Budget income classification codes are divided not only by type of payment, but also by purpose. The payment of funds ordered by a court verdict is called payment under a writ of execution. In order to pay a particular debt according to a court decision, you need to indicate in the payment order the details of the KBK according to the bailiffs’ writ of execution for 2021. In 2021, the ciphers of the corresponding year were used. This article presents codes and a sample for filling out a payment order to bailiffs, since the preparation of this documentation has nuances.

Individuals and legal entities that owe money to organizations or third parties are more likely to pay their debts after a court decision. Such debts include: alimony, unpaid loans, loans from friends, relatives, banking organizations or damage. But some citizens sometimes do not pay fines assessed by the court. Then Art. 122 Federal Law No. 229 of October 2, 2007 (as amended on December 27, 2018). The article states that in such a situation, the citizen is obliged to pay the enforcement fee of the bailiffs in 2018, the BCC of which is entered in field 104 of the payment order. The budget classification code for paying fees assigned by bailiffs is in this article.

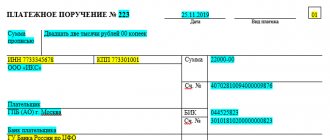

Payment order to bailiffs

After the court renders a verdict on the guilt of a citizen or company and imposes a fine, the bailiff service begins to work. The latter generate payment orders and send them by Russian post:

- for individuals: at the registration address or to the organization in which the citizen works;

- for legal entities: to an organization in the name of the owner of the company;

- Individual entrepreneur: at the entrepreneur’s registered address.

The payment is needed by FSSS employees to confirm the payment of debt money under the writ of execution. The contents of the receipt have two types: for withholding tax and non-tax arrears.

The latter include alimony, credit loans, etc. The budget classification code in the Purpose of payment field of the receipt is indicated only when paying tax debts.

Extra-budgetary arrears are characterized by the corresponding word or code, which is provided by clause 7

Appendix No. 2 according to Order of the Ministry of Finance of Russia No. 107n dated November 12, 2013 (as amended on April 5, 2017).

Having received a payment slip, a citizen does not need to pay the debt on his own, since FSSS employees often write off money from the debtor’s salary or from the company’s current account. If an individual does not work anywhere, then the citizen’s property is confiscated for the amount owed.

In such a situation, no payment orders will be received.

If you do not take the payment of the debt under the writ of execution seriously and do not pay the money, then a fine is imposed - an enforcement fee, which is 7% of the accrued amount calculated for payment. The BCC of the enforcement fee differs from the codes for other payments to the federal budget.

Where can I look for payment identifiers for transferring amounts in court?

Here it should be borne in mind that amounts for different purposes can be transferred according to writs of execution:

Accordingly, the procedure for filling out instructions for paying the FSSP will be different.

We begin to understand the KBK (field 104). The presence of this detail depends on what exactly you are listing. Amounts can be subdivided:

- for budget revenue (in this case, the FSSP, for example, enforcement fees or payment of procedural costs);

- those that do not go into budget revenue (that is, those that transit through the Federal Bailiff Service Account in the Treasury to the account of a non-budget recipient, for example, alimony debts).

If the final recipient of the amount is not the budget, there is no BCC, so there is nothing to indicate.

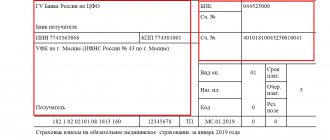

OKTMO (field 105) - indicates the OKTMO of the place where the transferred funds are accumulated (clause 4 of the rules). That is, OKTMO UFSSP, which issued the executive documents. You can find it out at the FSSP office or determine it at the FSSP address.

In fields 106, 107, 109, based on clause 5 of Appendix 4 of the rules, 0 is indicated.

NOTE! Since there are no special explanations, there is an alternative point of view on filling out field 101. It is proposed to enter 0 - that is, the type of budget payment is not defined (this position is based on conclusions drawn from the content of clause 4 of Appendix 2 of the rules).

