Every 5 years, Rosstat conducts continuous monitoring of the activities of small businesses. Between periods of continuous observation, statistical reporting is submitted upon request, that is, there are no common deadlines for all. But all individual entrepreneurs and organizations that belong to small and micro enterprises must report for 2021.

There are two different reports for this:

- MP-SP for legal entities and peasant farms;

- 1-entrepreneur for individual entrepreneur.

In this article we will figure out how to fill out and submit a report using the MP-sp form.

Free accounting services from 1C

Who should submit the form?

The MP-SP form is only for legal entities that are small or micro enterprises. Peasant farms also submit a report.

Let us remind you that small and micro-enterprises include organizations that meet the following criteria:

| Small businesses | Microenterprises | |

| Sales revenue for the calendar year (excluding VAT) | within 800 million rubles | within 120 million rubles |

| Average number of employees | up to 100 people inclusive | up to 15 people inclusive |

| Share of participation of the Russian Federation, constituent entities of the Russian Federation, municipalities, public and religious organizations in the authorized capital | no more than 25% | no more than 25% |

| Share of participation of foreign organizations and organizations that are not SMEs | no more than 49% | no more than 49% |

In 2021, the MP-SP form will be submitted to all legal entities that meet these requirements. Even if the organization did not operate for part of the reporting period, the form must be submitted in the standard manner.

Results

In accordance with Law No. 209-FZ, Rosstat carries out continuous statistical observations of the development of the Northern Sea Route once every 5 years. As part of this work, the department collects information provided by firms through special forms.

Based on the results of 2021, all legal entities belonging to small and micro enterprises must report to the statistical authorities by April 1, 2021. In some cases this can be done until 05/01/2021. For this purpose, the MP-SP form is used, through which key economic indicators are reported to Rosstat (such as business turnover, the number of staff of the company, payroll, etc.).

You can familiarize yourself with other nuances of reporting to Rosstat in the articles:

- “Kids shouldn’t shy away from the statistical census.”

- “Find out what statistical reporting you must submit and when.”

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Filling out the MP-sp form

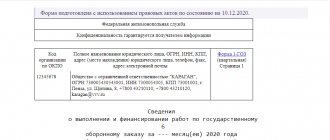

The MP-SP form and instructions for filling it out were approved by Rosstat order No. 469 dated August 17, 2020. The report consists of three sections and a title page, we will analyze everything in order.

Important! If in 2021 the organization underwent a reorganization, the structure of the legal entity or the methodology for calculating indicators changed, then the data for 2021 must also be provided based on the new procedure.

Title page

Completing the cover page usually does not cause difficulties for respondents. It must indicate the name and postal address of the organization. But please note that if the actual address does not coincide with the legal one, you must indicate in the line the address where you are actually located and can receive correspondence.

In the code part, indicate your INN and OKPO code. You can take the code from the notice of assignment of the OKPO code posted on the Rosstat website.

Section 1. General information

In the first section, a legal entity needs to answer only 4 questions. At the same time, economic entities that did not operate in 2021 answer only one of them.

Question 1.1 asks whether you were active in 2020. If yes, place an "X" on line 01 and continue to fill out the form sequentially. If not, put an “X” in line 02 and go to the third section (lines 24-32).

In question 1.2, enter the number of months of 2020 in which you were active. Count even those where you worked at least one full day.

In question 1.3 , indicate at what address you conduct business. If there are two or more such addresses, choose the one that generated the most revenue in 2021, and if the revenue is the same, choose the address with the largest number of employees.

In question 1.4, place an “X” next to the tax system used in 2021.

Section 2. Key indicators

In question 2.1 you need to talk about the number of employees and salaries. The first table is filled with one decimal place.

On line 09, indicate the number of employees on average per year; to do this, add up the payroll, external part-time workers and employees on the GPA.

Line 10 shows the average number of employees. Let us remind you that it does not include employees on maternity leave, on maternity leave, those studying and entering an educational institution (if they took leave at their own expense), and employees on the State Duty. To calculate the average number of employees for a year, you need to sum up the average number of employees in each month and divide by 12. In turn, calculate the average number of employees for the month by summing the payroll on each day of the month and dividing the sum by the number of days in the month.

On line 11, reflect the accrued salary fund. It includes wages in cash and in kind, bonuses and rewards, vacation pay, compensation, food and accommodation. Show in the line all accrued amounts, take into account personal income tax and other deductions. The actual payment date is not affected.

On line 12, select from line 11 payroll and part-time employees. To do this, it is necessary to take into account that line 11 reflects the payment to employees on civil servants’ contracts, as well as the payment to non-paid persons with whom contracts have not been concluded.

On line 13, show the average number of employees for 2021. Consider it by analogy with line 09.

In question 2.2, indicate the number of research workers for 2021. These include employees with higher education who are professionally engaged in research and development or manage its implementation. The number of months worked does not affect accounting.

In question 2.3, you need to talk about revenue from sales as a whole for the legal entity (line 15), as well as for each type of economic activity that the company actually conducts (line 16). Exclude VAT, excise taxes and other mandatory payments from the calculation.

Line 15 should be equal to the sum of the values for all free lines starting from 16. To fill out this line, use your reporting:

- for OSNO - income tax return;

- for the simplified tax system - a declaration according to the simplified tax system and KUDiR;

- for Unified Agricultural Tax - declaration on Unified Agricultural Tax;

- for UTII - according to primary accounting documentation, which reflects the cost of products sold.

