Unilateral settlement is permitted by Art. 410 of the Civil Code of the Russian Federation. For this purpose, the legislator has provided for the procedure for implementing the procedure through a written statement from one of the interested parties. To initiate such actions, it is necessary to ensure that the amounts of debts comply with several criteria established by civil law:

- business entities interested in the transaction have contractual relations, they can document them;

- according to accounting data, both participants, under different agreements, act in relation to each other simultaneously as a creditor and a debtor;

- obligations have a single measure (can be considered homogeneous);

- for counter debts the payment deadline has arrived or it was not fixed in the contracts.

Unilateral offset is impossible if the debt was caused by the collection of alimony or compensatory amounts for compensation of damage caused to the health of an individual. Procedures cannot be initiated in situations where the statute of limitations has passed and one of the parties to the transaction is in the process of bankruptcy. The prohibition is also established for cases where the obligations of only one of the parties to the agreement have come due.

What is offset and when is it acceptable?

Expert opinion

Novikov Igor Timofeevich

Legal consultant with 6 years of experience. Specializes in the field of civil law. Law teacher.

Essentially, this is a legal way to get rid of debt. Most often, this is a regular exchange of materials, services, etc. If there are difficulties with finances, organizations have to negotiate among themselves on an equivalent exchange.

However, this is not a simple exchange. The settlement procedure is quite complex.

This is a whole complex of operations that allow you to repay the debt and correctly display the transaction in accounting. Representatives of accounting, household, supply, financial and legal departments take part in drawing up the act.

The key to a correctly drawn up document is close and competent cooperation of all the listed departments.

If the liabilities relate to funds , they can be specified in any currency. Although many organizations transfer the amount of debt into a currency more convenient for settlements.

When offset is not allowed

There are situations when the law prohibits the execution of mutual settlements, which means drawing up a corresponding act. This includes the following situations:

- the debt accumulated during the collection of alimony;

- the obligation period has expired;

- the debt arose for compensation for damage to health;

- one of the parties is declared bankrupt;

- heterogeneity of obligations;

- use of different currencies;

- in any other situations that violate the law.

It is worth noting that this act is not always a bilateral document. There are situations when three or more parties take part in mutual settlement.

As a rule, this may be necessary in the case when all counterparties provide each other with the same type of services. Moreover, they all have a mutual connection.

In this case, the following information must be entered into the document:

- data from documents that prove the provision of mutual services;

- the amount of debt of each party at the time of signing the act;

- if the debt is not repaid in full, the amount of debt relief for each counterparty is indicated;

- the amount of debt that remains with each party to this transaction.

Extension of the method of offset in certain situations

Another innovation is the expansion of methods for carrying out offsets in the event that a creditor of a passive claim goes to court. Before the Plenum clarified, a counterclaim had to be filed in order to set off. Now you can not file a claim, but send a statement of offset to the other party and, in the objection to the claim, indicate the termination of the obligation through offset.

It is also possible to set off if the passive claim (i.e. the claim against the applicant) is confirmed by a court decision that has entered into force, but the active claim (i.e. the claim of the applicant) is not. Such set-off is allowed if the parties do not object to it.

Senior judges do not object to the offset in cases where enforcement proceedings have been initiated on one of the claims, but not on another.

Invalidation of offset

Set-off as a method of terminating an obligation is a unilateral transaction and can be declared invalid by the court, in particular, on the grounds provided for in Chapter 9 of the Civil Code of the Russian Federation. Let us recall that a unilateral transaction is a transaction for which, in accordance with the law, other legal acts or agreement of the parties, it is necessary and sufficient to express the will of one party (clause 1 and clause 2 of Article 154 of the Civil Code of the Russian Federation).

How to correctly draw up an act of offset in 2021

As mentioned, several parties may be involved in a transaction. Naturally, each of them should receive one copy of the act. However, the main and most common option is the participation of two parties in the transaction. Therefore, the act is drawn up in two copies.