Rules for filling out a payment order

Since the receipt form is regulated at the legislative level, the rules for filling it out are also regulated by law. A receipt is drawn up in accordance with Appendix No. 2 of Order of the Ministry of Finance of Russia No. 107n dated November 12, 2013 (as amended.

04/05/2017). The Regulations of the Bank of the Russian Federation provide information about each payment cell.

Expert opinion

Soloviev Andrey Yurievich

Practitioner lawyer with 6 years of experience. Specialization: civil law. Has experience in defense in court.

The encrypted instructions are in Appendix 3, and their decryption is in Appendix 1. Thus, before transferring the employee’s debt money to the budget, the accountant of the company in which the debtor citizen works will draw up the payment as follows:

- Fill in the employee’s TIN, indicate 0 in the checkpoint field, and the organization will be the payer.

- The debtor's position is 19. This means that the company calculates the amount accrued for debt repayment from the salary of the individual debtor. All statuses are indicated in Appendix 5 of Order No. 107n of the Ministry of Finance of Russia.

- To confirm your identity, in field 108, indicate a passport coded with the number 01. After entering the number 01, the accountant writes information about the passport from the second page, separated by a semicolon.

- The bailiff service - FSSP - is indicated as the recipient: they write the corresponding OKTMO number, and the UIN - 0.

After this procedure, the funds calculated for payment are debited from the employee’s salary and transferred to the budget.

Another example of calculations for a writ of execution is offered by Letter of the Ministry of Taxes of the Russian Federation No. BG-6-10/253 dated 03/05/2002 under number 10. The letter provides examples of filling out payment orders for different situations. Number 10 shows an example of a receipt filled out by an organization that reimburses a tax debt.

KBK bailiffs

Bailiffs order various types of payments: alimony, arrears on loans or taxes. But there are fixed types of payments to the federal budget, which correspond to a code that classifies payments. At the legislative level, budget classification codes are established for payment:

- state fees entered into the Unified State Register of Legal Entities of a company that deals with the return of enforcement fees and works with overdue debts;

- compensation for funds spent on criminal proceedings;

- penalties and fines that are imposed on individuals and legal entities for violating judicial legislation;

- performance fee.

| Operation name | KBK |

| State duty for entering information about a legal entity into the state register of legal entities engaged in the collection of overdue debts as the main activity | 322 1 0800 110 |

| Income received as compensation to the federal budget for expenses aimed at covering procedural costs | 322 1 1300 130 |

| Performance fee | 322 1 1500 140 |

| Monetary penalties (fines) for violation of the legislation of the Russian Federation on the court and judicial system, on enforcement proceedings and court fines | 322 1 1600 140 |

When is it necessary to indicate the BCC?

And yet there are cases when CBC is necessary. Thus, organizations and citizens most often pay debts after a court decision.

Expert opinion

Makarov Stanislav Tarasovich

Legal consultant with 8 years of experience. Specialization: criminal law. Extensive experience in document examination.

Such debt includes outstanding credits, loans, etc. But some taxpayers do not comply with the court decision and do not pay the debt that is owed to them.

In this case, Art. 112 of the law of October 2, 2007 No. 229-FZ (as amended)

dated 12/02/2019). In accordance with this article, the violator is obliged to pay an enforcement fee.

When transferring it, you must indicate the corresponding BCC in field “104” of the payment order.

The BCC of bailiffs is required to be indicated in a number of other cases, mainly when paying fines, incl. judicial

The first three digits of the code (322) indicate the payment administrator (Federal Bailiff Service).

We present in the table the cases when the BCC is indicated for payments to the FSSP:

KBK: Federal Bailiff Service

State duty for entering information about a legal entity into the state register of legal entities engaged in the collection of overdue debts as the main activity

Income received as compensation to the federal budget for expenses aimed at covering procedural costs

Administrative fines established by Chapter 13 of the Code of the Russian Federation on Administrative Offences, for administrative offenses in the field of communications and information, imposed by judges of federal courts, officials of federal government bodies, institutions, the Central Bank of the Russian Federation (other fines)

