Account 76. AB If it is necessary to calculate and withhold alimony amounts collected from employees, also

The registration number of the customs declaration is a specific reporting codifier indicating information about the customs authority,

To take part in obtaining profitable contracts and government orders and financially

Paragraph 2 of Article 257 of the Tax Code determines that the initial cost of fixed assets may change

Home — Articles According to Art. 53 of the Tax Code of the Russian Federation, the tax base is a cost, physical

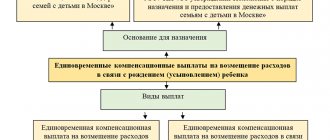

Home / Family law / Benefits and benefits Back Published: 07/29/2018 Reading time:

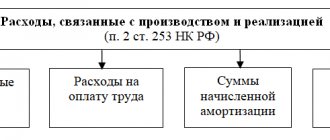

Such expenses, in particular, include: penalties for taxes and contributions to government

Changes in 2021 Drastic changes in reporting deadlines, tax payment and procedure

Why do you need an order for the right to sign the Ministry of Finance of the Russian Federation in information dated December 4, 2012 No.

According to statistics from tax authorities, VAT ranks second in terms of revenue. Any enterprise (or