Who is required to submit the Declaration and pay for the NVOS?

The declaration is submitted by tax payers. If your organization, in accordance with Federal Law No. 7-FZ, is not required to pay a fee for the tax assessment, then you do not need to submit a Declaration of payment for the tax assessment.

And yet, who is obliged to pay for the NVOS ? At the moment, we can say with confidence that the payers are legal entities and individual entrepreneurs carrying out economic activities on objects of categories I – III, and that objects of category IV are exempt from paying for the tax assessment. At the same time, business entities are exempt from paying for the disposal of municipal solid waste (MSW), the fee for which is paid by regional MSW management operators. In addition, it is possible for a number of waste disposal facilities (WDO) to obtain a decision from the territorial body

Rosprirodnadzor on eliminating negative impacts on the environment, allowing to reduce the amount of fees for the organization as a whole.

It would seem that we have gone through the procedure for registering NVOS objects, received a category and then everything, as in Federal Law No. 7-FZ, but not everything is so simple. Rosprirodnadzor has repeatedly clarified that calculations of fees for environmental impact assessment are not directly related to the definition of the facility providing environmental assessment, i.e. with registration of objects of the NVOS. Therefore, it is not yet clear what to do for objects that have been refused registration as not providing NVOS. The situation is aggravated by the fact that in 2016 there were no regional MSW management operators. Federal Law No. 486-FZ of December 28, 2016 “On Amendments to Certain Legislative Acts of the Russian Federation” established a transition period until January 1, 2019 for the introduction of public services for the management of solid waste and the establishment of a unified tariff on the territory of the constituent entities of the Russian Federation. Thus, until the date of approval of the unified tariff and the signing of agreements between the constituent entities of the Russian Federation and regional MSW operators, payment for the placement of MSW is carried out by business entities whose activities generate municipal solid waste.

What do we have as a result? With a high degree of probability, it can be argued that in 2021, all business entities must pay the fee for the 2021 IEE, regardless of the registration of IEE objects and the categories assigned to them. An exception may be small offices where the lease agreement clearly states that the payment for waste removal is paid by the lessor, who has entered into contracts for waste removal and is the payer of the fee for the NVOS.

Recognition of expenses for NVOS

In accounting

The payment for the NVOS, in accordance with clause 5 of PBU 10/99 “Expenses of the organization” (approved by order of the Ministry of Finance dated 05/06/1999 No. 33n), is included in the costs of ordinary activities and is displayed in the debit of expense accounts (20, 23, 25 , 26, 44).

The payment for the tax assessment is not a tax payment, therefore, account 68 “Calculations with the budget” is not used for accounting purposes. The occurrence and repayment of obligations for “negative impacts” is recorded in account 76 “Settlements with other debtors and creditors”.

In tax accounting

The payment for the NVOS within the limits of the standards relates to material costs (subclause 7, clause 1, article 254 of the Tax Code of the Russian Federation).

Payments for negative impacts on the environment in excess of these amounts are not taken into account in expenses (clause 4 of Article 270 of the Tax Code of the Russian Federation).

In letter dated 06/07/2018 No. 03-03-06/1/39148, the Ministry of Finance of the Russian Federation notes that the Tax Code does not establish a deadline for recognizing material expenses in the form of a fee for the tax assessment. For enterprises and individual entrepreneurs under the general taxation system, officials recommend recognizing expenses in the form of a fee for tax assessment on the last day of the tax period for which it is made. Officials also recommend recognizing quarterly payments as expenses on the last day of the reporting period for which they are made (letters of the Ministry of Finance of the Russian Federation dated 08/15/2016 No. 03-03-06/1/47690, dated 08/08/2016 No. 03-03-06/1/ 46432).

For organizations and individual entrepreneurs on a simplified taxation system with the object “income minus expenses,” the fee for the tax assessment (within the limits of the standards) can be taken into account as part of material income (subclause 5, clause 1, article 346.16 of the Tax Code of the Russian Federation). Expenses in the form of fees for the tax assessment are recognized at the time of debiting from the current account (subclause 1, clause 2, article 346.17 of the Tax Code of the Russian Federation).

Declaration form and electronic submission to the Rosprirodnadzor portal?

On February 22, 2021, Order of the Ministry of Natural Resources dated January 09, 2017 No. 3 “On approval of the Procedure for submitting a declaration on payment for negative impact on the environment and its forms” was registered with the Ministry of Justice and published, i.e. came into force.

The fee for the IEE must be paid no later than March 1 . Starting from 2021, a penalty in the amount of 1/300 of the key rate of the Bank of Russia .

The fee is paid separately for four environmental components: emission fee, APG emission fee, discharge fee and waste disposal fee. Each with its own BCC (budget classification code). It should be taken into account that if advance payments were made and, for example, there was an overpayment for waste, then it cannot be automatically included in the payment for emissions, because These components are paid according to different BCCs. The calculated total amounts of the fee for payment for the reporting period (lines 151 - 154 of the Declaration) are subject to payment; the amounts of the fee for return and/or offset (lines 161 - 164) should not affect the amount of the current payment .

