A legal entity can correct a difficult financial situation by using borrowed funds. Legislation allows borrowing not only from specialized financial and credit institutions, but also from other legal entities that have free circulating assets. The procedure for forgiveness of loan debt between legal entities must be carried out in strict compliance with the norms of current legislation and be documented. Otherwise, the tax authorities may recognize the transaction as invalid.

Rules for formalizing debt forgiveness between legal entities

It is prohibited to donate company assets. This states article number 575 of the Civil Code of the Russian Federation. To ensure that the tax authorities do not have suspicions about the debt forgiveness transaction, it must be properly executed.

Article number 415 of the Civil Code of the Russian Federation allows creditors to write off or forgive the debts of debtor companies. But here it is important that the rights of debtor enterprises are not violated. If such an enterprise does not want its debts forgiven, then it must notify its creditor about this.

Let's consider options for obtaining debt forgiveness. There are only two of them:

- Sending a written notice to the debtor about the cancellation of debts. The date of forgiveness here begins precisely from the day the letter was received.

- Drawing up a bilateral debt cancellation agreement. Copies of contracts and any other certificates and papers that are specified in the text of the agreement must be attached to such a document.

What should be included in the agreement?

- The total amount of debts eligible for forgiveness.

- Subject of the transaction.

- Participants' consent to the forgiveness procedure.

- The name of the organizations entering into the agreement and their details.

- Conditions and circumstances under which debt can be written off.

- Details of the contract concluded between the participants, on the basis of which one of them incurred debts.

- Documentary evidence of the debt incurred.

- An economic explanation of why debt should be forgiven, without evidence of a gift.

Expert opinion

Evgeniy Sergeevich Makarov

Arbitration manager with more than 10 years of experience

For the agreement to have legal force, the transaction must be accompanied by the results of a reconciliation, which will show the fact that one of the participants has a debt.

Actions of the creditor:

- Draw up a reconciliation report with the debtor company.

- Send a message to the defaulter, the text of which will reflect that the creditor is ready to forgive part of the debt or write it off completely.

- Wait for a response letter about consent or possible objections.

- Confirm the transaction by documenting it separately, or as an additional agreement to the main contract.

agreement on debt write-off under a loan agreement with the founder can be found here

In what cases can a debt be forgiven?

Loan agreements between legal entities are always concluded in writing and can be either interest-bearing or interest-free. The norms of civil and tax law allow the forgiveness of formed debt. Such a transaction can either be part of a debt restructuring program at the lender’s company, or a mechanism for the lender to receive significant material benefits in the future.

Chapter 26 of the Civil Code of the Russian Federation is devoted to the concept of “debt forgiveness”. The debt forgiveness procedure completely frees the borrower from the need to repay the debt under a specific loan agreement.

First of all, third parties should not suffer from such a decision. For example, an organization asked to borrow from another legal entity the funds necessary to purchase raw materials. As confirmation, an agreement with the supplier company was provided. The lender must check whether payment has been made under the contract for the supply of raw materials and only after that begin the procedure for writing off the debt.

Articles of the Civil Code of the Russian Federation provide for the following cases for writing off debt between legal entities:

- the debtor has circumstances that prevent him from repaying the loan. Such circumstances must occur after signing the contract, according to Art. 415 Civil Code of the Russian Federation;

- liquidation of a legal entity (both borrower and lender) – Art. 419 Civil Code of the Russian Federation;

- issuance of an act of a state authority or local government that does not allow the debtor to repay debt obligations – Art. 417 of the Civil Code of the Russian Federation.

Registration of the debt forgiveness procedure. Accounting

It is worth noting that debt forgiveness should not be taken into account when calculating the tax base. Because of this, differences with tax obligations constantly arise in accounting. Such a discrepancy must be reflected in DEBIT 99 and CREDIT 68.

