We will not consider payroll calculations in detail, but will analyze the entries that are generated in accounting after the calculations are completed for each employee.

Stages of work on payroll accounting in an organization:

- payroll;

- deductions from wages;

- calculation of insurance premiums;

- payment of wages;

- payment of personal income tax and contributions.

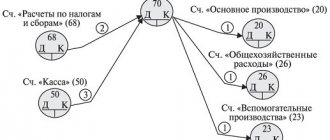

To record all transactions related to wages, account 70 “Settlements with personnel for wages” is used. The credit of this account reflects accruals, the debit - personal income tax, other deductions and salary payments. Postings for payroll, deductions, personal income tax and insurance contributions are usually made on the last day of the month for which wages are accrued. Postings for salary payments and personal income tax and contributions are made on the day of the actual transfer (issue) of funds.

How to organize accounting

The chart of accounts (Order of the Ministry of Finance No. 94n dated October 31, 2000) provides account 70 “Settlements with personnel for wages” to reflect accruals and payment of wages and deductions from it. Postings are generated using it when accruing salary in correspondence with other accounts. The account is passive, and its loan balance reflects the amount of wages the organization owes to its employees. The credit of the account reflects the accrual of fees for performing labor duties. The debit reflects a transfer from a current account or a posting for the payment of wages from the cash register, reflecting the amount of deductions.

Analytical accounting should be organized for each employee separately. This will allow you to receive up-to-date information on accruals and debts for each individual employee of the company at any time.

The main stages of organizing payroll accounting include:

- Calculation of wages.

- Calculation and accounting of deductions from salaries.

- Calculation of insurance premiums.

- Payment of wages.

- Transfer of personal income tax and insurance premiums.

The accountant repeats all stages every month, and individual entries are generated for each case. We will describe in detail everything an accountant needs to know in 2021 about the correspondence of accounts that are used most often.

ConsultantPlus experts examined how to reflect in accounting the wages overpaid upon dismissal of an employee, and the corresponding amounts of personal income tax and insurance contributions. Use these instructions for free.

Purpose of deposited salary: nuances

Let's consider an example of an atypical salary payment scheme - when it comes to depositing funds. What is it?

At some enterprises, salaries are issued through a cash register. This means that to receive it, the employee must personally appear at the enterprise. But for one reason or another, for example due to being on sick leave, he may not have time to arrive for the payment of wages on time.

To ensure that the employee has the opportunity to receive his salary later, the accounting department deposits it - temporarily reserving it for a future payment by returning it to a bank account or placing it in the cash register (in the latter case, you need to monitor the cash register limit).

IMPORTANT! As of November 30, 2020, the rule on reflecting in the payroll the deposit of wages not paid on time has been excluded from Central Bank instruction 3210-U.

ConsultantPlus experts told us what other innovations in the procedure for recording cash transactions came into effect on November 30, 2020. Get trial access to the K+ system and go to the review material for free.

If deposited wages are generated, then the posting reflecting this fact will look like this: Dt 70 Kt 76.4. The fact of the return of the amount corresponding to the deposited salary to the current account (if such a decision is made) is reflected by the posting: Dt 51 Kt 50. The fact of its payment when the employee applies is shown by correspondence: Dt 76.4 Kt 50.

An employee can receive a deposited salary within 3 years from the date of salary accrual (letter of the Federal Tax Service of Russia dated October 6, 2009 No. 3-2-06/109). If he does not do this, then the payment is written off as non-operating income. This fact is reflected by the posting: Dt 76.4 Kt 91.

You can learn more about the specifics of accounting for deposited wages in the article “How to correctly reflect deposited wages in 6-NDFL.”

How to reflect in accounting

The accrual of wages is reflected in the credit of account 70. Corresponding accounts when calculating wages reflect the direction of cost accounting depending on the labor functions performed by the employee. Also, the credit of account 70 reflects the accrual of fees for the time the employee is absent due to illness or vacation.

