Issues discussed in the material:

- Is VAT optimization always necessary?

- How not to optimize VAT

- How can you optimize VAT?

- What are the rules for VAT optimization?

The need to pay value added tax (VAT) is depressing for most entrepreneurs, especially since its size recently increased to 20%. In an effort to reduce VAT, businessmen often only get themselves into trouble with regulatory authorities. Today we will tell you how VAT optimization can be carried out with minimal risks.

Is optimization always beneficial?

VAT is included in the cost of a product or service; it is an indirect tax. He comes to the company when purchasing and leaves when selling. If you, as a seller, added VAT to the cost of a product and sold it, you cannot keep this tax for yourself - it must be given to the state. But often companies find it difficult to part with revenue, and various schemes appear that help reduce VAT or pay it back later.

VAT is the second most difficult tax to calculate, so its optimization schemes are not simple and not always legal. But even if the scheme does not contradict the law, the tax authorities look at it with dissatisfaction and make claims for it.

Also, when working with VAT, you must take into account that other companies also calculate VAT. And if you optimize the tax, it may be unprofitable for your counterparties. For example, if you are a seller and do not charge value added tax, your buyer will not be able to recover the VAT - he may refuse the transaction or request a discount of around 20%. If your customers are a large business that mainly works with VAT, then without this tax they are of little interest to you.

If you pay VAT, it is also beneficial for you to work with suppliers who pay this tax. Working with non-payers will bring you less profit, unless they agree to give a discount in the VAT rate.

If you conduct different areas of your business - taxable and non-taxable - you will have to keep separate records, and this is not always profitable. If a preferential direction without VAT brings in relatively little income, then all the funds saved on VAT can be used to pay for the work of an accountant. With separate accounting, he will have more work.

Requalification of advance payment

Advances received from the buyer must be subject to VAT. As soon as the amount of the advance payment is “covered” by the shipment of the goods, the tax amount will be adjusted. If you draw up appropriate agreements with the buyer, this payment to the budget will not be necessary.

Cash loan

The scheme for replacing an advance with a cash loan is as follows:

- an agreement is drawn up to provide a loan in an amount commensurate with the cost of the upcoming delivery;

- the money goes to the supplier and is not subject to VAT;

- goods are shipped or services are provided under a supply/service agreement;

- an act of mutual offset is approved, in which the parties stipulate the repayment of the loan provided at the expense of the supplied goods/services.

It is important to know : when replacing an advance with a cash loan, it is necessary to observe certain discrepancies in the amount of the contract, the timing of the loan transfer and the shipment of goods. If all operations are carried out within 1-2 days, there is a high probability of claims from the Federal Tax Service.

The loan agreement should not contain terms that give tax authorities the right to charge additional VAT and significant penalties. In addition, it is important to stipulate in the contract the purpose for which the supplier receives a loan from the buyer.

Agreement on deposit

This type of prepayment modification is relevant for manufacturing or construction companies that may receive advances from a potential buyer for the purchase of materials or raw materials. If an agreement on a deposit appears as an annex to the main contract, then there is no talk of charging VAT on this amount.

In this case, it is important to observe the correct wording in the payment order - it is necessary to indicate both the number/date of the main contract and the details of the additional agreement on the deposit.

Advance on a bill

This method of influencing the amount of VAT is not used very often, but, nevertheless, it is completely legal and practically devoid of pitfalls. The method for applying a bill advance is as follows:

- the supplier issues its own bill of exchange and transfers it to the future buyer by deed;

- in payment of the bill, the buyer must transfer the specified amount to the account of the drawer, and such cash receipt will not be perceived by the tax authorities as an advance;

- after the goods have been shipped, the parties must document the offset of mutual claims with an appropriate act.

You need to know: the “bill” scheme is used in cases where the specific delivery amount is known in advance, and in the act of transfer of the bill of exchange it is necessary to indicate all its details (number, date, amount).

Accurate accounting to reduce VAT

The amount of VAT depends on proper accounting. To avoid an overestimated tax amount by the end of the quarter, follow these rules:

- add all incoming acts, invoices and invoices to your accounting system;

- request advance invoices from suppliers;

- issue invoices to customers;

- check that all invoices received from suppliers are posted in the system;

- check that the system has not calculated VAT twice: to do this, check the link to accounts and contracts in incoming payment orders and outgoing acts and invoices;

- check the same in outgoing payment orders and incoming acts and invoices.

Web service for small and medium-sized businesses Kontur.Accounting will automatically check all VAT items in order to minimize the amount payable. The service will tell you what exactly needs to be done or checked in accounting.