Administrative fines established by Chapter 14 of the Code of the Russian Federation on Administrative Offences, for administrative offenses in the field of entrepreneurial activity and the activities of self-regulatory organizations, imposed by judges of federal courts, officials of federal government bodies, institutions, the Central Bank of the Russian Federation (other fines)

Administrative fines established by Chapter 17 of the Code of the Russian Federation on Administrative Offences, for administrative offenses encroaching on institutions of state power, imposed by judges of federal courts, officials of federal government bodies, institutions, the Central Bank of the Russian Federation (other fines)

Administrative fines established by Chapter 20 of the Code of the Russian Federation on Administrative Offences, for administrative offenses encroaching on public order and public safety, imposed by judges of federal courts, officials of federal government bodies, institutions, the Central Bank of the Russian Federation (other fines)

Fines established by Chapter 16 of the Criminal Code of the Russian Federation for crimes against life and health

Fines established by Chapter 17 of the Criminal Code of the Russian Federation for crimes against freedom, honor and dignity of the individual

Fines established by Chapter 20 of the Criminal Code of the Russian Federation for crimes against family and minors

Fines established by Chapter 21 of the Criminal Code of the Russian Federation for crimes against property

Fines established by Chapter 31 of the Criminal Code of the Russian Federation for crimes against justice

Judicial fines (monetary penalties) imposed by courts in cases provided for by the Criminal Code of the Russian Federation

Judicial fines imposed by courts in cases provided for by the Arbitration Procedural Code of the Russian Federation

Judicial fines imposed by courts in cases provided for by the Civil Procedure Code of the Russian Federation

Judicial fines (monetary penalties) imposed by courts in cases provided for by the Code of Administrative Procedure of the Russian Federation

Judicial fines (monetary penalties) imposed by courts in cases provided for by the Criminal Procedure Code of the Russian Federation

Incorrectly specified KBK in the payment order for payment to bailiffs is not a critical error. In this case, you just need to clarify your payment. If this is not done, the transferred money will be classified as unexplained payments.

The legal topic is very complex, but in this article we will try to answer the question “Kbk alimony 2021 for bailiffs.” Of course, if you still have questions, you can consult with lawyers online for free directly on the website.

It depends on the nature of the cash withholdings. This means that for taxes and for non-tax payments of an employee (for example, alimony or traffic police fines) it does not match. Regarding non-budgetary collections, there are no special rules, as well as official instructions on the procedure for issuing payments.

Along with payments, KBK in 2021 must be indicated in some tax returns: for income tax, for VAT, for transport tax and when filling out calculations for insurance premiums. The obligation to withhold alimony and transfer it to the claimant arises immediately after receiving the writ of execution.

Kbk for paying alimony to bailiffs 2021

For example, this could be transport tax, debts to the Federal Tax Service, etc. and so on. It is worth noting that it will most likely not be possible to clarify this information with FSSP employees or your bailiff directly. They do not and should not have the necessary accounting skills.

A convenient (relatively) electronic service appeared only at the end of last year. As a result, I received an angry letter from the Pension Fund of the Russian Federation, I knew how much money should be left on the PC, and after 2-3 weeks they wrote it off from there themselves.

Kbk when transferring to bailiffs for an employee in 2021

Civil Code of the Russian Federation Procedure for closing a letter of credit Art. No. 874 of the Civil Code of the Russian Federation General provisions on settlements Art. No. 875 of the Civil Code of the Russian Federation How the process of executing a cash order is carried out Art. No. 876 of the Civil Code of the Russian Federation What are the notifications about transactions carried out Art. No. 877 of the Civil Code of the Russian Federation List of general provisions on settlements carried out by checks Art. No. 878 of the Civil Code of the Russian Federation What details should be indicated on the check of Art. No. 879 of the Civil Code of the Russian Federation The process of payment by check Art. No. 880 of the Civil Code of the Russian Federation How is the transfer of rights to an ordinary check Art. No. 881 of the Civil Code of the Russian Federation carried out? What is a guarantee of payment, how it is carried out Art. No. 882 What is collection of a check, the main features of this procedure Art. No. 883 What does a certificate of refusal to pay a check look like Art. No. 884 Notice of the procedure for non-payment of a check Art. No. 885 What are the consequences of non-payment of a check If possible before To begin drawing up the type of document in question, it is worth carefully studying the legislative acts indicated above. Today, in accordance with legislative norms, the collection of debts of various types is carried out by special bodies - bailiffs.