Fill out column 3 on line 16 and the following in accordance with the list from OKVED2, which is posted on the Rosstat website.

In question 2.4 , from sales revenue for 2020 (line 15), highlight the cost of major and current repairs (excluding VAT), if you performed construction services not for your own needs, but under a contract or agreement. Reflect the cost on the basis of work acceptance documents.

In question 2.5 , from sales proceeds for 2020 (line 15), indicate the cost of construction or scientific and technical work, some of which was performed by other individuals and legal entities under a subcontract agreement.

In question 2.6, put an “X” in line 20 if in 2020 they provided services to the public and received payment from their consumers. A complete list of such services is given in the Guidelines.

In question 2.7 , line 22, if in 2021 you produced (shipped) new goods, works, services and (or) had costs for their development and implementation. New products are considered to be those that the company produces only starting in 2021 or has significantly improved in 2018-2020.

Section 3. Fixed assets and investments in fixed capital

In question 3.1, you need to show information about the availability of fixed assets and investments in them. The list of what relates to fixed assets within the MP-SP form is given in the Instructions. Line 24 reflects data on all fixed assets, and then separate types are distinguished from them: residential and non-residential buildings, structures, machinery and equipment, transport.

In column 3, reflect fixed assets at their original cost, taking into account its changes after revaluation, completion, modernization, additional equipment, reconstruction and partial liquidation. In column 4, show the availability of fixed assets at the end of 2021 at the residual book value, which is equal to the difference between the full book value and accumulated depreciation.

In question 3.2 from line 24 of column 5, highlight the cost of the acquisition and creation of fixed assets, which were made at the expense of the budget and separately from the federal budget.

In question 3.3 , indicate how many trucks, pickups, and vans your organization owns at the end of 2020. Consider employee drivers' own, leased, leased and personal vehicles.

Control ratios for MP-sp have not been approved. Therefore, check its correctness manually, sign it and send it to Rosstat.

MP-sp sample

Reports to microbusiness statistics in 2021

The activities of small businesses (including microenterprises) are subject to continuous statistical monitoring once every five years. The last such observation was in 2021 based on the results of activities for 2015.

In the interim periods, small businesses are subject to only random observation once a year. Its rules are defined in government decree No. 79 of February 16, 2008.

The full list of statistical reporting for microorganizations includes 18 forms. The vast majority of them are related to specific types of activities. The main form is MP (micro); Who is required to submit a report will be discussed below.

To understand what reports micro-enterprises submit to statistics in 2020, you should refer to the special Rosstat resource statreg.gks.ru. On the page that opens, after filling in the company data, you will receive a list of statistical forms to be submitted. Some regional departments of Rosstat publish a list of organizations included in the sample on their websites. For example, a list of selected organizations in St. Petersburg and the Leningrad region is located on the Petrostat page in the section Reporting → Statistical reporting → List of reporting business entities.

Responsibility for late delivery of MP-SP

For failure to submit the form or late submission, as well as for providing false information, an administrative fine is imposed (Article 13.19 of the Code of Administrative Offenses of the Russian Federation):

- for officials - from 10,000 to 20,000 rubles;

- for legal entities - from 20,000 to 70,000 rubles.

Please note that even if you have paid the fine, you still need to submit the form to Rosstat.

In some cases, statistical agencies can work directly with respondents who have evaded surrendering, by conducting a walk-through and calling. If the respondent submits a report based on the results of these activities, no penalties will be applied to him.

What is a PM form report?

Like most documents that entrepreneurs submit to Rosstat, the PM report form from small organizations consists of a title page and several tables. The current form was approved by Order No. 419 of July 22, 2019, and the rules for filling it out are prescribed in Order No. 22 of January 23, 2020.

The PM form was introduced to collect and analyze data on the main performance indicators of small businesses, including:

- number of employees;

- their wages;

- general economic indicators;

- production costs.

How to pass MP-SP through Extern

The MP-SP form can be submitted electronically on the Rosstat website and on the State Services portal, as well as through Kontur.Extern. Kontur.Extern is an automated service that supports the submission of more than 300 reporting forms to Rosstat, does not require additional agreement, automatically updates the forms and checks them before sending. In addition, you will be able to submit reports to all regulatory authorities at once and correspond with them.

To start working with Externa, register with the service and issue an electronic signature. New users receive 3 months of service as a gift.

To submit reports to the FSGS, log in to the service and go to the “Rosstat” tab. Select the method of generating a report - upload a file or create a report in the system interface.

Extern will automatically check the form before submitting and notify you when Rosstat receives the report. Detailed instructions for submitting reports.

Procedure for filling out PM

Step-by-step instructions on how to fill out a PM (statistics) report for respondents include the following steps.

Step 1. We draw up the title page: cumulative reporting months and year, name of the enterprise, its address, OKPO and main code of the type of economic activity.

Step 2. We answer the survey question from section 1: does the respondent use the simplified tax system - yes (1) or no (0).

Step 3. We enter in section 2 information about the average number of employees and the amount of salary accruals on an accrual basis from the beginning of the year.

Step 4. We present the organization’s performance indicators. We convert all values into thousands of rubles.

Step 5. We indicate the actual costs of working time. We reflect the number of hours worked by all full-time employees.

The PM's reporting is signed by the director. The manager has the right to appoint another person responsible for providing information to statistical authorities and transfer the rights to sign the PM form to such an employee.

IMPORTANT!

Be sure to include contact information to contact the artist.