Commercial enterprises quite often face the need to provide explanations on any issue to the tax office. To ensure that these explanations do not lead to further checks by the supervisory authority, you should be extremely careful and scrupulous in preparing your response and not delay sending it.

- Form and sample

- Free download

- Online viewing

- Expert tested

FILES

The most frequently asked questions from the tax office

Usually, the requirement to provide explanations comes some time after submitting all kinds of reports and declarations, so any, even the most minor, error or inaccuracy in the documents can become the reason for them. In many cases, clarification is required for VAT indicated for reimbursement due to discrepancies in information about taxable bases in income tax returns and, again, VAT, if there is a discrepancy in data from counterparties. Questions may cause unreasonable losses when checking the accrual of income tax, filing an updated declaration or calculation in which the corrected amount of tax payable is less than that originally sent, etc.

Explanation of discrepancies regarding 6-NDFL

Quarterly, the accounting department submits Form 6-NDFL to the Federal Tax Service, which indicates information about income and withheld tax amounts for each employee.

What to do if tax authorities ask for clarification on inaccuracies in the report? To get started you need:

- check all indicators reflected in the form;

- check the indicated figures with other reports with which the tax office is reconciling;

- specify the amount of the transferred tax;

- if it turns out that there is no error, then you need to send a logical explanation; if an error is discovered, send a clarifying report.

If it turns out that there is an error in the personal income tax information, the company may be fined for inaccurate provision of information in the amount of 500 rubles. for each document (clause 1 of Article 126.1 of the Tax Code of the Russian Federation). The company is released from liability if the error was identified independently and corrected. Therefore, every accountant should know the rules for preparing all types of reporting in order to avoid mistakes.

Procedure upon receipt of a request

After the taxpayer receives requests for clarification, he must check the documents submitted to the tax office with the data in his hands.

First of all, when checking a VAT return, the amounts indicated in it are analyzed (for their compliance with the amounts for all incoming and outgoing invoices). Next, dates, invoice numbers, and other details (TIN, KPP, addresses, etc.) are examined in the same way.

If questions arise regarding the simplified taxation system declaration or income tax , you should analyze all the amounts of expenses and income that were accepted for their calculation. All other types of documents that raise questions from the tax inspectorate are also checked using the same algorithm as above.

After the error is found, you need to submit updated tax reporting with corrected data - but this only applies to amounts. If the error does not relate to the financial part, then there is no need to submit a “clarification”; it is enough to provide the necessary explanations.

Attention: the law does not say that explanations must be given in writing, i.e. this means that they can also be provided orally. However, in order to avoid further disagreements, it is better to take care of drawing up a written response.

What you need to know about the requirement

Firstly, in some cases, the inspectorate should be notified of receipt of a request for explanations (see letter of the Federal Tax Service of the Russian Federation dated January 27, 2015 No. ED-4-15/1071).

Read about when and how to do this, and what the consequences of violating this duty are.

Secondly, it should be borne in mind that the request may not have the stamp of the tax authority (see letter of the Federal Tax Service of the Russian Federation dated July 15, 2015 No. ED-3-2 / [email protected] ).

Read more about this in the material “A requirement without an inspection seal is the norm .

What to do when the tax demand is unfair

It happens that the tax inspectorate demands explanations unreasonably, i.e. no errors were made in the reporting. In such situations, you cannot ignore letters from the tax office either.

In order to avoid any sanctions (including sudden tax audits), it is necessary to promptly notify the supervisory service that, in accordance with the information of the enterprise, all the information provided is correct.

In any case, when drawing up a response, you must remember that for the tax office it is not so much the content of the letter that is important, but the fact of the response to the request itself.

What happens if you don’t send a response to the tax office?

If the enterprise that has received a request for clarification ignores the request, then under paragraph 1 of Art. 129.1 of the Tax Code of the Russian Federation, the consequence will be administrative liability and penalties in the amount of 5,000.00 (if the answer is not provided once) to 20,000.00 rubles (if this is a repeated violation).

Providing detailed explanatory information will lead to a dialogue with the Federal Tax Service and further resolution of the situation, while an unanswered request will entail serious proceedings that do not exclude going to court.

How to file a response to a tax request for clarification

It can be completed either on paper, written by hand, or electronically, printed on a computer. At the same time, if the explanation is sent by regular mail, then it must be sent by registered mail with return receipt requested, then the risk that the letter will be lost will be minimized.

The use of an electronic format is possible only if the organization has an electronic digital signature.

Any additional documents may be attached to the explanation; their presence must be reflected in the content of the response.

Main reasons for requirements and response options

Typically, a tax demand is preceded by a desk audit of any declaration.

What will arouse the inspector’s suspicion and force him to send a demand:

- In the updated return, you have reduced the amount of tax (applicable to any type of tax). Of course, this may be a completely legitimate, justified action. However, when showing a tax reduction, be prepared to explain the reason and provide documents.

