Business trips

Olga Yakushina

Tax expert-journalist

Current as of June 13, 2019

Collective trips of employees on business trips are a regular occurrence. In relation to each employee, management must issue an executive order on departure for official purposes - but it is absolutely not necessary to make such acts personal. You can create one common one for all travelers - the legislator allows this and, moreover, proposes using the convenient unified form T-9a for such purposes.

On what basis is the order issued?

According to the new rules, registration of a business trip currently requires only the issuance of an appropriate order from the manager about this.

As necessary, heads of departments or other responsible persons who believe that it is necessary to send an employee on a business trip draw up a report or memo addressed to the director of the company.

In them, they justify the reason for the upcoming business trip, its purpose, duration in time, and also propose candidates for this trip. The purposes of a business trip can be representative or production.

The manager, having studied the received documents, makes a decision on this issue, for the execution of which an order is issued to send him on a business trip.

At large enterprises, business trips are planned. This can be expressed in drawing up a travel plan for the current year. When the time specified in this document arrives, the HR department prepares a business trip order, which is submitted to the manager for signing.

In addition, the organization may draw up a job assignment, which is currently used by organizations at their discretion. It can also be used as one of the sources for forming an order.

Whatever the basis for this document, the responsible person can use a company letterhead or a specialized form, the unified form T-9.

Attention! The form of the business trip order must be recorded in the accounting policy of the enterprise or the Regulations on business trips, which can be issued in the organization.

Return report

Upon return, you must complete and submit a report to the organization’s accounting department.

An advance report is a primary accounting document that confirms the expenditure of the amounts allocated to the employee, to which documents confirming the expenditure of accountable funds must be attached. It is drawn up according to the unified form No. AO-1. Documents confirming expenses must be attached to it.

The report must be submitted no later than 3 business days upon return for final payment.

How to issue a business trip order for an employee using the T-9 form in 2021

As soon as the manager decides to send employees on a business trip, the person in charge must draw up an order about this.

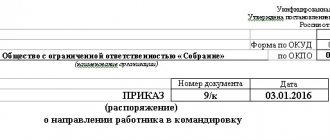

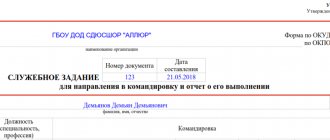

At the top of the document the name of the business entity and, if necessary, the name of its structural unit are reflected. Here, next to it, the registration code of the enterprise is indicated, which it receives when registering with Rosstat (OKPO code).

This is followed by the name of the administrative document, its sequential number and date of publication. Under these details, the order will subsequently be reflected in all other forms.

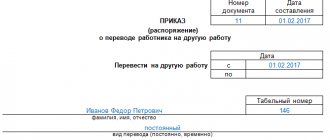

In the following lines, you need to write down the employee’s number according to the time sheet, which is assigned to him at the enterprise upon admission, as well as his full name.

After this, the designation of the department where the employee works, as well as the position or profession he occupies in the organization are indicated.

The T-9 form below requires entering information about the place where the employee is going. Here you can enter the country, city or name of the receiving organization.

After this, the duration of the business trip is entered, and just below the start and end dates of the business trip are indicated.

In the next section it is necessary to reflect the purpose of the upcoming business trip as stated in the report or approved plan.

After this, the order reflects the source from which the expenses for the upcoming business trip will be financed. Next, you need to write down the name of the document and its details, on the basis of which the manager’s order is generated.

After this, the order must be endorsed by the management of the company, indicating the position and its data.

Attention! The posted worker should be familiarized with this order, and he must make a note on the order in the form of a visa and write down the date the order was read.

Based on the issued order, the responsible persons pay before the business trip the amounts for expenses during the trip, including daily allowances for business trips.

How to fill?

Name of the organization. This information must be included in all of her official documents, including the travel order. The name fully corresponds to that specified in the constituent documents. Provided that the organization is additionally assigned an abbreviated name, the full name is written first, and then, in parentheses, the abbreviated name.

Code according to OKUD . The abbreviation OKUD stands for “all-Russian classifier of management documentation.” If the title of the document is contained in this classifier and the document itself is compiled in a unified form, the form code must be entered. However, now in most cases, forms are used to draw up orders, which are easy to find in electronic reference systems like Garant, and in them the code is indicated on the forms automatically.

Want to ? You should follow the link.

Form No. T-1 sample is presented here.

When is the T-51 payroll form used? This is discussed here.

The code of the organization itself . It is indicated according to the all-Russian classifier of enterprises and organizations; it consists of 8 characters.

Last name, first name and patronymic in full. Since an employee who is an employee of the company is sent on a business trip, it is not necessary to check the last name and initials with a passport or a document of similar legal force. Important point: full name must be written in the accusative case.

Personnel Number . Another detail that is often forgotten, but which must be indicated in the order. A personnel number is assigned to each employee upon employment.

Structural subdivision . Of course, this is indicated if the employee was hired specifically in a structural unit of the organization. Otherwise, this part of the order will not be filled in.

Job title . The full name of the position, profession and specialty is entered without abbreviations.

Destination . This item is indicated in the order in accordance with the previously issued official assignment. The country must be indicated if the employee is sent on a foreign business trip (the name is written according to the all-Russian classifier of countries of the world). If the destination is on Russian territory, then this is not necessary. As for the city, if it is not the capital of a region or a city of federal significance, it is necessary to additionally enter the administrative-territorial affiliation.

