general information

The use of business trips by employers is regulated by the Labor Code and other regulations. At the same time, he is obliged to guarantee the person sent on a business trip reimbursement of all his expenses. Registration of a business trip is carried out in accordance with established rules.

An employee can drive his own or a company car, or use public transport to travel. There is no minimum period for a business trip. Based on this, the employee can stay on a business trip for one day and receive appropriate compensation.

The duration of a business trip largely depends on the following factors:

- task scope;

- difficulty in completing the order;

- additional task characteristics.

There is also no maximum duration for a business trip. The norms that set a limit of 40 days for a business trip, excluding time on the road, were cancelled.

What reporting documents for business trips are drawn up upon returning from a trip?

Registration of a business trip does not end with the departure of the employee - he is obliged to report on the work done and money spent, and therefore other documentation must also be completed upon the employee’s arrival.

After a seconded employee returns from a trip, it is necessary that the following documents are kept at the enterprise:

- advance report with attached receipts, checks and other payment documents confirming expenses incurred during the trip. It states:

- A logbook for posted employees with a record of their return from a business trip.

- Service memo (when using the manager’s personal car or vehicle).

Decor

It is important for workers to know what documents are issued before traveling in 2021. There are various nuances of registration, for example, if an employee goes on a business trip in a personal car, then a memo and a waybill will be required. By law, some documents that were previously used when registering a business trip are no longer used. This is a travel certificate, official assignment, etc.

However, at some enterprises managers continue to use them, having issued the corresponding local acts.

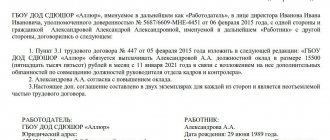

When sending an employee on a business trip, the manager is obliged to issue an appropriate order. For this, there is a legally established form T-9 or T-9a, if we are talking about sending several employees. In addition, the enterprise may have a different form of order.

If an employee goes on a business trip using official or personal vehicles, the order contains the following information:

- Company name;

- date and number;

- information about the employee;

- information about the place of business trip;

- duration of the trip;

- target;

- details about vehicles.

The order must be signed by the immediate supervisor of the posted employee. Based on it, the accounting department carries out the necessary calculations and issues daily allowances to the person.

How to make a waybill

A waybill is a confirmation of the use of a car on a trip, as well as the purchase and consumption of fuels and lubricants. It is drawn up on form No. 3 or according to a form approved by the organization and contains:

- Name and serial number.

- Validity period (duration of business trip).

- Personal data of the employee.

- Information about the vehicle (make and model, car number, information from the registration certificate).

- Fuel consumption.

IMPORTANT! The route sheet is provided to the employer within three days after returning to the place of work. A mandatory addition to the document is checks, receipts from gas stations, workshops, catering places and temporary residence.

Sample

Basic document samples:

- Standard intersectoral form No. 3 for drawing up a waybill.

- An example of filling out a waybill.

Expenses

Almost all expenses of posted workers are subject to reimbursement by the employer (Article 168 of the Labor Code of the Russian Federation). Among these expenses are:

- per diem, which the employee spends on food and other needs;

- travel (spending on gasoline);

- rental of property;

- other expenses.

As for the amount of daily allowance, the law sets a maximum for employees of government agencies. Private organizations have the right to independently set the amount, but there are nuances. The maximum daily allowance, which is not subject to personal income tax, in 2020 is 700 rubles for trips within Russia and 2.5 thousand rubles for business trips abroad. Other travel allowances are also calculated based on the organization’s budget.

To receive an advance, the employee must write an application indicating the required amount. It is signed by the manager and then transferred to the accounting department. Money is transferred to a subordinate’s bank card or given in cash. After returning, the employee must hand over the remaining funds to the accounting department on the basis of the appropriate order.

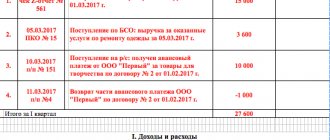

After returning, the employee is required to draw up an advance report and attach the following documents to it:

- hotel receipts or other documents confirming accommodation expenses;

- receipts for payment of fuel and lubricants;

- waybill, service note, etc.

Taxation of expenses when sending an employee on a business trip by car

Income tax

The following can be taken into account in full as part of other tax expenses that are associated with production and sales (clauses 11–12 of clause 1 of Article 264 of the Tax Code of the Russian Federation; letter of the Ministry of Finance of Russia dated April 20, 2015 No. 03-03-06/22368; clause 1 of the Decree of the Government of the Russian Federation dated 02/08/2002 No. 92):

- rent for the employee's car;

- travel expenses (fuels, etc.) to a business trip and back in the employer’s car or in a car rented from an employee;

- compensation for the very use (wear and tear) of the employee’s car used during a business trip.

