Rest time Olga Yakushina Tax expert-journalist Current as of September 30, 2019 Drawing up an annual schedule

Borrowing a drill from a neighbor or, conversely, giving him your charger for a dead car

Who is required to submit the Declaration and pay for the NVOS? The declaration is submitted by tax payers.

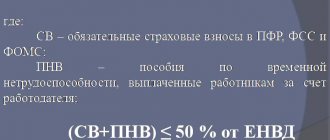

The single tax on imputed income is a popular tax regime used in Russia

Accounting for insurance premiums Account 69 To organize accounting for insurance premiums, a specially designed account is used.

Standard tax deduction is a reduction in the personal income tax withheld by a legal entity. The procedure for forming the tax base and

All taxpayers are required to submit reports to the tax authorities for a certain period, called the tax period.

Good afternoon, dear reader. Russian tax legislation allows you to receive property tax deductions in various

With the taxable object “Income” you need to fill out: title page; section 2.1.1; section 1.1. Section 3

Remuneration Anastasia Sotskaya Expert - personnel, tax and accounting Current on 19