Order of the Ministry of Natural Resources No. 3 determines the form of the Declaration itself, which must be submitted no later than March 10 .

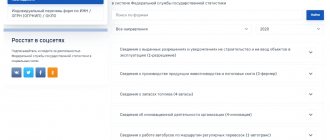

The declaration can be submitted on paper or in the form of an electronic document. Starting from 01/01/2017, the Rosprirodnadzor portal pnv-rpn.ru stopped accepting reports; it will only be available for viewing previously submitted reports until 06/30/2017. Now the State Services portal located at lk.fsrpn.ru is used to receive reports. To submit reports, you must have an account on the State Services portal.

Results

The procedure for calculating the annual pollution fee for 2021 remains the same as in 2021. The calculation itself is made in specially designated sections of the declaration, allocated depending on the type of polluting object. The fee accrued for these sections is then adjusted to the amount of expenses for measures to reduce the negative impact and to the amount of advances paid during the year.

Sources:

- Federal Law of January 10, 2002 No. 7-FZ

- Decree of the Government of the Russian Federation dated June 29, 2018 No. 758

- Decree of the Government of the Russian Federation dated March 3, 2017 No. 255

- Decree of the Government of the Russian Federation of September 13, 2016 No. 913

- Decree of the Government of the Russian Federation of September 28, 2015 No. 1029

- Order of the Ministry of Natural Resources of Russia dated 01/09/2017 No. 3

- Tax Code of the Russian Federation

- Order of the Ministry of Finance of Russia dated May 6, 1999 No. 33n

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

We can't find fee rates for pollutants

New payment rates were approved by Resolution No. 913, which brings the rates into line with the Order of the Government of the Russian Federation dated 06/08/2015 No. 1316-r “On approval of the list of pollutants for which state regulatory measures in the field of the environment are applied.”

The currently available permits for emissions and discharges were issued without taking into account Order No. 1316-r, which significantly reduces the list of pollutants and, as a consequence, the payment rates for them. For emissions and discharges of pollutants for which there are no payment rates, starting in 2021, you do not need to pay, even if these pollutants are indicated in the permits.

The current practice of using fee rates for pollutants with similar characteristics is unlawful . Thus, in the Letter of Rosprirodnadzor dated January 16, 2017 N AS-03-01-31/502 “On consideration of the appeal” it was said that “...substances such as abrasive dust, carbon (soot), iron oxide, due to their physical properties , related to solid particles, it is advisable to take into account the emissions as suspended substances.” This and the requirements previously applied by the administrators of the fee for the NVOS to pay for pollutants that are not in Resolution No. 344 are recognized by the courts as illegal. As an example, we can cite the decision of the Arbitration Court of the Khanty-Mansiysk Autonomous Okrug dated January 31, 2014 in case No. A75-2131/2013.

How to submit a declaration?

In accordance with paragraph 5 of the Procedure, reporting on the payment for the NVOS is submitted via the Internet in the form of an electronic document signed with an electronic signature.

Fill out and submit an “environmental” declaration online using the new form

A declaration can be submitted on paper (in person, through an authorized representative or by mail with a list of attachments and receipt of receipt) only if:

- no electronic signature;

- there is no technical ability to connect to the Internet;

- the fee for the previous year is 25,000 rubles or less.

Where can I get maximum permissible values and VAT for sources of emissions and discharges?

The new form of the annual Declaration provides for calculations of pollutants in the context of emission sources and wastewater discharges. This significantly increases the amount of work involved in calculating the fee. In addition, we needed MPE, VAT and VAT, VSS of pollutants for each source and release separately. The permitting documentation approves the data for the facility as a whole. To obtain data in the context of sources and releases, you need to raise the project documentation, namely the standardization section.

How to get back overpaid money?

Refunds or credits of previously transferred funds are carried out based on the payer’s application. The application form is currently free. The application must indicate the reason for the return of funds (for example, the return of advance payments), the justification for the amount being returned and the bank account to which the excess transferred amounts should be returned. Copies of payment orders must be attached to the application.

Within 30 days from the date of registration of the payer’s application, if a decision is made on a refund, Rosprirodnadzor forms an application for a refund and sends it to the Federal Treasury Department (UFK), and also sends a written response to the payer about the decision.

Upon receipt of documents from the FCC regarding the return of funds, Rosprirodnadzor is obliged to send the payer a written response and a document confirming the return of funds within 30 days

Upon receipt of documents from the UFK confirming the refusal to return the funds, Rosprirodnadzor within 10 days of the impossibility of returning the funds, indicating the reason.

How to calculate relief to relief?

People still ask how relief is calculated. The fee for the so-called stormwater drainage system was canceled back in 2014 (or rather, it was never approved and its application was unlawful). The discharge of wastewater is regulated by legal acts that define the relationship between subscribers and water supply and sewerage organizations (WSS) and water utilities. The methodological instructions of V.I. Danilov - Danilyan for calculating fees for unorganized discharge of pollutants into water bodies are not currently used. Payment must be made only for the discharge of pollutants and microorganisms into water bodies .