As for compensation for expenses associated with traveling on a business trip in an employee’s car, primarily fuels and lubricants, then, according to tax authorities, the amount of compensation established by clause 1 of Decree of the Government of the Russian Federation of 02/08/2002 No. 92 also includes reimbursement of the expenses in question (letter of the Ministry of Finance of Russia dated September 23, 2013 No. 03-03-06/1/39239, Federal Tax Service dated May 21, 2010 No. ShS-37-3/2199). A different approach, most likely, will have to be defended in court with an unobvious outcome, since the only court decision known to us on this issue was made in favor of the tax authorities (Determination of the Supreme Arbitration Court of the Russian Federation dated January 29, 2009 No. VAS-495/09 in case No. A07-1341/2008 ).

Personal income tax

The rent for an employee's car is subject to personal income tax when it is paid from the lessor - a tax agent on a general basis (clause 4, clause 1, article 208, clause 1, article 226 of the Tax Code of the Russian Federation).

Compensation for documented expenses (fuel and lubricants, etc.) on a business trip and back, as well as compensation for the very use (wear and tear) of an employee’s car (clause 3 of Article 217 of the Tax Code of the Russian Federation; letter of the Ministry of Finance of Russia dated 27.02. 2013 No. 03-04-06/5600). However, if the employee does not document the ownership of the car, then inspectors may charge personal income tax on the compensation in question (letter of the Ministry of Finance of Russia dated 08.08.2012 No. 03-04-06/9-228). A different position can be defended in court, since practice is developing in favor of taxpayers (for example, Resolution of the Arbitration Court of the North-Western District dated August 28, 2014 in case No. A56-50900/2013).

Insurance premiums

Insurance premiums are not fully subject to insurance premiums (clause 3, clause 2, clause “and” clause 2, part 1, article of Law No. 212-FZ; clauses 1–2, article 20.1 of Law No. 125-FZ ):

- rent for the employee's car;

- compensation for documented expenses (fuel, lubricants, etc.) on a business trip and back;

- compensation for the very use (wear and tear) of the employee’s car.

When calculating the amount of compensation, it is advisable to take into account the degree of wear and tear of the employee’s personal property, as well as its useful life, which can be determined on the basis of technical documentation for this property (clause 2 of the letter of the Pension Fund of the Russian Federation dated September 29, 2010 No. 30-21/10260).

If the employee cannot document ownership of the car, then inspectors can charge insurance premiums for the compensation in question (letter of the Ministry of Labor of Russia dated November 13, 2015 No. 17-3/B-542). A different position can be defended in court, since there is a court decision in favor of insurance premium payers (Decision of the Supreme Court of the Russian Federation dated August 3, 2015 No. 309-KG15-8423 in case No. A34-5577/2014).

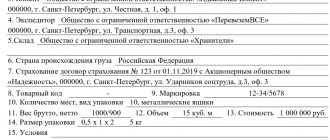

The taxation of expenses when sending an employee on a business trip by car is presented in the table.

Type of expenses | Income tax | Personal income tax | Insurance premiums |

| Rent for an employee's car under a bareboat lease agreement | Fully taken into account as part of other tax expenses that are associated with production and sales | Taxable (if paid from a tax agent) | Is not a subject to a tax |

| Compensation for documented travel expenses (fuel, lubricants, etc.) on a business trip and back in the employer’s car or in a rented car | Is not a subject to a tax | ||

| Compensation for the very use (wear and tear) of the employee’s car during a business trip, as well as compensation for documented travel expenses* (fuel, lubricants, etc.) on a business trip in the employee’s car under an additional or separate agreement to the employment contract and payment of appropriate compensation for the use of such property | Accounted for as part of other tax expenses that are associated with production and sales within the limits established by Decree of the Government of the Russian Federation dated 02/08/2002 No. 92 | Is not a subject to a tax** | |

Notes *According to tax authorities, these costs are already included in the amount of compensation for the use of a vehicle (letter from the Ministry of Finance of Russia dated September 23, 2013 No. 03-03-06/1/39239 and the Federal Tax Service of the Russian Federation dated May 21, 2010 No. ШС-37-3/2199) . **If the employee cannot document the ownership of the car, inspectors can charge personal income tax and insurance premiums (letters from the Ministry of Finance of the Russian Federation dated 08.08.2012 No. 03-04-06/9-228 and the Ministry of Labor of the Russian Federation dated 13.11.2015 No. 17-3/ B-542). However, judicial practice is developing in favor of taxpayers and contributions (Resolution of the Arbitration Court of the North-Western District dated 08/28/2014 in case No. A56-50900/2013; Determination of the Supreme Court of the Russian Federation dated 08/03/2015 No. 309-KG15-8423 in case No. A34- 5577/2014).

Ilya Antonenko , certified auditor

Answers to common questions about documents for business trips

Question No. 1: Is there a difference between preparing documents for sending an employee on a business trip if the employer is a legal entity or an individual entrepreneur?

Answer: No, in both cases, the required documents are a travel order, a memo (if necessary) and an advance report.

Question No. 2: Is it necessary to register a business trip lasting 4 hours according to all the rules?

Answer: If an employee is sent on a trip to another area and will perform work functions outside of the main place of work, then yes, the business trip is processed according to all the rules, regardless of its duration.

But, in the case of short-term trips that last less than 1 day, the employee is not paid daily allowance or compensation for accommodation. Rate the quality of the article. Your opinion is important to us:

Driver's travel license

1.

