All taxpayers are required to submit reports to the tax authorities for a certain period, called the tax period. It is during this time that the amount of profit received will be calculated, and then the amount of taxes payable will be calculated from it. This happens differently on different systems. Therefore, let us dwell in more detail on the UTII tax period.

Indicators for calculating imputed income

First of all, the amount of imputed income, on the basis of which UTII is calculated, depends on the type of activity transferred to this special regime. Or rather, on the physical indicator that characterizes such imputed activity. This could be the number of employees, the area of the sales floor, the number of retail places, etc. A complete list of physical indicators for different areas is contained in paragraph 3 of Article 346.29 of the Tax Code of the Russian Federation. Multidisciplinary organizations must keep separate records of physical indicators for each type of imputed activity (clauses 6 and 7 of Article 346.26 of the Tax Code of the Russian Federation).

In addition to physical indicators, to calculate you need to know:

- monthly basic profitability of a physical indicator (clause 3 of Article 346.29 of the Tax Code of the Russian Federation);

- the value of the deflator coefficient K1 (clause 4 of Article 346.29 of the Tax Code of the Russian Federation);

- the value of the correction coefficient K2 (clause 4 of Article 346.29 of the Tax Code of the Russian Federation).

The value of the K1 coefficient changes every year. For 2021, it is set at 1,798 (order of the Ministry of Economic Development of Russia dated October 20, 2015 No. 772).

Deadline for paying UTII tax in 2021

It is necessary to pay attention to the fact that the deadline for submitting a tax return and the deadline for paying UTII do not coincide.

| Tax return submission deadline | Deadline for payment of UTII |

| Until the 20th day of the month following the reporting tax period | Until the 25th day of the month following the reporting tax period |

| Taxable period | Tax return submission deadline | Deadline for payment of UTII |

| 1st quarter | until April 20 | until April 25 |

| 2nd quarter | until July 20 | until July 25 |

| 3rd quarter | until October 20 | until October 25 |

| 4th quarter | until January 20 | until January 25 |

Calculation of imputed income (tax base)

Determine the tax base for the quarter depending on whether the organization used UTII throughout this period or not.

If the organization was a UTII payer for the entire quarter, then calculate the tax base using the formula:

| Tax base (imputed income) for the quarter | = | Basic profit per month | × | ( | The value of the physical indicator for the first month of the quarter | + | The value of the physical indicator for the second month of the quarter | + | The value of the physical indicator for the third month of the quarter | ) | × | K1 | × | K2 |

This procedure is provided for in paragraph 10 of Article 346.29 of the Tax Code of the Russian Federation.

If you switched to imputed tax in the middle of the quarter, then you need to calculate UTII starting from the date of registration as a single tax payer. First, calculate the tax base for the month in which the organization began to use UTII. Formula for calculating UTII:

| Tax base (imputed income) for the month in which UTII began to be applied | = | Basic profit per month | × | The value of the physical indicator ___________________________ | × | The actual number of days when activities were carried out using UTII, in the month in which the organization became a UTII payer | × | K1 | × | K2 |

| The number of calendar days in the month in which the organization became a UTII payer |

Next, determine the amount of imputed income for the remaining full months of the quarter. And add it to the amount of income received for the month in which UTII began to be applied. The result will be the tax base for the entire quarter (clause 10 of Article 346.29 of the Tax Code of the Russian Federation).

An important detail: if in one of the months the value of the physical indicator has changed, for example, the retail space of the hall has increased, then for this month take the new value to calculate the tax. Even if the change occurred in the middle of the month (clause 9 of Article 346.29 of the Tax Code of the Russian Federation).

Example of UTII calculation. The organization became a UTII payer in the middle of the quarter

The Alpha organization sells goods at retail through its own store with a sales area of 80 square meters. m. In the city where the organization operates, the use of UTII is provided for such activities. The UTII rate for retail trade is 15 percent. "Alpha" became a payer of UTII on January 28. In fact, in January the organization was a UTII payer for four days, in February and March for full months.

In 2021, the value of the deflator coefficient K1 is 1.798. Local authorities set the value of the correction factor K2 at 0.7.

