As part of the activity of producing goods, in order to assess the results of the labor component, it is necessary to know the value of the final result, i.e. total produced marketable products, regardless of the percentage of its readiness (production in progress). Gross output is a unique indicator that includes the amount of semi-finished products and goods not ready for sale.

Gross output

A productive indicator in production in natural units of measurement for a specific period of time, as the sum of all goods produced, regardless of the percentage of their readiness.

Gross output formula

VP = T + N \text{V}\text{P} = \text{T} + \text{N} VP=T+N

where T \text{T} T is the amount of goods produced according to the plan,

Н \text{Н} Н – balances of unfinished commodity output at the end of the period (difference between initial and final balances).

Calculation methods

- Factory - the difference between the total gross turnover and turnover within divisions (intra-factory).

- Element-by-element - a method of summing up all elements of the indicator (finished products, semi-finished products, production at the release stage, industrial work, repair work and raw materials).

Gross turnover is the total volume of products produced for a specific period of time, regardless of its use both for subsequent processing and for the purpose of sale.

Intra-factory turnover is the release of goods for subsequent use in the production process by its own workshops and divisions.

Features of gross output

- calculated by enterprises with a long production cycle of more than 2 months;

- used in analyzing the activities of industries with large output volumes;

- used to plan production costs, determine the need to purchase material resources, and analyze production dynamics.

Topic 16

Gross output is calculated in current comparable prices, i.e. enterprise prices that are unchanged on a certain date. Using this indicator, the dynamics of total production volume, the dynamics of capital productivity and other indicators of production efficiency are determined.

Work in progress is accounted for at cost. To convert work in progress balances into wholesale prices, two methods are used: I) according to the degree of readiness of work in progress based on the ratio of the labor intensity of work already completed and the labor intensity of the finished product; 2) according to coefficients characterizing the ratio of the cost of finished products in wholesale prices and the actual cost of the same products.

Analysis

When analyzing gross profit, various methods are used, namely:

- horizontal analysis, which monitors changes in indicators for the reporting period;

- vertical analysis determines changes in items in the reporting of accounting information;

- trend analysis determines the dynamics of changes for different reporting periods;

- factor analysis, from which influences on various financial indicators are determined.

Gross profit formula for calculating the balance sheet

The second method focuses on the characteristics of changes in the net profit indicator by reporting periods (years or other established frameworks). Numerical data is considered in different sequences to achieve maximum forecasting performance. The following methods can be used: exponential, logarithmic, linear and other methods of working with numbers.

It is necessary to determine the estimated trade markup for each group of goods: For group 1, the estimated trade markup will be: RN = TN / (100 + TN); 39% / (100 + 39) = 28.057%. For goods of group 2: RN = TN / (100 + TN); 26% / (100 + 26) = 20.635%. Gross income (the amount of realized trade margin) will be equal to: (16,800 rubles x 28.057% + 33,200 rubles x 20.635%) / 100 = 11,564 rubles. In the company's accounting, it is necessary to register the following entries: Debit 50 Credit 90-1 – 50,000 rubles. – revenue from the sale of goods is reflected; Debit 90-3 Credit 68 – 7627 rub. – the amount of VAT is reflected; Debit 90-2 Credit 42 (reversal) – 11,564 rubles. – the amount of trade margin related to goods sold is written off; Debit 90-2 Credit 41 – 50,000 rub. – the sales value of goods sold is written off; Debit 90-2 Credit 44 – 3000 rub. – sales expenses are written off; Debit 90-9 Credit 99 – 937 rub. (50,000 rub. – 7,627 rub. – (–11,564 rub.) – 50,000 rub. – 3,000 rub.) – profit from the sale.

Relationship between profit and gross income

Gross revenue and profit are always interrelated. The first is the finances of the company’s commercial activities with the calculation of all expenses, the second is net income. The company's profit is calculated as the difference between gross income and the various costs of the enterprise from the main or additional activities.

Didn't find the answer to your question? Find out how to solve exactly your problem - call right now: +7 (Regions of the Russian Federation) +7 (Moscow) +7 (St. Petersburg) It's fast and free!

Gross income is the basis for the future distribution of the enterprise's funds, both within and outside its operations.

To determine the nuances of these economic values and profit volumes, it is better to seek help from a professional lawyer.