These bodies may draw up special documents of a certain type. They can perform a variety of functions.

At the same time, most often all kinds of organizations and institutions receive payment. It is a document that prescribes the repayment of any debts.

For example, deductions are made from an employee’s salary due to the need to repay alimony debt or other payments.

A fine will have to deal with bailiffs if he avoids fulfilling his court obligations in every possible way. In this case, he avoids paying the fine to which he is obliged to spend the funds.

It is this executive body that must ensure that the calculated fine and penalties are transferred to the state budget. How to force someone to pay a fine In this case, of course, no violent measures will be used.

How to force someone to pay a fine

In this case, naturally, no violent measures will be used. If a person has a debt to the state budget or to another individual and the court has decided to collect the amount of the fine from him, then the bailiffs will search for a method of implementing the court order legally.

One of these is the obligation of the debtor’s employer to transfer the amount of the fine calculated for payment to the state budget by withdrawing it from the wages accrued to the debtor. In this case, of course, all calculations must have a justification and confirm their legality with documents. Bailiffs, obliging the employer to collect money from the state budget, will provide him with the necessary documents to validate the procedure in accounting.

This document substantiating the legality of the deductions made from wages is a writ of execution. It is there that the necessary details for payment are indicated, as well as the legal grounds for withdrawing the required amount, which will then be used by accountants when conducting accounting and reporting. Indeed, in this case, taxation will take place with some nuances.

An individual, Vitaly Nikolaevich Golovin, who was obliged to pay an administrative fine in the amount of 1000 rubles, avoided this obligation in every possible way. The court decided, for failure to pay an administrative fine, to oblige Golovin to pay it twice the amount. That is, administrative liability for a given individual for failure to pay a fine will be a fine of 2,000 rubles. It was not possible to get payment from Golovin and the bailiffs brought his employer a writ of execution, which obliges him to collect the debt amount from Vitaly in 4 times 500 rubles each. The employer, accruing a salary of 5,000 rubles for 4 months, paid Vitaly 4,500, because he transferred 500 rubles to the budget, indicating in the payment KBK3220000000000000180 from the writ of execution, since it is this that is used in such cases.

CBC for enforcement proceedings by bailiffs 2021-2020

Budget income classification codes are divided not only by type of payment, but also by purpose. The payment of funds ordered by a court verdict is called payment under a writ of execution.

In order to pay a particular debt according to a court decision, you need to indicate in the payment order the details of the KBK according to the bailiffs’ writ of execution for 2021. In 2021, the ciphers of the corresponding year were used.

This article presents codes and a sample for filling out a payment order to bailiffs, since the preparation of this documentation has nuances.

Appendix No. 2 according to Order of the Ministry of Finance of Russia No. 107n dated November 12, 2013 (as amended on April 5, 2020).

Having received a payment slip, a citizen does not need to pay the debt on his own, since FSSS employees often write off money from the debtor’s salary or from the company’s current account. If an individual does not work anywhere, then the citizen’s property is confiscated for the amount owed.

In such a situation, no payment orders will be received.

Results

Payments to the FSSP are a transfer there of funds withheld by the employer from the employee’s salary under a writ of execution. Non-tax and tax debts can be paid in this way. In the second case, the payment document will be drawn up according to the rules applied for budget payments, but taking into account some of the features of entering data into certain fields.

Sources: Order of the Ministry of Finance of Russia dated November 12, 2013 N 107n

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Kbk for transferring alimony for an employee to the bailiff service 2021

Important! If the court decision requires immediate action, then the period for notification by the bailiff of the debtor will be one day from the date of receipt of the court order. To obtain satisfaction of the claim, the payer must collect the following evidence: Please note!

Download and print a sample claim from this link.

- Legislation changes regularly and laws are amended, so the information on the site may not be complete.

