Filling out form 6-NDFL raises many questions among tax agents who accrue and pay income to individuals. Since an error in calculation can lead to a fine, any reporting indicator must correspond to accounting data. Line 040 in 6-NDFL is no exception. When filling it out, the employer is obliged to take into account the ratios developed by the Federal Tax Service for verification.

The calculation of 6-NDFL was approved by order of the Federal Tax Service of Russia dated October 14, 2015 No. ММВ-7-11/ [email protected] (as amended on January 17, 2018). It shows generalized amounts of income and personal income tax. The report consists of two sections, the first of which is filled in with a cumulative total, and the second contains data for the last quarter of the reporting period.

Purpose of form 6-NDFL

To improve control over the timely receipt of income tax into the budget, form 6-NDFL was developed.

This form is submitted by entrepreneurs and organizations that have employees or are tax agents for other individuals. The task of those submitting the report is to provide reliable information on all calculated income, deductions, and tax payments. The task of the inspectors is to verify that the tax is calculated correctly and paid on time.

Data from tax registers must be used to complete the report. This is a requirement of Art. 80 Tax Code of the Russian Federation. The absence of such a register will be considered a violation and will be fined by controllers. This register can be developed independently by approving its form in the accounting policy. Every month you need to keep records of salary accruals and other income, tax calculation and withholding, and the dates of tax transfer to the budget.

You can see how to correctly compile such a register in our article “Sample of filling out a tax register for 6-NDFL” .

The data in section 1 of the calculation is indicated on an accrual basis from the beginning of the year, in section 2 - only for the last 3 months. Unlike the 2-NDFL reporting form, in this calculation all information is summarized without detailing by name, but broken down by date of transactions.

How to fill out the remaining lines of the report is discussed step by step in ConsultantPlus. See the authoritative opinion of K+ experts in the Ready-made solution by receiving free trial access to the legal reference system.

Report title page

The design of the form begins with the title page. Let us describe the decoding of lines 6 of personal income tax:

- details of the organization: INN and KPP of the company, code OKTMO;

- adjustment number (000 - without adjustments, 001, 002 - with adjustments);

- data filling period (report code for the first quarter - 21, report code for the first half of the year - 31, report code for the third quarter - 33, report code for the 4th quarter - 34);

- data submission period (calendar year, for example, 2021);

- Federal Tax Service code;

- name of the organization (short name of the legal entity or last name, first name and patronymic of the entrepreneur);

- contacts (landline or mobile phone);

- Full name of the head or representative of the organization (1 – head of the organization, 2 – representative of the company).

In the updated reporting, new columns must be filled in on the title page:

- reorganization form code and basic details (TIN, KPP) of the legal entity operating before the reorganization;

- code of location (accounting).

Here are examples of place of registration (registration) codes:

- 120 - at the place of registration of the entrepreneur;

- 213 - at the place of registration of the enterprise as a large tax agent;

- 220 - at the place of registration of the enterprise division.

General rules for the 1st section of the report

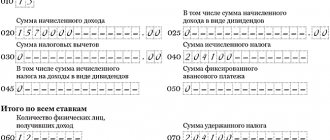

The first section is a summary table of personal income tax data for the period of provision - the tax base and indicators calculated by the agent.

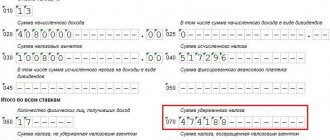

As we can see, there are two peculiar parts of the report. The top one is intended for income and tax calculated at different rates, the bottom one is for summing up information on all rates and indicating details (tax not withheld, returned).

The upper part must be completed for each tax rate applied by the agent. If, in addition to your regular wages, you paid winnings to an individual or you employ a non-resident whose income is taxed at a different rate than a resident, you will have to fill out several upper parts, one for each rate.

You will indicate the amount of income in field 020, the amount of deductions in field 030, and on page 040 you will need to indicate the amount of calculated tax. Separately, here you need to highlight the amount of tax calculated on dividends (on line 045) and indicate the advance payment (if you employ foreigners).

That's it, you've already filled out the top part of the section.

See also “How to fill out section 1 in the 6-NDFL report”.

How often are reports submitted?

Reporting on employee income taxes is submitted to the Federal Tax Service once a quarter. The deadline for submission is the last day of the month of the period following the reporting period. Information is presented on an accrual basis.