Payment for negative environmental impact in 2021

A fee for negative impact on the environment (NVOS fee) is an environmental fee that is levied by the state on firms or entrepreneurs whose activities are associated with harmful emissions into water, atmosphere, etc.

The need to pay this fee should, according to the legislator, encourage taxpayers to use all available tools to reduce overall emissions, and until then bear responsibility for all the consequences of their work.

The fee for environmental impact assessment is established in accordance with Article 16 of the Federal Law of January 10, 2002 No. 7-FZ “On Environmental Protection” (hereinafter referred to as Law No. 7-FZ).

Types of negative impact

Types of negative impact on the environment include (Article 16 Law No. 7-FZ):

- emissions of pollutants into the air from stationary sources;

- discharges of pollutants into water bodies;

- storage, burial of production and consumption waste (waste disposal).

It is necessary to pay a fee for emissions of pollutants into the atmospheric air if their source is stationary objects. Therefore, vehicle owners do not have to pay a fee in this part.

Fee for NVOS

Legal entities and individual entrepreneurs carrying out economic activities on the territory of the Russian Federation that have a negative impact on the environment are required to pay for the NVOS, with the exception of legal entities (IP) operating exclusively at category IV facilities ( Article 16.1 of Law No. 7-FZ) .

In addition, according to the law (paragraph 2, clause 1, article 16.1 of law 7-FZ):

- payment for the NWOS when disposing of waste, with the exception of solid municipal waste, is paid by legal entities and PBOYULs, during whose economic and (or) other activities the waste was generated.

- payment for the NWOS when disposing of municipal solid waste is paid by regional operators for the management of municipal solid waste (MSW), operators for the management of MSW, carrying out activities for their disposal.

What objects belong to category IV?

The criteria on the basis of which objects that have a negative impact on the environment are classified as objects of categories I, II, III and IV are established by Decree of the Government of the Russian Federation dated September 28, 2015 No. 1029.

Category IV includes objects if the following conditions are simultaneously met:

- the presence at the site of stationary sources of environmental pollution, the mass of pollutants in emissions into the atmospheric air of which does not exceed 10 tons per year, in the absence of substances of hazard classes I and II, radioactive substances in the emissions;

- the absence of discharges of pollutants in wastewater into centralized drainage systems, other structures and systems for the disposal and treatment of wastewater, with the exception of discharges of pollutants resulting from the use of water for domestic needs, as well as the absence of discharges of pollutants into the environment.

The assignment of an object providing NVOS to the appropriate category will be carried out when it is registered with the state register of objects providing NVOS (Clause 4, Article 4.2 of Law No. 7-FZ).

The procedure for paying for the NVOS

According to the clarifications (letter of Rosprirodnadzor dated 04/11/2016 N AS-06-01-36/6155):

- small and medium-sized businesses calculate and pay the fee in a lump sum before March 1 following the reporting period (i.e. for 2021 - by March 1, 2021);

- other organizations make quarterly advance payments (except for the fourth quarter) no later than the 20th day of the month following the last month of the corresponding quarter of the current reporting period, in the amount of ¼ of the amount of the fee for negative environmental impact paid for the previous year.

When determining ¼ of the amount of the fee for negative environmental impact, the amounts of the fee actually paid (not accrued) for the 1st - 4th quarters of 2021 are taken into account.

When determining 1/4 of the amount of the fee for the NVOS paid for 2017, the amounts of payments paid to repay the debt of previous years (2015, 2021, etc.) are not taken into account, regardless of whether the debt was repaid on a voluntary basis order or by court decision.

Calculation and timing of payment for the tax assessment

The reporting period for payment of fees for the NVOS is the calendar year (Clause 2, Article 16.4 of Law No. 7-FZ).

The payment calculated based on the results of the reporting period in the manner established by Article 16.3 of Law No. 7-FZ, taking into account the adjustment of its size, must be transferred to the economic entity no later than March 1 of the year following the reporting period.

In accordance with the budget legislation of the Russian Federation, the fee for NVOS:

- for emissions of pollutants, discharges of pollutants - paid at the location of the stationary source;

- for the placement of production and consumption waste - at the location of the production and consumption waste disposal facility.

Fees for environmental pollution are calculated separately for each type of pollution - air emissions, water discharges, waste disposal.

Small and medium-sized businesses calculate and transfer fees only at the end of the year (Clause 3, Article 16.4 of Law No. 7-FZ).

If the company is not small or medium-sized, then it must pay advance payments throughout the year - for the 1st, 2nd and 3rd quarters.

Each advance payment is equal to 1/4 of the payment for the previous year (Clause 3, Article 16.4 of Law No. 7-FZ).

The fee payable at the end of the year is calculated using the following formula:

Payment for the annual tax assessment at the end of the year = Payment for the tax assessment for the year – Advance payments paid during the year.