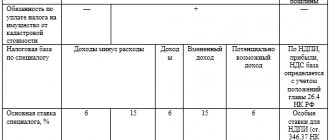

If an agreement is concluded to forgive a debt to a legal entity, the following entries may be used.

| Operation | DEBIT | CREDIT |

| Recording the fact of sale of finished products | 62 | 90.1 |

| Calculation of value added tax | 90.3 | 68 |

| Reflection of the write-off of the actual cost of the shipped batch of goods | 90.2 | 41 |

| Transfer by the debtor of part of the debt amount at the expense of the supplier | 51 | 62 |

| Partial/full repayment of debt upon concluding a debt forgiveness agreement | 91.2 | 62 |

| Permanent tax liability based on a certificate-calculation | 99 | 68 |

Expert opinion

Makarov Evgeniy Sergeevich

Arbitration manager with more than 10 years of experience

A company may develop debt not only due to the fact that it did not pay on time for the supply of goods or services, but also as a result of a loan taken out. Then here the lender must keep separate records of the loan taken and the interest on it.

Note! The creditor can agree to forgive not only the principal debt, but also the interest on it.

In the case of debt forgiveness, the following must be considered:

- The forgiven debt along with interest is not considered an expense transaction. But in accounting, such an operation will entail costs.

- The following entry is made in the accounting entry: DEBIT 91.2 CREDIT 76 for the amount of interest on the loan written off.

- Due to the fact that loans are not subject to VAT, if interest debt is written off, there will be no tax consequences for this type.

- After writing off the debt, the accountant must make the following entries.

| Operation | DEBIT | CREDIT |

| Reflection of the fact of issuance of borrowed funds | 58.3 | 51 |

| Monthly posting of interest accrual on the outstanding amount of the loan | 76 | 91.1 |

| Closing the principal debt | 51 | 58.3 |

| Write-off of loan interest specified in the debt forgiveness agreement | 91.2 | 76 |

| Fixation of permanent tax liability | 99 | 68 |

Drawing up an agreement

The content and form of the agreement are not regulated by law, therefore, when drawing up a debt forgiveness agreement, one should be guided by common sense and the basic requirements of the law for drawing up contracts in general.

There are three ways to conclude a contract - in simple written form, in complex written form and orally.

A complex form is an option for which the law provides for a mandatory notarization procedure. A simple form is a written agreement that does not require notarization. And the oral form is a regular bilateral verbal agreement.

It should be assumed that verbal forgiveness of debt may well take place, for example, in loan agreements for a small amount between close people.

You should know that oral communication is a full-fledged way to conclude a deal. By the way, daily purchases in a store are a new contract every day that does not need to be written. Moreover, these agreements are fully protected by the same law “On the Protection of Consumer Rights”. That is, verbal forgiveness is not empty words if they are spoken in front of witnesses or at least confirmed with a simple stroke of the pen.

As for loan agreements with the participation of legal entities, the oral form does not apply here. Also, an oral form of concluding an agreement will not be appropriate in cases where the very fact of debt forgiveness will give rise to the release of the debtor from various restrictions, for example, from a ban on traveling abroad, etc.

Legal justification for the agreement

This transaction is considered absolutely legal. It is permissible to conclude a contract unilaterally when the creditor sends notice of the procedure to the defaulter. You can also draw up a contract if all participants are present.

To give legal force to a document, it is necessary to include the following information:

- Personal data of all parties to the agreement.

- Certificates or papers indicating on what basis the debt arose.

- It is necessary to provide information about which specific obligation is subject to forgiveness.

- The amount of debt to be written off. It must be expressed in monetary terms.

Debtor: VAT payment

VAT deductions are made in case of exploitation of the received products in areas subject to VAT. If the transaction is executed by competent persons, adjustment of tax deductions will not be necessary.

Attention. Actions must be taken in accordance with the recommendations provided.

VAT restoration is carried out in accordance with clause 3 of Article 170 of the Tax Code of the Russian Federation.

It is not allowed to restore VAT if tax deductions from the products received were previously accepted.

Contractual obligations based on loans may be forgiven. The initiator of such procedures is always the bank. The unilateral decision on the creditor's intention to forgive the defaulter is accompanied by the execution and sending of an official notice.

The debtor may be considered released from the loan obligation if such paper is available. The main condition is his agreement with the proposed way out of the conflict situation.

