L. V. Sologubova author of the article, consultant to Askon on accounting and taxation in budgetary

A legal entity can correct a difficult financial situation by using borrowed funds. The law allows you to take

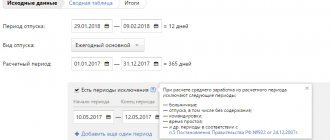

Labor Code of the Russian Federation on the timing of receiving vacation benefits Annual paid leave is provided to each employee.

Other current assets are those company resources that were not classified as fixed assets.

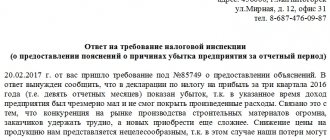

Commercial enterprises quite often face the need to provide explanations to the tax office regarding any

A personnel number is a detail that is used in personnel records. Using your personnel number

How should a tax return under the simplified tax system for 2020 be completed? in Excel,

Every successful company hires employees sooner or later. If you design them improperly

The Labor Code provides several grounds on which the employing organization can make deductions from wages

Sales costs are one of the main indicators that an enterprise must take into account to form