There is no need to use any standard form to draw up the act. Therefore, organizations draw up a document using their own template. It is also not prohibited to draw up an act on a regular sheet of paper. For this it is recommended to use A4 format. You can use a computer to enter information, or enter the data by hand.

( Video : “Carrying out netting in 1C Accounting 8”)

Regardless of how many copies the document has, each of them must have a “living” signature of the director of the company. Instead of the manager, this can be done by other employees authorized to sign documents of this kind.

At the request of the parties, stamps can be affixed to the documents. Despite the fact that their use is now not mandatory, many companies continue to use seals.

The document must display the following data:

- information about the parties who came to an agreement;

- information about how the debt was formed;

- list of obligations;

- the final amount of debt.

As appendices to the act, you can use copies of any documents, for example, confirming the fact of the debt and the reasons for its occurrence.

Peculiarities of execution of a unilateral act of offset

Expert opinion

Novikov Igor Timofeevich

Legal consultant with 6 years of experience. Specializes in the field of civil law. Law teacher.

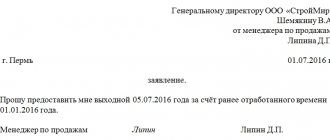

As already mentioned, in certain situations the act can be executed unilaterally. The party who intends to do this must send written notice to the counterparty indicating its intention.

For such situations, it is necessary to use registered mail with notification. This is how the sender will have in hand a document confirming that the addressee received the letter.

If the dispute is subsequently considered in court, such a notice will become essential evidence.

Set-off in case of expiration of the limitation period

Set-off cannot be carried out if the active claim (i.e. the claim made by the set-off applicant) has expired.

For example, it should. In turn, it should. The applicant for the offset is “Buttercup”. The statute of limitations on the accounts receivable has expired. Before the Plenum’s clarifications appeared, the courts denied the right to set-off if the statute of limitations had expired on the claims of both.

However, the expiration of the statute of limitations on a passive claim (in our example) does not prevent offset.

In practice, this means that if the company has made a claim for set-off, the company’s creditor has the right to set off its expired debt with a new claim.

At the same time, if the statute of limitations on an active claim expires, the debtor for it, having received an application for set-off, is not obliged to respond to it by notifying the creditor about the passage of the limitation period (clause 3 of Article 199 of the Civil Code of the Russian Federation).

Based on the conditions of our example, it is not profitable to take the initiative to conduct a test.

Instructions for drawing up a netting act in 2021

When drawing up the act, it is recommended to adhere to the standard structure of such documents:

- The “cap” is filled in at the top. The essence of drawing up the act is indicated here. It is also necessary to note the city in which the organization drawing up the document is registered. The date of registration is noted.

- Below is information about the parties. Their legal form, passport details and position of managers or other responsible employees are noted.

- The text indicates the regulation, charter or other document on the basis of which the manager takes his position.

- Then information is entered about the contracts on the basis of which the debts arose. The amounts of mutual debts must be indicated not only in numbers, but also in words.

- Next, you need to write that the parties mutually agree to such repayment of debts, and accordingly, do not have any claims against each other.

- It is imperative to note whether this is a partial or full offset. If the debtor agrees to pay the balance, this must also be stated. The period during which he must transfer the specified amount is also indicated.

- The final stage of filling out the document is affixing signatures. You need to write the manager's name, position and signature with a transcript.

"Occurrence" of requirements

“Concurrence” of claims means that obligations arise from the same persons, who are both debtors and creditors in relation to each other. This definition of “meeting” was previously given by the Presidium of the Supreme Arbitration Court of the Russian Federation in Resolution No. 14321/11 dated February 21, 2012.

In certain cases provided for by law or agreement, offset may be carried out against claims that are not counterclaims. For example, when fulfilling an obligation by a third party (clause 4 of Article 313 of the Civil Code of the Russian Federation).

Sample act of mutual settlement between organizations

What errors might there be?