If the result is negative, then the difference is the amount of overpayment that the organization will be able to return or offset against future payments for the NVOS (Letter of Rosprirodnadzor dated 04/11/16 No. AS-06-01-36/6155).

Responsibility for untimely or incomplete payment of the tax payment

Late or incomplete payment of fees for the tax assessment by economic entities entails the payment of penalties in the amount of 1/300 of the Bank of Russia key rate in effect on the day the penalties are paid.

The maximum interest rate is no more than 0.2% for each day of delay.

Penalties are accrued for each calendar day of delay in fulfilling the obligation to pay for the tax assessment, starting from the next day after the end of the relevant period.

Calculation of annual fees for air emissions or water discharges

The fee is calculated for each NEE facility for which a permit for emissions or discharges has been obtained from Rosprirodnadzor.

For the calculation you need (clause 2 of article 16.2, clause 4 of article 23 of law No. 7-FZ):

- internal accounting data of actual emissions or discharges (clauses 2, 3 of Article 67 of Law No. 7-FZ);

- standards and limits established in the permit;

- charge rates for air emissions or water discharges. When calculating the fee for territories and objects that are under special protection, the rate should be multiplied by 2 (clause 2 of Government Resolution No. 913 of September 13, 2016).

The fee must be calculated separately for each harmful substance, and then the results must be added up.

If actual emissions or discharges do not exceed the standard, then it is necessary to calculate the fee for each substance according to the formula (clause 4, article 16.2 of Law No. 7-FZ, clause 3, article 10 of the Federal Law “On Amendments to the Federal Law of December 29, 2015 No. 404-FZ "On Environmental Protection" and certain legislative acts of the Russian Federation", clause 8 of Article 11 of the Federal Law of July 21, 2014 No. 219-FZ "On Amendments to the Federal Law "On Environmental Protection" and certain legislative acts acts of the Russian Federation"):

Tax Fee = Actual Quantity of Substance x Rate.

If actual emissions or discharges exceed the standard, but do not exceed the limit, then the following is calculated:

-payment within the standard according to the formula:

Payment for sewage waste within the limits of the standard = Emission or discharge standard X Rate;

-and payment for excess emissions or discharges according to the formula:

Payment for excess emissions or discharges = (Actual amount of substance - Emission or discharge standard) X Rate X 5;

Payments for excess emissions or discharges are calculated in a similar manner. But at the same time, the rate increases not 5, but 25 times.

Let's calculate the amount of payment for air pollution. 2021 emissions data, regulations and rates are shown in the table.

| Substance | Actual emission, t | Standard, t | Limit, t | Rate, rub/t |

| Manganese | 1 | 3 | 10 | 5 248 |

| Magnesium oxide | 11 | 6 | 15 | 43,5 |

Manganese emission fee—RUB 5,248. (RUB 5,248/t x 1 t).

The fee for magnesium oxide emissions is RUB 1,348.5, including:

- within the standard - 261 rubles. (43.5 rub. x 6 t);

- above the standard - 1087.5 rubles. ((11 t - 6 t) x 43.5 rub. / t x 5).

The total amount of the fee is 6596.5 rubles. (5248 rub. + 1 3 48.5 rub.).

Calculation of annual fees for waste disposal

For the calculation you need (clause 2 of article 16.2, article 24 of Law No. 7-FZ):

- data on the actual amount of disposed waste;

- limits on waste disposal approved for the organization by Rosprirodnadzor (clause 5 of the Procedure for approving standards for waste generation and limits on their disposal, approved by order of the Ministry of Natural Resources of Russia dated February 25, 2010 No. 50);

- fee rates. When calculating the fee for territories and objects that are under special protection, the rate must be multiplied by 2 (clause 2 of the Decree of the Government of the Russian Federation dated September 13, 2016 No. 913). In some cases, rates are applied with a reduction factor.

Fees must be calculated separately for each type of waste.

If the actual amount of waste does not exceed the limit, then the fee is calculated according to the following formula (Clause 1, Article 16.3 of Law No. 7-FZ, Clause 8, Article 11 of Law No. 219-FZ):

Waste disposal fee = Actual amount of waste disposed x Rate.

If the actual amount of waste exceeds the limit, then the fee for waste disposal is within the limit according to the formula:

Fee for waste disposal within the limit = Limit x Rate.

The fee for over-limit placement is determined by the formula:

Fee for waste disposal in excess of the limit = (Actual amount of waste disposed – Limit) x Rate x 5.

We will calculate the fee for waste disposal. Data on waste limits and the amount of disposed waste for 2021 are shown in the table.

| Type of waste | Amount of disposed waste, t | Limit, t | Hazard Class | Rate, rub./t |

| Soil waste during open excavation | 5 | 6 | IV | 635,9 |

| Scrap of asphalt and asphalt concrete pavements | 5 | 2 | IV | 635,9 |

Fee for disposal of soil waste – 3179.5 rubles. (RUB 635.9/t x 5 t).