Editor: Igor Reshetov

How to find the value of gross output

2. Based on the financial statements, we find the value of work in progress balances at the beginning and end of the analyzed period. In the Balance Sheet, these figures are entered in lines 130 “Construction in progress” and 213 “Costs in work in progress”. We determine on line 214 of the Balance Sheet “Finished products and goods for resale” the cost of the balances of finished products at the beginning and end of the reporting period.

3. We calculate the gross turnover of products produced by all departments for the period (VO). To the sum of the balances of finished products and work in progress at the end of the period, we add the cost of goods sold and subtract the sum of the balances of finished products and work in progress at the beginning of the period. The calculation algorithm follows from the formula for calculating the balance of active accounts at the end of the period: Balance at the beginning + Income for the period - Expense for the period = Balance at the end of the period.

How are finished product indicators formed?

Initially, data on finished products is formed on account 43 of accounting. At the same time, the cost of products is not indicated and is written off as expenses to account 90:

Products intended for further sale or that will be used for the needs of the enterprise are formed in the form of the following entries:

If the products are used for the needs of the enterprise, then account 43 is not used, and the products are reflected in account 10. In this case, the indicator is not used to form the overall balance on line 1210 of the balance sheet, but is entered in the line “Raw materials, supplies and other material assets”.

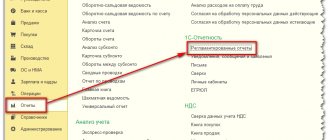

Get 267 video lessons on 1C for free:

Account 45 is used when we are talking about shipped products. In other words, if payment for sold and shipped products has not yet been received, then the indicators are formed on account 45:

- debit 45 – credit 43 – actual shipment of products;

- debit 90 - credit 45 – recognition of revenue from the sale of finished products.

To determine the deviation between the actual and standard cost, account 40 is used, which is closed monthly to account 90.

As a result, to form the overall indicator, it is necessary to take into account the indicators in accounts - 43, 40 and 45 of accounting.

Gross output

Sold products characterize the cost of the volume of products that entered the market in a given period and are payable by consumers. Sold products differ from commercial products by the balance of finished products in the warehouse. The volume of products sold (RP) according to the plan is determined by the formula

Thus, the gross output of an enterprise is the total volume of products in value terms produced during the reporting period by all workshops, minus intra-factory turnover. This means that the size of the enterprise's gross output is equal to the difference between gross turnover and intra-factory turnover.

Interesting to read: Court decision on the collection of alimony for minor children

How to calculate gross profit (calculation formula)

Gross profit is one of the main indicators characterizing the results of a company’s economic activities. Calculating gross profit - the formula is presented in our article - allows you to highlight promising areas of business activity and redistribute financial flows to obtain a more effective result.

Gross profit is one of the intermediate types of profit shown in the statement of financial results (clause 23 of PBU 4/99, approved by order of the Ministry of Finance of the Russian Federation dated July 6, 2021 No. 43n). Accordingly, it is determined according to accounting data and represents revenue from the main type (types) of activity, reduced by the cost of sales.

What is it and what does it characterize?

The indicator characterizes the financial result from the perspective of taking into account exclusively production costs.

A feature of this type of profit is the inclusion of administrative and commercial expenses in the amount.

How to calculate the result minus these items is discussed in detail in the article Operating profit (EBIT) and the formula for its calculation.

In other words, gross profit, among other things, contains wages of the AUP, costs of concluding agreements and contracts and other institutional costs.

The indicator is found as the difference between revenue and technological cost, which, in turn, consists of the costs of materials, wages of workers and shop expenses.

Each group of indicators is divided into narrower ones. It is necessary to understand that the income of managers directly related to the manufacturing process is taken into account in the technological cost.

The concept of revenue and methods for calculating it are described in detail in the article Revenue - what is it and how to calculate it.

How to correctly calculate revenue using the formula

A large number of entrepreneurs, especially among beginners, often cannot accurately calculate their own profit that their enterprise brings them. The point is not a mathematical failure, but the fact that many choose incorrect formulas for calculations, as well as incorrect planning of their expenses.

- Revenue that was received from the basic activity of the organization, that is, from the sale of products, performance of work and provision of services.

- Revenue received as a result of investment transactions (for example, the sale of non-current assets, transactions involving securities, etc.)

- Revenue generated as a result of the financial activities of the enterprise.

Concept of gross profit

Gross profit shows the difference between revenue and cost of production. The value includes the total profitability of the enterprise minus production losses. By decree of the Ministry of Finance, the indicator is included in the financial statements.

