According to labor legislation, an employee of an organization or individual entrepreneur with whom he has a registered labor

Coefficient K2 for UTII is a special multiplier on the basis of which the tax on imputed

From January 1, new KBK budget classification codes for 2021 will begin to be applied. Changes

You don't know whether certification for accountants should be carried out in 2020? Consider, required

Employers had until the end of 2021 to complete drawing up action plans for the introduction of professional

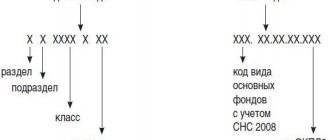

Accounting for fixed assets An asset can be recognized as a fixed asset of a company only if it meets the criteria:

How to cancel an erroneous advance invoice? We will tell you using the example of the 1C: Accounting 8 program, edition 3.0.

Transport tax has been levied in Russia since 2003 and is justified by the fact that the use

Dividends, like all income received by residents of the Russian Federation, are taxed. Accordingly, an individual

Introductory part The commented changes were made by two documents. The first is Federal Law of 07/03/16 No.