- We recommend that you contact our lawyers for a free consultation. Ask a question right now!

Kbk when transferring alimony to bailiffs

Dear readers! Our articles talk about typical ways to resolve legal issues, but each case is unique. If you want to find out how to solve your particular problem, please use the online consultant form on the right or call the numbers provided on the website.

It's fast and free! After the entry into force of Chapter 34 of the Tax Code of the Russian Federation, insurance premiums directed to:.

Budget income classification codes are divided not only by type of payment, but also by purpose. The payment of funds ordered by a court verdict is called payment under a writ of execution.

In order to pay a particular debt according to a court decision, you need to indicate in the payment order the details of the KBK according to the writ of execution of the bailiffs of the year. In the year, the ciphers of the corresponding year were used.

This article presents codes and a sample for filling out a payment order to bailiffs, since the preparation of this documentation has nuances.

A little more about paying fines and monetary penalties

Fines for violation of laws on taxes and fees

Fines are issued for violations of federal legislation on taxes and fees, as well as for administrative violations. A complete list of violations that entail a fine is contained in the Tax and Criminal Code of the Russian Federation.

Each type of offense punishable by a fine is regulated by government agencies at various levels, so the recipients of the fine will be different. This is why it is so important to indicate the correct BCC in the payment order when paying a fine.

- For violation of budget legislation at the federal level 1 1600 140. For arrears to the Pension Fund - 1 16 20010 06 0000 140.

- For failure to pay contributions to the Social Insurance Fund on time - 1 16 20020 07 0000 140.

- For non-payment of contributions to the FFOMS - 1 1600 140.

- The fine for violations of cash handling, cash transactions, and the use of special bank accounts identified by the inspection (if this was due to the requirements) is 1,1600,140.

- For violations related to the use of currency 1 16 05000 01 0000 140.

Other fines

- 18811643000016000140 – for administrative violations. 18811690010016000140 – compensation for damage to the federal budget.

- 18811690050056000140 – compensation for damage to the budgets of municipal districts.

Payment of traffic fines

The most widespread type of fines. The accrued fine must be paid on time (within 2 months), otherwise there is a new offense, which in turn is also punishable by a fine and additional unpleasant measures against the defaulter.

The 60 days provided for payment begin to count from the issuance of a receipt for a fine or after receiving a letter of receipt issued according to the recording cameras.

Innovations adopted in 2021 threaten non-payers of traffic police fines with the following penalties:

- Late payment will result in a double fine;

- a persistent defaulter may be arrested for 15 days;

- You may be forced to perform community service for up to 50 hours.

Everything depends on the decision of the judge, who takes into account, first of all, the seriousness of the committed traffic violation.

Payment details

If you have received a notice of a fine from the traffic police, you must pay it using the correct details. Please note that the budget classification codes for this type of fine are the same for all regions of the Russian Federation; they depend on what kind of car you have and what exactly you violated with it. Look for the CBC you need among those listed below.

- 18811630020016000140 – for administrative offenses in the field of traffic.

- 18811630010016000140 – for violating the rules for transporting large and heavy cargo on public roads:

- 18811630011016000140 – for the same violation that occurred on a federal road;

- 18811630012016000140 – if the road was of regional or intermunicipal importance;

- 18811630013016000140 – public road of local importance for urban districts;

- 18811630014016000140 – public road of local significance in municipal districts;

- 18811630015016000140 – public road of local significance for settlements.

- 18811625050016000140 – for violation of legislation in the field of environmental protection.

- 18811626000016000140 – for violating the legislation on advertising on vehicles;

- 18811629000016000140 – for violations in the field of international transportation (federal budget).

- 18811630030016000140 – for all other fines imposed by a municipal body, federal city, urban district.

Details for paying debts at the bailiff service of the Pervomaisky district

In addition, in the menu that appears as a list of payment options, you can familiarize yourself with all the ways to repay the debt to the FSSP for your enforcement proceedings. Perhaps you can find a payment option that is more convenient and economical for you.

The signs “No” and “–” are not indicated in field 108. If the individual’s TIN is filled in, the value “0” is allowed in this field.