Gross profit is the difference between revenue and the cost of selling a product or service. It should be kept in mind that gross profit differs from operating profit (profit before taxes, penalties and interest, interest on loans).

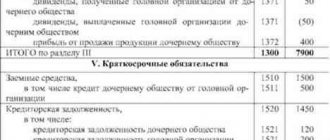

Balance formula:

1. VP – p. 2100. 2. Revenue – p. 2110. 3. Cost of sales – p. 2120.

Help: gross profit shows the difference between the income invested in the cost of production and the income received after sales.

This shows that gross profit expresses the difference between the planned and actual return on production.

Gross profit is calculated after the sale of goods, excluding taxes and other fixed payments. This is how it differs from net or operating profit.

External, internal factors

Gross profit is a value that depends on circumstances outside and inside the enterprise. The general economic situation in the country and in the region, the purchasing power of the population, and the demand for this type of products and services are among the external factors affecting the profitability of the enterprise.

External factors determining gross profit:

- costs of transporting raw materials and finished products;

- climatic, weather conditions;

- ecological situation;

- social and economic situation of the region;

- foreign economic cooperation.

Internal factors include the actual state of the enterprise at the current moment. Flexibility of pricing, technical and personnel equipment, general organization of work are the main components of the liquidity of products sold, affecting profitability.

Internal factors:

- revenue from product sales;

- income from investors' investments;

- income from related services;

- cost of goods;

- level of demand and sales;

- the price of the product.

Errors in pricing, poor organization of the work process, and monetary penalties for shortcomings in the organization of work cause financial damage to the enterprise. Gross profit reflects the effect of direct and indirect parameters on the degree of economic efficiency.

Gross profit compared to other financial indicators

It is not easy for a person who is far from accounting to understand the difference between gross profit and gross income, what is the difference between gross and net profit, how the ability to manage margin affects the success of a business, and how to display balance sheet and gross profit in transactions.

Gross profit and gross income

Revenue is all the cash a company has. The concept of “gross income” means the total turnover of finances, as opposed to immediate or daily revenue. Gross income includes all cash receipts into the organization's account for the current period. In addition to receiving money from direct activities, total or gross income takes into account subsidies, investments, funds from the rental of equipment or premises, collection of fines, commissions excluding taxes and other deductions. Gross profit is made up of gross income minus operating expenses.

The concept of net profit

Net profit is the amount of money that remains after deductions of taxes, fines, penalties, and other fixed or one-time payments.

The concept of marginal profit

Marginal profit or marginal income is the revenue that remains after minus variable costs. These include the cost of materials, employee salaries, and the like. Margin helps you choose the most profitable way to do business. Gross profit characterizes the efficiency of the enterprise as a whole.

Balance sheet profit and its difference from VP

Balance sheet and gross profit are similar concepts, but not identical. Gross profit is reflected in account 90 as the difference between income and expenses (balance) from the sale of goods. Balance sheet profit shows the total income of the enterprise without deducting taxes. Total income includes all of the company's assets. The balance sheet profit value represents the account balance of 99.

Components of gross profit

Gross profit consists of the following components:

- funds from the sale of goods, provision of services;

- benefits derived from forests and agriculture;

- finances received from the sale of company property, equipment, etc.;

- amounts from related income;

- amounts from the sale of shares.

Statistics show that the majority of gross profit comes from core activities.

Sales revenue - formula and concepts

The calculation formula may include product volume and discounts. Sometimes there is a guarantee of demand for products. Then the amounts from buyers are taken into account by direct counting, implying a specific amount of consumer demand. That is, the production and sales process are connected by a certain amount.

Return on sales is usually calculated by dividing operating profit by sales volume. Operating profit is that profit expressed before taxes. This type of profitability ratio shows whether the company's pricing policy is correct.

Gross profit indicator as a business development tool

Calculation of gross profit is needed to analyze production resources and determine the overall profitability of the enterprise. The VP does not reflect actual income; the indicator is calculated without taking into account the costs of advertising, wages, rent or operation of the premises.

Important: data on total profit serves not specific, but general purposes. They are needed to identify immediate and future prospects for business development.

The main purpose of calculating gross profit is to reveal the weak and strong points in the production and economic structure of production in order to find ways to increase labor productivity and improve performance.

VP shows the need:

- Optimization of pricing policy.

- Elimination of unnecessary expenses.