Corrective VAT return

Situations often arise when, at the end of the quarter, significant amounts of prepayment are received into the VAT payer’s account, from which tax must be paid. It is not economically profitable to withdraw a lot of money from circulation and wait three months until the VAT paid can be claimed as a deduction.

If, based on the advance payment received, shipment is expected in the near future, then it is quite possible not to include the amount of the advance payment in the declaration, but to calculate the tax without taking it into account. As soon as the goods are shipped/sold in the new quarter, the accounting department should draw up an adjusting declaration and send it along with the report for the next quarter.

Before sending both declarations (updated and current), you need to calculate the amount of penalties for late paid tax and transfer it to the budget. Since the amount of the penalty will be small, the taxpayer will thus be able to save a significant amount of money.

Working in special mode

You don’t have to pay VAT at all, as well as property and profit taxes. To do this, switch to a special regime: simplified tax system, PSN (for individual entrepreneurs), unified agricultural tax or UTII (cancelled from 2021). Instead of paying multiple taxes, you'll pay one at a lower rate. Compare your tax burden across different tax regimes using our free calculator.

Each special regime has restrictions on revenue, participation of other companies in the authorized capital, type of activity, cost of fixed assets, number of employees, etc. Be careful when switching to a special regime: if it turns out that you do not have the right to use it, the tax office will transfer you to OSNO , will assess additional taxes and fines. Accounting will also have to be restored.

With the main system (on which you have to pay VAT), you can combine special modes: PSN, Unified Agricultural Tax, UTII (until it is closed). And some special modes can be combined with each other: simplified tax system + PSN, simplified tax system + UTII, simplified tax system + ESKHN. You will have to keep records and submit reports separately for each mode.

To also get rid of VAT, at least parts of the business are often divided into several legal entities or individual entrepreneurs: one of them works with VAT, the other does not. The risk of such optimization is that the tax authorities may consider this a fragmentation of the business. Then all directions will be combined into one, which by default will work on OSNO, additional taxes will be assessed, and fines will be imposed. And if at the same time the Federal Tax Service discovers a tax arrears of more than 5 million rubles, a criminal case may be initiated against you (Article 199 of the Criminal Code of the Russian Federation).

Keep records of exports and imports in the Kontur.Accounting web service. Simple accounting, payroll and reporting in one service

Save on VAT using simplification

In order not to charge VAT when selling goods, you need to stop being a VAT payer. The easiest way to achieve this goal is to switch to a simplified version (Clause 2, 3 of Article 346.11 of the Tax Code of the Russian Federation). True, the Tax Code has established restrictions for the use of this special regime, the most significant of which are in terms of the amount of income, the cost of fixed assets and the number of employees (Clause 2.1, paragraphs 15, 16, paragraph 3 of Article 346.12, paragraph 4.1 of Article 346.13 of the Tax Code of the Russian Federation) . But if your company itself cannot switch to simplified taxation, this does not mean that you, in principle, cannot use the capabilities of this special regime to optimize VAT. Other legal entities or entrepreneurs through whom the sale or purchase of goods will take place may become simplifiers. Situation 1. You have buyers who do not need deductions. If you meet the conditions for applying the simplified tax, then everything is simple. Your company switches to simplification and sells goods at the same prices as before. If among your customers there are both those who do not need VAT deductions and those who need them, one company will no longer be enough. You will have to create a new company using the simplified tax system, through which all sales will be made without VAT. This new company can buy goods either from the same suppliers or from your main company. It also happens that buyers who, in principle, do not need VAT invoices, refuse to work with simplifiers for some subjective reasons. In this case, in order to achieve their consent, you can slightly reduce the price of the goods. To understand what kind of discount you can provide, you need to calculate how much money you will save from switching to a simplified system.

We advise the manager Those who for some reason do not want to deal with a simplified seller can be persuaded by providing a discount. The benefit from VAT savings will offset these additional costs.