The basic profitability for retail trade in the presence of trading floors is 1800 rubles/sq.m. m.

The imputed income for calculating UTII for January was: 1800 rubles/sq.m. m × 80 sq. m: 31 days. × 4 days × 0.7 × 1.798 = 23,386 rubles.

Imputed income for February–March was:

1800 rub./sq. m × (80 sq. m + 80 sq. m) × 0.7 × 1.798 = 362,477 rub.

Thus, the imputed income for calculating UTII for the first quarter is equal to 385,863 rubles. (RUB 23,386 + RUB 362,477).

UTII for the first quarter is equal to: 385,863 rubles. × 15% = 57,879 rub.

Now let’s talk about how to find out the amount of imputed income for the quarter in which the organization ceased its imputed activities. In this case, calculate the base from the first day of the quarter until the date of deregistration specified in the notification of the tax office. First, determine the tax base for the month in which the organization stopped using UTII using the formula:

| Tax base (imputed income) for the month in which UTII ceased to be used | = | Basic profit per month | × | The value of the physical indicator for the month in which the organization ceased to be a UTII payer | : | The number of calendar days in the month in which the organization ceased to be a UTII payer | × | The actual number of days of business activity using UTII in the month in which the organization ceased to be a UTII payer | × | K1 | × | K2 |

Next, determine the amount of imputed income for the remaining full months of the quarter. And add it to the amount of income received for the month in which UTII was no longer used. The result will be the tax base for the entire quarter (clause 10 of Article 346.29 of the Tax Code of the Russian Federation).

An example of calculating taxes on UTII. The organization ceased to be a UTII payer in the middle of the quarter

The Alpha organization sells goods at retail through its own store with a sales area of 80 square meters. m. In the city where the organization operates, the use of UTII is provided for such activities. The UTII rate for retail trade is 15 percent. Since March 21, the sales area in the Alpha store has exceeded 150 square meters. m, and the organization ceased to be a UTII payer.

In fact, in March, the organization was a UTII payer for 20 days.

In 2021, the value of the deflator coefficient K1 is 1.798. Local authorities set the value of the correction factor K2 at 0.7.

The basic profitability for retail trade in the presence of trading floors is 1800 rubles/sq.m. m.

The imputed income for calculating UTII for March was: 1800 rubles/sq.m. m × 80 sq. m: 31 days. × 20 days × 0.7 × 1.798 = 116,928 rubles.

Imputed income for January–February was:

1800 rub./sq. m × (80 sq. m + 80 sq. m) × 0.7 × 1.798 = 362,477 rub.

Thus, the imputed income for calculating UTII for the first quarter is equal to 479,405 rubles. (RUB 362,477 + RUB 116,928).

UTII for the first quarter of the year is equal to: 479,405 rubles. × 15% = 71,911 rub.

Situation: how to calculate the tax base for UTII when conducting retail trade through several outlets? During the quarter, some retail outlets were closed.

When calculating the imputed tax, take into account the months in which retail outlets were closed.

By closing individual retail outlets, the organization ceases its retail activities through these facilities. It is impossible to consider the liquidation of retail facilities as a change in the value of physical indicators (the area of sales floors or the number of retail places). Therefore, in this case, it will not be possible to take advantage of the provisions of paragraph 9 of Article 346.29 of the Tax Code of the Russian Federation, which allows you not to pay UTII for the months in which retail outlets were closed.

Paying tax in proportion to the actual duration of activity of closed retail outlets is also illegal. The fact is that the norms of paragraph 10 of Article 346.29 of the Tax Code of the Russian Federation, which provide for this option, are applied only in cases where an organization (entrepreneur) completely ceases its activities and is removed from tax registration as a UTII payer. This does not happen in this situation. Therefore, regardless of what dates of the month the activity of the retail facility was terminated, UTII for this month must be paid in full, without adjusting the tax base.