In order for an act to have legal force, no mistakes must be made when drawing it up. The most common of them are:

- Not all numbers are indicated, or the column intended to indicate VAT is missing;

- The cost is indicated only in numbers, although words are also required;

- Lack of links to documents that confirm the occurrence of debts;

- The act does not indicate that the parties agree to repay the debt in this particular way;

- Many people forget to note whether all or part of the debt is repaid;

- If the debt is not fully repaid, the date by which the debtor undertakes to repay it in full is not indicated;

- Responsible persons are indicated without position;

- There are no transcripts of the signatures.

_____________ "__" ________ 20____

______________, represented by _______________, acting___ on the basis of _________________, hereinafter referred to as "Party 1", on the one hand, and _________________, represented by ____________, acting___ on the basis of ________, hereinafter referred to as "Party 2", on the other hand, referred to together as " The Parties have entered into this agreement (hereinafter referred to as the Agreement) in accordance with Art. 410 of the Civil Code of the Russian Federation about the following.

SUBJECT OF THE AGREEMENT

1.1. The subject of the Agreement is _________________________ (indicate full/partial) termination of counter-similar claims of the Parties specified in clause 2.1 of the Agreement by means of offset.

1.2. The amount of offset of similar counterclaims under the Agreement is ______ (__________) rubles, including VAT _________ (__________) rubles.

OBLIGATIONS OF THE PARTIES

2.1. Information on mutual claims and debt of the Parties as of “___” __________ 20__.

2.2. The parties came to an agreement to offset mutual homogeneous claims specified in clause 2.1 of the Agreement in the amount of ________ (________) rubles, including VAT _______ (_________) rubles.

2.3. After the offset of mutual homogeneous claims under the Agreement

— the balance of debt of Party __ to Party __ as of “___” ___________ 20__ is ______ (_________) rub., including VAT _____ (_________) rub.

— the mutual debt of the Parties has been repaid in full.

CONFIDENTIALITY

3.1. The Parties undertake not to disclose any information related to the Agreement or its execution without the prior written permission of the other Party, except in cases where the provision of information is mandatory in accordance with the legislation of the Russian Federation.

3.2. The Parties take all necessary measures to ensure that their employees, agents, successors, without the prior consent of the other Party, do not inform third parties about the details of this Agreement.

DISPUTE RESOLUTION

4.1. All disputes and disagreements that may arise between the Parties on issues that are not resolved in the text of this Agreement will be resolved through negotiations.

4.2. If controversial issues are not resolved during negotiations, disputes are resolved in the manner established by the current legislation of the Russian Federation.

If it is impossible to resolve these disputes through negotiations, the dispute will be considered in ________________________________________ (the name of the court considering the dispute is indicated).

FINAL PROVISIONS

5.1. In all other respects that are not provided for in the Agreement, the Parties are guided by the current legislation of the Russian Federation.

5.2. Any changes and additions to the Agreement are valid provided that they are made in writing and signed by duly authorized representatives of the Parties.

5.3. All notices and communications under the Agreement must be sent by the Parties to each other in writing.

Messages will be considered duly executed if they are sent in one of the following ways: by registered mail, by email with confirmation of receipt, by telegraph, teletype, telex, telefax or delivered personally to the legal (postal) addresses of the Parties with receipt against signature by the relevant officials .

5.4. The Agreement comes into force from the moment it is signed by the Parties.

5.5. The Agreement is drawn up in two copies having equal legal force, one copy for each of the Parties.

Sometimes counterparties are faced with the question of conducting mutual offset transactions. For example, if two legal entities have entered into agreements with each other (for example, agreements for the provision of legal services), according to which they are obliged to perform certain actions in relation to each other, then counter obligations can be offset.

In accordance with Article 410 of the Civil Code of the Russian Federation, obligations can be terminated either in full or in part, taking into account a counterclaim of the same type, the time period for which has either already arrived, or its period is not specified or is determined by the date of demand. For offset, an application from one of the counterparties under the agreements is required.

If the other party agrees, then an act of offset of claims is drawn up.

