Why do you need an order for the right to sign?

The Ministry of Finance of the Russian Federation in information dated December 4, 2012 No. PZ-10/2012, commenting on the provisions of the Law “On Accounting” dated December 6, 2011 No. 402-FZ, expressed the opinion that the head of an economic entity is obliged to approve lists of persons who are authorized to sign primary accounting documents.

The position of the department is based on the provisions of Art. 7 and 9 of Law No. 402-FZ and can be considered as defining a successive rule of law relative to the one established in paragraph 3 of Art. 9 of the Law “On Accounting” dated November 21, 1996 No. 129-FZ, which was previously in force. The previous legal acts regulating accounting contained a direct requirement for the manager to approve the list of persons who have the right to sign on the primary document.

The current legislation does not regulate how the relevant persons should acquire their powers. In practice, in Russian organizations it is common to consolidate these powers by issuing by management:

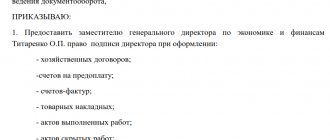

- an order for the right to sign the primary document by a specific person or a list of persons;

- power of attorney for the right to sign the primary document.

Let us consider the specifics of both methods of transferring rights to sign a primary document in more detail.

Document details

The legislation provides for mandatory details of primary documents that must be indicated by the organization. Their presence determines whether the documents will be taken into account in the final reporting when deducting amounts from the tax base, whether the fact of a business transaction will be accepted, and whether the Federal Tax Service will have any claims regarding the legality of the transactions.

Mandatory details of primary documents include the following information:

- names of the supplier, buyer, consignee and payer for transportation;

- bank details, TIN, physical and legal address of companies;

- document number and date;

- items that were moved, purchased or sold during the transaction;

- units of measurement, quantitative and cost expression of nomenclature;

- the total amount for all positions in the document;

- signatures, positions, transcripts of signatures of responsible persons;

- make, car number, driver’s details during transportation;

- number of seats, weight and category of cargo transported;

- the basis for issuing the document, the number and date of the contract, information about specifications, certificates, examinations, if any.

How to certify the right to sign primary documents - by order or power of attorney

The main criterion for distinguishing between an order for the right to sign primary documents and a power of attorney in this case is that the validity of a document of the first type applies only to employees of the business entity, while the second type applies to any persons specified in the document. The drawing up of orders and powers of attorney is regulated by different branches of law - labor and civil, respectively.

The procedure for issuing a power of attorney for the right to sign invoices was explained by ConsultantPlus experts. Get trial access to the system and upgrade to the Ready Solution for free.

The choice of an order as a normative act certifying the transfer of the right to sign the primary document will be optimal in cases where only internal documents are intended to be signed. At the same time, there is absolutely no need (primarily from the point of view of the security of the transfer of corporate information) to grant unnecessary powers to third parties.

In turn, if this or that documentation needs to be signed and then transferred to the third party (for example, accompanying documents for transported cargo or an invoice), then in this case a power of attorney may be needed.

Both in the power of attorney and in the order, it is important to reflect:

- personal data of the authorized person;

- a list of specific types of documents that an authorized person has the right to sign.

Also, in both cases, the head of the business entity certifies a sample signature of the authorized person, which is affixed by the person in a separate column of the order or power of attorney.

Examples of primary documentation

Every day the company performs certain actions: purchases goods, issues invoices, ships products, pays for purchases and taxes, receives and spends funds at the cash register. All these operations are documented with primary documents. To accurately reflect the listed actions in accounting, the following forms of documents are used:

- TORG-12 or waybill;

- invoice;

- incoming and outgoing cash orders;

- acts of completed work and services;

- acts of transfer of material assets;

- waybill;

- payment orders and bank statements;

- requirement for the issuance of material assets.

To this list you can add quite a lot of examples of primary documentation used in the company. Its main difference from accounting registers and reporting is the execution of the document during the operation or with a slight delay.

Where can I download an order for the right to sign primary documents - sample

You can download a sample order for the right to sign on our portal.

ConsultantPlus experts told how tax authorities check signatures in primary documents during an audit and how to properly prepare for a tax audit. Study the material by getting trial access to the K+ system for free.

Types of documents in an organization

Companies carry out business transactions every day, which must be immediately reflected in accounting, management and tax accounting. What are primary documents? This is precisely a reflection of these operations, also serving as proof that they took place. Then, for the purposes of analysis, systematization, control, forecasting and for the implementation of other economic procedures, all documents on transactions are registered in special directories and journals - accounting registers. And at the end of the reporting period, based on information about all operations, reporting documentation is prepared, which is the final reflection of the company’s activities for a certain period.

Results

An order for the right to sign primary documents (power of attorney) is a document the use of which is determined by the requirements of the legislation of the Russian Federation on accounting. The order (as well as the power of attorney) must reflect the data of the employee who has received the appropriate authority, a sample of his signature, as well as a list of documents that he has the right to sign.

You can learn more about how orders and powers of attorney for the right to sign primary documents are drawn up in the articles:

- “Sample order for granting the right to sign invoices”;

- “Sample power of attorney for the right to sign invoices”;

- “Order on granting signing rights to the chief accountant”.