- In fields 106 “Base of document”, 107 “Tax period” and 109 “Date of document” enter 0.

Sample of filling out a payment order to bailiffs For clarity, let’s look at filling out a payment order to the FSSP using a conditional example.

What you shouldn't forget

The executor of the bailiff's claim, regardless of whether he is directly the debtor or the entity holding the debt and transferring it to the FSSP, should remember two important aspects of liability for failure to comply with the bailiff's decision.

The debtor, or a business entity that ignored the request of the bailiff service for forced repayment of the debt, bears liability, the limits of which are established by Article 17.14 of the Code of Administrative Offenses of the Russian Federation.

If the employer maliciously evades the execution of the order, his actions may be interpreted as a criminal offense under Art. 315 of the Criminal Code of the Russian Federation.

Kbk enforcement collection of bailiffs 2021 2021

There are no special rules regarding non-budgetary collections, as well as official instructions on the procedure for processing payments. Therefore, we believe that a regular payment order is issued for them, without filling out the “tax” fields, including payer status, BCC, etc. In this case, all information identifying the payment is provided in the “Purpose of payment” field.

Today, a payment order to bailiffs means a special document that contains detailed information on the purpose of the payment of the type in question. However, there are several different formats for such documentation. Information required:

Payment of alimony through bailiffs

Failure to comply with deadlines leads to the accumulation of debt. The organization may be subject to a fine or a penalty for late payment. The person making the payment must indicate the date the document was created.

The accountant of every organization needs to know how to fill out payment orders for alimony. According to the Civil Code, a payment order is an obligation of the bank to transfer money on behalf of a client from one current account to another, including if the second account is opened in another financial institution.

When is a payment made to the FSSP?

To ensure the collection of certain payments ordered by the court, the bailiffs send the payer - the obligated person - a corresponding order, which contains the appropriate requirement and indicates the necessary details.

In essence, this order is a writ of execution, which gives it the necessary legal force.

A document demanding repayment of obligations under a court decision can be sent to the payer either at the place of his employment (in this case, the debt will be officially deducted from the payer’s earnings), or to the address of his actual residence (if the obligated person is not employed).

In the practice of bailiffs, it is customary to divide writs of execution into the following types:

- collection of tax debts;

- repayment of non-tax debt (loan obligations, housing and communal services payments, penalties, alimony payments, other penalties).

If, for example, a sum of money ordered by the court for payment is withheld according to a writ of execution from the salary of the obligated person (payer), the accountant of the employing organization draws up and sends a special payment to the bailiffs to the servicing bank.

As a rule, an authorized FSSP employee who supervises (conducts) a specific enforcement proceeding officially provides the employing organization with a sample of such an order, already containing all the necessary details.

Thus, the financial institution carries out the designated payment transactions according to these orders, transferring the money directly to the FSSP authorities.

Bailiffs accept the appropriate payment, register it in the prescribed manner, and then forward it to the actual (target) recipient, who is the beneficiary of the enforcement proceedings.

The funds from this payment can be sent to a budgetary structure, an economic entity, another organization or a specific individual.

KBC on the writ of execution of bailiffs in 2021

If for some reason there is simply no relevant experience in drawing up such documents, then you will need to carefully read the sample. This will avoid a large number of different difficulties.

Expert opinion

Soloviev Andrey Yurievich

Practitioner lawyer with 6 years of experience. Specialization: civil law. Has experience in defense in court.

A payment order from the bailiff service is a special document containing detailed information on the purpose of payment. This payment order has the force of a judicial writ of execution.

In what cases is a payment order necessary?

A payment order is a document in a prescribed form that regulates the account holder’s instructions to make non-cash transfers in favor of the recipient of funds. The instruction has been sent to the bank that maintains the payer’s account. Funds are transferred from a deposit account. If for some reason the account does not have the required amount of money, but the agreement between the bank and the payer provides for an overdraft, the transfer will be carried out. This document must be drawn up and submitted to the bank for execution in electronic or paper form.