The decision made by both parties to the conflict is fixed in a bilateral agreement, according to which the debt is forgiven. The clauses of the contract include options for remuneration or gratuitous fulfillment of conditions. Payment of interest on the principal debt after the conclusion of the transaction is not made.

The gratuitous option of forgiving a debtor from debt obligations is called a donation operation.

A small amount of debt is forgiven to the debtor due to the likelihood of additional collection costs exceeding the amount of the debt.

What does the process look like from a legal point of view?

It's quite easy to make such a deal. However, in order to avoid future problems with the law, it is necessary to formalize it correctly. Sometimes an agreement may be subject to challenge, since there are suspicions that its conclusion entailed the extraction of additional benefits. If during the investigation it turns out that the assets were donated, then other legislative acts will apply. And this, in turn, can cause serious problems if the case comes to trial. Writing off debts by donation between legal entities is prohibited by the laws of the Russian Federation.

Important! To avoid such situations, we recommend attaching evidence to the contract that can confirm the legality of the transaction.

How to compose?

Debt forgiveness is quite often used in business activities, since in this case you can also get additional benefits. As a rule, the transaction is concluded in a bilateral format. She looks like this:

- Separate agreement.

- An additional agreement to the main contract on the basis of which the debt arose.

Examples

Let's look at the situations that sometimes arise between legal entities:

- The transaction is concluded because the obligations to supply goods or provide services have not been fulfilled. The benefit is to conclude a more profitable agreement in the near future.

- A contract is signed with the financial institution where the company received the loan. Here, debt write-off occurs as a restructuring or is included in its program.

- Enterprises forgive each other's debts.

- Loan debt forgiveness.

Note! It is necessary to write off not only debts in monetary terms, but also obligations of a different nature.

How is this type of transaction executed?

Forgiveness, which releases a debtor from a certain type of obligation, can be considered as an ordinary transaction executed between two legal entities. Many people wonder: is it possible to formalize it orally? According to the decree prescribed in the legislation of the country, forgiveness can be issued both in writing and orally. The most important thing is that the document is signed between legal entities so that the debtor can be legally freed from debt. There are several ways to obtain debt forgiveness. For example, by drawing up an agreement that will be signed between the person who gave the loans and the person obligated to repay the debt. This design option is not the main documentation, but acts as supporting paper. The main document should show the following points if the creditor decides to sign the debt forgiveness:

- A copy and original of the document that is the basis for the loan.

- A statement signed between both parties indicating that the debt forgiveness is signed by mutual consent.

- Describe the item that was the main item in the debt obligation and its estimated value.

How not to make the forgiveness procedure a process of giving?

To avoid doubt, consider the following information:

- It is advisable to write off only part of the debt, and for the second part, ask the debtor to guarantee that it will be closed.

- You can write off the entire debt, but then you must provide all the information confirming the impossibility of a partial return of obligations. Or repayment of the debt may entail losses or new costs for the creditor.

- The agreement must state that the defaulter wishes to continue cooperation with the creditor in the future.

- Other evidence that the transaction is not a gift.

Forgiveness of debt obligations with compensation

Consider a situation where the supplier is willing to forgive the debt in exchange for certain obligations on the part of the borrower. Such actions cannot be called gratuitous forgiveness. In accounting, accounts payable written off due to the expiration of the statute of limitations are reflected in non-operating income.

When the income portion is formed at the expense of forgiven debt, the tax base increases, so it is very important to make a correct assessment of the debt so that the amounts received do not cause any complaints from the tax inspectorate. The most correct thing would be to contribute to the income side exactly the amount of debt that the creditor has forgiven. As a result of such a transaction, the buyer has the right to also take into account input VAT in his expenses.

When drawing up a debt forgiveness agreement, you must include in this document all the conditions under which the seller forgives the debt to the buyer. Only in this case can the forgiven amount be included in income. All actions of an accountant are regulated by Article 250 of the Tax Code of the Russian Federation, paragraph 18.