The reporting date for submitting the form is:

- date of receipt (date and time must be no later than twelve o'clock at night of the last reporting day) for submitting the form electronically;

- the date the Russian postal employee marks the attachment inventory as the date for submitting the form by mail;

- the date on your copy of the report, indicated by the inspectorate employee, when submitting the report in person to the Federal Tax Service.

Submission of the report in 2021 must be no later than:

- April 2;

- May 3;

- last working day of July;

- last working day of October.

Data to be reflected on line 040 6-NDFL

According to Art. 210 of the Tax Code of the Russian Federation, tax is calculated as a percentage of the tax base. In this case, the tax base is the total income of the taxpayer, reduced by the amount of deductions provided in accordance with the Tax Code of the Russian Federation.

The main interest tax rates for residents currently in effect are as follows:

- 13% - this may be salary, remuneration under civil partnership agreements, income from the sale of real estate or some other income;

- 35% - from the amount of savings on interest when receiving borrowed funds in terms of exceeding the established amounts.

Our section “Personal Tax Rate” will help you understand the general picture of personal income .

The calculation formula for calculating tax by a tax agent is simple:

(Individual's income - Deductions provided) × Tax rate for this type of income.

It is this amount that will appear in line 040 of the 6-NDFL calculation. That is, in relation to the report it will look like this:

(Page 020 – Page 030) × Page 010 / 100 .

If the calculated indicator does not coincide with the specified amount, this will not always be an error. The tax is calculated in full rubles. According to rounding rules, the tax amount is less than 50 kopecks. is discarded, and 50 kopecks. and more is rounded to the nearest ruble (rounding error). A discrepancy in any direction of up to 1 ruble is acceptable. for each individual. The published control ratios for checking Form 6-NDFL provide the following formula for calculating the permissible error:

Page 060 × 1 rub. × Number of lines 100 .

For example, if on line 060 “Number of people” you have 54 people indicated and during the reporting period income was paid 3 times (that is, line 100 “Date of actual receipt of income” is filled in three times), then the amount on line 040 for the 1st quarter may be 162 rub. differ from that calculated by the formula (54 × 1 × 3). The number of 100 lines will depend on the number of income dates in the reporting period.

IMPORTANT! But if the discrepancy exceeds the maximum error, then the tax authorities will consider that the amount of accrued personal income tax is underestimated or overestimated. This will result in a letter asking for clarification and an adjustment calculation.

How to do this, see our article “How to correctly fill out the clarification on form 6-NDFL?” .

Read more about control ratios for checking the form in our article “Control ratios for checking form 6-NDFL” .

Tax officials also compare the indicators of forms 2-NDFL and 6-NDFL. Find out what the amount of line 040 should be in ConsultantPlus by getting trial access to the system for free.

After filling out lines 010–050 for all tax rates applicable to your company, you can move on to the second part of the first section. There is line 070 here, which will summarize the withheld tax.

IMPORTANT! The amounts of calculated and withheld taxes (lines 040 and 070, respectively) may not coincide. This is possible if some income has already been accrued, the tax on it has been calculated, but the income has not yet been paid. For example, in a situation where salaries are accrued in one quarter and paid in the first month of the next quarter.

Let's compare the tax calculation dates and the withholding dates.

| Income | Tax calculation deadline | Tax withholding period |

| Salary | Last day of the month worked | On the day of payment in cash |

| Payments upon dismissal | Last working day | On the day of payment |

| Sick leave and vacation pay | On the day of payment | On the day of payment |

| Dividends | On the day of payment | On the day of payment |

| Travel expenses (not documented, “extra daily allowance”) | Last day of the month of approval of the advance report | On the day of salary payment for the month in which the advance report is approved |

| Income in kind | On the day of transfer of income | On the day of payment of the next income in cash |

Thus, we see that the dates for tax calculation and withholding do not coincide quite often. This means that inequality between lines 040 and 070 is common.

More information about the dates of receipt of income is described in the article “Date of actual receipt of income in form 6-NDFL”.

To learn how to reflect dividends in 6 personal income tax, read the article “How to correctly reflect dividends in form 6-personal income tax?”

