Regulatory regulation of tax reporting of an organization The main document regulating the composition and timing of reporting is Tax

When can you receive a social tax deduction from the state, and can you qualify for payments?

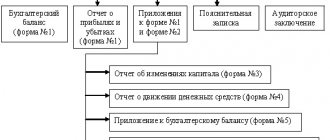

The most important requirement imposed by the legislator on the information included in the financial statements of a company is its reliability.

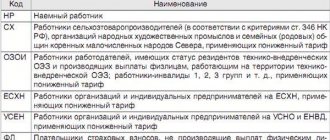

Budget income classification codes are divided not only by type of payment, but also by purpose.

Submission of calculations for insurance contributions made to the Tax Service office must be submitted before the 30th

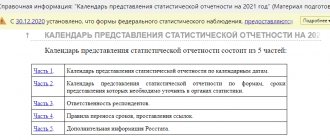

Every 5 years, Rosstat conducts continuous monitoring of the activities of small businesses. Between periods of continuous

Compliance period In order to understand how the credit institution fulfills the requirements

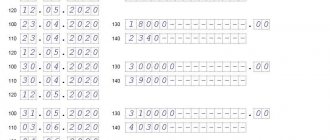

Employer reporting Olga Yakushina Tax expert-journalist Current as of May 27, 2019 Form 6-NDFL approved

Business lawyer > Accounting > Accounting and reporting > What is included

What is a report on the PM form? Like most documents submitted by entrepreneurs