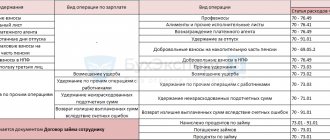

| Debit | Credit | |

| Posting of payroll for employees of main production | 20 | 70 |

| Workers of auxiliary production | 23 | 70 |

| Employees of departments serving the main production | 25 | 70 |

| Posting payroll to management personnel | 26 | 70 |

| The construction work of the new administrative building is being carried out on our own. | 08 | 70 |

| Calculated salaries of employees of a trade organization | 44 | 70 |

| Calculated payment for certificates of incapacity for work at the expense of the employer (the first three days) | 20, 25, 26, 44 | 70 |

| Calculated payment for certificates of incapacity for work at the expense of the Social Insurance Fund | 69 | 70 |

| Reflects accrued payments that are not directly related to work activities (for example, an employee’s anniversary bonus) | 91 | 70 |

| If a reserve is formed for vacation pay | ||

| A deduction was made to the reserve on the date when wages were accrued | 20, 25, 26, 44 | 96 |

| Vacation pay accrued | 96 | 70 |

Key points

Let's determine the important points when calculating salaries:

- The institution must develop and approve a regulation on remuneration, which is formed taking into account the specifics of the organization’s activities and does not contradict current legislation.

- The salaries of the employees of the institution should be calculated in strict accordance with the approved regulations on remuneration and individual local orders of the head of personnel.

- Regardless of the amount of the advance, which is provided for the first half of the worked period, wages are accrued in full. And on the last day of the month.

- Personal income tax should be withheld from wages and insurance premiums calculated for the entire amount of accruals, without deducting the advance already paid for the first half of the month. The amounts that should be included in the tax base are set out in the Tax Code.

- In 2021, apply the new minimum wage for workers whose salary does not exceed the minimum wage. The minimum wage is regulated by law dated June 19, 2000 No. 82-FZ with the latest amendments.

- Provide in the wage regulations, collective agreement and labor agreements that salary transfers to the organization are carried out at least twice a month.

- Take into account the regional coefficients established in the region where the organization is located. Take into account the amounts of regional surcharges when calculating the minimum wage.

- When terminating an employment contract, make final payments on the employee’s last working day. Moreover, the amount of mandatory compensation calculation does not depend on the reason for dismissal.

- In accounting, use standard entries for budgetary institutions in 2021.

You should follow instructions No. 174n and No. 157n - for public sector institutions, and instructions No. 94n - for non-profit organizations.

Salary deductions

Deductions from wages are reflected in the debit of account 70. The main ones are:

- personal income tax;

- alimony, other deductions under writs of execution;

- contributions to a trade union organization;

- compensation to the enterprise for damage or loss.

| Debit | Credit | |

| Personal income tax calculated | 70 | 68 |

| Payments under writs of execution (alimony, fines) are withheld | 70 | 76 |

| Amounts of compensation for shortages and damages due to the fault of the employee are withheld | 70 | 73 |

| Upon dismissal, payment for unworked vacation days is withheld, reversal | 96 (20, 25, 26, 44) | 70 |

Read more: Calculation and withholding of alimony

The difference between an advance and a deposit

An advance is often confused with a deposit. Both the advance and the deposit have one function - advance payment for a product or service, partial or full. There is no clear definition in the legislation to separate these concepts, but according to established practice, an advance payment is considered to be the amount of prepayment for the transfer of which a separate agreement to the contract has not been drawn up:

Payment of wages

Salaries, at the employee’s request, are issued to him in cash or by bank transfer. Regardless of whether it is transferred to the card or issued from the cash register, the posting of paid wages is generated by the debit of account 70.

| Debit | Credit | |

| Salaries were paid from the bank account to employee cards | 70 | 51 |

| Salary posting issued from cash register | 70 | 50 |

| Alimony and other deductions under writs of execution have been paid | 76 | 51 |

Personal income tax and insurance premiums: calculation and payment

From payments to employees, employers are required to calculate and transfer to the state:

- personal income tax (the rate for residents is 13% on incomes not exceeding 5 million rubles, 15% on higher incomes);

- insurance premiums (22% - OPS, 5.1% - Compulsory Medical Insurance, 2.9% - OSS).