Conditions for using the fixed advance payment amount

So, line 050 is filled out only by those employers who have foreign employees who have received a patent to work in the Russian Federation. However, this condition is not the only one for the appearance of data in this line. In addition to this, it is necessary to take into account that (clause 6 of Article 227.1 of the Tax Code of the Russian Federation):

- The tax reduction procedure can only be applied to one of the employers;

- To such employer, the foreign employee must provide: an application for reduction (drawn up in any form in relation to each of the periods for which a one-time advance payment was made); a document confirming payment of a fixed advance payment;

- the employer must request from the Federal Tax Service (in the form approved by Order of the Federal Tax Service of Russia dated November 13, 2015 No. ММВ-7-11 / [email protected] ) a notification confirming that the foreign employee has the right to apply a reduction in the accrued tax;

- The tax can be reduced only after receiving a notification from the Federal Tax Service (its form is approved by Order of the Federal Tax Service of Russia dated March 17, 2015 No. ММВ-7-11/ [email protected] ).

The amount of a fixed advance payment corresponding to the month of work is determined by its base value (1,200 rubles), fixed in the Tax Code of the Russian Federation (clause 2 of Article 227.1), and the coefficients applied to it, established for the calendar year:

- deflator - for 2021 it is equal to 1.729 (Order of the Ministry of Economic Development of Russia dated October 30, 2018 No. 595);

- regional - introduced in each region by its own regulatory act (if it is not introduced, then it is taken equal to 1 - clause 3 of Article 227.1 of the Tax Code of the Russian Federation).

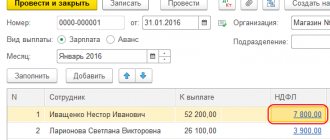

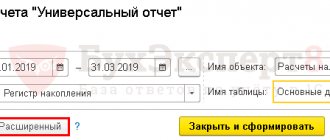

Example of filling line 040

Line 040 is generally not difficult to fill out. But for clarity, let's look at an example.

Example

At Sady LLC, the amount of accrued wages for the 1st quarter was:

- January - 30,000 rubles;

- February - 35,000 rubles;

- March — 49,000 rub.

No deductions are provided to employees. The report will be filled out like this:

Taxpayer liability

Responsibility has been introduced for submitting personal income tax reports with incorrect information in 2021. The inspector, guided by the Tax Code of the Russian Federation, must require written explanations if errors are detected in the reports. A fine can be avoided if the agent corrects the forms himself before the inspection employee clarifies the error.

Basic penalties

| Type of violation | Fine amount |

| Late provision (line 120 6 personal income tax) | 1000 rub |

| Incorrect information | 500 rub |

| Violation of electronic document flow | 200 rub |

A fine can only be imposed for calculations that were submitted after 01/01/16. There is no penalty for data submitted before 2016.

The Federal Tax Service has the right to suspend transactions on a current account if an organization delays the provision of 6 personal income taxes for more than ten days after the reporting date.

Results

Reflection of the calculated personal income tax in the 6-NDFL report is a process that requires knowledge of the nuances of the legislation. At the same time, the existing basic formulas for calculating report indicators will help you independently check the correctness of your accounting data, without waiting for a request from the tax office.

The article “Attention! These are common mistakes in 6-NDFL.”

Sources:

Tax Code of the Russian Federation

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Procedure for reflecting an advance in a report

Employees are paid twice a month. This is the employer's obligation arising from labor legislation. Employers avoid initiating inspections by the labor inspectorate, prosecutor's office and imposing fines and do not violate the law.

The day of the month when wages are paid is recognized as the date of receipt of income for the advance. The tax withholding day is the day the earnings are actually transferred. No income tax is withheld separately from the advance payment. The tax is transferred on the day after the salary is transferred (line 120 6 personal income tax). You can also transfer the next day. The entire income of the employee (salary including advance payment) is reflected in line 130 6 of personal income tax. The advance payment is not listed on a separate line.

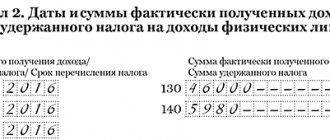

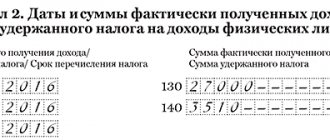

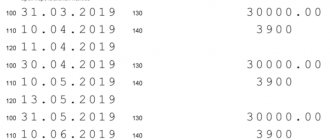

Section 2. Dates and amounts of income actually received and withheld personal income tax

Section 2 indicates the dates of receipt and withholding of the tax, as well as the deadline set for transferring the tax to the budget. To correctly fill out the section, it is necessary to distribute income for the last 3 months of the reporting period according to the dates of payment, withholding and tax remittance dates.