The fee for placing scrap is RUB 10,813.3, including:

— within the limit — 1271.8 rubles. (635.9 rub./t x 2 t);

- over the limit - 9538.5 rubles. ((5 t - 2 t) x 635.9 rub./t x 5).

The total amount of the fee is 13,992.8 rubles. (RUB 3,179.5 + RUB 10,813.3).

Accounting

Expenses of an organization are recognized as a decrease in economic benefits as a result of the disposal of assets (cash, other property) and (or) the occurrence of liabilities, leading to a decrease in the capital of this organization, with the exception of a decrease in contributions by decision of participants (owners of property) (clause 2 of PBU 10/99 “Expenses of the organization”, approved by order of the Ministry of Finance of Russia dated 05/06/99 No. 33n).

An encumbrance in the form of payment for a negative impact on the environment reduces the economic benefits of an economic entity and falls under the definition of expense.

The Constitutional Court of the Russian Federation indicated that payments for negative impacts on the environment are of an individual remunerative and compensatory nature and are, by their legal nature, not a tax, but a fiscal fee (determination dated December 10, 2002 No. 284-O).

Therefore, when calculating fees, account 76 “Settlements with various debtors and creditors” is used, as prescribed by the Instructions for using the Chart of Accounts for accounting financial and economic activities of organizations (approved by order of the Ministry of Finance of Russia dated October 31, 2000 No. 94n).

To prevent negative impacts on the environment, standards for permissible emissions and discharges of substances are established.

If compliance with them is impossible, then in order to gradually achieve the stipulated standards, limits on emissions and discharges may be established.

Based on this, fees for negative impacts on the environment can be charged within acceptable standards and in excess of standards:

- within established limits or

- for excess pollution.

The procedure for determining the fee and its maximum amounts for environmental pollution, waste disposal, and other types of harmful effects (approved by Decree of the Government of the Russian Federation of August 28, 1992 No. 632) (hereinafter referred to as procedure No. 632) proposed (clause 7 of the decree of the document):

- payments for maximum permissible emissions, discharges of pollutants, waste disposal, levels of harmful effects shall be attributed to the cost of products (works, services),

- payments for exceeding them are for the profit remaining at the disposal of the resource user.

Based on this, the calculation of fees for the tax assessment and its payment in accounting are accompanied by the following entries:

Debit 20 (26, 44) Credit 76

— a fee has been charged for the negative impact on the environment within acceptable standards;

Debit 91-2 Credit 76

— fees were charged for negative impacts on the environment in excess of the standards;

Debit 76 Credit 51

— funds are transferred to pay for the negative impact on the environment.

Tax paid when applying the simplified tax system

Organizations using the simplified tax system (object “income minus expenses”) reduce the income received by the expenses listed in paragraph 1 of Article 346.16 of the Tax Code of the Russian Federation.

The amount of payment for environmental pollution in amounts not exceeding established standards is included in material costs on the date of transfer of funds (subclause 5, clause 1, clause 2, article 346.16, subclause 7, clause 1, article 254, subparagraph 1, paragraph 2, article 346.17, subparagraph 1, paragraph 3, article 273 of the Tax Code of the Russian Federation).

The amount of payment for excess discharges is not recognized as an expense (such an expense is not mentioned in clause 1 of Article 346.16 of the Tax Code of the Russian Federation).

Corporate income tax

Payment for waste water treatment in amounts not exceeding the maximum permissible discharges is included in material costs (subclause 7, clause 1, article 254 of the Tax Code of the Russian Federation).

The date of recognition of expenses in the form of mandatory payments is the date of their accrual (subclause 1, clause 7, article 272 of the Tax Code of the Russian Federation).

Note that, according to the Ministry of Finance, material expenses in the form of fees for negative environmental impacts (quarterly advance payments) are recognized for the purposes of calculating corporate income tax on the last day of the reporting (tax) period for which the corresponding payments are made (letter dated 08.08 .16 No. 03-03-06/1/46432).

The amount of payment for excess pollution of the environment is not included in expenses (clause 4 of article 270 of the Tax Code of the Russian Federation).

Application of PBU 18/02

In accounting, fees for excess pollution of the environment are included in expenses, but are not taken into account when determining the tax base for income tax.

As a result, on the dates of recognition of this expense, permanent differences and corresponding permanent tax liabilities (PNO) arise in the organization’s accounting records (clauses 4, 7 PBU 18/02 “Accounting for calculations of corporate income tax”, approved by order of the Ministry of Finance Russia dated November 19, 2002 No. 114n).

Example During production activities at a facility, pollutants (included in the relevant list) are discharged into water bodies.

The amount of payment for negative impact on the environment at the end of the year (minus previously accrued and paid advance payments) amounted to (conditionally) 150,000 rubles, including for excess discharges - 50,000 rubles.

The organization applies a general taxation system using the accrual method.