Sources:

- Information from the Ministry of Finance of Russia N PZ-10/2012

- Federal Law of December 6, 2011 N 402-FZ “On Accounting”

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

How to delegate authority

Since the strict law on the right of second signature is no longer in force and any employee or third party is allowed to certify documents, two situations are possible:

- Authority is transferred to a full-time employee of the organization.

- Documents can be certified by a third party with whom a contract for the provision of paid services or another agreement has been concluded.

In the first case, the manager issues an order granting one or more employees the authority to certify certain documents. Such an order usually clearly stipulates who will be able to certify what papers in the absence of superiors, or transfers everything at once.

IMPORTANT!

It is impossible to include absolutely any employee in the order. If the employee’s responsibilities do not include actions with the distribution of funds, the formation and direction of payments, he will not be able to certify such papers.

The second option is if the company has outsourced accounting services or all accounting and financial activities are carried out by a third-party specialist. In this case, they first conclude a service agreement, which spells out the obligations of the parties, and in addition draw up a power of attorney to represent interests. There are no special requirements for a power of attorney; it is subject to the norms of civil law.

Download the required samples for free from ConsultantPlus:

- power of attorney template;

- order template.

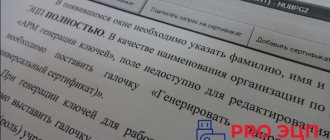

Electronic signature

The primary document can be signed in another way - electronically. The condition is the maintenance of electronic document management, the availability of appropriate software and hardware and an electronic signature certificate. A power of attorney must also be issued for the person whose name appears on the certificate. After completing all the procedures for setting up and registering electronic document management and signatures, the employee will be able to put his own signature on the basis of a power of attorney instead of the signature of the chief accountant, director and other persons provided for by the power of attorney.

What it is

This is a document for transfer from the seller to the client, which is required to record the completion of the next business transaction. It is called that because it combines the functionality and important fields of several files - SF and primary files.

The main goal is to reduce and speed up document flow, avoid errors and unnecessary time delays. Now included as standard data for successful transaction completion. It can be used for tax purposes, which greatly simplifies the process.

Completing all or individual signatures in the UPD is a serious part of the transaction. This form confirms that everything is drawn up correctly, the parties agree to this, and the paper is filled out correctly. You should clarify in advance who should sign and where.

Termination of power of attorney

The law does not establish maximum and minimum restrictions. Previously, it was allowed to empower representatives for no more than 3 years. Now Article 186 of the Civil Code of the Russian Federation does not contain any mention of this kind. However, lawyers recommend specifying the terms of powers of attorney. To avoid disputes, the exact period is indicated on the form. Otherwise, the document loses its relevance 12 months from the date of signing.

In addition to the expiration of the term, the Civil Code of the Russian Federation provides for other cases of termination of powers of attorney. These include:

- voluntary resignation by a representative;

- withdrawal of the document by society;

- liquidation of the company, including in the process of reorganization;

- bankruptcy of the principal or representative;

- death of an individual, loss of legal capacity, recognition as missing or dead.

If the power of attorney is revoked by the principal before the deadline established in it, the interested parties must be notified. The message is published in the Kommersant newspaper. Documents certified by a notary are revoked and a corresponding entry is made in a special register (188–189 of the Civil Code of the Russian Federation).

Nuances in signing papers by the chief accountant

Before changes were made to legal acts in 2014, the mandatory presence of a chief accountant’s visa in some papers, as well as the understanding that this is the right of a second signature, were enshrined at the legislative level.

Currently there is no definition provided in the legislation. In essence, this is the approval of some acts by another employee, in addition to the manager, the chief accountant. It is not provided on its own upon appointment to the position of chief accountant. The order states that the chief accountant receives the authority to sign specific papers, and this right of financial signature in the event of his vacation or illness will be temporarily transferred to another person.

What company documents are not signed by the director?

We are talking about documents that:

1. Sent to the Federal Tax Service for the purpose of state registration of a legal entity.

In accordance with sub. "a" clause 1.3 art. 9 of the Law “On State Registration” dated 08.08.2001 No. 129-FZ, a director or other person who has the right to act on behalf of a legal entity without a power of attorney has the right to send such documents.

In addition to the director, this right is vested in the founders, bankruptcy trustees, management of the legal entity that is the founder of the registered company, as well as persons authorized to register the organization by law or by virtue of the rules established by the state or municipal authority.

2. Signed in accordance with the charter of the organization only by its head.

For example, this could be accounting and financial reporting. If the charter does not contain a provision prohibiting the transfer of powers of the director to sign statements, then a power of attorney can be issued (letter of the Federal Tax Service dated June 27, 2013 No. ED-4-3/11569).

Where are the powers of attorney to perform the duties of a director?

You can download a completed sample power of attorney for the general director on our website.

This document provides a mechanism for transferring key managerial powers to a trusted person - related to the signing of contracts and documents used as part of the execution of business transactions.

In a number of cases, in order for a trustee to enter into legal relations, the range of powers delegated to him or her must be significantly expanded. For example, if you need to sign for a director within the framework of procedural legal relations - both within the framework of civil disputes (Article 54 of the Code of Civil Procedure of the Russian Federation) and within the framework of arbitration disputes (Clause 2 of Article 62 of the Arbitration Procedure Code of the Russian Federation). Separate requirements for drawing up a power of attorney for a representative are also established by administrative procedural legislation.