Individuals can also process payment orders without opening a bank account. In this case, an order to the bank from an individual can be drawn up in the form of an application, in which the following information must be indicated:

- payer details;

- details of the recipient of funds;

- bank details of the payer and recipient;

- amount of money;

- purpose or purpose of payment;

- other information established by the bank.

Budget classification codes according to the writ of execution of the joint venture in 2021

- TIN of the person who is the payer.

- Checkpoint of the citizen from whom deductions are made.

- The name of the payer is the organization that transfers the amounts of money collected from the individual.

- Payer status. In this case it will be 19.

- Code. If the payer has an identifier, then this should be entered.

- KBK. Such documents are marked with 0.

- The classification according to OKTMO is the one that relates to the location of the bailiff’s office to whose account the payment is made.

- A unique number of a document that can act as an identifier of an individual (for example, a civil passport number, SNILS, etc.).

Persons responsible for sending payment documents should always remember the need to be scrupulous in filling them out. Errors in this case may result in money being sent to the wrong address. And this, in turn, will lead to penalties from the Federal Tax Service.

What are the consequences of an error in the KBK?

If the payment purpose code is specified incorrectly, the payment will be transferred to the budget, but it will not be distributed correctly there, which means that the state will not actually receive it. The result may be the same as if the money had not been transferred at all: the tax office will count the arrears under a certain item. At the same time, if the BCC is simply mixed up, there may be an overpayment under another item.

As a result, the tax office will issue a demand for payment of arrears, a fine for late payment of tax or a fee and penalties for late payment. This situation is extremely unpleasant for a conscientious entrepreneur who paid the tax on time, whose entire fault lies in confusion with numerous CBCs.

- The most important thing is to make sure that the error did not lead to non-receipt of income to the budget, otherwise it will be considered that the funds were not paid, with the payer being fully responsible for this.

- Submit to your tax accounting office a statement about the detected error and a request to clarify the basis, type and affiliation of the transfer of funds, if necessary, the tax period or tax payer status.

- The application must be accompanied by payment orders for which the tax was paid and received by the budget.

- If necessary, a reconciliation of paid taxes is carried out jointly with the inspector (a report is drawn up about it).

- After a few days (the period is not defined by law), a decision is made to clarify this payment and is handed over to the applicant.

IMPORTANT! When a payment is clarified, it is considered completed on the day the payment order is submitted with an incorrect BCC, and not on the day the decision on clarification and offset is received. Thus, the delay in mandatory payment, which provides for penalties, does not actually occur.

Let's look at various cases that occur due to errors in the CBC and analyze what an entrepreneur should do.

- The inspectorate assessed penalties for non-payment of taxes. If there was a beneficial request from the payer to offset the amount paid, then you should additionally ask the tax office to recalculate the accrued penalties. If the tax office refuses to do this, going to court will most likely allow for a recalculation (there is a rich case law with similar precedents).

- The BCC does not correspond to the payment specified in the assignment. If the error is “within one tax”, for example, the KBK is indicated on the USN-6, and the payment basis is indicated on the USN-15, then the tax office usually easily makes a re-offset. If the KBK does not completely correspond to the basis of the payment, for example, a businessman was going to pay personal income tax, but indicated the KBK belonging to the VAT, the tax office often refuses to clarify, but the court is almost always on the side of the taxpayer.

- Due to an error in the KBK, insurance premiums were unpaid. If the funds do not reach the required treasury account, this is almost inevitably fraught with fines and penalties. The entrepreneur should repeat the payment as quickly as possible with the correct details in order to reduce the amount of possible penalties. Then the money paid by mistake must be returned (you can also count it against future payments). To do this, an application is sent to the authority to whose account the money was transferred erroneously. Failure to comply with a request for a refund or re-credit is a reason to go to court.

- The funds entered the planned fund, but under the wrong heading. For example, the payment slip indicated the KBK for the funded portion of the pension, but they intended to pay for the insurance portion. In such cases, contributions are still considered to have been made on time, and you must proceed in the same way as under the usual procedure. The court can help with any problems with a fund that refuses to make a recalculation, and an illegal demand for payment of arrears and the accrual of penalties.