For example, previously you bought goods for 118,000 rubles. (including VAT - 18,000 rubles) and sold them with a 20% markup for 141,600 rubles. (including VAT - 21,600 rubles). Assuming that the company has no other expenses, in this situation you would have to pay VAT in the amount of 3,600 rubles to the budget. (RUB 21,600 - RUB 18,000). This means that you had 20,000 rubles at your disposal before paying income tax. (RUB 141,600 - RUB 118,000 - RUB 3,600). After switching to the simplified tax system, you no longer need to pay VAT, so you will have 3,600 rubles left. more. Such savings allow you to set a discount of approximately 1 - 1.5% of the cost of the goods (1500 - 2000 rubles), because for you such conditions will still be beneficial compared to selling the goods at the previous price and paying VAT. And this does not take into account the savings on income taxes. And it can also be significant, since now instead of 20% income tax, you will need to pay a maximum of 15% tax under the simplified tax system (Clause 1 of Article 284, paragraph 2 of Article 346.20 of the Tax Code of the Russian Federation). It is much more difficult when the conditions for applying the simplification are not met . Here you will have to look for ways to comply with the restrictions established by the Tax Code. Method 1. We divide an existing company into several or simply create several new organizations . Each of them accounts for some share of sales, fixed assets and employees, so that none of them exceeds the limits set for simplifiers. For example, your company sells goods worth about 200 million rubles. in year. Since “simplified” revenue should not exceed 60 million rubles. per year (Clause 4.1 of Article 346.13 of the Tax Code of the Russian Federation), you will need at least four companies using the simplified tax system. They can buy goods directly from the same suppliers with whom you worked before. If the supplier agrees to work with only one (old) company, new companies using the simplified tax system can buy goods from it. In this case, as you understand, they should account for almost the entire markup on goods.

But remember that dividing a single business into several legal entities, some of which will apply a simplified procedure, is not the easiest thing. If only because a simplified company can only be 25% owned by other legal entities (Subclause 14, Clause 3, Article 346.12 of the Tax Code of the Russian Federation). But most importantly, you need to try to make sure that outwardly all your companies do not look like part of the same business. Otherwise, tax inspectors may consider that the entire structure was created solely to save on taxes. And this will give grounds to consider such savings an unjustified tax benefit and to charge one of the companies additional taxes that it would have to pay if all sales were made only through it (Paragraphs 3, 7, 9 of the Resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation of October 12, 2006 N 53).

Method 2. We create new companies using the simplified tax system and become their commission agent . This method is applicable when it is impossible either to insert an intermediary between the old company and the buyers on the simplified tax system, or to divide it into several legal entities. More precisely, it is impossible to find more or less plausible business goals for such actions. As an example, you can use any supermarket - you must agree, separating each department into a separate legal entity, despite the fact that all sales go through one cash register, is somehow completely unsightly. In such cases, it is possible to integrate several companies using the simplified tax system into the chain “supplier - store - buyer” using commission agreements, under which the simplifiers will be the principals, and the store will be the commission agent. The number of principals depends on the sales volume, and the benefit is achieved due to the fact that most of the trade margin falls on companies using the simplified tax system. At the same time, the store receives only a small remuneration, from which it pays VAT (Clause 1 of Article 156 of the Tax Code of the Russian Federation). Although, since the store’s income is now also determined based only on remuneration (Subclause 9, clause 1, Article 251, clause 1, clause 1, clause 1.1, Article 346.15 of the Tax Code of the Russian Federation), most likely, he himself will be able to switch to a simplified system, which will further increase your benefits.

Method 3. Become a buyer's commission agent . And we purchase goods for it from our suppliers. This will allow us to significantly increase the maximum volume of goods that can be sold on a simplified basis, since only commission fees will be recognized as the company’s revenue (Subclause 9, clause 1, Article 251, clause 1, clause 1, clause 1.1, Article 346.15 of the Tax Code of the Russian Federation). For example, you used to sell goods purchased from suppliers at a 10% markup. If, after becoming a commission agent, you set a commission that is also equal to 10% of the cost of goods purchased for the principals, you will be able to purchase goods for them in the amount of 600 million rubles. (RUB 60 million / 10%). It is clear that this method is not always applicable. At least for retail trade, it is definitely not suitable - you won’t enter into a commission agreement with every store visitor. But this method is safer than dividing a business, especially if you do not create any additional companies. Although it is still worth thinking about what business goal your company was pursuing when it stopped reselling goods and switched to commission agreements.

Of course, it is quite possible that your customers simply do not want to become consignors. But in order to persuade them, you will have very powerful “arguments” at your disposal - discounts on the price of goods. The maximum discount amount is determined again based on the tax savings that your company will receive from the transition to the simplified tax system.

Note There are other ways to circumvent the restrictions established for simplifiers, for example, using a simple partnership agreement. But, as a rule, they are more complex than those already discussed and - more importantly - they are known to the tax authorities and will almost certainly attract their close attention. And this is of no use to us at all.