It is advisable to notify the tax office of the cessation of activity at individual retail outlets. To do this, use the application form, in which indicate code 4 “other” as the reason for deregistration. Based on this statement, the inspection will take note that trade is no longer carried out at a specific address, but the organization itself still remains a payer of UTII. Such clarifications are contained in letters of the Federal Tax Service of Russia dated February 1, 2012 No. ED-4-3/1500 (the document is approved by the Ministry of Finance of Russia and posted on the official website of the tax service), dated December 18, 2014 No. GD-4-3/26206 , as well as in the information dated June 27, 2014.

It should be noted that the letter of the Ministry of Finance of Russia dated October 30, 2013 No. 03-11-11/46223 reflects a different position. The authors of the letter qualify the closure of some retail outlets and the continuation of trading activities at other facilities as a change in the value of the physical indicator provided for in paragraph 9 of Article 346.29 of the Tax Code of the Russian Federation. Answering a question from an entrepreneur who closed a retail facility on August 25, representatives of the Russian Ministry of Finance explained that this facility must be excluded from the calculation of the tax base from August 1.

A situation where the Russian Ministry of Finance expresses directly opposite points of view on the same issue can be considered as an irremovable contradiction that should be interpreted in favor of taxpayers (clause 7 of Article 3 of the Tax Code of the Russian Federation). But to resolve this contradiction, you need to go to court. If the payer does not intend to take risks, he should adhere to the official explanations of the tax service.

However, some courts recognize that the absence of an application for deregistration in itself cannot be a reason for charging UTII for a non-existent outlet. Examples – decisions of the Arbitration Court of the West Siberian District dated October 7, 2015 No. F04-24010/2015, the Thirteenth Arbitration Court of Appeal dated October 16, 2015 No. A42-686/2015.

The essence of the disputes that the courts considered is the same: the sellers closed part of their retail facilities, but did not submit applications for deregistration as UTII payers. As a result, they were charged additional taxes for the period when the retail outlets were no longer operating and were subject to sanctions.

The courts overturned the inspectors' decisions. The court decisions reflect the following conclusions:

– the entrepreneur is not obliged to pay tax for a retail facility that is not in use - this approach contradicts the essence of the UTII system;

– closing a retail outlet does not mean a change in the physical indicator, but the cessation of activity (this thesis coincides with the position of the Federal Tax Service of Russia);

– documented termination of the activity of a retail outlet is equivalent to deregistration as a UTII payer, regardless of the submission of the corresponding application to the tax office.

Thus, if the circumstances of the closure of retail outlets are similar, the organization has a chance to win the dispute.

Responsibility for violations in tax payment

Responsibility for violation of UTII payment is provided:

| Violation | Penalties |

| Conducting business activities without registration | 10% of income (at least 40,000 rubles) |

| Violation of deadlines for filing an application for tax registration | 10,000 rubles |

| Violation of deadlines for submitting tax returns | 5% of taxes (at least 1,000 rubles) |

| Violation of tax payment deadlines | 20% of the tax amount (in case of intentional non-payment of tax 40% of the tax amount) |

Questions and answers

- We plan to organize delivery trade in different cities. Where do you need to register for taxes?

Answer: According to clause 2 of Article 346.28 of the Tax Code of the Russian Federation, it is necessary to register for taxation at the location of the organization (place of residence of the individual entrepreneur).

2. Our organization has planned to cease activities falling under UTII. What needs to be done for this?

Answer: To terminate an activity falling under UTII, you must submit an application to the tax authorities no later than 5 days from the date of termination of the activity. The application indicates the day the activity ends, which will be considered the date of deregistration.

- I am an individual entrepreneur, conducting business using the UTII taxation system. Can I switch from UTII to simplified tax system in the middle of the year?

Answer: You can switch to the simplified tax system from the month in which your UTII activity was terminated. For example, you decided on August 12 to stop operating under UTII, as a result of which the application of the simplified tax system can be considered from August 1.

Section 3

This section is intended for calculating UTII taking into account tax deductions. Organizations deduct from tax the amount of contributions paid during the period for employee insurance. Due to this amount, the tax can be reduced by no more than half.

Entrepreneurs without employees reduce tax by the amount of contributions they paid for their own insurance. You can deduct all contributions from the tax and reduce it down to zero. Individual entrepreneurs add up contributions for employees and for themselves, but at their expense reduce the tax by a maximum of half.