- Improving work efficiency.

Important: gross profit is not a constant value. Proper coordination in the business world allows entrepreneurs to change it for the better.

Monitoring the dynamics of VP development allows you to see the practical results of the reforms carried out, draw up a schedule of financial and economic performance, identify profitable areas and eliminate obstacles to increasing profitability.

Accountant's Directory

The gross output of the agro-industrial complex represents the value of the total product created as a result of the production of agricultural raw materials, its processing and bringing it to its final consumer form. In the agricultural sector of the agro-industrial complex, gross output is understood as the value of products obtained as a result of growing plants, animals and their economic use for a certain period of time (day, month, quarter, season, calendar year, etc.).

1.the cost of means of production consumed in the production process during a given period (year)

, that is, from the value transferred to the product, created by past labor (the cost of material production costs, that is, the cost of seeds, feed, fuel and other material resources spent in the production process);

Measures to increase

You can increase your gross profit by:

- tax benefits;

- flexibility in pricing;

- reducing costs;

- writing off bad debts;

- use of high technologies;

- improving the quality of goods and services;

- increasing control over intangible assets.

With the help of reasonable labor organization, high-quality raw materials, the use of high-tech equipment and modern technologies, it is possible to increase the liquidity of products, and, consequently, increase gross profit.

Gross output formula for calculating the balance sheet

To quickly count points and the number of transactions, we use account monitoring. : the trader made 100 trades, the currency is GBPJPY, the spread is 7 points, the working fixed lot is 1, the swap amount is approximately -$50 (for all trades), there were profitable and unprofitable trades, as a result the trader earned 100 points. we get: income $8050, net income $950, costs $7050, profit to cost ratio

In this case: TN – trade markup as a percentage. Turnover refers to the total amount of revenue. : At Biryusa LLC, the balance of goods at sales value (balance on account 41) as of July 1 amounted to 12,500 rubles. The trading margin on the balance of goods as of July 1 (account balance 42) is 3,100 rubles. In July, products were received at the purchase price excluding VAT in the amount of 37,000 rubles. According to the order of the head of the organization, the accountant must charge a trade margin of 35 percent on all goods. Its amount for goods received in July was 12,950 rubles. (RUB 37,000 x 35%). The company earned 51,000 rubles from sales in July (including VAT - 7,780 rubles). Selling expenses – 5000 rub.

Interesting read: What benefits are available to disabled people of the Great Patriotic War?

What is net profit (NP)

These are the funds remaining from the balance sheet profit after deducting taxes, fees, and contributions to the budget. PE is used to invest in the production process, organize reserve funds, and increase working capital. Its size depends on several factors:

- tax burden on the organization, additional payments;

- In enterprises;

- cost of goods.

Table

| Gross profit | Net profit |

| What do they have in common? | |

| Net profit is calculated on the basis of gross profit and indirectly depends on the factors influencing it | |

| Calculated without taking into account operating expenses | |

| What is the difference between them? | |

| Corresponds to the difference between the firm's revenue and expenses, which reflect the cost of goods | Corresponds to the difference between gross profit and cash transfers to the budget - in the form of taxes, fees and other payments established by law |

| Reflects the effectiveness of the business model | Reflects the efficiency of accounting and tax accounting |

Calculation of gross, marketable and sold products

Because the price per unit of work in progress has not been determined, then we will consider the price of work in progress to be 500 rubles per unit, the work in progress is a 1st grade product., then work in progress at the beginning of the year in the amount of 1000 x 500 = 500,000 rubles, at the end of the year 2021 x 500= 1,000,000 rubles.

Fixed assets are the material basis of production. They include active and passive fixed assets: the first includes material objects that take a direct part in the production process (machines, machines, tools); and to the second - objects that provide normal production conditions, but are not directly involved in it (industrial buildings, transfer devices, etc.).

Principle of gross profit analysis

The analysis consists of studying the constituent elements of gross profit and searching for its further use.

At the first stage, the dynamics are studied through the terms of the VP. This is the so-called horizontal approach. At the next stage, a set of measures is formed to change the quality indicators of the components (vertical approach).

A detailed analysis includes a thorough examination of each element individually and all data together. Components and influencing factors are considered.

Postings: accounting for gross profit

Gross profit is shown in account 90 “Sales”. Account 90/9 is closed every month, writing off the balance to account 99 “Profits and losses”.