In accounting, fees for negative impacts on the environment, including for excess discharges, should be reflected in the following entries:

Debit 20 (26, 44) Credit 76 “Calculations for payment for negative impact on the environment”

— 100,000 rub. — a fee has been charged for the negative impact on the environment within the limits of the standard (basis: accounting certificate-calculation);

Debit 91-2Credit 76 “Calculations for payment for negative impact on the environment”

— 50,000 rub. — a fee was charged for a negative impact on the environment in excess of the standard (basis: accounting certificate-calculation);

Debit 99 Credit 68/PNO

— 10,000 rub. (50,000 x 20%) - PNO reflected (basis: accounting certificate-calculation);

Debit 76 “Calculations for payment for negative impact on the environment” Credit 51

— 150,000 rub. — payment for negative impact on the environment is listed (bank statement of current account).

T. Bursulaya, leading auditor of RIGHT WAYS LLC

How to fill out the form, example of filling

Calculation of the amount to be contributed to the budget

Calculation of the amount to be contributed to the budget includes indicators of payment amounts, including by type, for each facility providing NVOS. This declaration sheet is filled out for each municipality separately. When filling out, you must indicate the serial number of the page.

Line 010 indicates the code of the corresponding municipality - OK.

Line 020 is general. It indicates the total amount of payments, without taking into account adjustments to their size. The indicator is defined as the amount of fees for all types of tax assessments and includes payments calculated:

- within the limits of permissible emissions standards (APE),

- permissible discharge standards (VAT),

- limits on emissions of pollutants and limits on discharges of pollutants exceeding such standards, limits, emissions and discharges (including emergency),

- within the limits for the disposal of production and consumption waste and above the specified limits.

The fee for each type of NVOS is determined as the amount of the fee for each pollutant for which the rate is established.

The amount for line 020 in the table is determined in the following order: line 020 = line 021 + line 022 + line 023 + line 024

Lines 021, 022, 023 and 024 indicate the components of the payment amount by type of tax assessment, the values of which are taken equal to the value of the indicator of the corresponding line:

- page 021 = page 040

- page 022 = page 060

- page 023 = page 080

- page 024 = page 100

Line 031 indicates OKTMO of stationary sources specified in Section 1 “Calculation of the amount of payment for a negative impact facility for emissions of pollutants into the air by stationary facilities.”

Line 040 reflects the amount of payment for emissions of pollutants into the air by stationary objects, calculated for each stationary source, without adjusting its size.

The amount for line 040 in the table is determined in the following order: line 040 = line 041 + line 042 + line 043 .

indicator 040 = total according to column 17 of Section 1, line “Total for stationary sources”.

Indicators on lines 041, 042 and 043 are decipherable to the amount reflected on line 040 . All data for filling them out is contained in Section 1.

Line 041 reflects the amount of payment for emissions within the maximum permissible limit; the amount must correspond to the total in column 14 of Section 1, line “Total for stationary sources.”

Line 042 reflects the amount of payment for emissions within the limits for emissions of pollutants (VER), the amount must correspond to the total in column 15 of Section 1, line “Total for stationary sources”.

Line 043 reflects the amount of payment for emissions in excess of the emission limit; the amount must correspond to the total in column 16 of Section 1, line “Total for stationary sources.”

Other lines of the Calculation are filled in similarly. Each indicator must correspond to the total amounts of calculations for the corresponding Section.

Lines 060 to 063 reflect the amounts of fees for emissions of pollutants during flaring and/or dispersion of associated petroleum gas, calculated for all stationary sources (flares, dispersion installations).

The data to be filled out is contained in Section 1.1 “Calculation of the amount of payment for an object of negative impact for emissions of pollutants into the atmosphere during flaring and (or) dispersion of associated petroleum gas without exceeding the volume corresponding to the maximum permissible value of the combustion indicator” and Section 1.2. “Calculation of the amount of payment for an object of negative impact for emissions of pollutants into the atmospheric air during flaring and (or) dispersion of associated petroleum gas when the volume corresponding to the maximum permissible value of the combustion indicator is exceeded.”

page 060 = page 061 + page 062 + page 063.

Amount for line 060 = total for column No. 17 of Section 1.1 + total for column No. 12 of Section 1.2.

Amount for line 061 = total for column No. 14 of Section 1.1.

Amount for line 062 = total for column No. 15 of Section 1.1.

Amount for line 063 = total for column No. 16 of Section 1.1 + total for column No. 8 of Section 1.2.

Lines 080, 081, 082, 083 reflect the amounts of fees for discharges of pollutants into water bodies, calculated for each release. The data to be filled out is contained in Section 2 “Calculation of the amount of payment for an object of negative impact for the discharge of pollutants into water bodies.”

page 080 = page 081 + page 082 + page 083.

Amount for line 080 = total for column No. 18 of Section 2, line “Total for all issues.”

Amount for line 081 = total for column No. 15 of Section 2, line “Total for all issues.”

Amount for line 082 = total for column No. 16 of Section 2, line “Total for all issues.”