- The VAT return declares the tax to be reimbursed from the budget. It is not profitable for the Federal Tax Service to reimburse you, so it is quite natural that the inspector should make sure that your claim is legal. Be prepared to provide copies of all invoices.

- The safe percentage of VAT deductions has been exceeded.

- Low tax burden.

- The declaration violated the control ratios.

- The declaration shows the loss.

- The supplier did not reflect the VAT transaction.

- Counter check. When checking your counterparty, the Federal Tax Service, to ensure the legality of the transaction, requires copies of documents from both parties.

We have given the most common reasons for the requirements of the Federal Tax Service. In practice there are many more of them.

Submit electronic reports, submit responses to requirements to the tax office via the Internet. Kontur.Extern gives you 3 months free!

Try it

If you think that the tax demand is unfair, you still need to write an explanation. In your explanation, you can refer to the articles of the Tax Code of the Russian Federation and justify your position. It also happens that the tax inspector is wrong. You need to defend your position.

Sometimes a list of documents must be attached to the request. This is done if the taxpayer brings the documents personally or sends them by Russian Post.

Sample list of documents to the tax office upon request:

- Sales book for the first quarter of 2021

- Purchase book for the first quarter of 2021

- Invoice (for prepayment) No. A0000000001 dated May 25, 2021

- Invoice No. 2172 dated June 17, 2021

- Consignment note No. 2172 dated 06/17/2021

How to sew documents for the tax office upon request? The taxpayer usually staples the submitted documents together with the inventory. There are no stitching rules. The main thing is to certify all copies of documents for the tax office accordingly.

As such, there is no sample explanatory note to the tax office upon request. The type of explanation will directly depend on the content of the requirement and its reasons.

Let's summarize. The deadlines for providing explanations at the request of the tax inspectorate are set out in the Tax Code of the Russian Federation. The Federal Tax Service also duplicates these deadlines in the submitted requirement. Responses to the tax authorities’ requests for explanations are submitted both on paper and electronically. The exception is explanations for the VAT return. They usually need to be submitted electronically via TKS.

Sample of a response to a tax request for clarification

As mentioned above, there is no unified response form for giving tax explanations, so you can compose it in any form. It is worth noting that the form of the response must be extremely correct and standard in terms of the rules for preparing such papers.

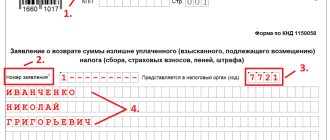

- First, on the left or right (it doesn’t matter) you need to indicate the addressee, i.e. exactly the tax office where the response is sent. Here you need to enter its number, as well as the region and locality to which it belongs.

- Next, the sender of the letter is indicated: the name of the company, its address (actual), as well as the telephone number (in case the tax inspector has any additional questions for clarification) is written.

- Further in the answer you should refer to the request number (and the tax service always assigns numbers to such documents), and its date (note: not the date of receipt, but the date of preparation), and also briefly outline the essence of the question.

- After this, you can proceed directly to giving explanations.

They should be written in as much detail as possible, with all the necessary links to documents, laws, regulations, etc. The more carefully this part of the answer is prepared, the greater the chance that the tax office will be satisfied with it. In no case should you give unreliable or deliberately false information in your answer - they will be quickly detected and then immediate sanctions from the tax authorities will follow. - After the explanation is given, it is necessary to certify the letter with the signature of the chief accountant (if necessary), as well as the head of the company (required).

Explanation of lack of activity

When conducting business activities, the company's management often encounters financial difficulties, which serves as a reason for suspending activities.

To avoid misunderstandings, it is recommended to immediately inform the tax authority, the Pension Fund of the Russian Federation, and social security services that for specific reasons the organization’s activities have been suspended, employees have been fired, and wages have not been accrued.

Let's find out what arguments can be written in a letter. Most often these are the following reasons:

- due to the economic crisis in the country;

- production volumes have decreased, activities have been temporarily suspended, if work is resumed, the organization undertakes to notify government authorities about this;

- The company decided to liquidate.

Suspension of a company's business activities does not relieve the taxpayer from submitting reports. Penalties are provided for late submission of even zero declaration forms.

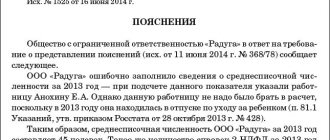

Reporting discrepancies

Quite often there are situations when the same economic indicator has different values in the presented forms of fiscal reporting. Such discrepancies are caused by the fact that for each tax, fee, contribution, individual rules for determining the taxable base are established. And if tax authorities require you to provide an explanatory note on this issue, provide explanations in free form. In the text, indicate specific reasons why the discrepancies arose.

Also, the reason for such inconsistency may be different norms and rules of tax accounting in relation to a number of specific situations. Write down the circumstances in an explanatory note.