Tax consequences of executing a debt forgiveness agreement

Regarding tax accounting, you need to pay attention to the type of taxation at the enterprise:

- If the accrual method is used, then revenue must be recognized without reference to the date of receipt of income.

- If the cash method is used, then the day the revenue is received must coincide with the date the income is accepted.

Important! The debt to be written off must not be overdue.

Two ways to write off debt under tax law:

- By paying off debt from net profit.

- Write-off for non-operating expenses to reduce the tax base.

Note! After the debt is forgiven, the defaulter must reflect it in non-operating expenses for tax accounting.

Income received from companies whose founders own more than 50% of the authorized capital of the debtor enterprise is not subject to income tax in the event of debt forgiveness.

Contributions to state extra-budgetary funds

As a general rule, amounts transferred to an individual under civil contracts (in our case, a loan agreement), the subject of which is the transfer of ownership of property (including money), are not subject to insurance contributions to state extra-budgetary funds (clause 4 Article 420 of the Tax Code of the Russian Federation).

This is consistent with the position of the judiciary. According to the judges, a debt under a loan agreement forgiven by an employer to his employee is not subject to insurance premiums if these relations are not related to the employee’s work responsibilities, and the debt write-off is formalized by a gift agreement (see resolution of the AS PO dated 05/07/2015 No. F06-22195/ 2013 in case No. A12-30165/2014, decision of the Supreme Court of the Russian Federation dated August 18, 2015 No. 306-KG15-8237).

A similar position is presented in the letter of the Federal Tax Service of Russia dated April 26, 2017 No. BS-4-11/8019.

However, as noted in the same document, if such non-repayable loans are issued by the employer to its employees systematically, this may mean that the employer is hiding labor benefits under the loans.

Features of debt write-off by its founder

In this case, debt forgiveness is issued on the basis of general requirements. Taxation also does not have any nuances, everything happens according to the general scheme. But the calculation of taxes for a defaulting company will depend on what share in its authorized capital the creditor has:

- If he owns 50 percent or less, the business's written-off debt is included in his income as received property on a free basis. This amount must be taken into account when calculating tax.

- If he owns more than 50 percent of the authorized capital, then the written off amount of debt is not included in the tax base.

Note! The amount of interest written off is always included in the enterprise’s income, and, as a result, increases the tax base.

debt forgiveness agreements can be found at this link

Is value added tax subject to cancellation of a transaction?

If we consider the tax that is provided for value added in debt forgiveness, then the situation in this matter is ambiguous. According to the state tax service, the debtor will have to pay tax because he did not pay for the products, so he has no legal right to deductions. If the debtor is forgiven, it means that he does not incur material costs, so the tax must be paid without fail.

The current situation cannot be favorable from an economic point of view and for the creditor. After all, according to the legislation of the country, organizations do not have the right to reduce tax obligations for any goods, taking into account those that the debtor has not fully paid.

Main mistakes

Error: The creditor enters into a contract to forgive debt obligations in full.

Explanation: To avoid problems from the tax authorities, we recommend signing an agreement to forgive half of your debt obligations. Otherwise, tax authorities will be able to accept such a transaction as a gift. And this is prohibited by the legislation of the Russian Federation. It is important to note that if writing off debt leads to costs for the creditor, then this must also be indicated in the text of the document.

Error: The creditor executed a contract for forgiveness of debt obligations without notifying the debtor.

Explanation: The creditor must make sure that during the conclusion of the transaction, its terms will not infringe on the rights of the debtor and third parties.

Another way

The creditor can create a special notification document that will reflect the forgiveness of the debt and forward it to the person acting as the debtor. The document should indicate the date until which the debtor is allowed to make some objections. If no objections are received before the appointed period, the transaction will be considered cancelled.

You can also sign a debt forgiveness in front of a panel of judges. It should be remembered that if debt forgiveness is signed between the creditor and the debtor on a legal basis, the first person will not be able to demand from the debtor the fulfillment of the conditions that were specified in the original version of the agreement. Even the court will not help to repay any type of debt in this situation if the creditor decides to turn to the state judicial body for help.