Reflection of transactions with penalty amounts in the accounting of government institutions has its own characteristics depending on

Home / Taxes Back Published: 08/18/2020 Reading time: 6 min 0 349 Last

The UTII declaration for the 3rd quarter of 2021 has been changed, the new template recommended by tax authorities is given in

KBK 18210501011012100110 in the payment slip indicates penalties. For what tax – see the article here

Compensation by an employee for damage caused: accounting and taxation 02.12.20 The article was published in the newspaper “Pervaya

The calculation and payment of benefits is a rather complex process that requires constant keeping abreast of changes in legislation.

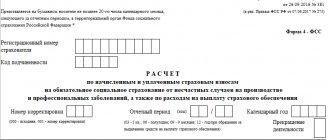

New form 4-FSS from the 4th quarter of 2021. Annual reporting on form 4-FSS for 2021

Employer reporting Olga Yakushina Tax expert-journalist Current as of December 21, 2019 Confirmation of the main type

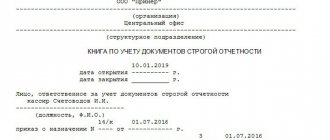

How do BSOs differ from regular forms? To BSO in an institution, as opposed to ordinary ones

SZV-M what kind of report is this? What is this SZV-M report? In fact, this is a special reporting form