Clearly established travel dates. The entire period during which the employee will be on a business trip must be comprehensively indicated here - that is, the time spent on the road also applies to the duration of the business trip. When specifying this point, you must be guided by the provisions of the previously drawn up job assignment.

Dates . Indicated on the basis of the official assignment. More details about the principles of accurate date calculation will be discussed below.

The purpose for which the employee goes on a business trip. It must be formulated in detail and thoroughly, without using phrases that can be interpreted ambiguously or not fully understood. Specificity first.

Reimbursement of expenses to an employee. Cash expenses incurred by the employee are reimbursed to him before or after the trip. When filling out, you need to determine exactly who reimburses the employee for his expenses and indicate the appropriate option. There are three of them: either the employer or the receiving party pays, or the payment is distributed between them in the proportion established by agreement.

The basis is a job assignment.

Signature of the decision maker. Without a signature, the order has no legal force. In addition to the signature itself, its decoding must be indicated, as well as the position of the person who signed the order.

Date the order was issued. In fact, the date the order was signed by the manager. The order of day – month – year is indicated, and exclusively in numbers. Denoting a month with a word, as is sometimes practiced, is unacceptable.

number . It is placed only after its registration in a special form. Since this order is subject to storage for at least 5 years, its registration is carried out separately, or along with orders that have a similar storage period. The order number is usually accompanied by an indication of the letter index. In this case, the index “sk” is used. The document is registered after signing and the registration number is written by hand.

Signature certifying that the employee has read the order. The employee must certify that he has read the order with his signature.

Sample of filling out a business trip order using form T-9a

When it is necessary to send several employees on a business trip at once, then in this case the order form t-9a is used. The standard form includes columns to reflect the trip of three people. If necessary, the form can be expanded to cover the required number of employees.

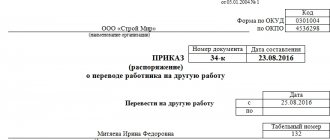

The document is filled out as follows. The full name of the company is entered in the upper part, and next to it in the column on the right is its code according to the general OKPO directory.

Further below, the serial number of the order and the date on which it was drawn up are indicated. Under it, this order will then need to be registered in the order book for the organization.

You might be interested in:

An employee took a taxi on a business trip - is it possible to deduct these expenses?

The document itself looks like a table. The lines contain indicators that need to be noted for each employee. Data on the latter are entered into columns. The rows in this table are not numbered.

Full name is written in the first line. employees who are going on a business trip. The next line contains their personnel numbers.

In the third line you need to write down the names of the departments in which the employee works. Quadruple - the names of their positions, as indicated in the staffing table.

The next line should include travel details. It, in turn, is divided into several substrings.

In the fifth and sixth fields you need to write down the name of the country and city where you will be traveling, as well as the name of the host organization.

Next come the seventh and eighth lines - in them you need to write down the start and end days of trips for each of the employees. The ninth includes the number of days of travel for each business traveler. The tenth line should contain a brief summary of the purpose of the trip.

Eleventh line - it indicates the source of funds from which payment for the business trip is made. Usually these are the company’s own funds, but in some cases the business trip may be paid for by the host party.

The twelfth line serves to confirm that the employee has read the order. In it he must put his signature and the date when he did it.

At the bottom of the document, after the table, there is a line in which you need to enter information about the document on the basis of which the business trip is issued.

The completed order is signed by the director of the company.

Nuances

If a group of employees is sent on a business trip, then you can use the unified T-9A form to draw up an order. It looks like a table in which data for each employee is entered line by line.

As a rule, the company finances the trip of its people itself. However, there are cases when, on the basis of a concluded agreement, all costs are paid by the receiving party - for example, when carrying out commissioning of new equipment. In this case, the relevant data is entered in the column “Trip at expense”.

Related documents

When an order is drawn up to send an employee on a business trip, a personnel specialist can draw up additional documents along with it.

It is important to remember that some of them are no longer mandatory, but must be compiled if this is expressly stated in the accounting policies:

- Travel certificate. It is necessary to put marks in it in the form of seals of the receiving companies. It is not mandatory, but can be used by the employer at will.

- Service assignment. A document in the T-10 form, which contained a list of tasks that the employee had to complete during the trip. Currently also recognized as optional.

- Logbook for travel workers. A note must be made in it when the employee departs on a business trip and when he arrives at the company. Nowadays, journaling is not mandatory.

- Service note. Drawed up by the employee justifying the amount of the requested accountable amount for the duration of the business trip. Another note can be issued upon arrival from a business trip with a request to pay the costs of purchasing fuel and lubricants - if the employee used a personal car.

General information

A business trip is a trip by a full-time employee with whom an employment contract has been concluded, by order of the employer, to another location (outside his permanent place of work) for official reasons.

For registration and payment, you will need to fill out an order on Form T-9. The following expenses are paid:

- daily allowance;

- expenses for renting residential premises;

- travel expenses to and from the site.

Other expenses may also be paid, such as, for example, telephone or postal fees, visas and passports, consular fees, etc.

The organization determines the duration of an employee’s stay on a business trip independently, taking into account the volume, complexity and other features of the official assignment.