Decree of the Government of the Russian Federation dated May 6, 2008 No. 359

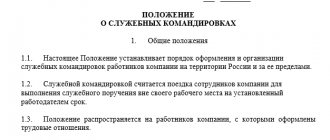

Approved

Government Decree

Russian Federation

dated May 6, 2008 No. 359

Regulations on the implementation of cash payments and (or) settlements using payment cards without the use of cash register equipment

1. This Regulation establishes the procedure for organizations and individual entrepreneurs to carry out cash payments and (or) payments using payment cards without the use of cash register equipment in the case of providing services to the population, subject to the issuance of a document drawn up on a strict reporting form, equivalent to a cash receipt, as well as the procedure for approval, recording, storage and destruction of such forms.

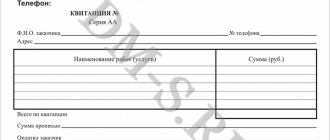

2. On strict reporting forms, receipts, tickets, travel documents, coupons, vouchers, subscriptions and other documents equivalent to to cash receipts (hereinafter referred to as documents).

3. The document must contain the following details, except for the cases provided for in paragraphs 5 and 6 of these Regulations:

a) name of the document, six-digit number and series;

b) name and legal form - for the organization;

last name, first name, patronymic - for an individual entrepreneur;

c) location of the permanent executive body of the legal entity (in the absence of a permanent executive body of the legal entity - another body or person having the right to act on behalf of the legal entity without a power of attorney);

d) taxpayer identification number assigned to the organization (individual entrepreneur) that issued the document;

e) type of service;

f) the cost of the service in monetary terms;

g) the amount of payment made in cash and (or) using a payment card;

h) date of calculation and preparation of the document;

i) position, surname, name and patronymic of the person responsible for the transaction and the correctness of its execution, his personal signature, seal of the organization (individual entrepreneur);

j) other details that characterize the specifics of the service provided and with which the organization (individual entrepreneur) has the right to supplement the document.

4. The document form is printed or generated using automated systems.

A document form produced by printing must contain information about the manufacturer of the document form (abbreviated name, taxpayer identification number, location, order number and year of its execution, circulation), unless otherwise provided by regulatory legal acts on the approval of forms of such document forms.

5. If, in accordance with the legislation of the Russian Federation, federal executive authorities are vested with the authority to approve forms of document forms used in the provision of services to the population, such federal executive authorities approve the specified forms of document forms for making cash payments and (or) settlements with using payment cards without using cash register equipment.

6. If it is necessary to exclude from the form of the document the details provided for in subparagraphs “g” - “i” of paragraph 3 of these Regulations, the form of document forms when providing services by cultural institutions (cinema and film distribution institutions, theatrical and entertainment enterprises, concert organizations, philharmonic groups, circus enterprises and zoos, museums, parks (gardens) of culture and recreation), including exhibition services and artistic design, and physical culture and sports services (carrying out sports and entertainment events) are approved by the relevant federal executive authorities exercising the functions of developing state policy and legal regulation in the established field of activity.

7. The list of information contained in the documents specified in paragraphs 5 and 6 of these Regulations is established by the federal executive authorities vested with the authority to approve forms of document forms.

The forms of document forms approved in accordance with paragraphs 5 and 6 of these Regulations are used by organizations and individual entrepreneurs providing services to the population of the types for which these forms are approved.

8. When filling out a document form, it must be ensured that at least 1 copy is completed at the same time, or the document form must have detachable parts, unless otherwise provided by the regulatory legal acts of the federal executive authorities specified in paragraphs 5 and 6 of these Regulations.

9. Placing the series and number on the form of a printed document is carried out by the manufacturer of the forms. Duplicating the series and number on the document form is not allowed, with the exception of the series and number applied to the copy (tear-off parts) of the document form, drawn up in accordance with paragraph 8 of these Regulations.

10. The document form must be filled out clearly and legibly; corrections are not allowed. A damaged or incorrectly filled out document form is crossed out and attached to the document form book for the day on which they were filled out.

11. Document forms can be generated using an automated system. At the same time, in order to simultaneously fill out the document form and issue the document, the following requirements must be met:

a) the automated system must be protected from unauthorized access, identify, record and store all operations with the document form for at least 5 years;

b) when filling out a document form and issuing a document by an automated system, the unique number and series of its form are stored.

12. Organizations and individual entrepreneurs, at the request of tax authorities, are required to provide information from automated systems about issued documents.

13. Accounting of document forms produced by printing, according to their names, series and numbers, is maintained in the document form accounting book. The sheets of such a book must be numbered, laced and signed by the head and chief accountant (accountant) of the organization (individual entrepreneur), and also sealed (stamp).

14. The head of the organization (individual entrepreneur) concludes with the employee who is entrusted with receiving, storing, recording and issuing document forms, as well as accepting cash from the population in accordance with the documents, an agreement on liability in accordance with the legislation of the Russian Federation.

The head of the organization (individual entrepreneur) creates conditions that ensure the safety of document forms.

15. Document forms received by the organization (individual entrepreneur) are accepted by the employee specified in paragraph 14 of these Regulations in the presence of a commission formed by the head of the organization (individual entrepreneur). Acceptance is made on the day the document forms are received. Upon acceptance, the compliance of the actual quantity, series and numbers of document forms with the data specified in the accompanying documents (invoices, receipts, etc.) is checked, and an acceptance certificate of document forms is drawn up. The act approved by the head of the organization (individual entrepreneur) is the basis for the acceptance of document forms for registration by the specified employee.