Cases when offset of claims is not possible in accordance with the law

1. If, at the request of one person, the claim is subject to a statute of limitations and this period has expired.

2. When compensating for harm caused to the personal health or life of an individual.

3. When collecting alimony.

4. With lifelong maintenance, etc.

If this does not contradict the existing agreements between the parties, then, in the event of an assignment of the right of claim, the debtor has the right to set off against the claim of the new creditor his counterclaim against the original creditor. This offset is made if the claim arose on the basis that existed at the time the debtor received the notice of assignment of the right of claim, and the term of the claim came before its receipt, or this period is not specified or is indicated by the moment of the claim.

Must be observed when drawing up the act

Firstly , obligations must be only between the parties to the agreements in question; if the demand is made by a third party that is not participating in these transactions (is not a party to the agreements within the framework of which offset is carried out), then drawing up this act is impossible.

Secondly , the act must indicate only homogeneous claims, for example, monetary claims and claims of a non-material nature are not subject to offset, since in this case the claims will be of a counter nature, and therefore cannot be offset in the act.

Thirdly , the parties have the right to make the necessary mutual offset only of those obligations (demands), the calendar deadline for fulfillment of which has already arrived in accordance with the contracts under study. Such a period must be specified in the contracts, otherwise the debt obligation of one party is recognized as arising from the moment when the other party fulfilled its obligation under the contract.

In this case, the deadline for fulfilling obligations must pass.

It must be remembered that in accordance with the legislation of our country, offset of both full mutual obligations of the parties and their partial repayment is allowed. In this situation, the act must indicate the smallest amount of claims of one of the parties and a similar amount of claims of the other party.

Offsetting act

The entire form of the netting act is in the attached file.

- What is an act of mutual settlement between organizations?

- How to draw up an Act of Settlement?

- Instructions for filling out the Settlement Certificate 2021

- Peculiarities of execution of a unilateral act of offset

Sometimes there are situations when mutual loan obligations arise between organizations that need to be repaid. For this purpose, a special document was invented that allows you to write off the obligations of both parties - an act of mutual settlement between organizations.

Notice of unilateral offset of mutual claims

Closed Joint Stock Company "Electroset", hereinafter referred to as "CJSC "Electroset", represented by General Director _____, acting on the basis of the Charter, on the one hand. Limited Liability Company "Avtotrans", hereinafter referred to as "LLC "Avtotrans", represented by ____, acting on the basis of a power of attorney dated ___.

Closed Joint Stock Company "Transservice", hereinafter referred to as "CJSC "Transservice", represented by Director ____, acting on the basis of the Charter, on the third party. Closed Joint Stock Company "Spetsstroy", hereinafter referred to as "CJSC "Spetsstroy", represented by the General Director ____, acting on the basis of the Charter, on the fourth side.

For offset you will need: an act of offset (sample) or an application for offset (sample), a reconciliation act (sample). Instead of the first or second document, you can draw up an agreement on offset between organizations (sample). The document is drawn up before offsetting mutual claims. It should contain a breakdown of each concluded agreement (if there were several agreements).

This allows you to determine the exact amount of debt that can be repaid by offset.

Letter of application, notification of offset of mutual claims in order

This Act is drawn up to the effect that as of the date of reconciliation, the state of mutual settlements between Torgovaya LLC and Alfa CJSC according to their accounting data (from the date of the previous reconciliation) is as follows: The document is drawn up if the organization has a counter debtor or creditor and you decided to set off mutual obligations unilaterally.

Settlement between organizations is a very convenient way to terminate mutual obligations.

You will learn in this article about in what cases netting is possible and how to arrange it correctly. Liabilities are homogeneous in nature (for example, expressed in monetary debt).

The deadline for fulfilling all obligations subject to offset has already arrived.

It is also possible to set off obligations whose fulfillment period is not specified at all or is determined by the moment of demand.

An act of offset or offset of mutual claims between legal entities under an act.

In this topic we will talk about how to correctly draw up an act of offset between 3 and 2 legal entities. An act of reconciliation of settlements (an act of reconciliation of mutual settlements) is a document that confirms the debt obligations of a trade or public catering enterprise.