Please, what other documents do the driver of the car need to present to the traffic police inspector if the waybill has expired? They showed the inspector a travel certificate, and said that it was only needed because the doctor’s stamp was missing. Lawyer Cherednichenko V.A., 193,097 answers, 73,712 reviews, on the site from 05/12/2015 1.1.

The list of documents is specified in the traffic rules (clause 2.1.1) Have with you and, at the request of police officers, hand over to them for verification: - a driver’s license or temporary permit to drive a vehicle of the corresponding category or subcategory; - registration documents for this vehicle (except for mopeds), and if there is a trailer - also for the trailer (except for trailers for mopeds); - in established cases, permission to carry out activities for the transportation of passengers and luggage by passenger taxi, waybill, license card and documents for the transported cargo, and when transporting large, heavy and dangerous goods - documents provided for by the rules for the transportation of these goods; - a document confirming the fact of disability, in the case of driving a vehicle on which the identification sign “Disabled” is installed; — an insurance policy of compulsory civil liability insurance of the owner of a vehicle or information printed on paper about the conclusion of a contract of such compulsory insurance in the form of an electronic document in cases where the obligation to insure one’s civil liability is established by federal law.

In cases expressly provided for by the legislation of the Russian Federation, have and submit for inspection to authorized officials of the Federal Service for Supervision of Transport a vehicle access card for international road transport, a waybill and documents for the transported cargo, special permits, if available

Waybill for a truck in accounting (form)

> > > February 21, 2021 All story materials A truck waybill is the most important element of the document flow of a transport organization.

Let's consider what forms can be used to generate a waybill for a truck. Documents and forms will help you: Registration of these documents is a mandatory procedure for companies that provide transportation services on various types of public transport and cars: the corresponding regulations are contained in clause 2 of Art. 6 of the Charter of motor transport and urban ground electric transport dated 08.11.2007 No. 259-FZ.

We also note that in accordance with sub. 2.1.1. clause 2.1 art. 2 of the Traffic Rules, Russian drivers on the road are required to have truck waybills with them in the cab - in case the police check the documents.

We recommend reading: Types of hooliganism briefly

A company may require a truck waybill not only due to legal requirements. It is also used in accounting - as a primary document. Using information recorded in truck waybills, accountants:

- write off the company's expenses for fuels and lubricants, reducing the tax base for profits or the simplified tax system;

- pay salaries to drivers working in the company based on the amount of work they perform;

Cm.

article.

- if necessary, reimburse gas costs for employees who use a personal car for work.

The personal responsibilities of an accountant may include ensuring the storage of waybills for trucks, and in some cases, maintaining a specialized log of relevant documents. For more information on how the storage and accounting of waybills is organized, read the articles:

- .

- ;

As a form for a waybill for a truck, you can take Form 4-P, introduced into the document flow by Decree of the State Statistics Committee of Russia dated November 28, 1997 No. 78. Waybill

Common mistakes

Error: The employer did not issue a travel document for the employee on the grounds that he was using a personal vehicle rather than a company-owned vehicle.

Comment: An itinerary sheet is also issued if the employee’s personal transport is used, since the costs of traveling along the shortest route to the place of arrival must be reimbursed by the employer.

Error: An employee who returned from a business trip did not provide the employer with a memo and an advance report within 3 days.

Comment: The advance report along with the memo must be given to the manager within the next 3 days upon returning from a business trip.

What is considered a business trip under the Labor Code of the Russian Federation?

It should be a means of business development, not an additional risk. This means that it must be organized correctly. And then you will be able to correctly fill out documents and confidently answer questions from employees, GIT inspectors and the court, if the case comes to him.

It is not always easy to determine when an employee needs to arrange a business trip, and when his trips fit within the framework of traveling work. We will help you figure it out by answering questions from our readers.

The traveling nature of work is not a hindrance to a business trip

How to document the daily allowance for a business trip for long trips (3 days) if an employment contract with a traveling nature of work has been concluded with an employee-driver?

: In the case of a traveling nature of work, as well as a business trip, employees need to be reimbursed for travel expenses, and also, in some situations, paid per diem, if this can be justified. For example, this is possible if the time spent traveling to the work site is several hours, that is, the driver needs several hours to get to the garage where the cars are located. The amount of compensation and the procedure for their payment must be established by a collective agreement, agreement or local regulatory act of the organization

However, traveling work and business travel are not the same thing. When sent on a business trip, an employee, as a rule, does not have the opportunity to return home every day. Thus, an employee whose work is traveling in nature, for example a driver, can be sent on a business trip in the general manner. And it is advisable to register long trips of drivers as business trips.

During the business trip they are entitled to a daily allowance, which does not need to be documented. Also, during a business trip, the employee is compensated for travel and accommodation expenses (if any).

Daily allowances for business trips are not always provided

The driver is on a business trip for 2 days - in the area where he lives. Does he need to be paid a daily allowance?

: The answer to this question depends on whether the employee had the opportunity to return home every day.