16. Forms of documents are stored in metal cabinets, safes and (or) specially equipped premises under conditions that prevent their damage and theft. At the end of the working day, the storage area for document forms is sealed or sealed.

17. Inventory of document forms is carried out within the time frame for conducting an inventory of cash in the cash register.

18. When monitoring the proper use of document forms, the presence of the seal of the organization (individual entrepreneur) and the signature of the chief accountant (accountant) or individual entrepreneur on the covers (sheets pasted on books) of used books with receipts (bound forms) is checked, as well as the presence of copies of documents (document spines), the absence of corrections in them, the correspondence of the amounts indicated in the copies (document spines) with the amounts reflected in the cash book.

19. Copies of documents (stubs) confirming the amount of cash received (including using payment cards) packed in sealed bags are stored in a systematic manner for at least 5 years. At the end of the specified period, but not earlier than the expiration of a month from the date of the last inventory, copies of documents (stubs) are destroyed on the basis of an act of their destruction drawn up by a commission formed by the head of the organization (individual entrepreneur). Incomplete or damaged document forms are destroyed in the same manner.

20. If documents are used, cash payments and (or) payments using payment cards without the use of cash register equipment are carried out in the following order:

a) when paying for services in cash, an authorized person of the organization (individual entrepreneur):

fills out the document form, with the exception of the space for personal signature (if such details are available);

receives funds from the client;

names the amount of funds received and places them separately in full view of the client;

signs the document (if there is space for a personal signature);

names the amount of change and gives it to the client along with the document, while paper bills and small change coins are issued at the same time;

b) when paying for services using a payment card, an authorized person of the organization (individual entrepreneur):

receives a payment card from the client;

fills out the document form, with the exception of the space for personal signature (if such details are available);

inserts a payment card into a device for reading information from payment cards and receives confirmation of payment on the payment card;

signs the document (if there is space for a personal signature);

returns the payment card to the client along with a document and a document confirming the transaction using the payment card;

c) when making a mixed payment, in which one part of the service is paid in cash, the other - using a payment card, the issuance of the document and change, as well as the return of the payment card, are carried out simultaneously.

Accounting for BSO in an LLC: traditional forms

Accounting for traditional BSO in a business company includes 3 types of basic procedures:

1. Reflection of information about forms in a special Accounting Book.

2. Organization of storage, issuance of BSO to employees, receipt of relevant documents from them, acceptance of forms from the printing house.

3. Reflection of transactions with forms in accounting registers.

Read about the procedure for accepting BSO from the printing house in the article “Act of acceptance and transfer of strict reporting forms - sample.”

Accounting for BSO in an LLC using the simplified tax system

In general, the procedure for the turnover of BSO under the simplified tax system is carried out in exactly the same way as in companies operating on the special tax system, however, tax accounting for the cost of forms on the simplified tax system and the special tax system differs. If a company operates under a simplified “income minus expenses” scheme, the costs of issuing forms can be taken into account as part of material costs (subclause 6, clause 1, article 254 of the Tax Code of the Russian Federation). In turn, if the company operates on the operating system, then the corresponding costs are included in other expenses (subclause 49, clause 1, article 264 of the Tax Code of the Russian Federation). In addition, VAT paid on invoices from the printing house can be accepted for deduction by a business company operating under the OSN.

BSO from 07/01/2019: details

In the updated BSO (those whose registration rules are regulated by Law No. 54-FZ), the list of details is significantly wider than in traditional forms. They should be recorded:

- Title of the document;

- BSO serial number for the shift;

- date, time, place of settlements with the client;

- name of the service provider company, its tax identification number;

- information about the taxation system applied by the service provider;

- payment indicator (receipt, return, expenditure of funds);

- the name of the services provided, if possible - their quantity and composition, price taking into account discounts and markups;

- total invoice amount to the client including VAT information;

- payment method - cash or electronic means;

- Full name and position of the employee of the service provider company who accepted the payment;

- CCP registration number;

- serial number of the fiscal drive;

- fiscal sign;

- the address of the web page where you can test the authenticity of the fiscal indicator;

- the client’s phone number or e-mail if the BSO is sent to him electronically;

- e-mail of the service provider company that sent the BSO to its client in electronic form;

- serial number of the fiscal document;

- work shift number;

- a fiscal sign for a message using a form, information about which is recorded in the cash register storage device or transmitted to the operator.

The algorithm for filling out a new BSO generally corresponds to that discussed above. However, the peculiarity of BSOs generated using automatic systems related to cash register systems is that information about settlements for services rendered is transmitted to the Federal Tax Service automatically - through online channels.

The organization determines the procedure for appointing those responsible for the turnover of new cash registers independently as the user of cash register equipment, who is responsible for the use of cash register equipment on his own behalf (Article 1.1 of Law No. 54-FZ).

Results

The requirements for drawing up and filling out the BSO in the legislation of the Russian Federation are the same for service providers in any organizational and legal form, including LLC. When using strict reporting forms, business companies must ensure compliance of the applied BSO with the requirements of Government Decree No. 359 dated 05/06/2008 and Law No. 54-FZ dated 05/22/2003.

You can learn more about the use of BSO in enterprises in the articles:

- “Act on writing off strict reporting forms - sample”;

- “When were paper checks KKT and BSO abolished?”

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.