Persons, and also, what are the requirements for the registration procedure? According to paragraph 1 of Article 9 of the Accounting Law, all business transactions carried out by a trade or public catering enterprise must be documented with supporting documents, which serve as primary accounting documents.

Primary accounting documents are accepted for accounting and tax accounting if they are drawn up in the form contained in the albums of unified forms of primary accounting documentation, and documents whose form is not provided there, including a statement of reconciliation of calculations, must have the following mandatory details: a) name document; b) date of preparation of the document; c) the name of the organization on whose behalf the document was drawn up; d) content of the business transaction; e) measures of business transactions in physical and monetary terms; f) the names of the positions of the persons responsible for the execution of the business transaction and the correctness of its execution; g) personal signatures of these persons.

Often, mutual debts arise between organizations. You can pay off these debts by transferring money to each other, but there is an easier way - draw up an act of offset of mutual claims.

What is an act of mutual settlement between organizations?

An act of mutual settlement is a document that serves to write off mutual debts between different enterprises. It is used mainly between small and medium-sized businesses when one or both organizations are experiencing financial difficulties and agree to make a certain exchange.

This allows you to get a number of advantages, including:

- saving time on drawing up various documentation;

- no bank commissions for completed transactions;

- repayment of long-term debt to a counterparty.

The procedure for drawing up and applying the act of mutual settlements is regulated by the Civil Code of the Russian Federation in Article 410.

A prerequisite for drawing up this document is that mutual requirements must be of a homogeneous nature.

At the same time, monetary obligations can be listed in the currencies of different countries; for convenience, they can be converted into the most convenient one. In addition, these obligations must be documented. There are some cases when mutual settlements are prohibited by law:

- the debt arose in the case of alimony collection;

- obligations arose during the performance of lifelong maintenance obligations;

- obligations arose when funds were contributed to the authorized capital fund;

- debt cannot be used after the expiration of the obligation;

- debt arises when compensating for damage caused to a person’s health or life;

- in other cases provided for by contractual obligations between organizations, or in cases subject to prohibition in accordance with the legislation of the Russian Federation.

According to the letter of the law, netting is possible at the request of one of the parties, however, in practice this usually happens by mutual desire:

- completed using one of the following documents:

- agreement on offset of claims;

- mutual debt reconciliation act;

- netting agreement.

When the amount of debt is settled, a mutual settlement act is signed between the organizations.

New introductory notes from senior judges

In order to ensure a unified approach in the practice of application by courts of the provisions of the Civil Code of the Russian Federation on the termination of obligations, the Plenum clarified certain rules for conducting offsets.

In the Resolution, the Plenum uses such unusual concepts as active and passive requirements. The first means the requirement of the offset initiator (i.e., it is the requirement of the person who makes the application for offset), the second is the requirement that is used to offset the active claim (i.e., the claim against the offset applicant himself).

How to draw up an Act of Settlement?

The legislation does not define a strict form; it is drawn up in free form, taking into account certain requirements, in two copies for each of the parties involved. If more than two parties are involved in mutual settlements, then the number of copies must be equal to the number of participants in the act.

Each copy must contain the signatures of the managers or their substitutes of all parties involved.

If desired, managers can affix a seal (from 2021, all legal entities are exempt from the obligation to have a seal in their organization). But you need to know that many government organizations, including the Tax Service, still require certification of all documents.

In addition, the legislation establishes the presence of the following mandatory details:

- the reason for the occurrence of obligations (it is enough to indicate the details of the relevant documents);

- details of organizations that participate in the mutual settlement agreement;

- the amount of debt in digital and written terms;

- list of credit obligations that have arisen.

Copies of documents that indicate the debt has arisen must be attached to the act.

Uniformity of requirements

For credit, it is sufficient that the requirements are uniform at the time of the test.

This means that the counterclaims of the parties at the time of their occurrence (i.e. initially) may be heterogeneous (for example, a demand for the transfer of an item and a demand for the return of the loan amount), and by the time of offset they will already be homogeneous (a demand for compensation for damages for violation obligations to transfer the item and the requirement to repay the loan amount).