Situation 2: The goods you sell are intended for VAT evaders In this situation, your goal is to reach those buyers who do not need VAT invoices. It is clear that you cannot sell goods to them directly, otherwise you would have been doing this for a long time, and not sharing profits with intermediaries. But you can reach the right buyers through commission agreements or agency agreements, under which the agent acts on his own behalf . Agents or commission agents in this case will be your direct buyers. And you, as a principal or principal, will transfer goods to them for sale. If there are several intermediaries between you and buyers who do not need deductions, you will have to persuade them to become subagents or subcommission agents of their suppliers (Clause 1, Article 994, Article 1009 of the Civil Code of the Russian Federation). If this is successful, then you proceed in the same way as if you had buyers who do not pay VAT, that is, either you switch to the simplified tax system yourself, or you create one or more new companies using the simplified tax system. As a result, you do not pay VAT on the difference between the purchase price and the sale price of the goods. But your former buyers-turned-agents have nothing to lose. For example, before you bought a product for 118,000 rubles. with VAT and sold it (increasing the price without VAT by 20,000 rubles) for 141,600 rubles. VAT included. Your buyer increased the price excluding VAT by another 10,000 rubles. and sold the goods to the next buyer for 153,400 rubles. VAT included. He, in turn, added another 10,000 rubles to the price. and sold the goods for 165,200 rubles. with VAT to the final buyer who does not pay VAT, for example to a store on UTII. Assuming that neither you nor your customers have any other deductions other than deductions for goods, your company should have paid VAT to the budget in the amount of 3,600 rubles, and your customers - 1,800 rubles each.

Now the first and second buyers become an agent and a subagent, respectively, and your company switches to the simplified tax system. Agents' remuneration is set in an amount equal to the markup on goods that they previously applied - 10,000 rubles. (RUB 11,800 including VAT). It is from this amount that they will have to pay VAT to the budget - the same 1,800 rubles. At the same time, your company will stop paying VAT altogether, that is, it will save 3,600 rubles.

The main problem that can be encountered when implementing such a scheme is the reluctance of buyers to switch to working under agency contracts. To solve it, you need to interest the buyer. To do this, you can: - provide a discount. That is, set the remuneration in the amount not of 11,800 rubles, but, say, 12,800 rubles. Then you will have additional expenses in the amount of 2,000 rubles, but the scheme will still remain profitable, because you save 3,600 rubles on VAT alone; — explain to buyers that, having become agents, they will most likely be able to switch to a simplified system, since only remuneration will now be recognized as their income. This means that even without any discounts, each of them will save 1,800 rubles. only due to the fact that it will stop paying VAT.

VAT exemption

Companies without import operations and excisable goods can submit an application and be exempt from paying VAT on certain operations or activities (Article 145 of the Tax Code of the Russian Federation). To do this, a condition must be met: the company’s revenue excluding VAT should not exceed 2 million rubles for three consecutive calendar months. If this limit is exceeded, the right to the privilege “burns out.”

There is also an exemption from VAT for certain types of goods and services (Article 149 of the Tax Code of the Russian Federation). These include medical services, care for the disabled, child care, arts services, and research and development. Study the list of operations in Art. 149, you may find your products or services there.

What not to do when calculating the VAT amount

When considering a particular method of influencing the amount of taxes, it is necessary to carefully follow the regulations for drawing up supporting documents. We must remember that

Fiscal authorities thoroughly know all tax evasion schemes, so only correct legal and accounting documents can protect the taxpayer from claims of the Federal Tax Service.

It is strictly not recommended to use semi-legal fly-by-night companies to obtain a VAT deduction or to underestimate the amount of revenue received. Such actions are easily detected, and the punishment for VAT evasion can far exceed the amount of savings.

Reduced VAT rates

In most cases, the VAT rate is 20%, but for some goods and services it is reduced to 10% and 0%.

- 10% VAT applies to food products, medications and other medical goods, school supplies, children's clothing (clause 2 of Article 164 of the Tax Code of the Russian Federation);

- 0% VAT is applied for international transportation services and export products (Clause 1, Article 164 of the Tax Code of the Russian Federation). The “zero” rate does not relieve you of the obligation to maintain documentation: issue invoices, fill out and submit VAT returns.

How not to optimize VAT

So, let’s look at how “experts” on the Internet advise you to optimize your tax burden, offering supposedly absolutely legal ways to do this. What's the catch?

Purchasing incoming invoices

Businessmen resort to this optimization method most often; in most cases, it does not arouse suspicion in them. They think they are withdrawing funds legally. However, this method involves the purchase of fictitious goods and services that exist only on paper. Accordingly, a noticeable and crude trace remains in the reporting.