Amount for line 083 = total for column No. 17 of Section 2, line “Total for all issues.”

Lines 100, 101, 102 indicate the entire amount of the fee for waste disposal. The data to be filled out is contained in Section 3 “Calculation of the fee amount for the disposal of production and consumption waste” and Section 3.1 “Calculation of the fee amount for the disposal of municipal solid waste”.

page 100 = page 101 + page 102.

Total for line 100 = total for column No. 25 of Section 3 + total for column No. 8 of Section 3.1.

Total for line 101 = total for column No. 23 of Section 3.

Total for line 102 = total for column No. 24 of Section 3.

Lines 110, 111, 112, 113, 114 indicate the amounts of funds for environmental protection measures (the amount of adjustment of the fee planned for offset) as part of emission reduction plans, discharge reduction plans and/or for the implementation of projects for the beneficial use of associated petroleum gas, which is taken into account when adjusting the size of the fee.

page 110 = page 111 + page 112 + page 113 + page 114.

Line 111 indicates the amount of funds for the implementation of environmental protection measures as part of emission reduction plans, which is accepted for credit when adjusting fees for emissions of specific pollutants by stationary facilities (excluding flare combustion plants and sources of dispersion of associated petroleum gas).

The amount is determined based on documents and calculations confirming the actual use of funds for environmental protection measures that are included in emission reduction plans.

Line 112 indicates the amount of funds for the implementation of projects that reduce flaring and dispersion of associated petroleum gas, which is taken into account when adjusting the payment for pollutant emissions during flaring and dispersion of associated petroleum gas.

The amount is determined based on documents/calculations confirming the actual disbursement of funds for the implementation of activities that are included in the project for the beneficial use of associated petroleum gas.

Line 113 indicates the amount of funds for environmental protection measures as part of discharge reduction plans, which is accepted for credit when adjusting fees for discharges of specific pollutants.

The amount is determined based on documents/calculations confirming the actual use of funds for environmental protection measures that are included in the discharge reduction plans.

Line 114 indicates the amount of funds for the implementation of environmental protection measures as part of an environmental action plan or an environmental efficiency improvement program, which is accepted for credit when adjusting the fee for the disposal of waste of a particular hazard class.

The amount is determined based on documents/calculations confirming the actual use of funds for environmental protection measures that are included in plans for reducing emissions and discharges.

Lines 120, 121, 122, 123, 124 indicate the amount of the fee, taking into account the adjustment of its size to the actual costs of implementing environmental protection measures as part of plans to reduce emissions and discharges and/or for the implementation of projects for the beneficial use of associated petroleum gas.

page 120 = page 121 + page 122 + page 123 + page 124.

Line 121 indicates the amount of payment for emissions of specific pollutants by stationary facilities (excluding flares and sources of dispersion of associated petroleum gas), the reduction of the negative impact of which on the environment is carried out through the implementation of environmental protection measures as part of plans to reduce emissions and discharges.

Line 121 = total for column 17 of Section 1, line “Total for all stationary sources for those pollutants for which the fee is adjusted.”

Line 122 indicates the amount of payment for emissions of pollutants when flaring (dispersing) associated petroleum gas, the reduction of the negative impact of which on the environment is associated with a reduction in the flaring of associated petroleum gas through the implementation of relevant projects.

Line 122 = line 022 - amount of payment for emissions in the absence of measuring instruments*

*Meeting the requirements established by the Ministry of Energy of the Russian Federation, measuring the volume of associated petroleum gas actually produced and flared and/or dispersed.

Line 123 indicates the amount of payment for discharges of specific pollutants, the reduction of the negative impact of which on the environment is carried out through the implementation of environmental protection measures as part of discharge reduction plans.

Line 123 = total for column No. 18 of Section 2 for the line “Total for all releases for those pollutants for which the fee is adjusted.”

Line 124 indicates the amount of payment for the disposal of specific types (hazard classes) of waste, the reduction of the negative impact on the environment is carried out through the implementation of environmental measures as part of an environmental action plan or an environmental efficiency improvement program.

Line 124 = the sum of the data on the corresponding lines for specific types (hazard classes) of waste in column 25 of the tables of Section 3 or the sum of the data on the corresponding lines for specific types (hazard classes) of waste in column 25 on the line “Total, including” for Section 3 in in general.

Line 130 indicates the amount of fees payable to the budget system for all types of negative impact on the environment.

page 130 = page 131 + page 132 + page 133 + page 134

page 130 = page 020 – page 110 with page 120≥ page 110

or

page 130 = page 020 – page 120 with page 120 ≤ page 110

Line 131 indicates the amount of payment for emissions of pollutants by stationary facilities to be entered into the budget system.

page 131 = page 040 – page 111 with page 121≥ page 111

or

page 131 = page 040 – page 121 with page 121 ≤ page 111

Line 132 indicates the amount of payment to be made to the budget system for emissions of pollutants during flaring and dispersion of associated petroleum gas.

page 132 = page 060 – page 112 when page 122 ≥ page 112

or

page 132 = page 060 – Section 1.2 (TOTAL for column 8 – TOTAL for column 12).