IMPORTANT!

For 2021, reduced rates of insurance premiums for small and medium-sized businesses have been retained: 10% - compulsory insurance, 5% - compulsory medical insurance, 0% - compulsory insurance for payments exceeding the minimum wage.

To generate entries for accounting tax payments, the chart of accounts provides account 68, and for the calculation and accounting of insurance premiums - account 69.

| Debit | Credit | |

| Personal income tax calculated | 70 | 68 |

| Insurance premiums have been calculated | 20, 23, 25, 26, 44 | 69 |

| The withheld personal income tax was transferred to the budget | 68 | 51 |

| Insurance premiums transferred to the budget | 69 | 51 |

Read more: Deadlines for personal income tax payment

Read more: Basic information about insurance premiums

Reduced contribution rate for SMEs

From April 1, 2020, business entities classified as SMEs (in accordance with Federal Law No. 209-FZ dated July 24, 2007) have the right to apply special rates for deductions from payments to employees exceeding the minimum wage at the beginning of the year:

- for OPS - 10% both before and after the annual income limit is exceeded;

- according to the Social Insurance Fund – 0%;

- according to compulsory medical insurance – 5%.

The final amount of deductions will be 15%.

Let's look at an example of how contributions are calculated for income below and above the minimum wage:

| Index | Salary below minimum wage | Salary above minimum wage |

| Monthly salary, rub. | 12 000 | 21 000 |

| Minimum wage, rub. (effective 2021) | 12 130 | |

| General deduction rate for income within the minimum wage | 30% (22% + 2,9% + 5,1%) | |

| Total amount of contributions for income within the minimum wage, rub. | 12,000 x 30% = 3,600 | 12,130 x 30% = 3,639 |

| Deduction rate for income above the minimum wage | 30% | 15% (10% + 0% + 5%) |

| Total amount of contributions for income above the minimum wage, rub. | — | (21,000 – 12,130) x 15% = 1,330.50 |

| Amount of deductions at the regular rate (30%), rub. | 12,000 x 30% = 3,600 | 21,000 x 30% = 6,300 |

| Employer benefit, rub. | — | Saving: 6 300 – (3 639 + 1330,50) = 1330,50 |

There are no special features for preparing accounting entries for insurance premiums with a preferential tariff. If desired, you can open separate sub-accounts to account for deductions at reduced rates. In this case, contributions to the budget are transferred according to a single BCC - both at the basic and at a reduced rate. The use of different subaccounts will lead to the need to divide the payment in accounting into two parts to offset accruals in the context of the new analytics.

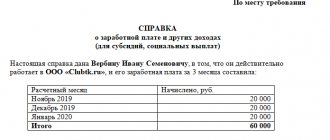

Reflection of PO transactions in accounting registers

Forms of registers for recording business transactions are developed and approved by a commercial organization independently. They must ensure that they can obtain up-to-date information about the company's assets and liabilities at any time.

As mentioned above, the payroll accounting register is required to provide detailed data for each employee. It is also advisable to detail the data on the types and amounts of charges, deductions and payments. Such detailed accounting is organized in an independently developed form or using the T-54 form, approved by the State Statistics Committee in Resolution No. 1 of 01/05/2004. The basis for calculating wages and filling out registers for its accounting are:

- time sheets;

- employment contracts;

- bonus orders;

- vacation orders;

- writs of execution and statements of deductions;

- other documents on labor standards and remuneration.

Form T-54

Also, according to Article 136 of the Labor Code of the Russian Federation, the employer is obliged to notify staff about accruals and deductions before transferring wages. This can be done by issuing a pay slip to the employee. Its form should be clear and allow the employee to know about accruals, deductions and amounts to be received. The organization has the right to inform an employee both on paper and in electronic form, for example by sending a payslip by email.

Pay slip form:

Read more: Procedure and deadlines for issuing pay slips

Salary issued (reflected on the employee’s personal account): postings

The fact of salary payment is reflected in accounting by the entry: Dt 70 Kt 51 (or 50).

A similar posting is used when paying an advance.