Top 3 articles that will be useful to every manager:

- How to choose a tax system to save on payments

- How to minimize taxes and not interest the tax authorities

- How to create an electronic signature quickly and easily

When inspectors reveal such facts during an audit, the management of the enterprise can even be sure that one of the employees revealed to the tax authorities the true content of the business transaction. Although there is no need for any insider information here - it is already clear from the papers that lending large sums to organizations without requiring repayment is impossible.

Optimizing VAT through the purchase of incoming invoices is fraught with:

- accumulation of huge remnants of products that actually do not exist. It is worth noting that if the company goes bankrupt or the manager changes, then the return of these balances may be requested;

- large debts to counterparties, the presence of which does not allow attracting investment funds for the development of the company.

Of course, many today know how to clear out missing goods hanging on the balance sheet, but such methods only further aggravate the situation of a businessman breaking the law.

Cash withdrawal with provision of invoices

This method of VAT optimization is also popular. It is used to cash out money for salary payments in an envelope, for bribes, kickbacks and other illegal financial transactions.

The documentation for the implementation of this scheme can be done properly. In this case, it will not be noticeable to inspectors during inspection. And yet, the tax office can identify the illegal withdrawal of funds by conducting an audit of a one-day counterparty. It is worth saying that nowadays, when organizing such companies, more and more nuances are taken into account, so identifying them with a superficial analysis is impossible.

Statistics show that to implement this method of VAT optimization, companies that previously carried out legal commercial activities are often involved. They introduce a new founder and manager (who have nothing to do with the business: this could be a marginalized person, a student, outsiders participating in the scheme for a certain fee, and even people who do not have identity documents). In our opinion, the above argument shows that it is definitely not worth closing a business using alternative methods.

Currently, it is becoming increasingly more expensive for entrepreneurs to cash out: a lot of investments are required to enter the scheme. In addition, getting rid of criminal prosecution is also expensive, this follows from the provisions of paragraph 2 of the notes to Art. 199 of the Criminal Code of the Russian Federation.

According to these provisions, a person who has evaded taxes, fees and (or) insurance contributions that an organization must transfer to the budget for the first time can avoid criminal liability only if he pays in full the arrears and accrued penalties. In addition, he will be charged a fine, the amount of which is established in the Tax Code of the Russian Federation.

Loans

With the help of loans, you can defer the payment of VAT for a quarter or more. To do this, the seller takes a loan from the buyer equal to the advance amount. After shipment, the debt for the goods sold and the loan are offset. Since loans are not subject to VAT, tax will only be charged on the sale of goods.

This scheme does not break the law, but it does have its risks. Firstly, the tax office is well aware of the scheme and is wary of it, so it will not be possible to use this technique regularly. Secondly, it is not profitable for the buyer to postpone the tax payment deadline or give a loan, so it is important to take into account the interests of the buyer.

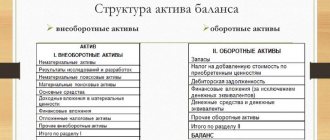

Postings in accounting

As we already said in advance, in order to recover VAT from the budget, it is necessary to submit a corresponding application and declaration to the territorial Federal Tax Service. To reflect the tax refund in accounting, the following entries are made:

Table - Postings in accounting

| Dt | CT | Sum | Operation |

| 68.02 | 19 | Amount of VAT to be refunded | Submitted VAT for reimbursement from the budget upon application |

| 51 | 68.02 | The amount of VAT received on the account | The VAT refund was credited to the account by decision of the Federal Tax Service, this amount is also indicated in the bank statement |

VAT can be calculated in organizations and individual entrepreneurs in various ways and have many nuances, and the VAT refund itself to a bank account is reflected in accounting quite simply.

Including shipping amount in price

If you sell goods subject to a 10% VAT rate, it is beneficial for you not to allocate the delivery amount (where the tax rate will be 20%), but to include the costs of transporting the goods to the buyer's warehouse. Then you will pay 10% VAT on the entire cost of the goods, and for the services of transport companies you will deduct 20%. To apply this scheme, state in your accounting policy that the cost of goods includes delivery costs, and in the contract with the buyer indicate that delivery is included in the price of the goods.

Work with VAT in the Kontur.Accounting web service. The system makes it easy to keep records, pay salaries, and report online. The service will help you optimize VAT and tell you how to reduce your payment. The first two weeks are free for all new users