It is welcome to provide explanations with references to the norms of the current fiscal legislation. Even if the company is wrong (incorrectly interpreted the norms of the Tax Code of the Russian Federation), the Federal Tax Service will provide detailed explanations, which will help avoid larger mistakes and fines in future activities.

Personal income tax accrued incorrectly

The error occurs infrequently, but still occurs. If the tax authorities have discovered an incorrectly calculated tax, the organization will have to not only prepare an explanatory note, but also generate corrective statements (certificate 2-NDFL).

For such a situation, an explanatory note in any form is suitable. If you don’t know how to write an explanatory note correctly, a sample will help you cope with the task.

Results

Tax Code in Art. 88 provides an exhaustive list of grounds for requesting explanatory information. Reasoned explanations submitted within the prescribed period at the request of the tax authority will allow you to objectively and reliably confirm the information originally submitted to the Federal Tax Service, as well as defend your position in a possible dispute with the tax authorities.

Sources:

- Tax Code of the Russian Federation

- Order of the Federal Tax Service of Russia dated November 7, 2018 N ММВ-7-2/ [email protected]

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Compiling a cover letter for the clarification

There is no legally developed form for such paper, so it is written in any form. The document must bear the signature of the head of the company, individual entrepreneur or person authorized for these actions.

A cover letter consists of a header and a body. The following information must be included in the header:

- To whom is the letter addressed? Here they write that the letter is intended for the head of the Federal Tax Service to which the entrepreneur belongs. That is, they indicate the tax office number, its address with an index.

- Who is the letter from? Enter the name of the company, its address, OGRN, INN, KPP.

- Letter number.

- The name of the document is a covering letter to the updated declaration.

Next comes the main part. It details:

- the reason why the amended declaration is being submitted;

- the period and tax for which the update was sent;

- what changes were made to the document; this item can be presented in the form of a table, where you indicate the line number of the declaration with the correction, the previous data and the new;

- amount to be paid and penalties or overpayment.

You also need to indicate what documents are attached to the letter: this is usually an updated declaration with the number of sheets, copies of payment documents (additional tax and penalties must be paid before submitting the update) or an application for a refund or offset of tax (in case of overpayment).

At the end, the individual entrepreneur or the head of the company signs. The letter must be registered in the outgoing correspondence journal.

The number of copies will depend on the method of submitting the clarification. One will be needed if the letter and declaration are sent by mail or email. Two copies are needed when submitting documents in person. In this case, one copy remains with the tax office, and on the second, the Federal Tax Service employee marks the receipt of the documents.

Attention! To write a letter, you must use a business style; there should be no colloquial or colloquial expressions and various types of errors.

Who is called and why?

Tax authorities can exercise the above right in relation to:

- taxpayers;

- fee payers;

- tax agents.

They are called to the tax office to give explanations on:

- completeness and timeliness of payment (withholding plus transfer) by them of certain mandatory payments;

- a tax audit, say, to find out the position of the person being audited regarding the violations identified by the audit;

- in other situations that relate to the implementation of fiscal legislation. For example, if there are facts and circumstances that indicate that the taxpayer received an unjustified benefit.

Briefly about the updated declaration

Such a document must be sent to the Social Insurance Fund at the place of residence of the individual entrepreneur or at the place of registration of the LLC. It is also important that it must be in a form that is valid at the time it is submitted. This is stated in paragraph 5 of Art. 81 Tax Code of the Russian Federation.

It happens that errors in the declaration lead to an overstatement of the tax, then filing an amendment will be the right of the taxpayer, and not an obligation. In this case, the tax can be refunded or offset against future payments. A covering letter may also be attached to this return application.

Tax sanctions

As for sanctions , various types of liability may be applied for violation of the law in the area in question. Thus, for non-payment of taxes there is a fine of 20% of the debt amount (tax liability).

For failure to provide information to the tax service as part of control measures - a fine of 100 to 300 rubles for individuals (administrative liability). If tax evasion is large or especially large, then criminal liability is applied.

We hope we have helped you understand what forms of interactions and consequences are hidden behind the wording of the letter from the tax office . There is no need to shelve this document: solving the problem in a timely manner will help prevent a bigger problem.

TOP materials on the topic:

Appealing the decision of the tax inspectorate in court

The IRS files for bankruptcy. Procedure for individuals and legal entities

Taxes: main changes from 2021

What happens if you don't pay taxes by December?

Do you have a controversial situation with the tax authorities?

Urgent assistance from a lawyer

Grounds for requesting documents

The basis for the requirement that is presented to a business entity is a tax audit of this entity. This is stated in Article 93 of the Tax Code. There are two types of such checking:

- On-site NP - when an inspector checks the taxpayer at his location during the period of his actual stay;

- Desk NP - when a submitted declaration is checked within 3 months after its submission;

- Counter IR - when during an audit of one taxpayer, his counterparty is also audited.

Important! A requirement may be made to a taxpayer by a regulatory authority during one of the types of inspections - counter, desk or on-site.