Article 410 of the Civil Code of the Russian Federation allows, among other things, the offset of active and passive claims that arose from different grounds. In this case, the criterion of homogeneity is met when offsetting the requirement for payment of the principal debt (for example, the purchase price under a purchase and sale agreement) against the requirement for payment of a penalty, interest or compensation for losses (for example, due to delay in performance of work under a contract).

This approach is already used in judicial practice. Thus, in the Resolution of the Moscow District Administration of June 26, 2020 No. A40-221264/2019, the following situation is considered.

The buyer, in violation of the terms of the supply agreement, unreasonably refused to accept the supplier’s products. As a result, the supplier incurred losses for excess turnover of wagons and payment for storage services due to the fault of the buyer. And since the buyer refused to compensate for the losses, the supplier offset counterclaims for this amount. This offset was recognized by the court as lawful.

Peculiarities of execution of a unilateral act of offset

Expert opinion

Novikov Igor Timofeevich

Legal consultant with 6 years of experience. Specializes in the field of civil law. Law teacher.

According to Russian legislation, it is not prohibited to offset mutual obligations at the request of one party. Thus, mutual obligations can be repaid unilaterally.

To do this, you must first notify your partners about this in writing. To do this, the initiator must send a registered letter to the other party with a notice inside.

This is done in order to subsequently have documentary evidence in the form of a notification of receipt as evidence.

It will definitely come in handy in the event of controversial situations and litigation.

The act of mutual settlements is a simple document and significantly facilitates the work of employees and interaction between organizations. It has many benefits and is designed to make life easier for businesses in general. It is easy to put together and has little nuance.

When obligations are considered terminated by offset

Obligations are considered terminated by offset in the amount of the lesser of them not from the moment the application for offset is received by the relevant party, but from the moment at which the obligations themselves become capable of offset. For example, if the deadline for fulfilling the requirements came before the statement of offset, then the obligations are considered terminated by offset from the moment the deadline for fulfilling the obligation arrived.

If the claims become counterclaims as a result of a change of person in the obligation, then the moment of their termination cannot be earlier than the date of such change.

Settlement without problems

The article from the magazine “MAIN BOOK” is current as of June 19, 2015.

Contents of the magazine No. 13 for 2015 Yu.V. Kapanina, certified tax consultant

How to properly formalize and take into account the offset of counterclaims

When a company and its counterparty have mutual debts, they can simplify and speed up their settlements through offset. This will allow you to avoid sending money “you to me, I to you” and thereby save on bank commissions. You will learn about the nuances of netting, the preparation of related documents and the reflection of this operation in accounting from our article.

Results

If two business entities have mutual homogeneous obligations (for example, to pay for goods or services supplied in the same currency), then such obligations can be canceled by drawing up a netting agreement. Such a document must comply with the provisions of Art. 410 and 411 of the Civil Code of the Russian Federation.

You can learn more about the procedure for netting commercial obligations in the following articles:

- “The procedure for netting under the simplified tax system “income””;

- “How to deduct VAT during netting (nuances).”

Drawing up and submitting an application for offset of claims

Any party to enforcement proceedings can prepare an application to set off similar counterclaims. The other party's wishes have no legal significance. That is, to carry out the test, the will of one person is sufficient. The bailiff, on his own initiative, does not have the right to offset claims.

When drawing up the document, it is necessary to indicate within the framework of which enforcement proceedings it is possible to offset claims and to what extent. The position of the other party will not be taken into account when making a decision.

An application for offset of similar claims is submitted to the bailiff, who, based on the results of its consideration, issues an appropriate decision. If the application is satisfied and the requirement is fulfilled, you can submit an application for termination of enforcement proceedings. Although it is likely that the bailiff will make such a decision himself.

It is possible to challenge a ruling on the offset of similar counterclaims. But not because of the other side’s disagreement. The interested party must prove the heterogeneity of the requirements. Or expiration of the statute of limitations, etc.

The applicant or another person may appeal any decision made on an application for offset of similar counterclaims within 10 days by filing a complaint against the actions of the bailiff with the court or with the senior bailiff.