Line 133 indicates the amount of payment to be entered into the budget system for discharges of pollutants into water bodies.

page 133 = page 080 – page 113 at page 123 ≥ at page 113

or

page 133 = page 080 – page 123 with page 123 ≤ page 113

Line 134 indicates the amount of payment for waste disposal to be entered into the budget system.

page 134 = page 100 – page 114 when page 124 ≥ page 114

or

page 134 = page 100 – page 124 with page 124 ≤ page 114

Line 140 indicates the amount of advance quarterly payments made in the reporting period to the budget system for all types of negative impact on the environment and for each quarter separately.

page 140 = page 141 + page 142 + page 143 + page 144

Line 141 indicates the amount of quarterly advances for emissions of pollutants by stationary facilities.

Line 141 = the sum of the values for the lines “1st quarter”, “2nd quarter”, “3rd quarter”, which are accepted in accordance with the amounts of advances specified in payment orders for their transfer.

Line 142 indicates the amount of quarterly advances for emissions of pollutants during flaring and/or dispersion of associated petroleum gas.

Line 142 = the sum of the values for the lines “1st quarter”, “2nd quarter”, “3rd quarter”, which are accepted in accordance with the amounts of advances specified in payment orders.

Line 143 indicates the amount of quarterly advances for discharges of pollutants into water bodies.

Line 143 = the sum of the values for the lines “1st quarter”, “2nd quarter”, “3rd quarter”, which are accepted in accordance with the amounts of advances specified in payment orders.

Line 144 indicates the amount of quarterly advances for waste disposal.

Line 144 = the sum of the values for the lines “1st quarter”, “2nd quarter”, “3rd quarter”, which are accepted in accordance with the amounts of advances specified in payment orders.

Line 150 indicates the amount of quarterly advances for all types of negative impact on the environment.

page 150 = page 151 + page 152 + page 153 + page 154

page 150 = page 130 – page 140 with page 130 ≥ page 140

Line 151 indicates the total amount of payment for emissions of pollutants by stationary facilities.

page 151 = page 131 page 141 when page 131 ≥ page 141

Line 152 indicates the total amount of payment for emissions of pollutants during flaring and (or) dispersion of associated petroleum gas.

page 152 = page 132 page 142 when page 132 ≥ page 142

Line 153 indicates the total amount of payment for discharges of pollutants into water bodies.

page 153 = page 133 page 143 when page 133 ≥ page 143

Line 154 indicates the total amount of the fee for waste disposal.

page 154 = page 134 page 144 when page 134 ≥ page 144

Line 160 indicates the total amount of the fee for the reporting period for refund from the budget or offset against the subsequent reporting period for all types of negative impact on the environment.

page 160 = page 161 + page 162 + page 163 + page 164

line 160 indicator is checked in the following order:

page 160 = page 140 – page 130 when page 140 ≥ page 130

Line 161 indicates the total amount of payment for the emissions of pollutants by stationary facilities for the reporting period for return from the budget or offset against the subsequent reporting period.

page 161 = page 141 page 131 when page 141 ≥ page 131

Line 162 indicates the total amount for the reporting period for return from the budget or offset against the subsequent reporting period, the amount of payment for emissions of pollutants during flaring and dispersion of associated petroleum gas.

page 162 = page 142 page 132 when page 142 ≥ page 132

Line 163 indicates the total amount of payment for the discharge of pollutants into water bodies for the reporting period for return from the budget or offset against the subsequent reporting period.

page 163 = page 143 page 133 when page 143 ≥ page 133

Line 164 indicates the total amount of payment for waste disposal for the reporting period for return from the budget or offset against the subsequent reporting period.

page 164 = page 144 page 134 when page 144 ≥ page 134

How to calculate the amount of the tax assessment?

Calculation of the amount of payment for negative environmental impact depends on the following factors:

- nature of the source of pollution;

- type of pollutant (or its hazard class);

- volumes of actual emissions;

- the fact that there are no means of measuring emissions;

- presence of excess pollution above established standards;

- the fact that the contaminated object or territory is under special protection;

- expenses incurred on measures to reduce negative impacts.

Based on the first 2 indicators, the rate used in the calculation is determined. By multiplying it by the volume of actual emissions (if it does not exceed the maximum permissible) the amount of payment for pollution is determined. The following odds are applied to the bet amount:

- increasing, if we are talking about the lack of means of measuring emissions, exceeding permissible pollution standards, or the location of an object (territory) under special protection;

- reducing, depending on the hazard class of the disposed waste, the method of its generation and disposal.

To calculate the amount of payment for the environmental impact assessment, the following methodology is used (approved by Decree of the Government of the Russian Federation dated 03.03.2017 N 255 “On the calculation and collection of fees for negative impacts on the environment.”

The amount of payment for the NVOS can be calculated in the Natural Resources User Module.