the simplified tax system engaged in certain types of activities and if their cumulative income for the calendar year does not exceed 79 million rubles. | 20,0 | 0 | 0 |

| Payers of UTII: pharmacy organizations and entrepreneurs with a license for pharmaceutical activities, with payments to citizens who have the right or are admitted to pharmaceutical activities | |||

| Non-profit organizations that use simplified legislation and operate in the field of: – social services for the population; – scientific research and development; – education; – healthcare; – culture and art (the activities of theaters, libraries, museums and archives); – mass sports (except professional). Exception – state and municipal institutions | |||

| Charitable organizations simplified | |||

| Entrepreneurs who apply the patent taxation system, except for: – those leasing (renting) residential and non-residential premises; – working in the retail and catering industry | |||

| Organizations participating in the Skolkovo project | 14,0 | 0 | 0 |

| Commercial organizations and entrepreneurs with the status of residents of the territory of rapid socio-economic development in accordance with the Law of December 29, 2014 No. 473-FZ8 | 6,0 | 1,5 | 0,1 |

| Commercial organizations and entrepreneurs with the status of residents of the free port of Vladivostok in accordance with the Law of July 13, 2015 No. 212-FZ | 6,0 | 1,5 | 0,1 |

All of the above reduced rates can also be summarized into a single table with rates. As a result, we get the following:

| Rate | Who has the right to apply |

| 20% | Small businesses using simplified rules, patents, pharmacies using special regimes, charitable and socially oriented non-profit organizations using simplified rules |

| 14% | Economic companies and partnerships that are engaged in technical innovation activities and tourism and recreational activities in the territory of special economic zones |

| Participants of the Skolkovo project | |

| IT companies | |

| 7,6% | Payers who received the status of a participant in a free economic zone in the territory of Crimea and Sevastopol, the status of a resident of the territory of rapid socio-economic development, the status of a resident of the free port of Vladivostok |

| 0% | Payers in relation to payments to crew members of ships from the Russian International Register of Ships |

What “simplified” people need to know about the new OKVED classifier

In 2021, the new OKVED2 classifier came into force (approved by order of Rosstandart dated January 31, 2014 No. 14-st). Because of this, the codes for some preferential activities have changed. This does not affect the reduced tariff in any way. A change in OKVED cannot deprive you of benefits. This is provided for by Federal Law No. 335-FZ of November 27, 2017. For more details, see “New preferential activities under the simplified tax system”

Payment of fees: nuances

Firms with Skolkovo resident status may also not pay contributions to the FFOMS. Moreover, they have the right to use this opportunity for 10 years after acquiring the corresponding status (more precisely, from the 1st day of the month following the month in which the Skolkovo resident status was obtained).

In addition, the company’s activities must comply with a number of other criteria:

- the enterprise’s cumulative profit from the beginning of the year should not exceed 300,000,000 rubles;

- The company’s revenue at the end of the year should not exceed 1,000,000,000 rubles.

From the 1st day of the month following the month in which the company exceeded the relevant indicators for revenue and profit, the benefit in question is not used. Data on the financial performance of the company is provided to the Federal Tax Service by the structure that manages it.

Additional tariffs for 2021

Employers pay additional insurance premiums from the salaries of employees who work in harmful and dangerous conditions. Tariffs depend on the results of a special assessment or their absence (clause 3 of Article 428 of the Tax Code of the Russian Federation). If a special assessment of working conditions was not carried out and classes of working conditions as of 2021, then apply the following additional tariffs:

| Who pays | Pension insurance contribution rate, % |

| Organizations and entrepreneurs that make payments to employees engaged in work specified in paragraph 1 of part 1 of Article 30 of the Law of December 28, 2013 No. 400-FZ (according to List 1, approved by Resolution of the Cabinet of Ministers of the USSR of January 26, 1991 No. 10) | 9,0 |

| Organizations and entrepreneurs who make payments to employees engaged in work specified in paragraphs 2–18 of part 1 of Article 30 of the Law of December 28, 2013 No. 400-FZ (approved lists of professions, positions and organizations in which work gives the right to early retirement old age) | 6,0 |

If a special assessment of working conditions was carried out, then additional tariffs are distributed by class:

| Working conditions | Pension insurance contribution rate, % | Base |

| class – dangerous subclass – 4 | 8,0 | clause 3 art. 428 Tax Code of the Russian Federation |

| class – harmful subclass – 3.4 | 7,0 | |

| class – harmful subclass – 3.3 | 6,0 | |

| class – harmful subclass – 3.2 | 4,0 | |

| class – harmful subclass – 3.1 | 2,0 | |

| class – valid subclass – 2 | 0,0 | |

| class – optimal subclass – 1 | 0,0 |

If it is possible to apply different additional tariffs for payments in favor of one employee, then contributions must be calculated at the highest. For example, a special assessment (certification) was not carried out, and the employee is simultaneously employed in the work specified in clause 1 of part 1 of Art. 30 of Law No. 400-FZ, and on the work specified in paragraphs 2 - 18, part 1, art. 30 of Law No. 400-FZ. This means that contributions from his payments must be calculated at an additional rate - 9%.

Insurance rates for individual entrepreneurs

From 2021, the amount of individual entrepreneur contributions no longer depends on the minimum wage. Now the legislation fixes the exact amount of payments made by individual entrepreneurs “for themselves” for compulsory pension insurance. See “Insurance premiums for individual entrepreneurs from 2021”.

For individual entrepreneurs whose income does not exceed 300 thousand rubles, the amount of contributions for compulsory pension insurance is 26,545 rubles, for compulsory medical insurance – 5,840 rubles. However, individual entrepreneurs whose annual income is more than 300 thousand rubles still must pay additional pension contributions at a rate of 1%. That is, if the income of an individual entrepreneur for a year exceeds 300 thousand rubles, then in addition to fixed contributions, the entrepreneur must transfer to the Federal Tax Service an additional amount in the amount of 1% of the amount exceeding the limit (clause 1 of Article 430 of the Tax Code of the Russian Federation). Here is a table with the new values:

| Contributions | Bid | Payment amount |

| Fixed contributions to pension insurance if the amount of income for the year does not exceed 300 thousand rubles | – | RUB 26,545 |

| Additional contributions to pension insurance if the amount of income for the year is more than 300 thousand rubles | 1 % | 1% of the amount of the individual entrepreneur’s annual income, reduced by 300,000 rubles. |

| Fixed premiums for health insurance | – | RUB 5,840 |

Read also

25.10.2016