The account balance 90/9 shows the gross loss for the main activities. A credit account of 90 confirms the gross profit for the month. For account 90, second-order accounts (sub-accounts) are closed.

Formula for calculating VP

After the sale of goods, when summing up the results, a quantitative indicator of VP is calculated. The cash balance before tax expresses the degree of effectiveness of the management strategy, shows the effectiveness of the pricing policy, and shows the dependence of profitability on reducing production costs and reducing production costs.

The value is determined by the formula:

VP = D – (S + W);

Where VP is gross profit;

D - quantity of goods sold;

C is the cost of the product;

Z - production costs.

Note: Gross profit is usually calculated once a year.

Information about the profitability or unprofitability of controlled companies gives higher authorities a reason to liberalize taxation if it impedes the intensity of their development.

Calculation of gross profit using an example

The company produces electric irons. Production costs are 30,000 rubles, other costs are 15,000. Sales on average per day are 500 irons at a price of 1,000 rubles per product.

Attention: gross profit is the basis for planning the company’s future activities, taking into account the correction of shortcomings that hinder the increase in profitability.

To calculate VP, daily revenue is calculated: the number of irons sold is multiplied by the cost of one piece. They receive 500,000 rubles. From this amount, production costs and production losses are subtracted, amounting to a total of 45,000 rubles. Subtract 45,000 from 500,000 to obtain 455,000 rubles of gross profit.

Specifics of calculation depending on the type of enterprise

An enterprise selling its products displays gross profit after deducting all expenses. In addition to cost, these include discounts and product returns. The difference between revenue and expenses shows gross profit.

Help: the calculation algorithm is common to all enterprises.

The gross profit of a company providing services is calculated without taking into account the cost of production. Discounts and other similar expenses are subtracted from daily revenue. The remainder shows gross profit.

Formula for calculating cost of goods sold

To illustrate the application of the methodology for calculating the cost of products sold, let’s consider a specific example. The company Posuda LLC produces various types of tableware. It is required to calculate the cost of production for July, when it is known that 70 saucepans and 50 kettles were produced, and 52 saucepans and 35 kettles were sold.

- assessment of changes in the cost value and its relation to planned indicators;

- assessment of the validity of planned cost values;

- identification of factors influencing the formation of the indicator and its changes, as well as deviations of the final value from the plan;

- identification of lost opportunities and unused reserves;

Determining the value of the gross output of the ORGANIZATION

Types of products Gross harvest / output, c Comparable price for 1 c, rub. 1994 Cost of gross output in comparable prices, thousand rubles. 2021 2021 2021 2021 2021 2021 PLANT CULTIVATION Cereals and legumes, c 10.9 Corn, c 27.2 Soybeans, c 43.6 Sugar beets, c 5.6 Flax, c 35 .2 Tobacco, c 59.4 Sunflower, c 26.8 Potatoes, c 31.5 Open ground vegetables, c 48.5 Protected ground vegetables, c 72.3 Melons, c 31.2 Fruits, c 81.8 Grapes , c 96.4 Tea, c 380.7 Forage root crops, c 3.3 Perennial grasses for hay, c 3.7 Perennial grasses for green mass, c 2.0 Annual grasses for hay, c 4.3 Annual grasses for green weight, c 2.0 Corn for silage and green fodder, c 1.1 Ensilage, c 1.1 Haying, c 1.2 Total for crop production — — — — ANIMAL HUSBANDRY Milk 29.6 Live weight gain of cattle silent. herd 113.8 Live weight gain of beef cattle 113.8 Live weight gain of pigs 190.5 Live weight gain of sheep 97.0 Wool 140.8 Eggs 90.8 Live weight gain of poultry 192.6 Honey 80.6 Fish 38.1 Total for livestock farming — — — — TOTAL — — — —

- Find, according to the financial statements (form 5 Explanations to the balance sheet and profit and loss statement), the value of work in progress balances at the beginning and end of the analyzed period. In f. 5, these figures are entered in lines 5240 “Construction in progress” and 5403 “Costs in work in progress”. Determine line 5404 f. 5 “Finished products and goods for resale” the cost of finished product balances at the beginning and end of the reporting period.

21 Dec 2021 uristland 956

Share this post

- Related Posts

- Liability of a legal entity for the debts of the founder

- How much does Surrogacy Cost in Russia in 2021

- Payment under compulsory motor insurance 2021 maximum amount

- What Documents Are Needed at the Maternity Consultation?