You can learn more about the peculiarities of calculating an advance at an enterprise in the article “Advance is what percentage of the salary?”

The date of formation of the above posting for salary or advance payment is determined based on the date of each payment.

In this case, the actual amount of the “basic” labor payment is calculated minus the advance and personal income tax. It turns out that the tax is “withdrawn” from the corresponding amount, although it is charged on the total salary (the summed amount of the “basic” payment and advance payment). This circumstance reflects the specifics of tax accounting.

In accounting, therefore, in any case, the following should be distinguished:

- advance amount;

- the amount of the “basic” payment.

Postings of payment of wages in terms of the advance and its second half are recorded in the accounting registers on the day the funds are issued to employees.

After all the transfers, the employees’ personal payroll accounts are filled out (on Form T-54). Information is entered into them monthly.

You can learn more about the use of form T-54 in the article “Unified form No. T-54 - personal account.”

Accrual example: calculation and postings

Let's look at an example of the procedure for generating entries for debt to an employee for accrued remuneration for wages for work and its payment. LLC "Company" employs two people. The organization is engaged in wholesale trade, and wage entries for the director and all other employees are generated and assigned to account 44. Salaries are paid on the 10th of the next month. On the same day, personal income tax and alimony are transferred. Insurance premiums were transferred on December 14, 2020.

Manager Petrov P.P. pays alimony according to the writ of execution - 25% of the salary. Everyone is tax residents, that is, the personal income tax rate for everyone is set at 13%. The organization pays insurance premiums at regular rates (22% - OPS, 5.1% - Compulsory Medical Insurance, 2.9% - OSS). All employees are paid salaries via bank cards.

| FULL NAME. | Job title | Accrued based on salary | Sickness benefit (all payment at the expense of the Social Insurance Fund) | Personal income tax | Alimony | To payoff | Insurance premiums | ||

| OPS | Compulsory medical insurance | OSS | |||||||

| Ivanov I.I. | Director | 40 000 | 10 000 | 6 500 | 43 500 | 8 800 | 2 040 | 1 160 | |

| Petrov P.P. | Manager | 30 000 | 3 900 | 6 525 | 19 575 | 6 600 | 1 530 | 870 | |

| Total | 70 000 | 10 000 | 10 400 | 6 525 | 63 075 | 15 400 | 3 570 | 2 030 | |

The accountant will generate the following accounting records:

Entries for payroll and taxes for January 2021

| Sum | Debit | Credit | |

| January 31, 2021 | |||

| Salary accrued | 70 000 | 44 | 70 |

| Disability benefits | 10 000 | 69 | 70 |

| Personal income tax withheld | 10 400 | 70 | 68 |

| Child support withheld | 6 525 | 70 | 76 |

| Insurance premiums accrued (15,400 + 3,570 + 2,030) | 21 000 | 44 | 69 |

| February 10, 2021 | |||

| Salary paid | 63 075 | 70 | 51 |

| Alimony payments listed | 6 525 | 76 | 51 |

| Personal income tax paid to the budget | 10 400 | 68 | 51 |

| February 15, 2021 | |||

| Insurance premiums listed | 21 000 | 69 | 51 |

Please check the wiring:>

The organization produces the following types of products: P1, P2, P3. Products are manufactured sequentially in main production workshops No. 1 and No. 2. The organization has two auxiliary workshops: repair and transport. During the reporting period, the repair shop carries out repairs of the organization's fixed assets according to the order of workshop No. 1 and the order of workshop No. 2. Materials and finished products are stored in general plant warehouses. The plant management manages the organization. General plant departments manage the technical, economic, supply and sales policies of the organization.

The organization produces the following types of products: P1, P2, P3. Products are manufactured sequentially in main production workshops No. 1 and No. 2. The organization has two auxiliary workshops: repair and transport. During the reporting period, the repair shop carries out repairs of the organization's fixed assets according to the order of workshop No. 1 and the order of workshop No. 2. Materials and finished products are stored in general plant warehouses. The plant management manages the organization. General plant departments manage the technical, economic, supply and sales policies of the organization.