The UTII declaration for the 3rd quarter of 2021 may contain a deduction for the amount of contributions that were paid strictly in the same quarter. However, they can be accrued for earlier periods. The main thing is that they were actually listed in the reporting quarter.

Section 3 of the declaration is completed as follows:

- in line 005: code 1 - for organizations and individual entrepreneurs engaging individuals under employment and civil law contracts, 2 - for entrepreneurs without employees;

- in line 010 - the amount of UTII before deductions, calculated in section 2;

- in line 020 - the amount of contributions for employees and other expenses by which the tax can be reduced. In our example, the individual entrepreneur paid 113,250 rubles, but he is an employer, so he can only reduce the tax by 50%: 38,799 / 2 = 19,389.5 rubles. Let's round the deduction down - to 19,389, otherwise in the end there is a risk of receiving an underpayment of 1 ruble;

- line 020 reflects the amount of insurance premiums for the individual entrepreneur himself. If he did not pay them in the reporting quarter, then dashes are added;

- in line 040 - cash deduction from section 4. In our case, this is 18,000. Companies and individual entrepreneurs that have not declared a deduction put dashes;

- line 050 calculates UTII payable for the quarter. Deductions are sequentially subtracted from the base tax amount: 38,799 - 19,389 - 18,000 = 1,390 rubles.

Free tax consultation

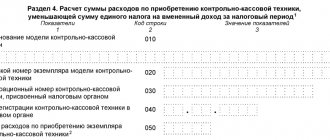

Section 4

This section exists in the UTII 2021 declaration for individual entrepreneurs who have installed online cash registers. They can deduct related expenses from taxes in the remaining quarters of 2021. There is a condition - the cash register must be registered with the Federal Tax Service in a timely manner. For individual entrepreneurs on UTII from the service sector, the deadline is July 1, 2021. Entrepreneur Simonov registered the cash register on June 10, so he retained the right to deduct.

The individual entrepreneur spent 23,000 rubles at the cash register. However, he has the right to deduct only 18,000 rubles, since the maximum deduction is limited to this amount.

Each section 4 block is intended for one cash register. Our individual entrepreneur fills out only 1 block, since he claims a deduction for one cash register. You need to enter the following information:

- on line 010 - the name of the cash register from the passport;

- on line 020 - serial number, also from the passport;

- on line 030 - the number assigned to the cash desk by the Federal Tax Service;

- on line 040 - date of registration of the device;

- on line 050 - the amount of the deduction.

Since from the 1st quarter of 2021 it will no longer be possible to declare deductions, there is a high probability that changes will be made to the declaration form again. To avoid missing this, we recommend keeping track of the latest news about reporting forms.

Introductory information

IP Simonov Pavel Sergeevich has a small veterinary clinic in the city of Noginsk, Moscow region. It employs 6 people, including the entrepreneur himself. During the 3rd quarter, they paid insurance premiums for employees in the amount of 113,250 rubles.

Prepare a UTII declaration for only 149 rubles

On June 10, 2021, the individual entrepreneur registered the ATOL Sigma 7F cash register with the Federal Tax Service. The cost of its implementation amounted to 23,000 rubles - this is confirmed by an invoice and a cash receipt.

The UTII declaration for the 3rd quarter of 2021 is filled out according to the form approved by order of the Federal Tax Service dated June 26, 2021 No. ММВ-7-3/414. He also approved the procedure for filling out the report (hereinafter referred to as the Procedure). Let's look at how to fill out each section according to the given conditions. For clarity, we recommend that you open the completed form, which you can download from the link below, and compare it with the description.

This might also be useful:

- Changes in UTII for individual entrepreneurs in 2021

- What taxes does the individual entrepreneur pay?

- Tax system: what to choose?

- Coefficients K1 and K2 UTII for 2021

- Fixed payments for individual entrepreneurs in 2021 for themselves

- Changes in individual entrepreneur taxation in 2021

Is the information useful? Tell your friends and colleagues

Dear readers! The materials on the TBis.ru website are devoted to typical ways to resolve tax and legal issues, but each case is unique.

If you want to find out how to solve your specific issue, please contact the online consultant form. It's fast and free!