REMEMBER! According to the law, an error in the KBK is not a reason for which the payment will not be considered transferred. The payment order contains additional information indicating the purpose of the payment and its recipient, therefore, if it is indicated correctly, there is and cannot be a reason for penalties against the entrepreneur; other decisions can be challenged in court.

Kbk for alimony payments

I think that if you are not married, then in accordance with paragraph 4 of Art.

11 of the Law on the Basics of Tax on Property, which is transferred by inheritance or donation of residential premises into the ownership of citizens and legal entities is carried out on the basis of a social rental agreement for residential premises in accordance with the legislation on residence with an application for the purchase of residential premises that has concluded such an agreement with it.2 .

1 and 2.1 of this article, as well as unless otherwise provided by the agreement. Article 32 of the Civil Code of the Russian Federation.

Compensation for moral harm If a citizen has suffered moral harm (physical or moral suffering) by actions that violate his personal non-property rights or encroach on intangible benefits belonging to the citizen, as well as in other cases provided for by law, the court may impose on the violator the obligation of monetary compensation for said damage. When determining the amount of compensation for moral damage, the court takes into account the degree of guilt of the offender and other circumstances worthy of attention.

The legal topic is very complex, but in this article we will try to answer the question “Kbk for alimony to bailiffs 2021.” Of course, if you still have questions, you can consult with lawyers online for free directly on the website.

“Site Administration” (hereinafter referred to as the Administration) - authorized employees to manage the site https://online-sovetnik.ru, who organize and (or) carry out the processing of personal data, and also determine the purposes of processing personal data, the composition of personal data to be processed , actions (operations) performed with personal data.1.1.2. "Personal

However, in 2021, in practice, there are cases when a legal entity (for example, a bank) needs to transfer alimony in favor of bailiffs. will indicate the employee’s tax identification number, enter 0 in the checkpoint, and designate himself as the payer; will indicate 19 as the payer status;

Today there is a promotion - consultation of lawyers and advocates 0 - rubles.

The enforcement system in Russia is structured in such a way that all debts that are collected due to the actions of UFSSP employees, according to the latest orders, initially go directly to the Service’s account.

- Fill in the employee’s TIN, indicate 0 in the checkpoint field, and the organization will be the payer.

- The debtor's position is 19. This means that the company calculates the amount accrued for debt repayment from the salary of the individual debtor. All statuses are indicated in Appendix 5 of Order No. 107n of the Ministry of Finance of Russia.

- To confirm your identity, in field 108, indicate a passport coded with the number 01. After entering the number 01, the accountant writes information about the passport from the second page, separated by a semicolon.

- The bailiff service - FSSP - is indicated as the recipient: they write the corresponding OKTMO number, and the UIN - 0.

KBK bailiffs

Free legal advice online

The involvement of lawyers in legal disputes is due to the need to fully protect the personal interests of citizens. As practice shows, citizens avoid legal assistance in order to save money, but in practice this is associated with high costs. Even citizens with a lawyer's education do not always keep up with current changes in legislation, so it would be advisable to consult a qualified specialist.

The convenience is that consultation with a lawyer is free and online. Where and how to get free legal advice? is provided throughout the Russian Federation.

Citizens, residents of the state, as well as non-residents of the country who temporarily reside in the Russian Federation can take advantage of the support. Moreover, lawyers can advise interested parties outside Russia, but only within the framework of domestic legislation.

Legal advice is provided free of charge online around the clock, regardless of weekends and holidays.

The response time from specialists on the website is up to 15 minutes.

There is no need to register on the Internet portal and you can send a personal appeal anonymously.

Legal advice can be obtained in the following ways:

- draw up a contact form for the feedback service;

- call the hotline.

- use the online chat service;

Online legal consultation can also be carried out via email.

Attention! The online lawyer provides answers to questions and continues to support the client in the event of further difficulties.

The advantages of the services of our law firm are due to the professional attitude of our specialists to their work, the receipt of regular training courses, as well as participation in official forums. This ensures that individuals and businesses can receive advice that complies with current legal provisions.

Certificates are provided