Last changes: January 2021 Work beyond the established duration is always the employer’s offer and not

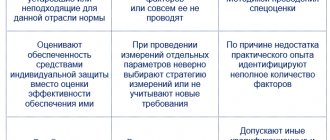

From 01/01/2020, the rules for conducting a special assessment of working conditions (SOUT) are changing. New responsibilities will appear for

What should be displayed The header of the document should contain the following: full name of the organization; date of,

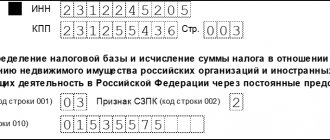

Important: the new reporting form for 2021 has been amended by the Federal Tax Service for the second time.

The SOUT declaration to the labor inspectorate is a document with which the employer reports

Accept is not only a famous rock band from Germany, but also an important legal

We will not consider salary calculation in detail, but will analyze the entries that are generated in the accounting

If the employee worked officially, then upon dismissal of his own free will or in another case

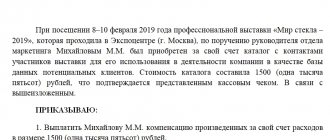

Business trips Olga Yakushina Tax expert-journalist Current as of June 13, 2019 Collective trips of employees to

Deferred income (FPI) is an important criterion taken into account when analyzing the economic and financial functioning of an organization. IN