By line 100

the actual date of receipt of income reflected in

line 130

.

Attention! The year of actual receipt of income, reflected in the date on line 100

, may be equal to the previous year if income was accrued last year and received in the current year.

On line 110

the date of tax withholding from the amount of income actually received reflected on

line 130

.

Attention! Tax withholding date on line 110

must be earlier than the tax payment deadline indicated on

line 120

.

On line 120

indicates the date no later than which the tax amount must be transferred.

Attention! If the tax payment deadline reflected on line 120

falls on a weekend or holiday, then the next working day following it is indicated.

On line 130

the total amount of income actually received as of the date reflected in

line 100

.

Attention! The amount of income actually received is indicated without reduction by the amount of withheld tax (letter of the Federal Tax Service of Russia dated June 14, 2016 No. BS-3-11 / [email protected] ).

On line 140

indicates the amount of tax withheld by the agent on time, reflected on

line 110

.

Attention! If different types of income are actually received on the same date, but have different tax payment deadlines, then lines 100 - 140

are filled out separately for each tax payment period.

New control ratios

By letter dated October 17, 2019 No. BS-4-11/21381, the Federal Tax Service supplemented the control ratios of indicators of form 6-NDFL with two new ones:

| KS between types of tax reporting | ||||

| 6-NDFL, 2-NDFL, information on the minimum wage | 3.1.1 | Average salary > = minimum wage The average salary is determined for each employee based on the data in the Appendix “Information on income and corresponding deductions by month of the tax period” of Form 2-NDFL, related to wages, presented according to the corresponding INN, OKTMO, KPP for the same period. Please note: the ratio applies to 6-personal income tax for the year. | Art. 210 Art. 226 Art. 230 Art. 24 Tax Code of the Russian Federation Art. 133 and 133.1 Labor Code of the Russian Federation | If the average salary is < the minimum wage, then the tax base may be underestimated |

| 6-NDFL, 2-NDFL, information on the average industry wage | 3.1.2 | Average salary > = average salary in a constituent entity of the Russian Federation for the corresponding sector of the economy. The average salary is determined for each employee based on the data in the Appendix “Information on income and corresponding deductions by month of the tax period” of Form 2-NDFL, related to wages, presented according to the corresponding INN, OKTMO, KPP for the same period. Please note: the ratio applies to 6-personal income tax for the year. | Art. 210 Art. 226 Art. 230 Art. 24 Tax Code of the Russian Federation Art. 133 and 133.1 Labor Code of the Russian Federation | If the average salary is > the minimum wage, but the average salary is < the average salary in a constituent entity of the Russian Federation for the corresponding sector of the economy for the previous tax period (calendar year), then the amount of the tax base may be underestimated |

In these CS we are talking about the average salary, which is determined for each employee on the basis of 2-NDFL certificates. Its indicator should not be less than:

- Minimum wage;

- average salary in the region by economic sector.

If at least one of these ratios is not met, the Federal Tax Service will consider that the tax base is underestimated. Then, on the basis of clause 3 of Art. 88 of the Tax Code of the Russian Federation will request clarification and may carry out other tax control measures.

Read also

23.10.2018

General rules for reconciliations

The Federal Service has developed an algorithm for checking 2-NDFL and 6-NDFL for 2021 for its territorial branches. That is, uniform recommendations are intended to identify errors by inspectors when reconciling submitted reports. But not only controllers have the right to use the recommendations.

All taxpayers have the right to check their reporting forms for compliance with the control ratios. This approach to reporting will help avoid mistakes.

All information was presented in the form of a separate letter from the Federal Tax Service of Russia dated March 10, 2016 No. BS-4-11/ [email protected] The final reconciliation of 6-NDFL and 2-NDFL in 2021 is included in a separate appendix to this letter. The information is presented in the form of a table that contains:

- type of reference ratio;

- a reference to the norms of fiscal legislation that may have been violated;

- a detailed statement of the error, violation or discrepancy;

- recommendations for the inspector (what actions to take in relation to the taxpayer).

IMPORTANT!

The use of control ratios for checking reporting forms is not mandatory for tax agents. But reconciliation of individual indicators will allow you to avoid claims from controllers.